Not Your Father’s Emerging Markets

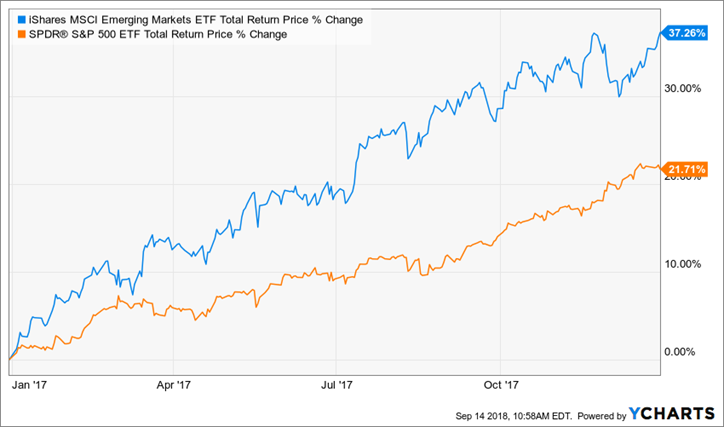

It felt great to be an investor in Emerging Markets in 2017.

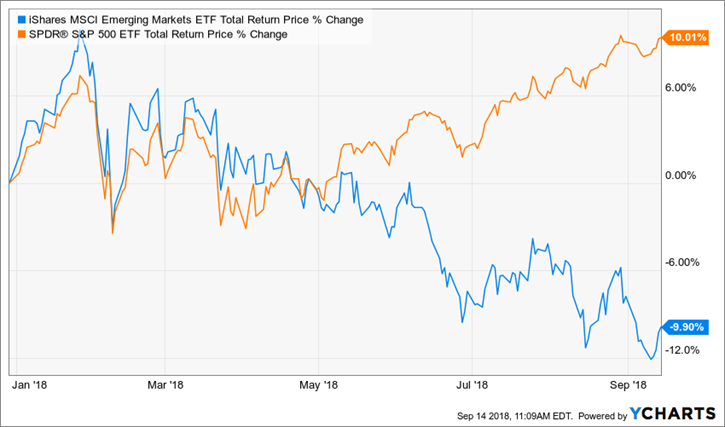

Thus far in 2018? Not so much.

“Less than a year? That’s just noise”, you might say. “Let’s look at the last ten years. That will assuredly paint a rosier picture, right?”

Woof.

Morgan Housel summed up investor attitudes towards Emerging Markets perfectly with this tweet:

2007: "Emerging markets will generate higher returns, but expect lots of volatility."

— Morgan Housel (@morganhousel) September 6, 2018

[lots of volatility happens]

2018: "Why would you invest in emerging markets? They're so volatile."

After ten years of lots of volatility and not much to show for it, it’s perfectly natural to ask yourself why you should even bother allocating to Emerging Markets in the first place. This sore thumb sticks out even further when juxtaposed against a U.S. stock market that continues to hit new all-time highs.

What follows is Part One of a two-part series on Emerging Markets. Today’s post explores the origins of the asset class and how these economies have evolved over time. The next post will revisit the rationale for a strategic allocation to Emerging Markets and the importance of establishing reasonable expectations about risk, return and diversification.

As ubiquitous as Emerging Markets are in today’s investment landscape, the term entered our lexicon not even forty years ago. It dates back to 1981 when Antoine van Agtmael – then working for the International Finance Corporation, a division of the World Bank – coined the phrase. Per The Economist:

He hoped to create what he had named: a set of promising stock markets, lifted from obscurity, thereby attracting the investment they needed to thrive.

Interestingly enough, “Emerging Markets” wasn’t the first name chosen for this bunch. Instead, this grouping was christened the “Third-World Equity Fund.” Catchy, huh? Eventually, after some pushback from potential investors that loved the idea but hated the name, Emerging Markets was born. A few years later, in 1986, Capital Group pioneered the first EM-focused fund. Not long after that, in 1988, MSCI launched their Emerging Markets Index that now serves as the de facto benchmark for every asset manager in the category.

