Letters Home from Capital Camp

Capital Camp reminds me of the old Rodney Dangerfield line, “I went to a fight the other night, and a hockey game broke out.” Only substitute food & wine festival for fight and investment conference for hockey game.

For those unfamiliar with Capital Camp, it is the brainchild of co-hosts Patrick O’Shaughnessy and Brent Beshore. The premise is pretty straightforward:

- Invite some of the smartest and most curious investors they know down to Colombia, MO (Brent's hometown) for a few days

- Bring in some incredible speakers across a diverse set of disciplines

- Fill everyone's bellies with insanely good food and drink

- Leave a healthy amount of unstructured time for activities and conversation

- Sit back and watch the serendipity unfold.

Here is a great Twitter thread from Brent explaining the origin story in his own words:

(Note to self: when my daughter is old enough to get married, reach out to Brent to have him plan the wedding reception.)

As I reflect on this year's Camp and review my copious notes, I wanted to share what I learned (besides that I have the handwriting of a 6-year-old).

Saying you're a contrarian and actually being one are two different things. The irreverent Dan Rasmussen of Verdad Capital has a knack for making people uncomfortable because he challenges a lot of their preconceived notions and closely held beliefs. The three "investment heresies" below certainly run counter to today's conventional wisdom.

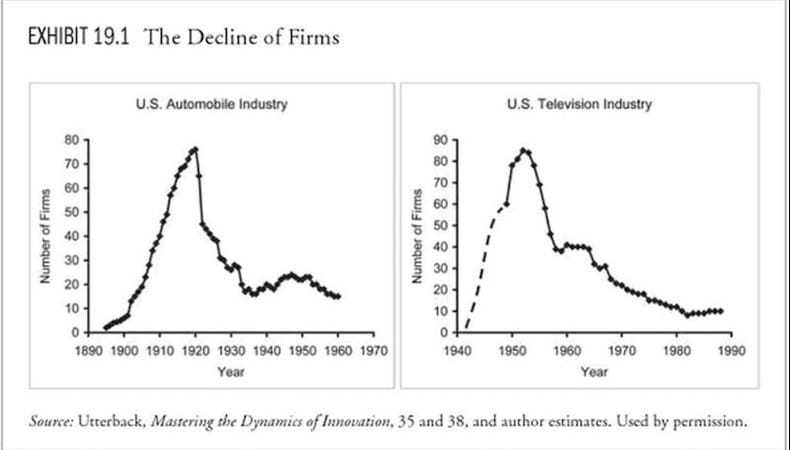

It’s impossible to know in advance what inning we’re in. This could apply to asset classes and market cycles of all stripes, but seems particularly germane to some of the "disruptive" technologies that are en vogue today. The pockets of excess and mini-bubbles may be real, but you can also appreciate that out of the ashes of some of the inevitable failures there will be some unbelievable success stories. You must leave room in your head for these conflicting thoughts.

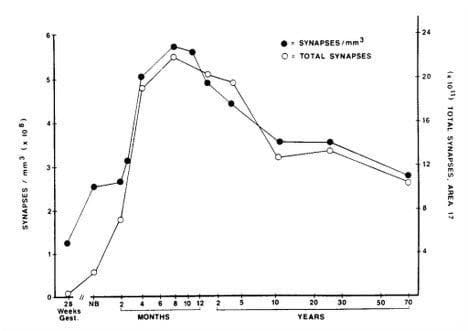

Michael Mauboussin likens the emergence of general purpose technologies like blockchain to other historical analogues like electricity, the printing press, automobiles and television.

These industries underwent a process similar to that of the neural development of a toddler. From the time a child is born until they are about four years old, the number of synaptic connections increases exponentially until the brain starts pruning. Similarly, emerging industries are littered with new entrants, many that ultimately fail. But the ones that stick around often go on to do amazing things.

Brand management is both art and science. One of the more impressive speakers was Kat Cole, former COO & President of FOCUS Brands (Cinnabon, Auntie Anne's, Carvel, etc.). I've always thought of a "brand" as sort of this fuzzy, nebulous concept. Hearing Kat recount the evolution and refinement of the Cinnabon brand was the first time I had heard brand management being discussed with such rigor. It was also worth noting the importance of community and content to a brand's ecosystem in today's connected, social world.

(I think the Capital Camp folks are starting to get the hang of this brand management thing.)

