Groundhog Rates

When it comes to the bond market, the past eight years or so have felt like a scene from the movie Groundhog Day. Only instead of Ned Ryerson, it’s been Ned Risingraterson accosting me in the street, shouting:

“Phil? Phil Connors Huber? Is that you?

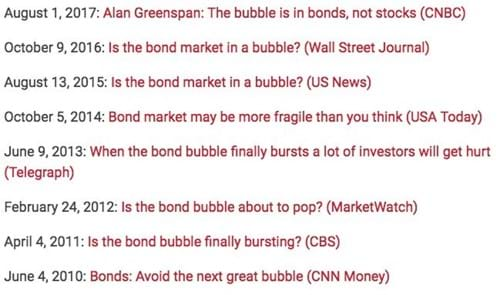

In what has become an annual tradition on Wall Street and in the financial media, market gurus and pundits alike have been calling for the bursting of a bond bubble, pointing to the specter of rising interest rates as the death knell of fixed income portfolios. Shout out to Ben Carlson for compiling this broken record of headlines below:

Source: A Wealth of Common Sense

Source: A Wealth of Common Sense

Meanwhile, back here on Earth, this is what has actually happened to interests rates across the maturity spectrum since 2010:

THE HORROR.

With the new year fully underway, calls for a top in bonds are en vogue again – the latest coming from the original “Bond King” himself, Janus’ Bill Gross. In his latest commentary, Gross states that “Bonds, like men, are in a bear market.”

To anyone that has been following the bond market over the last decade, these types of prognostications have become anathema. For unsuspecting investors, however, forecasts like these – especially coming from once vaunted figures such as Gross – can easily conjure up fears and lead people to make questionable decisions with what is supposed to be the safety valve and anchor of a balanced portfolio.

In a recent post, Josh Brown quells fears of a fixed income crisis by pointing out that rates have been stealthily climbing higher for well over a year now and – lo and behold – the bond market has taken it in stride. Here’s Josh:

We’ve been hearing about a bond catastrophe in the making for quite a while now. Meanwhile, rates have risen very gradually and the central bank has never been more open about their moves, telegraphing their actions in a way that watchers of the Greenspan era could only have dreamed of.

No such crisis has taken place yet as the Fed first began buying less during QE, then buying none, then began to talk about slowly winding down its portfolio. Overall, fixed income market participants have been extraordinarily well-behaved. Liquidity has not been a problem.

The folks over at Gurtin Municipal Bond Management have done a little mythbusting of their own in a recent research report. One of the trends they (and others) have noticed is that fears of how intermediate – and long-term bonds might perform in the current Fed tightening environment has led many investors to actively shorten the duration of their fixed income portfolios. Concurrent with shortening duration, many investors are also adding more credit risk in an effort to compensate for some of the lost yield. Based on their findings, the authors of the paper urge caution in such an approach.

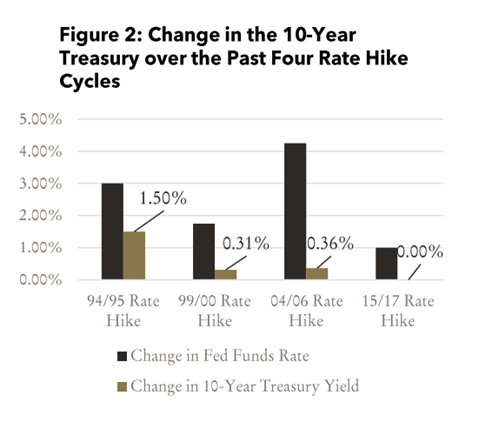

Making large duration bets implies that a) there is some magnitude of correlation between short-term and long-term rates and that b) Yield Curve movements can be forecasted. First, let’s take a look at correlation. The chart below looks at the last four Fed rate hike cycles and what the 10-Year Treasury did over the same time frame:

Source: Gurtin Municipal Bond Management

Source: Gurtin Municipal Bond Management

Via Gurtin (emphasis mine):

“Over the past four Fed rate hike cycles, dating back to 1994, the change in the 10-year Treasury yield has ranged from 0% to 50% of the corresponding change in the fed funds rate over the rate hike cycle, with the most recent rate hikes of 1999-2000 and 2004-2006 at less than 20% and 10%, respectively. Formal academic studies also indicate that the Federal Reserve has much more control over short-term interest rates than long-term rates, which appear to be driven in large part by economic fundamentals and market dynamics.”

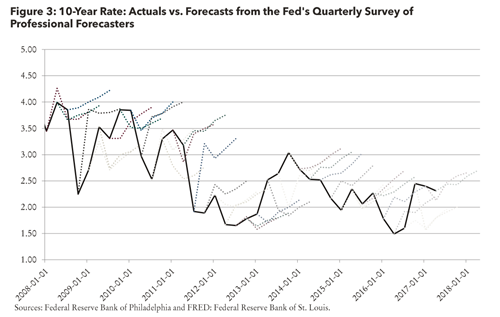

The next chart is one of my absolute favorites. The solid line below is the actual path of the 10-year Treasury rate since 2008 and the dotted lines represents the interest rate forecasts from the Fed’s Quarterly Survey of Professional Forecasters. If this doesn’t deter you from making rate bets, I don’t know what will…

Source: Gurtin Municipal Bond Management

Lastly, I shouldn’t have to remind anyone about the dangers of emphasizing junk rated bonds in the defensive part of your portfolio. Or is 2008-09 so far in the rear view now that we have forgotten the lessons it taught us? By shortening the maturity of your bond portfolio while also adding lower rated securities, you are effectively exchanging one risk (duration) that diversifies your equity exposure in favor of another (credit) that will become more correlated to equities exactly when you need diversification most.

So the next time someone tries to serve you up a double whammy of low duration (have your cake!) and high-yield (eat it too!), it might be time to take a page out of Phil Connors’ playbook…

Additional Reading:

When Did Rates Bottom? (The Reformed Broker)

Financial News Doesn’t Rhyme But It Does Repeat Itself (A Wealth of Common Sense)

(Full Disclosure: my firm, Huber Financial Advisors, uses funds from Gurtin Municipal Bond Management in constructing client portfolios.)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.