These Go To Four

The Securities and Exchange Commission on Tuesday approved a request to list and trade quadruple-leveraged exchange-traded funds, marking a first for the growing market for such funds in the United States.

The request to list ForceShares Daily 4X US Market Futures Long Fund and ForceShares Daily 4X US Market Futures Short Fund was filed by Intercontinental Exchange Inc’s NYSE Arca exchange.

One of the funds is designed to deliver 400 percent of the daily performance of S&P 500 stock index futures, while another fund will aim to deliver four times the inverse of that benchmark.

That’s right, the investment industry’s version of the infamous Spinal Tap amp is not far away. So-called “geared” ETFs are nothing new, as there have been funds providing leveraged and inverse exposure to various asset classes and market segments for over a decade now. First came 1x, then 2x, then 3x…and here we are today.

Make no mistake about it, these products are nothing but capital destroyers for investors. Notice I said investors, not day-traders. If you are buying and holding geared funds for a significant period of time, you are virtually guaranteed to lose a substantial portion of your investment. It doesn’t matter if the particular fund is leveraged, inverse, 2x, 3x, or now even 4x. Any way you slice it, you lose over the long-term.

Todd Rosenbluth and Brett Manning recently explained why these products can be losers even if your call on the market’s direction is right:

The problem investors run into with these funds occurs when people hold them for more than a day or two, say Rosenbluth and Brett Manning, senior market analyst at Briefing.com.

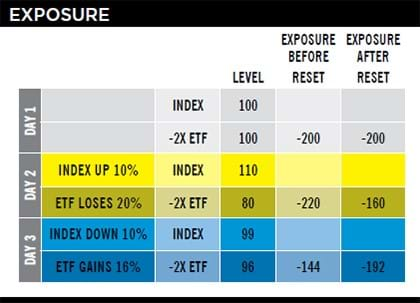

Because they reset daily, arithmetic works against buy-and-hold investors, Manning says.

Manning used a hypothetical example to explain the long-term drag for leveraged performance. If an index on Monday is at 10, on Tuesday rises to 11 and on Wednesday falls back to 10, a double-leverage long ETF would rise to 12, but then fall to 9.82. It rose 20% on Tuesday, but fell 20% on Wednesday. Because a 20% drop from the higher number leads to a larger nominal decline, the investor loses money.

Don’t believe me? Here’s proof:

The above chart looks at five year returns for three ETFs that provide different forms of exposure to gold mining stocks. The VanEck fund (red line) represents direct exposure to the underlying stocks without any leverage or inverse qualities. The two Direxion funds (blue and yellow lines) respectively offer 3x leveraged or inverse exposure to the underlying stocks. Let’s pretend for a moment that in 2012 you had perfect clairvoyance and knew that gold mining stocks were going to get clobbered (which they did) over the next five years. Wouldn’t it have been wise to maximize that bet by attempting to capture three times the downside benefit by investing in the 3x Bear fund? You may have looked like a genius early on but over time it would have eroded your capital to approximately zero.

And it’s not just individual investors that are using these “investments” improperly. Just a few months ago, Morgan Stanley paid $8M to settle charges related to recommending inverse ETFs to their clients. From ETF.com:

In a statement, the Securities and Exchange Commission said Morgan Stanley admitted to wrongdoing, adding that the company had from 2010 to 2015 “recommended securities with unique risks and failed to follow its policies and procedures to ensure they were suitable for all clients.”

Do I think these types of products pose any sort of systemic risk to the financial system? No, I don’t. As Bloomberg’s resident ETF expert Eric Balchunas pointed out on Twitter:

Not to rain on the "this will end well" crowd's parade but context is imp. Leveraged ETFs acct for 2% of ETF aum and < 0.5% of all fund aum. https://t.co/flpEdp4S38

— Eric Balchunas (@EricBalchunas) May 3, 2017

At the end of the day, these funds represent a minuscule portion of overall fund industry AUM. So why spill all the ink on this topic? Because all it takes is seeing one brokerage statement from a prospective client littered with these toxic products carrying irreversible losses to make your blood boil.

Despite not being designed for mainstream consumption, there is nothing prohibiting or stopping an unsuspecting person from logging into their brokerage account and making a trade. Perhaps there should be. But until that day arrives, please do yourself a favor and steer clear. Unless, of course, you enjoy lighting $100 bills on fire.

SEC approves request to list and trade quadruple-leveraged ETFs (Nasdaq)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.