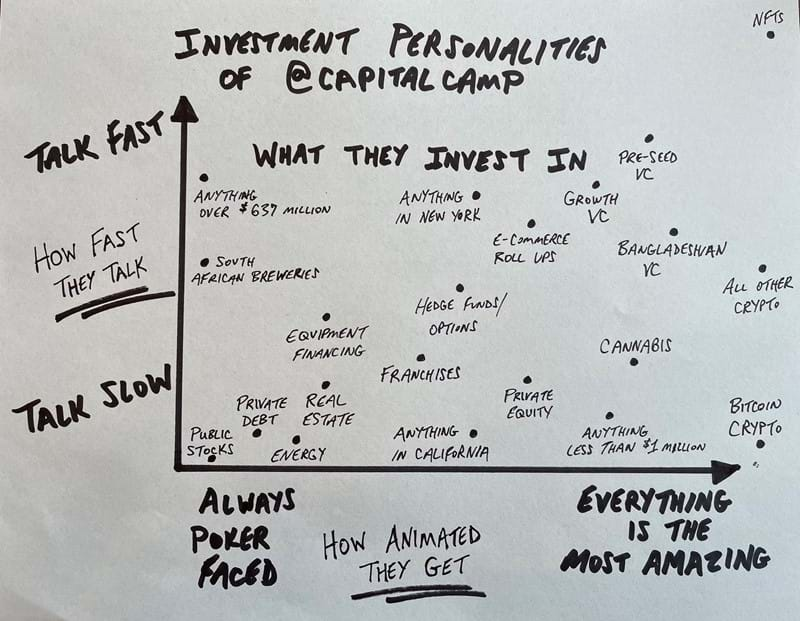

Variety is the spice of life. Most of the conferences I attend are oriented towards the RIA/Wealth Management crowd, which makes sense given what I do for a living. Those can be fun, but when you meet someone new at one of those events, you're never surprised by someone's response to the question "what do you do?". At Capital Camp, every conversation was a new adventure, with attendees ranging from public markets, venture capital, private equity, real estate, hedge funds, FinTech, crypto, and many other corners of finance. It was quite refreshing to be one of the few RIAs in attendance. My friend Tommy Martin put together this hilarious chart below that perfectly encapsulates the different personalities at Capital Camp:

Growth is not the opposite of value, and vice versa. There is nothing novel about this statement, but it's something I need to remind myself periodically. Growth is inherently a good thing. It's overpaying for that growth that has historically gotten investors into trouble. Conversely, statistical cheapness doesn't necessarily equate to a good value. Ultimately, you want to own quality business and pay a reasonable price. Sometimes those things overlap. Sometimes they don't.

Creator and platform economies are HUGE. The ecosystems that exist within platforms like Amazon, YouTube, and Instagram are far larger than most people realize. According to Ali Hamed of CoVenture, Amazon 3rd party sellers are largest asset class hiding in plain sight. Amazon, Shopify, and other e-commerce platforms have become the highways for modern small business and the emerging tech-enabled middle class.

NFTs and DeFi and the Metaverse, oh my. I thought I was as up to speed as I needed to be in these areas of as an interested observer from the outside looking in. I mean, I read Packy McCormick and Matthew Ball as much as the next investment blogger. After speaking with several campers who are directly involved in these areas, one thing become clear to me: I have only begun to scratch the surface of these emerging applications of web3.0. It's easy to engulf yourself in the hyperbolic headlines about NFT-mania, become a "right-click saver", and dismiss these nascent corners of the crypto landscape. But I think that would be a mistake. I will personally be making it a priority to become more well versed in these areas in the coming months.

(This isn't an NFT, it's a picture of an owl that was hanging up in a bar in Columbia. That said, I think I am going to mint it on OpenSea. Funding secured.)

Being a generalist is way more fun than being a specialist. I love my role as an asset allocator, being able to wander and spend time learning about and researching a plethora of different asset classes and strategies. VC investor Fred Wilson recently summed it up nicely:

"...as individuals, there is something quite helpful about moving back and forth between domains. It stimulates the mind in ways that going deep and staying deep on one thing cannot."

In that vein, I really enjoyed listening to Scott Wilson, the CIO at Washington University of St. Louis, a ~$10 billion endowment. Scott and his team all act as generalists, managing a concentrated and opportunistic portfolio that is completely unconstrained - a departure from the traditional endowment model. I loved hearing that they eschew traditional asset class categorization and simply bucket assets into one of two groups - growth and diversifying assets.

True innovation happens when the bar for excellence is raised. This paraphrased sentence came from Sam Teller, GP at Valor Equity Partners and former Chief of Staff to Elon Musk. Some of the stories Sam had about his time working for Elon put into perspective how rare and special of a human being he is. You don't have to be a Tesla bull to appreciate the fact that people like Elon Musk come along (maybe) once in a generation.

It’s time to retire “business casual” attire at conferences. There’s something so simple and yet so refreshing about being at a conference with no dress code. Especially after many of us have gotten used to wearing more relaxed attire over the last eighteen months of working remotely. When everyone is dressed at their own comfort level, it brings out their personalities in a way that a Brooks Brothers button down and pair of slacks can't.

The future of investing is bright. Pretty much everyone at Capital Camp, regardless of their age, was bright, motivated, and kind. But some of the most impressive people I encountered were the twentysomethings (or barely thirtysomethings) in attendance. From Dan McMurtrie (Tyro Partners) and David Perell (Write of Passage) to Ali Hamed (CoVenture) and Dan Rasmussen (Verdad Capital), I was blown away by the young talent that will be raising the bar for decades to come.

The second annual Capital Camp was a runaway success. I learned a ton and made some new friends. It truly is a special event that has reimagined and redefined the concept of an investment conference. I plan on making it an annual tradition and can't wait to see what Brent, Patrick and their team have in store in 2022 and beyond.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.