Wise Beta

The Wall Street Journal’s Jason Zweig tweeted this out over the weekend:

The world is awash with smart people.

— Jason Zweig (@jasonzweigwsj) September 18, 2016

Wise people, not so much.

He couldn’t have hit the nail more square on the head. A similar dynamic exists in financial markets today. We live in a world of abundant choice that has driven down costs of investing and broken down the barriers between the haves and the have nots. The paradox we face is that the plethora of options at our disposal can leave us feeling overwhelmed and susceptible to poor decision making.

In other words:

The world is awash with smart investments.

Wise investors, not so much.

When I say “smart” above, I am referring not to individuals, but rather a subset of investment strategies that have been labeled with the moniker of Smart Beta (and its cousins). According to FactSet, there are now +450 ETFs that are lumped together in this category. BlackRock estimates there will be over $1 Trillion in Smart Beta ETF assets by 2020. Heck, there’s even a Smart Beta conference that advisors can attend! Whether we like the term or not (I don’t), it’s here to stay until the investment industry finds another shiny new toy to slap a gimmicky name on.

The point of this post isn’t to throw Smart Beta under the bus – far from it. In fact, many reputable fund companies – DFA, AQR and Vanguard to name a few – were doing Smart Beta before Smart Beta was cool. Only at that time the term hadn’t been force fed into our collective lexicon. In an article written a couple of years ago, AQR founder Cliff Asness had the following to say about the perception that this trend was something novel (emphasis mine):

Let’s be blunt. Smart Beta is mostly re-packaged, re-branded quantitative management. That’s not to say we don’t like it or think it’s not good for investors. We love quantitative management, having spent our careers pursuing these types of strategies. However, we work in a business where good ideas are constantly repackaged as something new. Smart Beta is the latest example. It takes well-established, quantitative investing styles, or factors, and implements them in a simple, transparent manner often, though not always, at lower fees than what we’ve seen in the past. That certainly sounds like a worthwhile repackaging, and it’s not surprising that Smart Beta has received great attention.

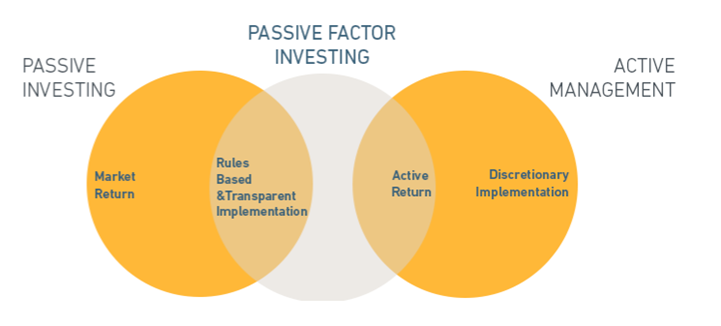

In other words, Smart Beta aims to deliver value-added sources of returns that are grounded in economic intuition and backed by decades of empirical research. What’s different about Smart Beta (referred to below by MSCI as Passive Factor Investing) is that it sits at the intersection of Passive Investing and traditional Active Management, combining the pursuit of active return from the latter with the rules-based design, transparent implementation and lower (most of the time) cost structure of the former.

Source: MSCI

My issue is not with the various strategies – several of which I am a fan of – that fall under the Smart Beta umbrella. My concern is that the way these products are marketed may serve to further muddy the very waters they wish to clarify. We have already seen signs that this may provide investors with false hope and misguided expectations, which may ultimately lead to the same ol’ destructive behavior that has plagued investors for generations.

In a recent interview with Robin Powell, famed author and Evidence Based Investing luminary Charley Ellis echoed those sentiments:

Smart beta is such a clever name — second only to the clever Scots who changed the name of death insurance to life insurance…There are factors that can be identified and experienced specialists with great skill can here and there exploit these ephemeral opportunities. But most offerings are likely to attract the most interest when the case looks best: unfortunately that will be after the best opportunity has passed, so most of the money going into such products will miss the positive and, as that area of the market inevitably regresses to the mean, that same factor will surely underperform. It cannot do better forever.