Throughout the eighties and nineties, dedicated Emerging Markets allocation were a rare breed – particularly among individual investors. Fast forward to today, and you’d be hard pressed to find an asset allocation model from an institutional capital allocator or financial advisor that doesn’t have at least one EM position. So just how different are Emerging Markets today than they were forty years ago? Let’s take a look…

Economic Growth & Development

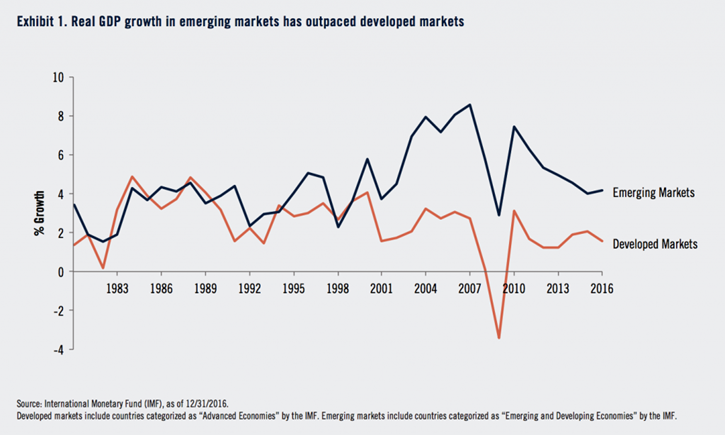

- Real GDP growth of Emerging and Developed Markets tracked each other somewhat closely for a number of years until EM broke away meaningfully throughout the aughts.

Source: PGIM

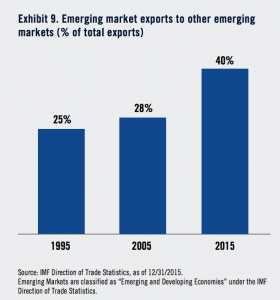

- In the mid-nineties, Emerging Markets were extremely reliant on Developed Markets for exports. More recently, that is less of a concern with exports to other EM countries at forty percent as of 2015.

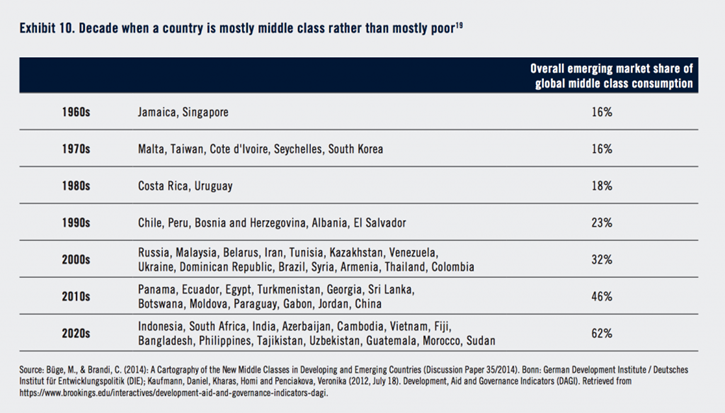

- Until the 1990’s, less than twenty percent of global middle class consumption came from Emerging Markets. It is projected that number will grow to over sixty percent over the next decade.

Source: PGIM

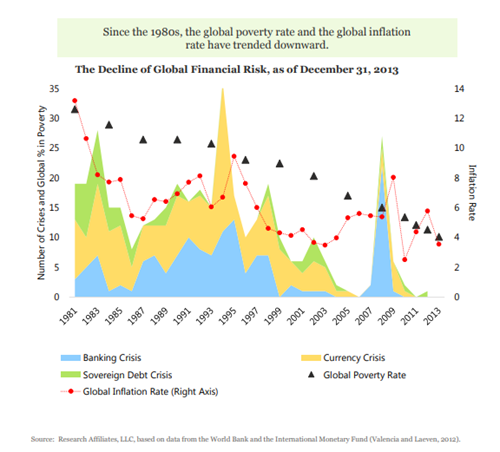

- Crises related to currency and sovereign debt are far less frequent than they were in the 80’s and 90’s.

