Portfolio Appendectomy

About four months ago, whatever residue remained from the Great Financial Crisis left our collective consciousness. Sure, some scars will always remain for those who lived through it. But in terms of how we think about our investments today, it is barely visible in the rear-view mirror. For now, at least. What exactly happened, you ask?

The New York Times wrote about the phenomenon that occurred in April as investors across the country began to review their Q1 account statements (emphasis mine):

From Sept. 7, 2007 until March 9, 2009, the S&P 500 plummeted more than 50 percent in the worst bear market since the Great Depression. Until this spring, at least part of that horrendous decline weighed down 10-year stock market returns. But now, because of the arbitrary logic of the calendar, the miserable 2007-2009 bear market is no longer incorporated in 10-year returns. Yet for many practical purposes, the long-term horizon in investing is defined as just 10 years. That means investment returns appear to have brightened across the board.

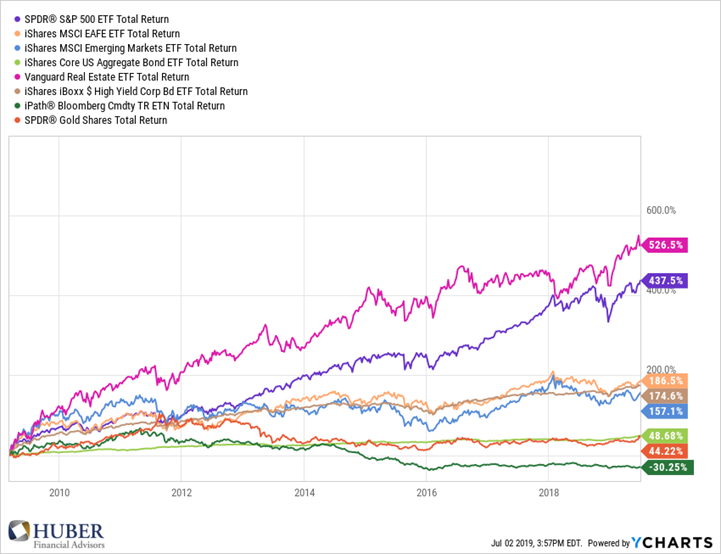

With the exception of commodities, the last ten years have generally been a tide that has lifted all boats. But the magnitude of the waves each asset class has rode up until this point have been miles apart. Other than Real Estate, U.S. Stocks have been pretty much the only real game in town since the market bottomed in ’09. And trust me, very few people were willing to touch REITs with a ten foot pole after the asset class dropped over 65 percent in the crisis.

Looking back, it is easy to understand why balanced investors have been left wondering why they should own anything other than a plain-vanilla 60/40 split of U.S. stocks and bonds. Just about every diversifier you can think of has acted as a drag on performance. Morningstar’s Jason Kephart recently wrote an article about the unusual decade experienced by a Vanguard mutual fund that allocates 60% to U.S. Stocks and 40% to U.S. Bonds (emphasis mine):

The results showed that the portfolio’s 10-year annualized returns of 10.79% over the period ended April 30, 2019, were the third-best out of the 198 rolling 10-year periods we looked at (the best was the 11.69% annualized return for the period ended Feb. 28, 2019, so apologies to readers for being two months late on catching this phenomenon). Not only were the returns in the top 1% of the periods we looked at, but the portfolio’s 7.61% annualized standard deviation (a measure of volatility) was the lowest out of the 198 periods…Putting those risk and return characteristics together, not only has it been one of the most profitable times for this two-fund portfolio, it’s also been the smoothest ride to get there. This translates directly to the fund’s risk-adjusted returns, as measured by Sharpe ratio, also being in the top 1% of periods we looked at.

To many investors, the last ten years have rendered the (perceived) diversification benefits of many asset classes and strategies to be superfluous. In fact, some might even draw parallels between these exposures and their own appendix.

