This is the Normal Part

Friday was a rough day for the stock market, with both the S&P 500 and the Dow down…bigly. It didn’t help that rates spiked, leaving bonds with negative returns as well. Diversified investors got bit by both ends.

The accumulated complacency from the last two years of steady, positive returns and non-existent volatility got smacked right in the face last week.

The media did its job by getting investors all excited. I got the following alert on my phone yesterday afternoon:

“DOW DROPS 500 POINTS”

All caps. Nice touch, CNBC.

The higher the market goes, the more irrelevant “point movements” become. On Black Monday in 1987, 500 points meant a single-day decline of OVER TWENTY TWO PERCENT. Friday, it meant a little over two and a half percent. As Jason Zweig pointed out on Twitter, it was the 531st worst day in the history of the Dow Jones Industrial Average.

Perspective, people. Moving on…

It’s important after days like Friday to remember that the experience of 2017 was an aberration, not the norm. Typically, even the best years have some very bad days, weeks, and even months. Last year was an exception to the rule.

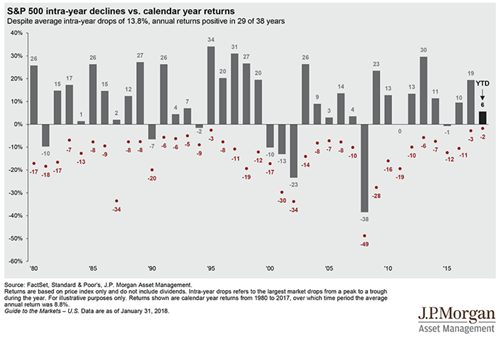

J.P. Morgan regularly updates the chart below as a recurring part of their Guide to the Markets piece. The dark grey bars represent the price return of the S&P 500 in each calendar year, while the red dots and the numbers below them show the largest intra-year drop in the market during those same years.

Source: J.P Morgan Asset Management

Despite the grey bars being positive in 29 out of the 38 years provided (and that’s before taking into account reinvested dividends!), you can clearly see that almost every one of those positive years experienced drawdowns of at least five percent. In many positive years, the drawdowns were at least ten percent, and in some greater than twenty percent.

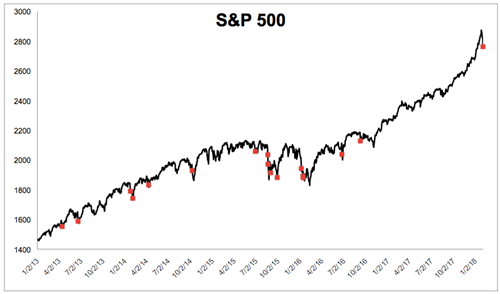

Although we hadn’t seen a day like Friday in almost two years, it was actually the seventeenth -2% day for the S&P 500 since the beginning of 2013 as my friend Michael Batnick points out over at his blog.

Source: The Irrelevant Investor

Imagine if you had gone to cash after one of those “down 2% days” in early 2013. Or 2014. Or 2015. Or 2016. You get the idea…

What happened last week is a regular and normal part of investing in equities – the price of admission for long-term wealth creation. I have no idea what Friday’s drawdown means for near-term market returns. But I do know that it doesn’t change my investment plan a single bit.

Not. One. Bit.

In closing, I’ll leave you with this tweet from my friend Morgan Housel:

Worst day in the market since the last 2% decline you don't care about or remember anymore.

— Morgan Housel (@morganhousel) February 2, 2018

Additional Reading:

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.