- The global poverty rate has declined from around thirty percent in the 1980’s to less than ten percent today.

- Global inflation has steadily trended downward from double digits in the early 80’s to low single digits.

Source: Research Affiliates

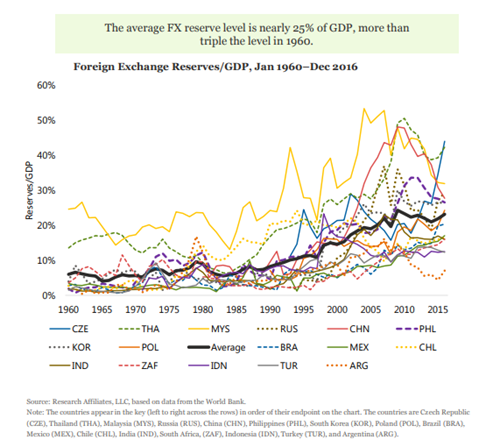

- EM countries have become significantly wealthier over the last few decades. On average, Foreign Exchange (FX) reserves as a percent of GDP have more than tripled since 1960.

Source: Research Affiliates

Market Capitalization

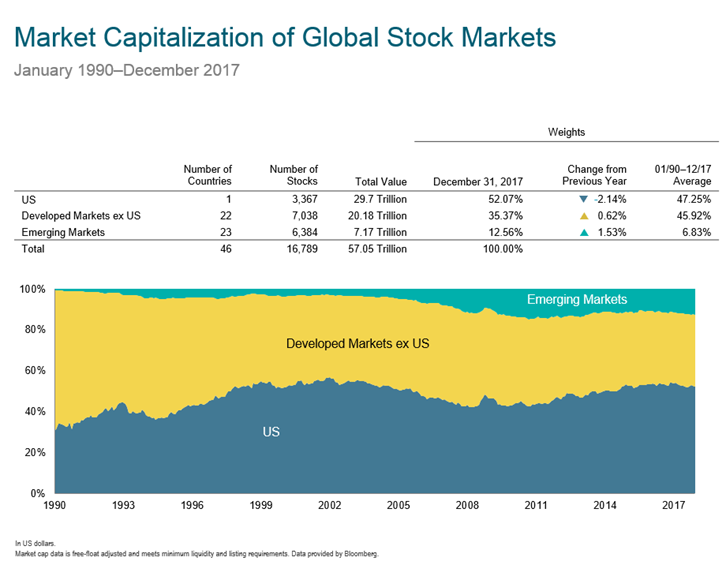

- Near their infancy, Emerging Markets represented an infinitesimal percentage of the global equity market capitalization. At end of last year, EM represented over twelve percent of the global opportunity set.

- There are well over six thousand publicly trades stocks in the twenty four Emerging Market countries, with a total value of roughly $7 Trillion with a “T.”

Source: Dimensional Fund Advisors

Sectors & Industries

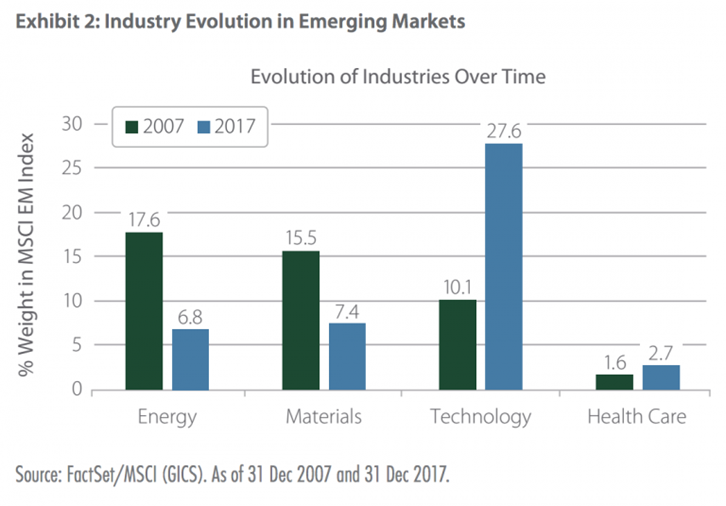

- In 2007, the MSCI Emerging Markets Index was dominated by exposure to companies in the Energy and Materials sectors. Today’s sector composition looks markedly different, with Technology accounting for nearly thirty percent.

