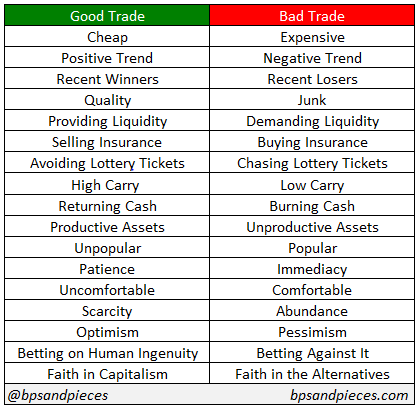

The Investor’s Cheat Sheet

In investing, there are good trades and there are bad trades.

I use the word “trades” here loosely, referring to the all aspects of the investment decision making process – asset allocation, portfolio construction, investment selection, holding period, etc. All choices, in markets and in life, are an exercise in balancing trade-offs. While there are always two sides to every trade – for every seller there is a buyer and vice-a-versa – there are also ex-post winners and losers from each one.

To that end, I put together this little cheat sheet (free of charge!) to improve the odds of being on the right side of the trade more often than not. Bear in mind that none of these are ironclad rules, but rather tendencies that tend to pay off on average and over time. What is certain is that every ex-ante good trade will at some point feel terrible (and for longer than we can imagine.) And you can be just as sure that long-term losing trades will occasionally feel great. Just about any asset or strategy with a positive expected return can be linked to one or more of these “trades.” None of this will get you rich quick; but if spend a lot more time in the left column than the right, I have a high degree of confidence you’ll be better off in the end than most.

So go ahead and print this baby off and pin it up near your desk as a gentle reminder the next time you find yourself wresting with an investment decision.

Oh, and by the way…

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.