The Paper Trail – May 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

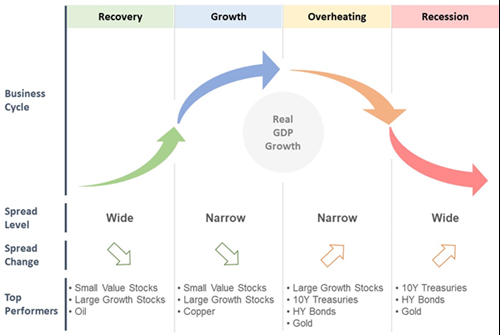

How informative are high-yield credit spreads as an investment indicator?

“If US investors could only use one macro indicator to inform their investment decisions, we feel that indicator should be the high-yield spread. It is a compound measure that combines both the pricing of risky assets (i.e., corporate debt), which is sensitive to risk appetite, and “risk-free” assets (i.e., Treasurys), which are sensitive to expected growth. So a declining spread can reflect more appetite for risky assets, rising growth expectations, or both, and vice versa.”

The Best Macro Indicator: Why You Should Be Following High-Yield Spreads (Verdad Capital)

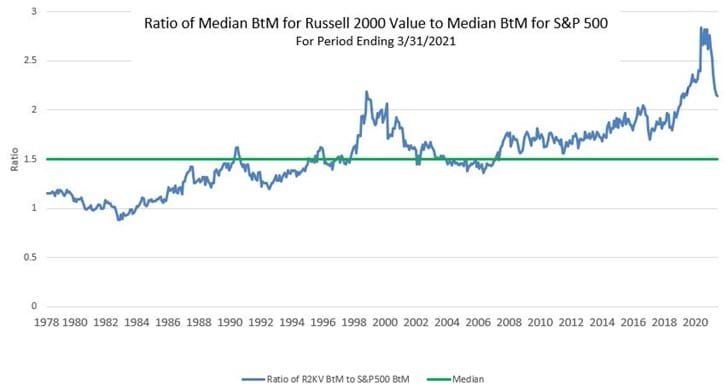

Does the rally in small cap value stocks still have legs to it?

“So, where do we go from here? Holding book value constant and varying only the relative prices of small-value stocks, prices would have to rise 43% from their March 31, 2021 levels to return to the historical median ratio. In other words, we’ve still got quite a bit of open field in front of us, or “room to run ” relative to the S&P 500.”

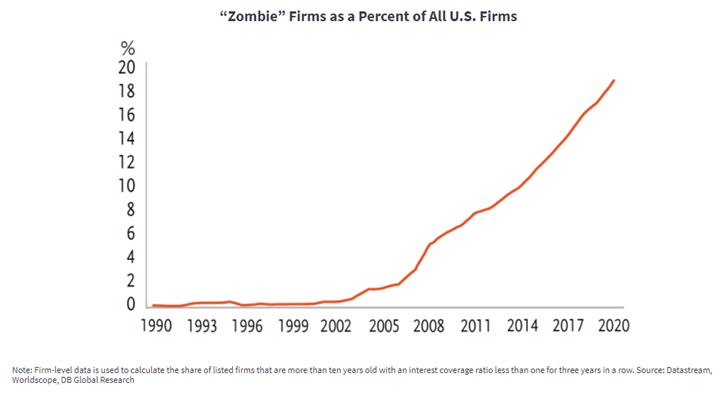

What are the unintended consequences of artificial asset prices?

“The Fed protests that it has the tools and the talent to stop inflation when the time comes. But those tools need trust to work, so if an inflation problem stems from a lack of trust, the Fed will find itself powerless, a bit like what can happen to a central bank in an emerging economy.”

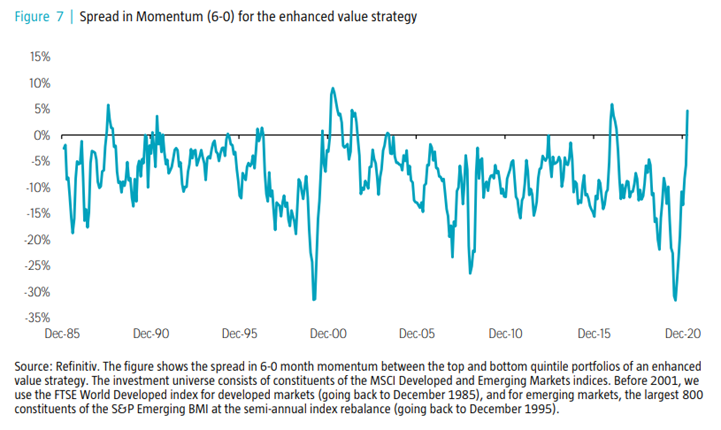

Are value stocks turning into momentum stocks?

