In Defense of Complexity

Last year, I wrote about the proclivity of human beings to bucket things into black and white terms. I listed out fifteen examples specific to investing that (IMO) require a more nuanced, grey approach. In hindsight, I wish I would have included another: simple vs. complex.

One of the defining zeitgeists of the modern investor epoch has been K.I.S.S. – Keep Investing Simple, Stupid. The ascent of “60/40” asset allocation, the proliferation of passive investing, and the explosion of ETFs are all byproducts of this era. From one generation to the next, the rallying cry shifted from Beat the Market! to Buy the Market!

Don’t let the title of this post fool you. I am not here to rail against the hallmarks of “simple” investing – lower costs, broad diversification, systematic rebalancing, tax-efficiency and a long-term mindset. Allow me be perfectly clear – these are unequivocally good things.

But simple is impossible without complex. Simple is how you interact with your web browser or an app on your phone. Complex is everything else happening in the background that allows it to function.

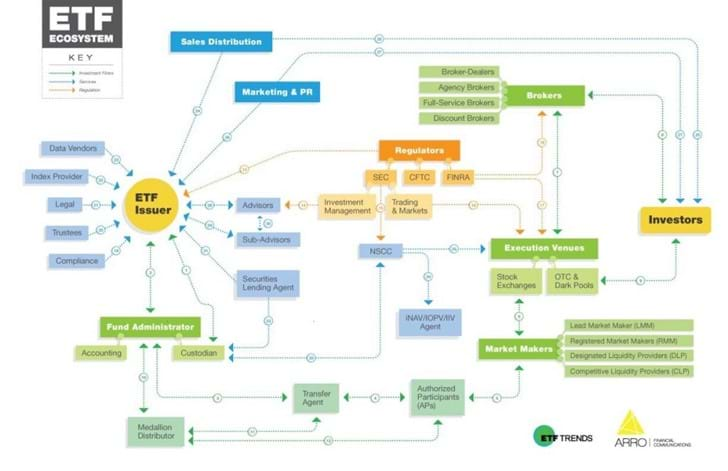

Let’s use our friend the Exchange Traded Fund as an example. It doesn’t get much simpler these days than buying an ETF, right? But the ecosystem that underlies this facade of simplicity is anything but. I love this diagram below from ETF Trends that illustrates all the moving parts that make ETFs tick (click to enlarge):

Source: ETF Trends

The idea of logging in to your custodial website and obtaining broad-based exposure to equity and fixed income markets around the globe with just a few clicks of a mouse would have been unfathomable decades ago. The architecture and infrastructure supporting this activity is riddled with some of the most complex mechanisms you could possibly conjure up.

Imagine traveling back in time and comparing portfolio notes with an investor living in the 1950’s. The conversation might go something like this:

1950’s Dude: I own about 20 blue chip stocks and a few Treasury notes.

You: Oh yeah, well I own over 8,000 stocks and 12,000 bonds across 40 countries in both developed and emerging markets.

1950’s Dude: Yikes, that sounds insanely complicated. Also, what is an emerging market? Also, what are those white things dangling from your ears? You look like a moron.

What seems simple today would have been obscenely complex just a few decades ago. Which brings me to alternatives, one of the most polarizing topics in investment management. This segment of the investment universe might as well be wearing a scarlet letter C for it’s perceived complexity.

(Before I proceed, please note that this is NOT an explicit endorsement for all things alternative. Even the “good ones” are not appropriate for everybody for a variety of reasons. There’s a lot of hot garbage out there as well. But that’s been the case for traditional investments too, so there’s that. Anyway, moving on.)

Investors/advisors/allocators with an aversion to alternative investments will often cite the usual suspects of higher fees, tax-sensitivity, tracking error and (in some cases) illiquidity as their reasons for omission. And to be clear, these can be perfectly valid considerations. But the one excuse I take umbrage with is that alternatives are “too complex.” Really? Let’s look at a few examples…

Real Estate

Most people would consider direct ownership of real estate an alternative investment. But how should its publicly traded cousin, REITs, be classified? I conducted a Twitter poll to ask that very question.

REITs should be classified as a part of the ________ sleeve of a diversified portfolio?

— Phil Huber (@bpsandpieces) March 14, 2019

There are some valuable and diversifying asset classes that routinely get discarded to the “Too Complex” pile for reasons related to ambiguous classification, unfamiliar tools, novel wrappers and peer/career risk. Which is unfortunate, because I would argue that certain alternative investments are complex in implementation only. Conceptually, they are often quite simple, intuitive, backed by data and grounded in economic theory. The arc of the investable universe is long, and it bends towards democratization and innovation. Not every shiny new toy deserves a spot in your portfolio, but it would be wise to reconsider exactly what constitutes simplicity in investing.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.