The Paper Trail

I’m trying something new here on the blog. I know the last thing the world needs is another link-fest…but I’m going to put my spin on one anyway!

Each month, I am going to compile and share some the most interesting, thought-provoking and informative white papers, investment research and market commentaries that I come across from asset managers, investment consultants, research firms and academia. I’ll intro each piece with the primary question the authors aim to explore and/or answer. I’ll also include the best visual or chart. Lastly, I’ve bucketed them into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Let me know if you like the format and hit me up on Twitter if you have any suggestions for future editions.

“bps” (reading time < 10 minutes)

What are the trade-offs between various investment approaches designed to protect against equity selloffs?

The Winter’s Tail – Protecting Against Equity Selloffs (Graham Capital)

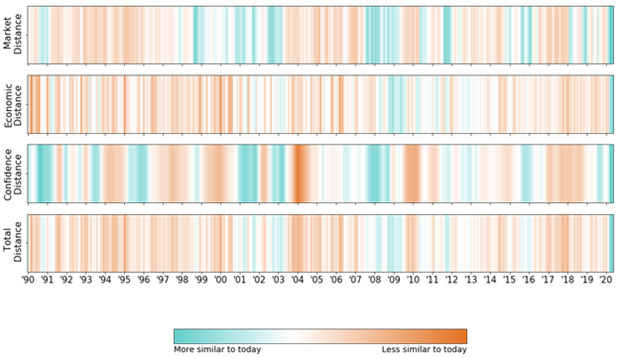

Do any historical periods even closely resemble the COVID-19 crisis from an economic and market standpoint?

Markets in the Rear-View Mirror: COVID-19 Collision (Two Sigma)

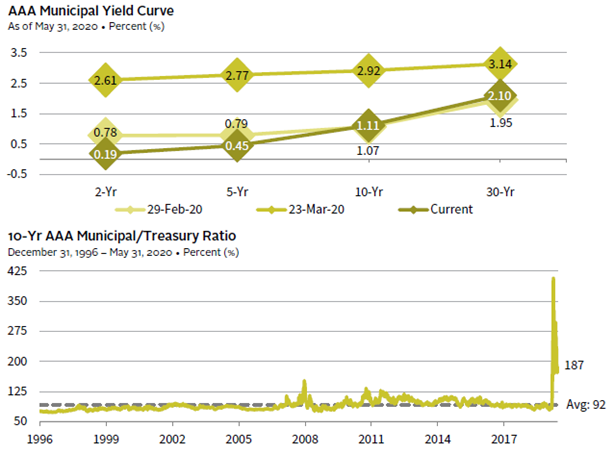

In the aftermath of COVID-10, are municipal bonds a looming risk or an attractive opportunity?

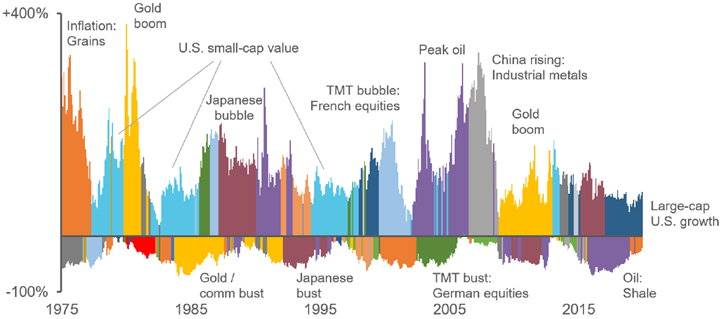

Why is durable diversification so hard to find?

Re-examining Diversification: 20/20 Perspective (Acadian Asset Management)

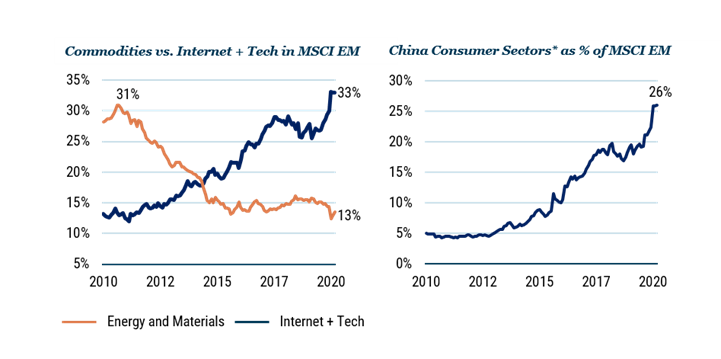

Are Emerging Markets more resilient today than in years past?

“pieces” (reading time > 10 minutes)

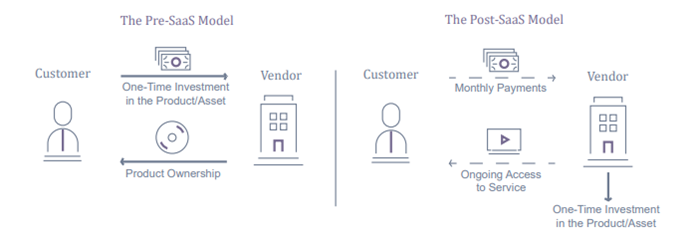

Is alternative credit changing the landscape of how tech-enabled businesses are financing their growth?