Source: Artisan Partners

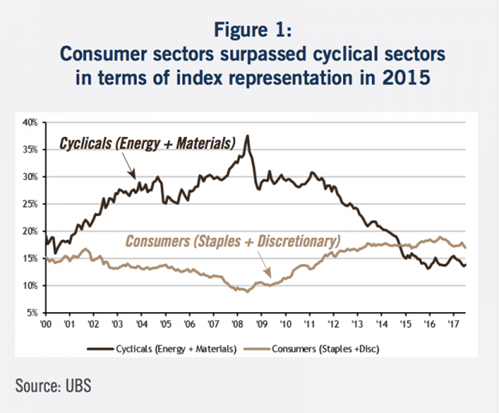

- The cyclical sectors of Energy and Materials hit their apex around 2008. Since the Global Financial Crisis, the influence of those sectors has dwindled. Their combined weight fell below that of the Consumer sectors in 2015.

Source: Driehaus Capital Management

Countries

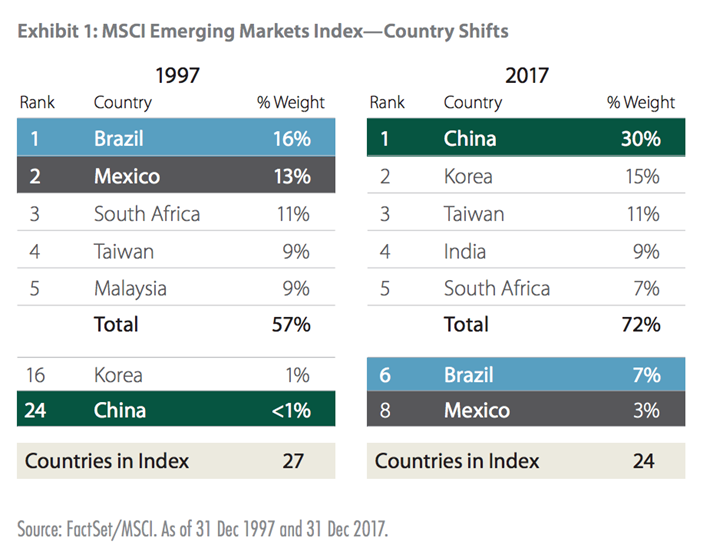

- In 1997, Brazil and Mexico were the top two countries by weight in the MSCI Emerging Market Index, representing nearly thirty percent combined. At that same time, China was less than one percent of the index. Over half of the index was concentrated in the top five countries.

- By 2017, China alone represented thirty percent of the index. In addition, it was even more top heavy than it was twenty years prior, with the top five constituents representing nearly three quarters of the index.

Source: Artisan Partners

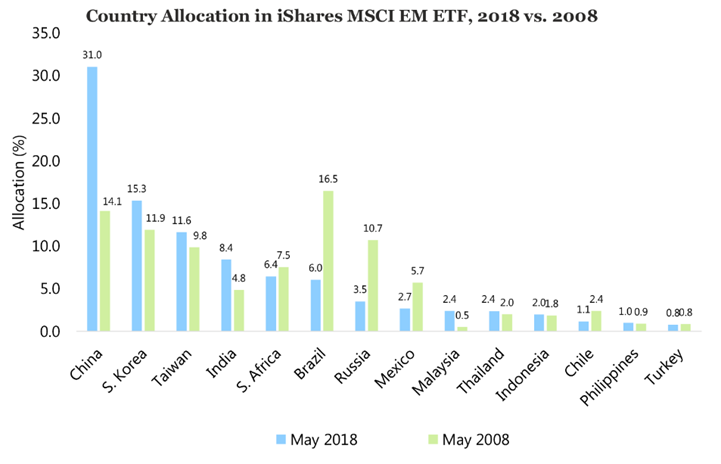

- The ten year period from 2008 to 2018 saw both Brazil and Russia’ lose about two-thirds of their respective weights within in the index.