“As the price momentum of value stocks continues to improve in the coming months, momentum strategies should start to purchase cheap stocks instead of expensive ones. Alongside this, analyst earnings revisions have almost never been more positive for value stocks, compared to their growth counterparts.”

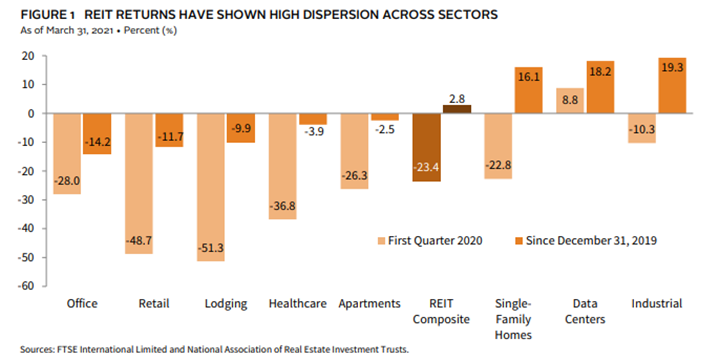

How will the long-term impacts of COVID-19 affect the outlook for real estate?

“Overall, we are reluctant to sound overly bullish about the broad asset class, as the outlook for some sectors is unclear. Still, for investors looking to immediately deploy capital, we highlight two categories of opportunities. One is markets currently experiencing dislocation or distress, including bridge lending and categories with stressed fundamentals, such as hotels. The second is strategies that continue to benefit from secular tailwinds, including single-family home rentals (demographics) and data centers (digitization).”

US Real Estate Outlook: Patience Required (Cambridge Associates)

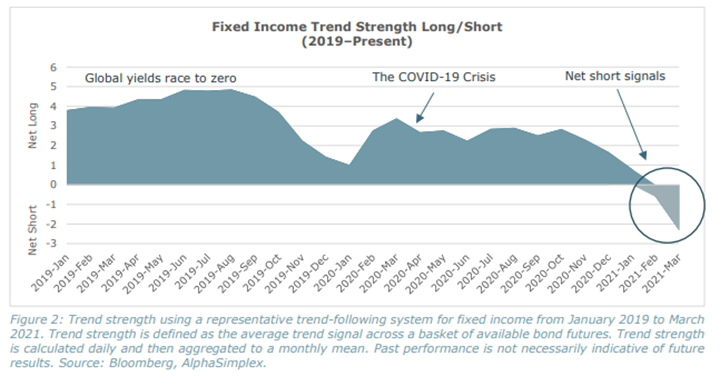

Is the long bond trend coming to an end?

“This chart shows that short bond signals have not been common since 1981, and have become even more uncommon in the period of quantitative easing post-2008. It is also notable that bond trends moved to net short in February of 2021.”

The Great Fiscal Experiment: What could be next? (AlphaSimplex Group)

“pieces” (reading time > 10 minutes)

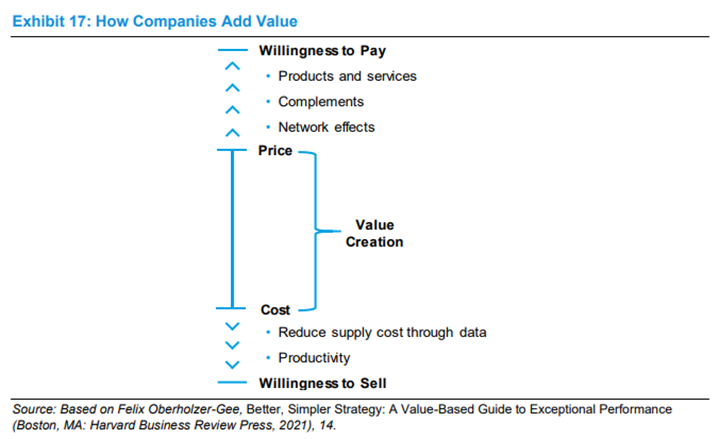

How do companies create value for customers?

“Companies and investors can consider the customer as the basic unit of analysis in understanding value. The rise of digitalization in the economy has allowed companies to gather unprecedented amounts of data on their customers and their behavior, permitting an assessment of overall value based on granular statistics.”

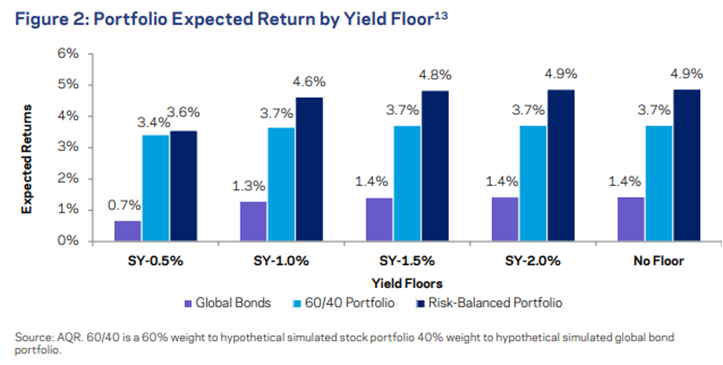

How low can bond yields go before their role is diminished?

