A Matter of Principles

There’s no getting around it – today was an ugly day in the stock market. A sea of red throughout the day that turned crimson into the close. October is certainly living up to its reputation as the worst month of the year for stocks:

- The S&P 500 has closed lower in 13 of the last 15 sessions.

- Through 18 trading days in October, the S&P has made a 1% intraday move 9 times.

- The Dow has now given back all of its gains for the year.

- The VIX – a.k.a. the “Fear Index” – is now above 25, more than double its level at the beginning of the month.

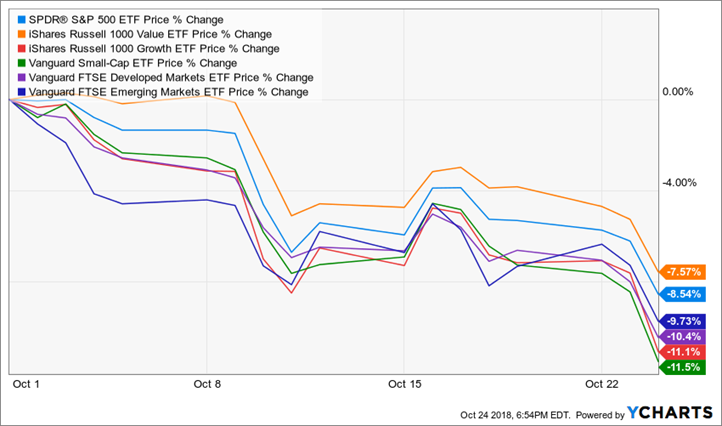

Punishment in equities has been broad and swift. Take a look at the month-to-date returns for a sampling of equity ETFs:

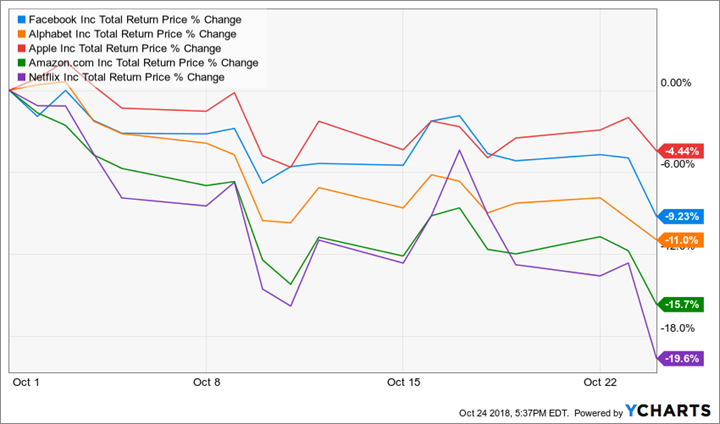

Large, Small, Value, Growth, U.S., International – there has been nowhere to hide. And how about those “FAANG” stocks you keep reading about in Barron’s? They got bit too.

It’s periods like the one we’re in now where it’s customary for financial advisors (myself included) to email blast “One-Percent Letters” in an effort to assuage our clients’ (assumed) fears about the recent sell-off. And just to be clear, I have absolutely no argument against this exercise. In many cases, it achieves the intended objective of calming investors’ nerves by:

- Providing historical context

- Recognizing the media noise for what it is

- Reinforcing concepts like diversification and risk management

- Dissuading people from succumbing to their worst behavioral instincts

- Tying everything back to a broader, long-term financial plan

That said, this is not one of those posts. Rather than spill more ink on what is happening in the market and what it might mean in the short term, I thought this would be a timely opportunity to introduce something I’ve been working on for a while.

Yesterday on Twitter, I shared a “sneak peek” at the new Investment Philosophy brochure that our firm has just finished putting together. (Beautiful, ain’t it?)

Brand new @HuberFinancial Investment Philosophy brochures hot off the press 🤗

— Phil Huber (@bpsandpieces) October 23, 2018

This has been a big project for me the past couple of months and I couldn’t be happier with how they turned out (1/2) pic.twitter.com/rkb32kIbd4

There are a number of different sections throughout, but perhaps the most salient is our list of Investment Principles. This was simultaneously the most challenging and fulfilling section of the entire piece to compose. Not because these principles didn’t exist before, but because we had never written them down. We ended up with fourteen and I think they truly encapsulate how we think about constructing thoughtful portfolios designed to maximize our clients’ odds of achieving their desired long-term outcomes.

