Around the ETF World in 80 Hours

A few weeks ago, I attended the annual Inside ETFs conference down in Hollywood, FL. This has become the go-to event for the latest trends not just in ETFs, but across the investment industry at large. As I have in years past, I wanted to share my highlights and takeaways from my 3 1/2 days immersed in the world of ETFs.

ANTs, or Active Non-Transparent ETFs

To say that it has been tough sledding for traditional active managers over the last decade would be putting it mildly. The movement towards, low-cost, passive, systematic, factors, et al. has resulted in tremendous outflows for traditional stock pickers. A recent development may provide active funds a last-ditch Hail Mary attempt to fight this trend.

Precidian Investments, whose proprietary Active Shares model was approved by the SEC, would allow ETFs to avoid disclosing their holdings daily – a design feature that many active managers will find highly valuable. Several other models for nontransparent actively managed ETFs have also obtained the SEC’s blessing in recent months, including those from Fidelity, Eaton Vance, and T. Rowe Price. American Century seems likely to be the first asset manager to launch products under the newly approved structure, with several of the largest fund complexes right behind them. Precidian has already reached licensing deals with 14 asset managers that represent roughly $14 Trillion in AUM. Time will tell if investors gravitate to these new structures that attempt to capture some of the benefits of ETFs while still allowing active managers to protect their “secret sauce.”

Crypto Comeback?

Crypto was all the rage at the 2018 Inside ETFs conference after the – surprise, surprise – huge run up in prices throughout 2017. At last year’s conference, after the crypto-bubble popped, it was barely an afterthought. This year, following another strong year in returns. there was a palpable resurgence of interest in the emerging asset class. Despite there not being a single Bitcoin or cryptocurrency ETF available for purchase in the U.S., several crypto-focused asset managers could be found throughout the conference exhibit hall showcasing their wares. With at least a dozen providers vying to be the first to receive SEC approval, it seems safe to say that crypto is here to stay and that the arrival of a Bitcoin ETF is a when, not if, question.

Liquid Alts Time to Shine

I was blown away by the amount of people that attended the panel I was on, not due to the quality of the content and speakers but because Liquid Alts represent such a small subset of the ETF universe. Not to mention that performance has generally been disappointing against the backdrop of continually strong returns from traditional assets. The level of engagement from the audience was great to see, and showed me that there are plenty of advisors out there not looking exclusively in the rearview mirror, but preparing for an era where “60/40” might not work as well as it has been.

If I’m being honest, I think there’s more junk than quality out there right now when it comes to Liquid Alts products. That said, I’m encouraged by some of the innovation I’m seeing in this segment of the ETF landscape and there are some bright spots if you look hard enough. Investors today can find ETFs that deliver cheap, efficient exposure to alternative strategies such as put writing, merger arbitrage, trend following and even the anti-beta factor. There will always be certain Alternatives better packaged inside a mutual fund, interval fund or private fund wrapper. But I have a feeling that Liquid Alts ETFs will play a greater role in investor portfolios in the years to come.

ESG: Arrival

For many years, Environmental, Social and Governance (“ESG”) strategies were a bit of a head scratcher. Every survey you would read about responsible/sustainable investing seemed to indicate significant interest among investors, particularly the Millennial generation. And yet when it came time to put their money where there mouth was, very few opened up their wallets to ESG. That tide may be beginning to shift.

Several of the “Best New ETF of 2019” nominees were different variations of ESG strategies. The top 2 fund launches by size in 2019 were both ESG-oriented, each attracting over $1B in assets. Investing giant BlackRock placed sustainability front and center with Larry Fink’s annual letter to clients. And lastly, indexing juggernaut MSCI is predicting that money tracking indices tied to ESG criteria will eventually supplant that of market-cap weighted benchmarks. Color me highly skeptical on that last one, but regardless – it seems as though 2020 will be ESG’s coming-out party.

Late Cycle Lament

The sun was shining in Florida, but that didn’t stop GMO’s James Montier from hanging a dark cloud over the audience as it relates to forward looking return expectations. James outlined a handful of scenarios that would have to play out in order for U.S. stocks to achieve their historical return of ~6% above inflation going forward. Each involved highly improbable and lofty assumptions pertaining to multiple expansion, return on capital, and earnings growth. It wasn’t all doom and gloom though. According to James, Emerging Markets, particularly EM Value stocks, are poised for sizable future returns. Montier’s advice – avoid the “institutional imperative” and embrace unconventional portfolios.

As compelling as James’ arguments were, the rebuttal would be that GMO has been making this case for several years now and that anyone acting on their forecasts would have missed out on extraordinary returns in the U.S. stock market. After all, being early is the same as being wring in this business. This just goes to show you that valuation is a blunt timing tool, and that portfolio allocation decisions based on such should be done at the margins and with a long horizon. I have a ton of respect for GMO’s research and thinking. And while they have been painfully early in their bearishness this cycle, I think it would be a bit foolish to be entirely dismissive of their outlook.

Direct Indexing

If ETFs disrupted Mutual Funds, it begs the question – what will disrupt ETFs? To some, the answer to that question is Direct Indexing. I’ve written about this topic before, as our firm uses a platform called Canvas to deliver customized equity strategies to our clients.