“While some investors believe that yields have limited room for further drops, i.e. current levels are approaching a so-called “yield floor,” many struggle with identifying the point where their yield floor view materially impacts asset allocation in practice—the point where a bond’s return generation and diversification properties are impaired.”

Yield Floors and Asset Allocation: When Is the Role of Bonds Impaired? (AQR)

Are today’s highfliers falling back to Earth?

“Because maintaining a speculative bubble requires keeping demand perpetually in excess of supply, a growing supply of speculative assets makes the levitation act ever harder to maintain.”

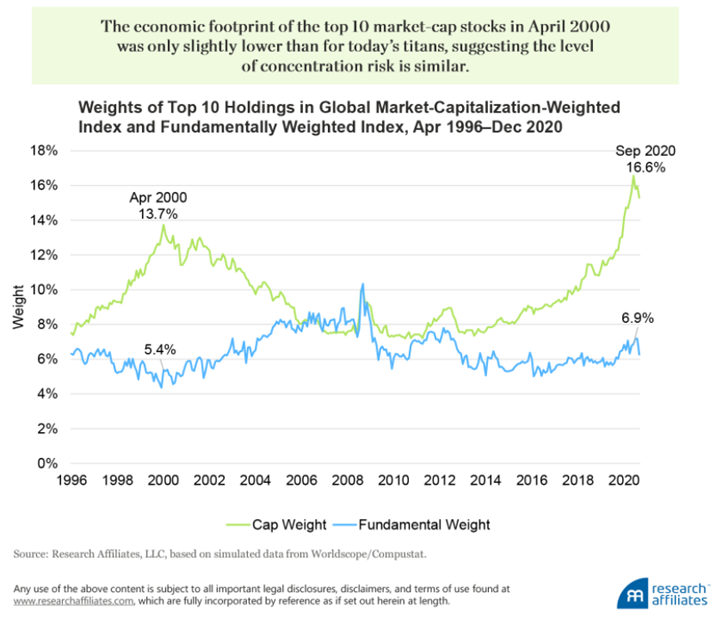

How risky is the concentration in market-cap weighted indices?

“Given that today’s titans are heavily skewed toward growth companies, coupled with the concentration risk of their dominating a large part of a market-cap-weighted portfolio, the potential for future underperformance of these (likely overvalued) stocks and the portfolios that hold them has merit.”

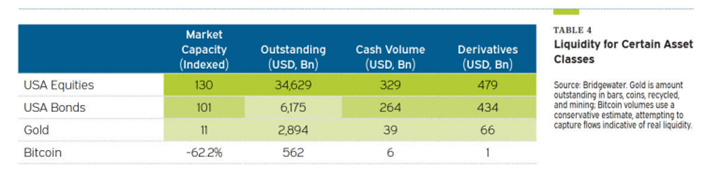

Do cryptocurrencies have a place in institutional portfolios?

“While Bitcoin appears to have a low correlation with equities and bonds, it lacks a sufficiently long track record for most institutional investors to draw meaningful conclusions about its future return behavior. And despite the aforementioned growth in liquidity and institutional services, there is an insufficient amount of both to meet the needs of most large institutional investors”

Cryptocurrencies: bitcoin, blockchain, and institutional investors (Meketa)

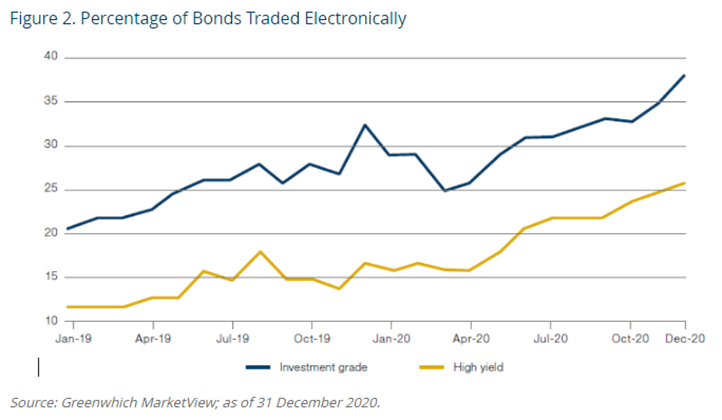

Will quant credit follow a similar path to quant equity?

“The attraction of quant credit is clear. Fixed income is still dominated by large, slow-moving, buy-and-hold money and unlike equity markets it is not yet heavily trawled by quant managers. Consequently, it is a market rife with inefficiencies and quant strategies exist to harvest the opportunities that such inefficiencies throw off.”

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.