Most people are of the belief that the human appendix serves no purpose and is nothing more than an evolutionary relic. But they would be wrong. Rory Sutherland wrote about this “common knowledge” in his excellent new book, Alchemy: The Dark Art and Curious Science of Creating Magic in Brands, Business, and Life (emphasis mine):

For instance, for a long time the human appendix was thought to be nonsense, a vestigial remnant of some part of the digestive tract, which had served a useful purpose in our distant ancestors. It is certainly true that you can remove people’s appendices and they seem to suffer no immediate ill effects. However, in 2007, William Parker, Randy Bollinger and their colleagues at Duke University in North Carolina hypothesized that the appendix actually serves as a haven for bacteria in the digestive system that are valuable both in aiding digestion and in providing immunity from disease. So, just as miners in the California Gold Rush would guard a live sourdough yeast ‘starter’ in a pouch around their necks, the body had its own pouch to preserve something valuable. Research later showed that individuals whose appendix had been removed were four times more likely to suffer from clostridium difficile colitis, an infection of the colon.

We all have at least one holding in our portfolios akin to the human appendix. In what seems like ages ago, we added it to the mix to either improve returns, reduce risk or enhance overall diversification. It all made sense at the time, too. There was data backing it up and sound economic theory supporting the asset’s inclusion. And then something crazy happened – our expectations didn’t match up with reality.

At first, we didn’t give it much thought. After all, even the best strategies can have a bad year, right? Eventually mean reversion would kick in and we would be vindicated! But then the bad years kept piling up for the appendix. And not even necessarily bad absolute years, just bad relative years compared to that damn S&P 500 that doesn’t seem to do anything but go up…

Frustration sets in. We want answers! Perhaps the strategy is broken? Maybe there was too much money chasing it and it got arbitraged away? We rationalize and rationalize and rationalize until we convince ourselves that the right move – nay, the ONLY move – is to eliminate this laggard, post-haste!

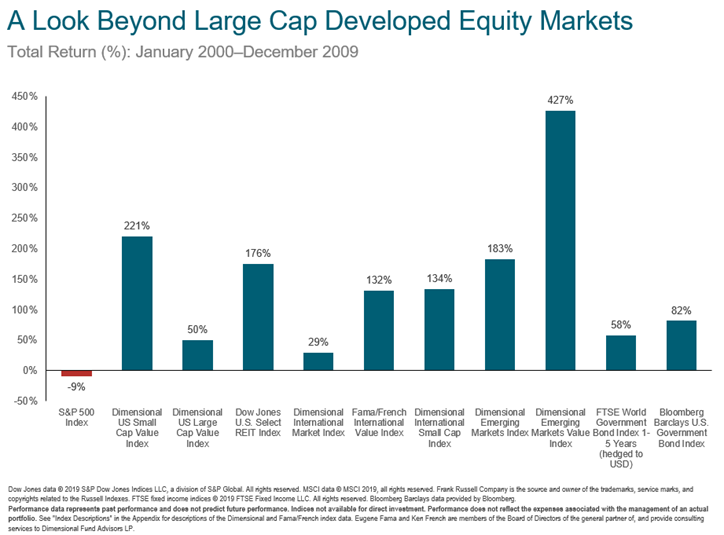

Many appendixes were surgically removed from portfolios in the late 90’s/early 2000’s in the run-up to the Dot Com bubble bursting. And then again leading up to the Financial Crisis in 2007-08. Imagine that, a ten-year period bookended by two of the worst declines in U.S. stock market history. Here’s how some of those appendixes did during what inevitably became known as the “lost decade.”

Source: Dimensional Fund Advisors

Source: Dimensional Fund Advisors

Somewhere along the way, the “lost decade” got lost and the last decade became all that mattered. How quickly we forget…

A portfolio appendectomy might make sense if your “appendix” never served a purpose in the first place. But certain aches and pains are part and parcel of owning a diversified portfolio. The biggest mistake an investor can make is to put their holdings on the operating table and remove the very thing(s) they might need or want the most when the anesthesia eventually wears off.

This final quote from Sutherland’s book is apropos to how investors should think about diversifying assets that have gone through a rough patch:

The lesson we should learn from the appendix is that something can be valuable without necessarily being valuable all the time.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.