Assets-as-a-Service: Credit Investors’ Role in a Transforming Economy (Magnetar Capital)

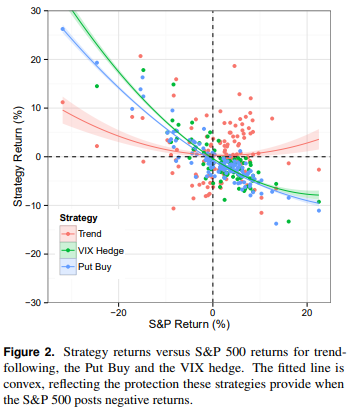

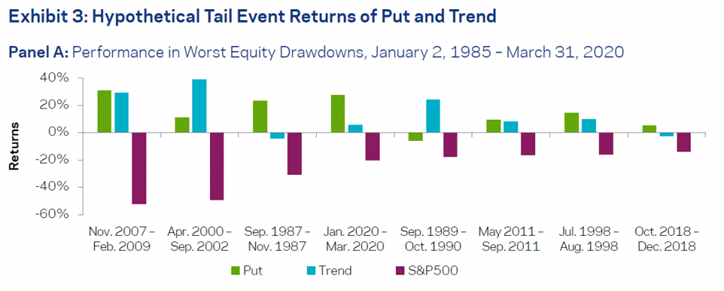

Which type of strategy – Put or Trend – makes for a more effective tail risk hedge?

Tail Risk Hedging: Contrasting Put and Trend Strategies (AQR)

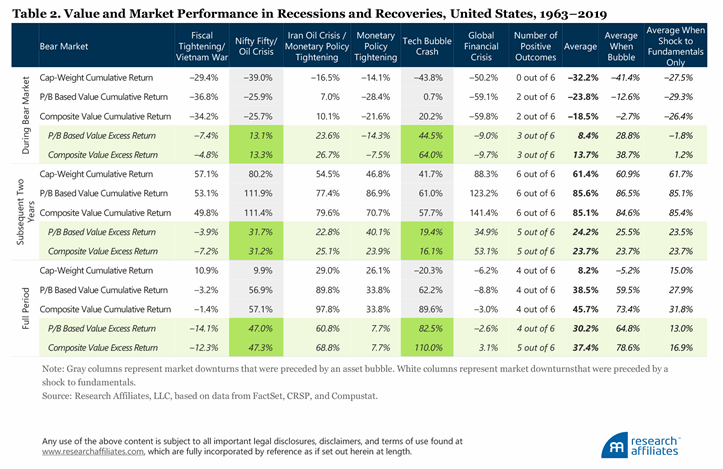

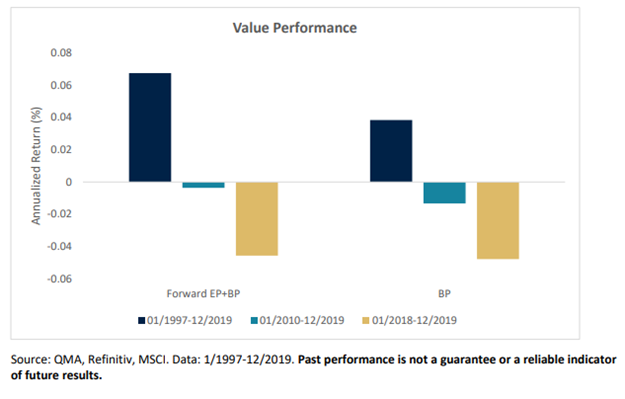

Under what conditions does Value do well or poorly in bear markets?

Do changes in fundamentals affect value and growth companies in an asymmetric fashion?

Fasten Your Value Belt: Growth Could Take You for a Wild Ride (PGIM Investments)

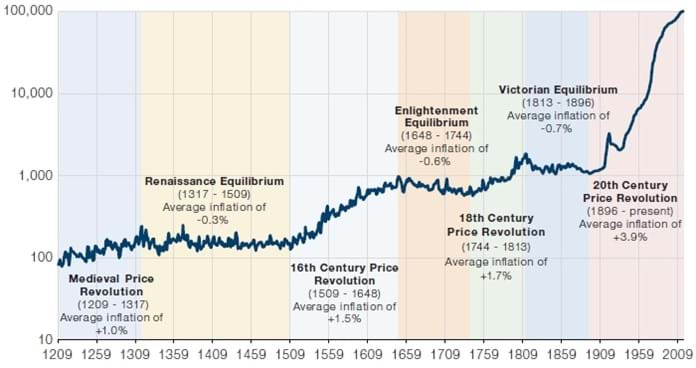

Will the current recession ultimately lead to an inflationary paradigm shift?

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.