Twelve Books Everyone in Finance Will Be Talking About in 2018

‘Tis the season for year-end Holiday Book Lists. Try as you may, there is no escaping them:

The 19 best business books of 2017 (Business Insider)

10 Books for Winter Reading (The Big Picture)

The Best Books of 2017 (Bloomberg)

Rather than join the fray with my own stocking stuffer recommendations, I find it fun to look about 6-12 months into the future- kinda like the stock market! I’ve scoured the “Coming Soon” titles on Amazon to put together a list of what I feel are going to be the most talked about books in finance/business next year. In no particular order:

1. Mastering the Market Cycle: Getting the Odds on Your Side by Howard Marks

I often get asked what investment book(s) I would recommend to a novice investor. My response is always the same: The Most Important Thing by Howard Marks.

Marks is one of my investing heroes and his highly anticipated memos always lead me to drop what I’m doing. You can imagine my excitement when in one of his recent memos, Howard teased that he was working on a new book about market cycles. Scheduled to be released in October of 2018, this has the potential for “instant classic” written all over it.

2. Big Mistakes: The Best Investors and Their Worst Investments by Michael Batnick

Widely known for his blog The Irrelevant Investor, Mike Batnick is anything but these days. Mike has grown by leaps and bounds as a writer the past couple of years and I, for one, can’t wait to read his hardcover debut. Most investment books that profile the greats tend to focus on what they did best. Mike appears to be taking a different approach by examining the failures of some of the most legendary investors to provide his readers a crash course in what NOT to do with their portfolios. The subject matter of this book, coupled with Mike’s trademark wit, is sure to be a recipe for success. It literally might break Finance Twitter after it’s released.

3. Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb

Guess who’s back, back again. Taleb’s back, tell a friend.

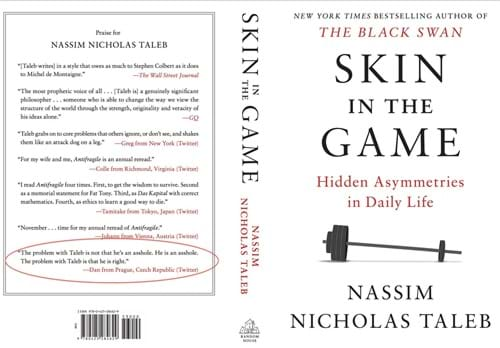

Love him or hate him, Nassim Taleb is one of the most provocative and original thinkers in finance. The author of Fooled by Randomness, The Black Swan and Antifragile returns to the scene in February with Skin in the Game, aiming to challenge long-held beliefs about risk and return in investing, politics, religion and more.

One interesting factoid: rather than have other authors or celebrities provide endorsements for the back cover, Taleb used actual quotes from strangers on Twitter. I’d say the bottom one pretty much sums him up

4. The Square and the Tower: Networks and Power, from the Freemasons to Facebook by Niall Ferguson

This ambitious title from renowned economic historian Niall Ferguson tackles the collision course between old-world hierarchies and new-world social networks. I have very high hopes for this one!

5. The Behavioral Investor by Daniel Crosby

My pal Daniel Crosby crushed it with his last book, The Laws of Wealth. Now he’s back and this time, it’s…behavioral.

Daniel is going to dive deep into the world of psychology and examine the factors that drive investor behavior. Readers will likely walk away with a better understanding of their own hard-wired behavioral shortcomings and some actionable ideas to construct portfolios in spite of them.

6. Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts by Annie Duke

Anyone who’s played poker before has likely heard of Annie Duke. Now a business consultant, the former poker champion has written a book on probabilities and decision making and the parallels to investing are sure to be plentiful. Just read this description and tell me this isn’t an investing book in disguise:

“For most people, it’s difficult to say “I’m not sure” in a world that values and, even, rewards the appearance of certainty. But professional poker players are comfortable with the fact that great decisions don’t always lead to great outcomes and bad decisions don’t always lead to bad outcomes.

By shifting your thinking from a need for certainty to a goal of accurately assessing what you know and what you don’t, you’ll be less vulnerable to reactive emotions, knee-jerk biases, and destructive habits in your decision making. You’ll become more confident, calm, compassionate and successful in the long run.”

7. Safe Haven: Investing for Financial Storms by Mark Spitznagel

Spitznagel, a hedge fund manager, first rose to prominence with his first book The Dao of Capital. A student of the Austrian School of Economics, Spitznagel is often pegged a “doomsday” investor given his penchant for tail-risk hedging. I’m not exactly the Armageddon type, but I am a big proponent of broad diversification and building portfolios resilient enough to survive and thrive across different market regimes. I’ll be curious to find out how much I agree or disagree with the prescriptions laid out in this book. If nothing else, I’m confident it will offer me an alternative perspective.

8. The Elephant in the Brain: Hidden Motives in Everyday Life by Kevin Simler, Robin Hanson

Understanding human nature is critical to becoming a successful investor. In The Elephant in the Brain, authors Kevin Simler and Robin Hanson study the unconscious motives that pervade our daily lives.

9. When the Wolves Bite: Two Billionaires, One Company, and an Epic Wall Street Battle by Scott Wapner

I don’t watch CNBC regularly, but I happened to be watching this particular day when Scott Wapner played referee in a heavyweight battle between to Wall Street legends: Carl Icahn and Bill Ackman. I couldn’t believe what I was witnessing as I watched these two billionaires trade insults back and forth related to their years-long feud and competing positions in Herbalife stock. Nobody was closer to the action than Scott and I’m anxious to learn more of the behind-the-scenes stories of this rivalry.

10. The Truth Machine: The Blockchain and the Future of Everything by Paul Vigna, Michael J. Casey

The mainstream rise of Cryptocurrencies was unequivocally the investing story of 2017. Seemingly overnight, Bitcoin went from relative obscurity to having its own chyron on CNBC. Bitcoin’s price seems to defy gravity daily, with people shouting bubble every step of the way.

Vigna and Casey were writing about Crypto before Crypto was cool when they released The Age of Cryptocurrency in 2015. Now they are back to demystify the blockchain technology that is the backbone of cryptocurrencies and it’s potential to disrupt modern finance and broaden access to the global economy.

11. When: The Scientific Secrets of Perfect Timing by Daniel Pink

I’m a big Daniel Pink fan and loved To Sell is Human. Before you get too excited by the subtitle, this book has nothing to do with market timing…

There are only so many hours in a day and we all struggle with how to best fill them between our work lives and our personal lives. Pink aims to change that by exploring the science behind timing to help us maximize the world’s most valuable commodity.

12. Enlightenment Now: The Case for Reason, Science, Humanism, and Progress by Steven Pinker

In this follow up to The Better Angels of Our Nature, Pinker takes a big picture look at human progress. While it can feel at times like the world is coming to an end, we are now living in a time when health, prosperity, safety, peace, knowledge, and happiness are on the rise globally and we have reason and science to thank.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.