Active Bond Funds: An Evidence-Based Outlier?

“Software is eating the world.” – Marc Andreessen

BlackRock, the world’s largest asset manager, made headlines a couple of weeks ago when it announced they would be consolidating a substantial number of their actively-managed equity mutual funds into a handful of new quantitative model-driven strategies. This is just the latest example in the generational zeitgeist that has seen billions of dollars flow out of high-cost active mutual funds and into their low-cost systematic counterparts. As the war between man and machine wages on in the investment landscape, the machines undoubtedly have the upper hand.

But something was missing from the press release. Despite the decision to jettison 53 human stock-pickers in favor of models and algorithms, the BlackRock bond-pickers never got the memo as there was no accompanying announcement signaling similar change to their fixed income lineup. Shouldn’t the arithmetic of active management apply to bonds just as it does to stocks? John Rekanthalter over at Morningstar pondered this question in a recent article (emphasis mine):

BlackRock’s action suggests that there is more opportunity for traditional active managers with investment-grade bonds than with U.S. stocks. BlackRock, after all, did not remove its fixed-income managers. They, apparently, are still able to compete with index strategies. How could this be? If the U.S. stock market is so thoroughly researched that active management is much stymied, then what about investment-grade bonds? They are no less scrutinized; and, at the top of the credit ladder, they’re simpler to analyze, because they mostly respond only to changes in interest rates.

He continues:

My guess is that BlackRock would deflect the question, by stating that it is happy with its fixed-income management but felt that its equity approach needed to be tweaked. My guess is also that if Jeff Gundlach of DoubleLine were asked a similar query, he would give a similar response. Portfolio managers tend to talk about what they believe that they do well, rather than theorize about market structures. But it’s true that there is more faith these days in active fixed-income management than in active U.S. stock-fund management. It is hard to explain why.

John’s right about one thing: it is hard to explain why. For advisors using passive in one bucket and active in another, conversations with a prospect or new client might go something like this:

CLIENT: That makes a lot of sense. It doesn’t seem like these active stock-pickers have added enough value to justify their fees. I agree that the prudent approach to equity management is to (insert your preferred choice of market-cap weighted index or multi-factor strategy here)

ADVISOR: Great, I’m glad our investment philosophy resonates with you.

CLIENT: It sure does. So I imagine it’s basically the same story with the fixed income portion of my allocation, right?

ADVISOR: Not exactly. We do utilize some active bond managers in our client portfolios.

CLIENT: Doesn’t that contradict everything we just discussed regarding equity markets?

ADVISOR: Well, not necessarily. Bonds are just different.

But it can’t end there. When people entrust you with their hard-earned dollars, saying “just trust me” doesn’t quite cut it. An effective advisor must be able to articulate not just what they do but why they do it. Show will always be more important than tell.

Enter PIMCO.

They just put out a new research piece out titled “Bonds Are Different: Active Versus Passive Management in 12 Points” that goes further than just telling you bonds are different and shows you why they are different. I won’t belabor you with all twelve points but here are a few highlights:

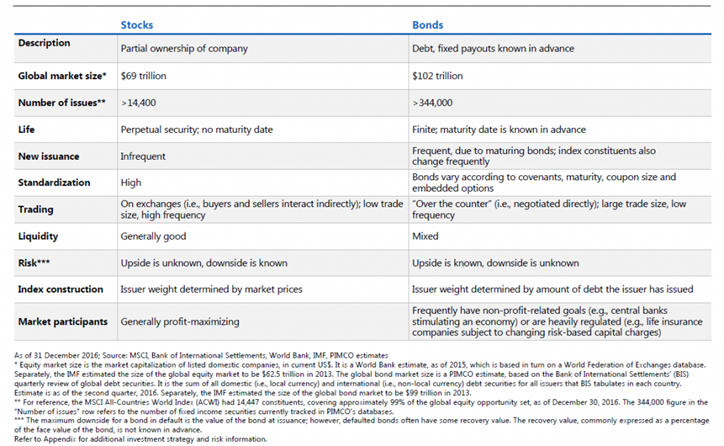

Bonds vs. Stocks: Tale of the Tape

It should go without saying but stocks and bonds are apples and oranges. There are many structural differences between the two major asset categories, with the table below providing a helpful summary:

Bucking the Performance Trend

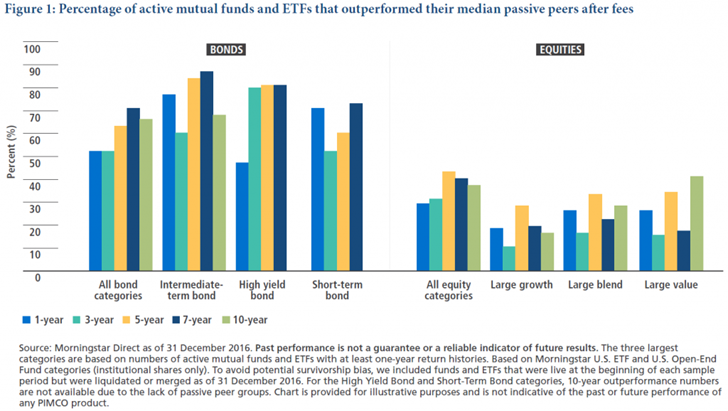

It’s no secret that active equity funds as a group have delivered dismal performance relative to both their benchmark indices and their passive peers. What might surprise some is that the results in fixed income have been markedly different.

Figure 1 below looks at the three largest Morningstar categories for both stocks and bonds as well as a composite of all categories for each and measures the percentage of active funds that have outperformed their median passive peers, net of fees, over 1, 3, 5, 7, and 10 year time frames. In almost all instances, more than half of active bond funds beat their passive peers. Over the past five years ending 2016, 63% of active bond funds outperformed versus only 43% for active equity funds.