Source: Research Affiliates

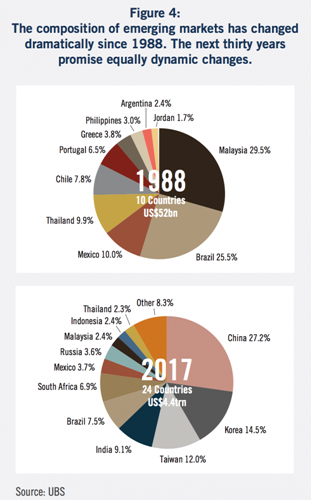

- In 1988, there were only ten countries in the MSCI Emerging Markets Index. As of 2017, there were twenty-four countries represented.

Source: Driehaus Capital Management

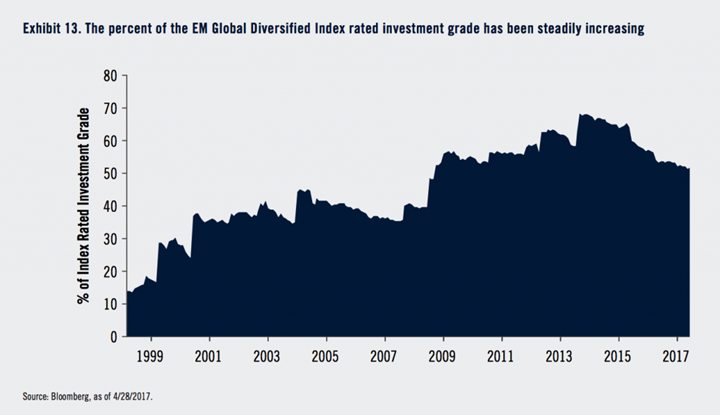

Credit Quality

- A common misconception about Emerging Market debt is that it is almost all “junk.” The reality is that the credit quality of EM hard currency sovereign debt has improved significantly over the years, with more than half of the J.P. Morgan EMBI+ Index rated investment grade as of mid-2017.

Source: PGIM

In a recent interview with Bloomberg, Dimensional Fund Advisors Co-Founder David Booth, when asked how Emerging Market countries have changed curing his career, had the following to say:

What’s happened to emerging markets over the last couple of decades is they’ve kind of wised up and realized if they want to attract capital, they better have better trading practices, shareholder rights have to mean something and I would say in a lot of emerging countries now, the quality of the investment climate is as good as a lot of the developed countries.

There is no shortage of headlines today giving investors pause as it pertains to their EM allocations, or lack thereof. Tariffs, trade war rhetoric and a strong dollar are all contributing to investor malaise, leading to visits from The Ghosts of Crises Past. Investors that have been around the block a few times with Emerging Markets might hearken back to the Latin American debt crisis of the early 1980s, the Tequila Crisis of 1994, or the 1997 Asian financial crisis. The evolving dynamics cited throughout this post are not meant to serve as a “coast is clear” signal or as a prediction of what’s to come. Rather, they are meant to illustrate the futility of reading the tea leaves based on events that transpired decades ago when Emerging Markets were far less resilient than they are today.

Stay tuned for Part Two of this series…

Additional Reading:

Pundits Predicting Panic in Emerging Markets (Research Affiliates)

Emerging Markets at the Crossroads (PGIM)

Emerging Markets: The Changing Dynamics (Artisan Partners)

Defining emerging markets (The Economist)

The Metamorphosis of Emerging Markets (Driehaus Capital Management)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.