There are dozens of factors that have been documented in academic literature over the past few decades, many of which lack long-term efficacy and are a result of data-mining. Most would agree that the five highlighted below are the most commonly accepted and agreed upon factors.

Source: BlackRock

In the chart below, I plotted the total returns for five popular Smart Beta ETFs from iShares that are based on the five factors above. I also included the SPDR S&P 500 ETF for comparative purposes. I think I have some pretty smart readers so I’m guessing you can determine which ticker symbols belong to which factors. 🙂

Source: YCharts

The performance period measure above begins in early 2013, when most of the funds referenced were launched. You can see that despite each fund having a positive return (no surprise there as the broad market was up in the same period) the gap between the best performer and the worst performer was quite large. The iShares Edge MSCI USA Momentum Factor ETF (MTUM) had the highest return at over 50 percent, while the iShares Edge MSCI USA Value Factor ETF (VLUE) had the lowest return at just over 31 percent. Two of the factor ETFs beat the S&P 500, while three lagged it. Therein lies the issue with the catch-all nature of the Smart Beta label. All five of these products, despite their wide disparities in performance and varying drivers of return, are all considered Smart Beta.

While Momentum has been the go-to factor the past three years, the belle of the ball recently in Smart Beta land has been the Minimum Volatility (“Min Vol”) factor. No other factor has come close to garnering as much attention – and assets – as Min Vol in 2016. BlackRock’s Dr. Andrew Ang is a factor investing authority, and recently sat down for an interview with ETF.com. Here is what he had to say about the recent surge in popularity of Smart Beta strategies focused on Min Vol:

I have some concerns that smart-beta strategies like min vol, which have done well recently, could have poor investor behavior. Investors should not be in min vol if they want to beat the market. You should be in min vol if you want to reduce your risk. Investors who understand this are less likely to make timing mistakes. Understanding the purpose of your investments helps you stay the course, whether that’s for smart beta, factor investing or anything else.

But how people should use a strategy and how they actually use them in real life are night and day. Michael Batnick ran a great play-by-play analysis of Minimum Volatility flows and performance this year. You can probably guess what happened.

Tale as old as time…

song as old as rhyme…

beauty performance and the beast chase

We have known for decades that investors as a whole make poor timing decisions, playing hot potato with stocks, fund managers, asset classes, etc. The availability of hundreds of Smart Beta ETFs won’t change that. Different dog, same fleas.

There are many redeeming qualities of Smart Beta but without the requisite improvements in behavior, those potential advantages will be unattainable for most. We can debate ad nauseam which factor is best, whether single-factor or multi-factor makes the most sense, which measure of value is most effective, yada yada yada. The fact of the matter is any factor’s staying power is 100% irrelevant if the very investors owning them don’t have staying power themselves.

Plenty of strategies work over time. The onus is on us as an industry to help people find the strategy that works best for them. It could be some variation of Smart Beta. It could also be plain old Dumb Beta. To paraphrase Cliff Asness, a great strategy you can’t stick with is vastly inferior to a very good strategy you can stick with. Steps we can all take towards finding something we can stick with include:

- Understanding how we are likely to behave in good times and bad

- Eschewing short-term performance, a.k.a. NOISE

- Dispelling the myth of “silver bullet” investments

- Setting realistic expectations so that we can limit surprises

- Recognizing there are no one-size-fits-all solutions

Seneca described a wise man as one who is “Content with his lot, whatever it be, without wishing for what he has not …”

The more we can effectively promote Evidence Based Investing and empower people to practice smart investing behavior, the better odds we have of cultivating wise investors who are content with their beta, whatever it be, without wishing for what they have not.

Further reading:

BlackRock’s Ang On The Next Frontier in Factor Investing (ETF.com)

Performance Chasers Exit (The Irrelevant Investor)

Smart Beta: Not New, Not Beta, Still Awesome (AQR)

Fees for active investing more than 100% — Charley Ellis (The Evidence Based Investor)

(Full Disclosure: My firm, Huber Financial Advisors, uses funds from DFA, AQR, BlackRock/iShares and Vanguard in constructing client portfolios.)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.