Little Things I’m Thankful For

This year, I have more to be thankful for than ever before. Our little girl Hannah is now four months old and she has immeasurably changed our lives for the better. It’s easy to remember the Big Things we are grateful for. What gets lost in the shuffle at times are the little things that give us joy. When I think about the investment profession, there are a number of little things that come to mind that make me feel #blessed:

I’m thankful I don’t need a Bloomberg terminal – affordable (or in some cases free) resources like YCharts, Koyfin, Portfolio Visualizer, and Venn (to name a few) provide incredible value relative to their cost. For professional allocators and investors without astronomical budgets, there are some incredible tools out that can fulfill all of your investment research, data and analytics needs.

I’m thankful that my podcast queue is never empty – The quality and quantity of investing and business related podcasts out there is just mind-blowing. To be able to access the thoughts and wisdom of many of our industry’s greatest minds, all while driving to work or doing chores around the house is a pretty cool thing.

I’m thankful for Cliff Asness’ footnotes – Nine times out of ten, you’re OK skipping the footnotes when reading a research paper. Not with AQR though. If you’re a regular reader of Cliff, you know that’s where the good stuff is.

I’m thankful for the frontiers of factor investing research – Between Dimensional’s recent implementation of the investment factor, OSAM’s work on Alpha Within Factors, and Corey Hoffstein’s near-obsession with the role of rebalancing timing luck, I’m confident that there is still plenty of terrain to be explored in an area that some might think has been picked over.

I’m thankful there’s no one right way to invest – Investing is a personal experience and there is no one formula for success. Finding a strategy that works for you is part of the journey and some of the most valuable knowledge can be gained from those that do things differently than you.

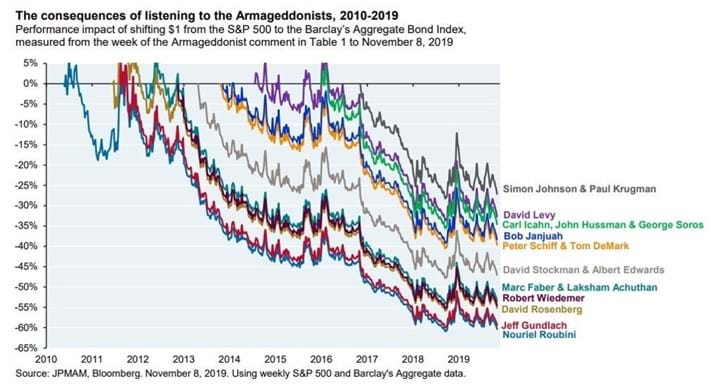

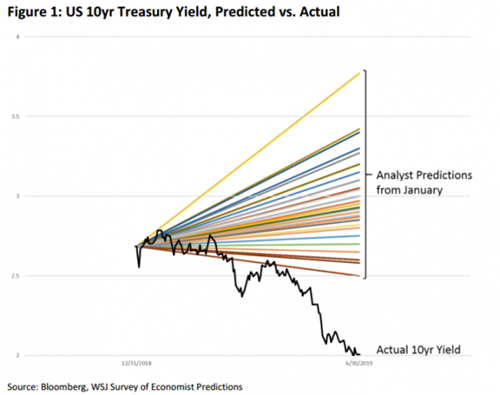

I’m thankful for the periodic reminders that “nobody knows nothing”:

Exhibit A

Exhibit B

I’m thankful for the people who summarize academic papers so I don’t have to read them in full – I’m looking at you Alpha Architect and @ReformedTrader

I’m thankful that very few frictions remain for smaller investors – commission free trading, digital advice solutions and fractional shares have broken down barriers and allowed investors of all sizes to enjoy a successful investment experience.

I’m thankful for the Twitter handles that use their anonymity for good – it’s easy to be a troll if you’re hiding behind a cloak of invisibility. Fortunately, some of the best follows on Finance Twitter are those whose identities are a mystery.

I’m thankful that we all finally agree on stock buybacks – just kidding.

I hope all my readers have a wonderful Thanksgiving (and a minimal amount of uncomfortable dinner conversation) with loved ones. Please take time to celebrate all of the things – big or small – that bring joy to your life!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.