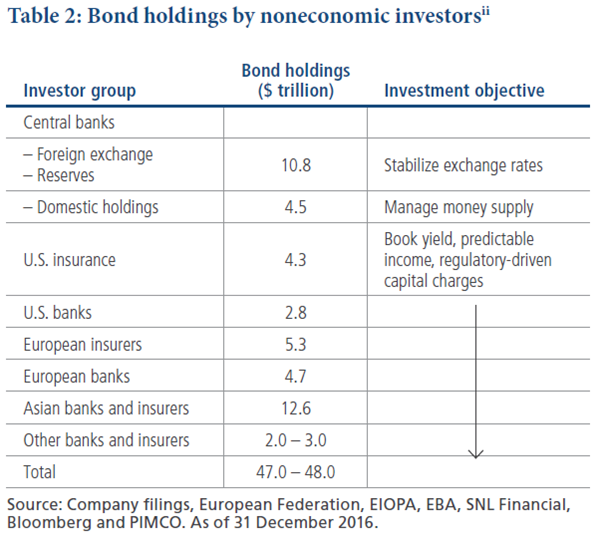

The Impact of Non-Economic Investors

A sizable portion of investors in fixed income markets – roughly 47% according to the table below – operate with primary objectives that differ from profit maximization.

The authors at PIMCO go on to say:

Central banks buy bonds to depreciate their currency and boost inflation, growth and asset prices; commercial banks and insurance companies may care more about book yield than total return for a variety of reasons…

…To the extent constraints are binding (most of them are), by construction, economic investors tend to outperform noneconomic investors,

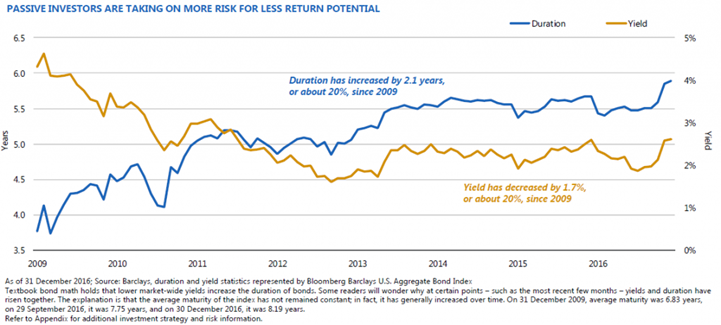

An Index with Fleas

The chart below illustrates the change in the characteristics of the Bloomberg Barclays U.S. Aggregate Bond Index (“the Agg”) since the Financial Crisis ended in 2009. This is a meaningful shift over an eight year period, with the duration of the index more than 20% higher and its yield more than 20% lower.

I am by no means a bond market doomsayer. Historically speaking, a bad year for bonds has been the equivalent of a bad day for equities. But it’s hard to deny that the Agg is in a precarious position with its sensitivity to interest rate fluctuations at the higher end of its historical range while its yield cushion is at the lower end.

Structural Tilts, Off-Index Exposures and Flexible Trading

Readers of this blog should by now be aware (I hope) of my affinity for strategic tilts to equity style factors such as Value, Size, Momentum and Profitability. Since discussions about factor investing often focus on equities, it often gets lost that there are a number of unique investing styles and structural tilts that have acted as arrows in the bond fund manager quiver. Here are just a few:

- Variable Maturity/Duration

- Variable Credit

- Liquidity premia

- Option selling

- Non-index exposures such as TIPS, High Yield, Non-Agency Mortgages and Emerging Market Bonds

- Yield curve positioning

- Carry

- Convexity trades

Sure, there are a handful of Smart Beta fixed income ETFs and “quant clones” that have attempted to codify and replicate some of the “secret sauce” advantages that active funds have enjoyed, but few have reached critical mass and/or proved their worth. Score one for the humans I guess…for now.

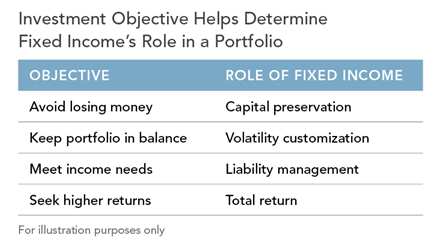

At the end of the day, different investors approach fixed income with varying objectives, some of which are outlined below.

All of the above cannot be accomplished simultaneously. For example, pursuing higher total returns or targeting a specific level of income may need to come at the expense of dampening overall portfolio volatility or preserving capital. Bond investing, like all other forms of investing, is about trade-offs. Investors would be well served to focus first and foremost on determining what the appropriate trade-offs are for their particular situation. Choices between active/passive or mutual fund/ETF should be secondary.

This post was not meant to cast a negative light on index-based fixed income products. Nor was it an attempt to blindly extol the virtues of active bond funds. Neither is perfect and each can serve a valuable and distinct role in a diversified fixed income portfolio. For investors or advisors that may have just assumed Evidence Based Investing was synonymous with passive index exposure, it might be an opportune time re-examine that enthusiasm with your bond portfolio.

Passive investing may be eating the world, but for now at least, active bond funds are still enjoying their leftovers.

(Full Disclosure: my firm, Huber Financial Advisors, uses funds from PIMCO and BlackRock in constructing client portfolios.)

Additional Reading:

Bonds Are Different: Active Versus Passive Management in 12 Points (PIMCO)

BlackRock Sends in the Clones (Morningstar)

At BlackRock, Machines Are Rising Over Managers to Pick Stocks (New York Times)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.