The Dull Days of Summer

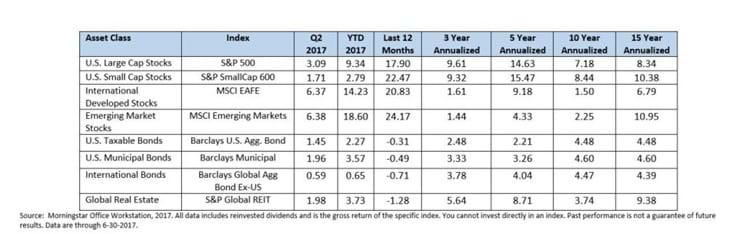

School’s out for summer and by the looks of it, market volatility is too. Returns have been solid and steady, with second quarter and year-to-date performance positive across the board in all of the major asset classes listed in the table below.

While the current White House administration has adopted the mantra of “America First,” stock market performance in 2017 has not followed suit. Halfway through the year, both International Developed Stocks and Emerging Market Stocks are both up double digits, gaining 14.23 percent and 18.60 percent respectively. Should this trend of outperformance by Non-U.S. stocks continue through year-end, it would be the first calendar year since 2012 that either the MSCI EAFE Index OR the MSCI Emerging Market Index outperformed the S&P 500 since 2012. This should be welcome news to globally diversified investors that have started to question why they have owned foreign stocks the last few years.

Returns for U.S. Stocks, while positive for the year, are more muted. U.S. Large Cap Stocks, as measured by the S&P 500, are up just over nine percent. U.S. Small Cap Stocks have largely sat out the 2017 rally, returning a relatively meager 2.79 percent. The current small cap “performance lag” should be put into context though as it comes on the heels of a year in 2016 in which they returned nearly thirty percent. Positive stock market returns through the first half of the year have historically tended to bode well for returns in the second half of the year.

Global Real Estate has cooled off a bit the over the past twelve months, down 1.28 percent since the end of June last year. Real Estate Investment Trusts, or REITs, have been one of the best performing asset classes since the Financial Crisis ended, posting positive calendar year returns every year since 2008. Global REITs are up just under 4 percent year-to-date.

Bonds in almost every fixed income category experienced positive returns in the second quarter amidst tightening credit spreads and a flattening yield curve – both generally positive for bond prices. What has surprised many investors – particularly those who have shortened the duration of their bond portfolios in anticipation of rising rates – is that intermediate and long-term bonds fared better than short-term bonds despite the Federal Reserve increasing the Federal Funds rate in June for the second time this year. The Barclays U.S. Aggregate Bond Index is up 2.27 percent for the year, much of which came this past quarter. International Bonds are relatively flat for the year but have provided meaningful diversification benefits over longer periods. Municipal Bonds, which suffered in the final months of 2016, have rallied quite a bit with year-to-date returns of 3.57 percent.

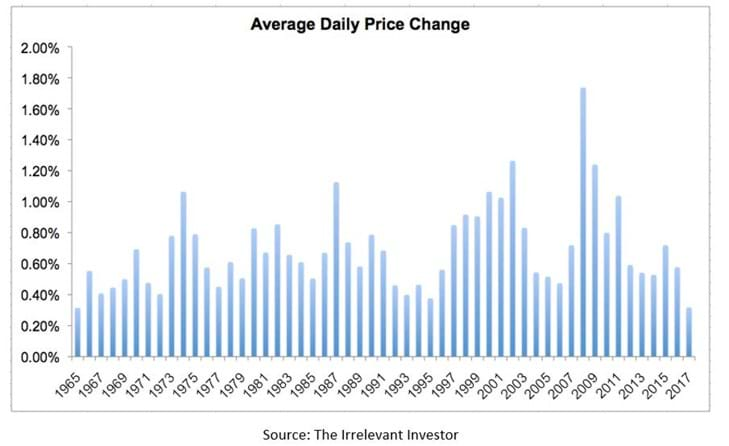

As mentioned in the introduction, volatility has been quite low across financial markets. Michael Batnick over at The Irrelevant Investor blog recently put together the following chart that shows the average daily absolute (meaning positive or negative) price change in the S&P 500 each calendar year since 1965.

Per Michael, if the year were over now it would be the smallest daily price change in over 50 years. Markets like this tend to elicit one of two responses from investors:

- Get me out before the you-know-what hits the fan!

Or

- Backup the truck, time to take on more risk!

In other words, you may be feeling either fearful or greedy. For those of you who identify as one of the former, a little historical context might help. According to research from Bespoke Investment Group, since 1961, in years where the S&P 500 was up in the first half of the year, the index had an average return in the second half of the year of 5.41 percent and was positive roughly 78 percent of the time.

For those who want to let the good times roll, I would caution that positive market returns paired with low volatility can lead to complacency. And complacency can lead to surprises. Making money feels good, but periods like this require a reinforcement of appropriate expectations so that you are not caught off guard when – not if – the next downturn in markets occurs. Now is as good a time as ever to revisit your investment strategy with your advisor to better understand its expected risk and return and remind yourself why it makes sense for your unique financial goals and circumstances. A great portfolio is useless if not paired with the proper expectations and the right time horizon.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.