Evidence Based Investing in 10 Words or Less

My friend Michael Batnick just wrote a post titled I Don’t Think That Means What You Think it Means. In it, he discusses the challenge in defining a term that has picked up a ton of steam in the financial advisor community over the last few years: Evidence Based Investing.

Here’s Michael:

“Ask ten different investment professionals “what is evidence-based investing?” and you’ll get ten different answers. Not different variations, but completely different responses. One person’s evidence is another person’s nonsense.”

One thing I have learned about Evidence Based Investing over the years is that it’s less a map telling you exactly where to go and how to get there and more an internal compass of investing principles that are supported by data, theory and common sense.

I asked a group of investment industry friends and colleagues what Evidence Based Investing, or EBI, means to them…in ten words or less. When Barry Ritholtz sent me his response, he noted that working around constraints can serve as a source of creativity and innovation. Based on the responses below, he couldn’t have been more spot on.

Mike Batnick, The Irrelevant Investor, @michaelbatnick

Find what works for you and eliminate what doesn’t.

Morgan Housel, Collaborative Fund, @morganhousel

Works on both a chalkboard and in real life.

Toby Carlisle, Carbon Beach Asset Management, @Greenbackd

Have one eye in the land of the blind.

Lawrence Hamtil, Fortune Financial Advisors, @lhamtil

Evidence Based Investing is the triumph of experience over hope.

Jeff Ptak, Head of Global Manager Research at Morningstar, @syouth1

Investing based on data, not narrative, in a dispassionate way.

Ben Johnson, Director of Global ETF Research for Morningstar, @MStarETFUS

Long data, short narratives.

Eric Balchunas, ETF Analyst for Bloomberg Intelligence, @EricBalchunas

Just ’cause you feel it, doesn’t mean it’s there.

Cullen Roche, Pragmatic Capitalism, @cullenroche

The triumph of empirical expectation over empty & expensive emotions.

Dan Egan, Director of Behavioral Finance and Investing at Betterment, @daniel_egan

Actively test and adapt. Seek disconfirmation. Be skeptical. Build systems.

Dr. Daniel Crosby, Nocturne Capital, @danielcrosby

Backed by data, founded in reason with roots in behavior.

Brian Portnoy, Virtus, @brianportnoy

Stories without evidence are just myths.

Corey Hoffstein, Newfound Research, @choffstein

Statistics can never prove a positive; be skeptical.

Wes Gray, PhD, Alpha Architect, @alphaarchitect

Synthesizing all available evidence to make an informed objective decision.

Jack Vogel, Alpha Architect, @jvogs02

Behavior, Theory, and Data.

Ryan Kirlin, Alpha Architect, @RyanPKirlin

Strip away seniority, eloquence, volume of fluff, fear and indifference.

Adam Butler, ReSolve Asset Management, @GestaltU

The plural of anecdote is not data.

“Jake”, EconomPic blog, @EconomPic

Garbage In, Garbage Out.

Charlie Bilello, Director of Research at Pension Partners, @charliebilello

Past performance may be indicative of future probabilities.

Nick Maggiulli, Of Dollars and Data blog, @dollarsanddata

Fear is loud. Evidence is quiet. Listen to the evidence.

Jim O’Shaughnessy, O’Shaughnessy Asset Management, @jposhaughnessy

Unemotional use of time-tested strategies with best base rates.

Anora Gaudiano, MarketWatch, @AnoraJourno

Investing with acknowledgement and humility that future returns are truly uncertain.

Peter Lazaroff, Plancorp, @PeterLazaroff

Using process and accountability rather than speculation and narrative.

Isaac Presley, Cordant Wealth Partners, @SeekingDelta

Maximizing your probability of success versus trying to sound smart.

Josh Brown, The Reformed Broker, @ReformedBroker

Evidence based investing or you can go back to astrology. Your choice.

Barry Ritholtz, The Big Picture, @ritholtz

1. Avoid Heuristics

2. Context matters

3. Rely on Data

4. Stop fooling yourself

Perth Tolle, Life + Liberty Indexes, @Perth_Tolle

Empirically proven solutions that also make intuitive sense.

Tadas Viskanta, Abnormal Returns, @abnormalreturns

Investing on faith, not facts, is a fool’s errand.

Bob Seawright, Above the Markets, @RPSeawright

A relentless focus on what works, what doesn’t, and why.

Andrew Miller, Miller Financial Management, @millerak42

Applying the scientific method and behavioral economics to investing.

Robin Powell, Ember Regis Group, @RobinJPowell

Basing investment decisions on peer-reviewed, time-tested, academic evidence.

Elisabetta Basilico, Academic Insights on Investing, @ebasilico

Investing without emotions by following systematically rigorous research insights.

Jeremy Schwartz, Director of Research at WisdomTree, @JeremyDSchwartz

Mostly getting smarter with your betas, not alphas.

Meredith Jones, Author of Women on the Street, @MJ_Meredith_J

Keep your forecasts, feelings, and

Prejudice away

From investment selection.

(Editor’s Note: +1 for the Haiku)

Brendan Mullooly, Mullooly Asset Management, @BrendanMullooly

Data over dogma.

Danny Noonan, Portfolio Manager at Huber Financial Advisors, @_DannyNoonan2

Throwing the forecasts and predictions in the garbage. Facts only.

Taylor Schulte, CEO of Define Financial, @DefineFinancial

Combining data, logic, and science to help improve investment returns.

Christie Jones, Children’s Health Investment Office, @ROIChristie

Replacing biases and gut feelings with intellectual honesty.

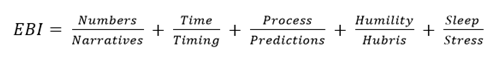

Now I guess it’s my turn. Like many of the respondents, I found it quite challenging to keep it under ten words. I decided to give myself a little loophole by going Full Nerd and creating an Evidence Based Investing equation:

In each of the above ratios, your numerator should be higher than your denominator. Since we obviously can’t precisely quantify these metrics, think of it as more of a personal scorecard. If you assess yourself honestly and come up with an overall “EBI Score” of greater than five, you are well on your way to being a bona fide practitioner of Evidence Based Investing.

I’d be remiss if I didn’t plug the 2nd Annual Evidence Based Investing Conference (East) next week in New York City, hosted by Ritholtz Wealth Management and IMN. It was the best conference I attended last year and I am already overflowing with FOMO for not being able to make it this year. The agenda is stacked and it is sure to not disappoint!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.