Direct Indexing is nothing new. Firms like Parametric have been doing it for decades. The recent buzz surrounding the strategy comes on the heels of new entrants entering and innovating in the space, as well as account minimums and costs coming down as trading commissions (more on that in a minute) have largely been eradicated. It seems inevitable at this point that certain industry giants, like Charles Schwab and others, will throw their hat in the Direct Indexing ring.

While I am very bullish on Direct Indexing in the future, I have a hard time believing it will disrupt the trajectory of ETFs any time soon. Direct Indexing begins and ends with customization, and the value of customization can vary significantly from one investor to the next.

The No-Fee Era

When Charles Schwab announced last October that it would be eliminating commissions on all stock and ETF trades, it sent shock-waves throughout the investment industry. Their biggest competitors (TD Ameritrade, Fidelity, etc.), feeling their hands forces, quickly followed suit. This ultimately led to Schwab swooping in and acquiring TD, taking advantage of their depressed stock price.

This development has had major implications for financial advisors, who are no longer limited to the “commission-free” list at their preferred custodian. RIAs who manage model portfolios of ETFs can now build and manage those more efficiently than ever. The removal of this trading friction allows for more regular rebalancing, tax-loss harvesting, and effective implementation of small-dollar deposits.

The Impact of Giving

We take for granted how privileged we are to do what we do for a living. I want to applaud and thank Tyrone Ross Jr. for getting on stage and challenging all of us in the wealth management community to do a better job of giving back to those less fortunate than ourselves. Tyrone shared the personal story of his own youth in this incredibly powerful and moving talk. I’m sure I wasn’t the only one in attendance with goosebumps. You can see Tyrone’s talk here:

— Tyrone V. Ross Jr. (@TR401) January 29, 2020

Were it not for the people that gave him opportunities and invested in his future, Tyrone isn’t sure where he would be today. His efforts to support the local community surrounding the conference were remarkable. He finished his talk by asking those in attendance to donate to a local nonprofit organization, Voices for Children of Broward County, which provides resources for children in the county’s welfare system. If you’d like to support some of these children that are in desperate need, please click here to learn more.

What to do When an Investment Strategy Performs Poorly

Larry Swedroe, Chief Research Officer for Buckingham Strategic Wealth, closed out the conference with a great talk on how to behave when a strategy does poorly – very timely considering anything other than large-cap U.S. stocks has acted as a drag on performance in recent years! He spoke about relativism – how your portfolio does against an arbitrary index – and recency – focusing too much on the most recent returns and projecting them into the future – as enemies to investors. The S&P 500 is a perfect example of this. Larry pointed out three period where the index underperformed one-month Treasury Bills for at least ten years – 1929-1943 (15 years), 1966-1982 (17 years) and 2000-2012 (13 years).

Other topics Larry touched on:

- Setting proper expectations by using base rates to get a sense of the odds a particular factor or strategy will experience negative returns over different time frames.

- Valuations being the best predictor of long-term returns.

- The five requirements to have confidence there is evidence of a premium: persistence, pervasiveness, robustness, implementable, and intuitive.

- Whether or not value has become overcrowded.

I’ll end with this quote that Larry used in his presentation that made me chuckle:

“Diversification for investors, like celibacy for teenagers, is a concept both easy to understand and hard to practice.” – James Gipson

Inside ETFs in Pictures:

My Liquid Alts panel, along with Vance Barse, Shana Sissel, and Bill DeRoche.

Active Non-Transparent ETFs (“ANTs”) are the new kid on the block.

Vanguard unveiled a new economic indicator from their research group, The Idea Multiplier.

Matt Hougan and Dave Nadig giving their annual State of the ETF Union Address, where they touched on the growing popularity of Direct Indexing.

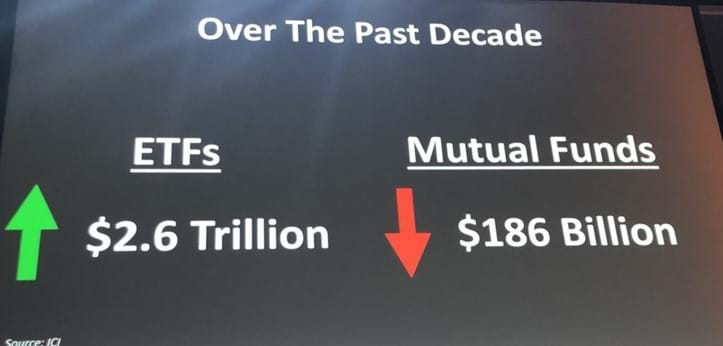

ETFs flows trounced Mutual Fund Flows in 2019.

It’s been the same story all decade. Just mind-blowing numbers.

Catching up with my friends Perth Tolle (Life + Liberty Indexes) and Corey Hoffstein (Newfound Research). And yes, those are drawstrings on Corey’s trousers.

The “ETF Pundit Super Bowl” making their case for Best New ETF of 2019.

Fun night at Margaritaville with some of FinTwit’s finest.

Fireside chat (sans fire) between Josh Brown and Howard Lindzon, talking the latest trends in fintech, wealth management and startup investing.

Morningstar ETF guru Ben Johnson and I getting our closeup with Amelia Garland of CityWire.

The Diplomat Resort in Hollywood, FL – such an amazing venue. See you next year!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.