Principle One | Shades of Grey

Active versus passive, traditional versus alternative, cheap versus expensive – all examples of black and white thinking that are too simplistic for the complexity of investing. When context matters, respect the grey zone

Principle Two | Markets are Smart

Financial markets are very efficient. Not perfectly so, of course, but enough to eliminate any low-hanging fruit. The market is collectively smarter than any of us are individually. We must demonstrate humility in our actions and understand that “edges” in investing are few and far between.

Principle Three | Focus on Factors

If asset classes are food, then factors are the underlying nutrients. Macro factors – such as interest rates, inflation, liquidity, credit and economic growth – and style factors – such as value, momentum, quality, volatility and size – are the building blocks of returns.

Principle Four | No Investment is an Island

Like all complex systems, portfolios aren’t single investments but rather intricate webs of raw materials, each influencing the other. The merits of any particular investment, therefore, must be weighed not only in isolation, but also in the context of how it fits and interacts with the rest of the portfolio.

Principle Five | Frictions Matter

Tax drag, trading costs and anything else that deters from efficiency should be closely scrutinized because over time, these frictions can accumulate and become costly to the

investor. It’s what you keep, not what you earn, that matters.

Principle Six | Markets Change, People Don’t

Economies go through expansions and recessions. Markets go boom and bust. The root

cause in each instance is different, but the human element is constant: fear, greed, hope, envy.

Markets are continually evolving, but human nature is unlikely to change.

Principle Seven | Expectations over Forecasts

The stock market crashes from time to time. The stock market is going to crash next year.

The former is an expectation, the latter is a forecast. Expectations are grounded in history

and examined through a probabilistic lens. Forecasts require a crystal ball. Better to be vaguely right than precisely wrong.

Principle Eight | Data Drives Decisions

Stories are incredibly powerful. Statistics can feel cold and impersonal. Unfortunately, for

investors, letting the narrative overwhelm the numbers is a recipe for disaster. The best

investors apply a dispassionate and objective lens to their analysis.

Principle Nine | A Whole Greater Than the Sum of its Parts

Diversification comes in many flavors – sectors, asset classes, geography, styles, and strategies.

It is often referred to as the only free lunch in investing. A truly diversified portfolio has no single point of failure. It is robust and resilient to any number of unknown future outcomes.

Principle Ten | No Silver Bullets

There is no reward without risk, or returns without volatility. The holy grail of all of the

upside and none of the downside is pure fiction. The secret to success is not to avoid risk,

but to take intelligent risks that have historically been compensated.

Principle Eleven | Let Compounding Run Wild

The power of long-term compounding cannot be overstated. There is a reason it is referred

to as the Eighth Wonder of the World. It is why time in the market is vastly more important

than timing the market. Investment decisions should be made with an “own” not “rent” mentality.

Principle Twelve | Dare to be Different

Above average results don’t come to those who always run with the crowd. A differentiated

approach will feel uncomfortable at times, but that is by design. Choose unconventional

success over conventional failure.

Principle Thirteen | Strong Beliefs Loosely Held

Conviction is healthy but rigidity can be limiting. A healthy dose of skepticism is a virtue.

Regularly challenge preconceived beliefs and have a willingness to give up your sacred cows.

Principle Fourteen | Stand on the Shoulders of Giants

Decades of academic research and real-world experience have led to groundbreaking

innovations and a deeper understanding of what makes markets tick. There has never been a

better time to be an investor.

This is by no means an attempt to shove our principles down anybody’s throat. You may agree with some and disagree with others, but for us they work. They serve as our compass and our anchor when we are making investment decisions on behalf of our clients. Particularly during turbulent times, having a set of deeply rooted principles is paramount to long-term success. Now is as good a time as any to ask yourself – or your advisor – what pillars define your beliefs and guide your actions.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.