The Paper Trail – December 2020

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

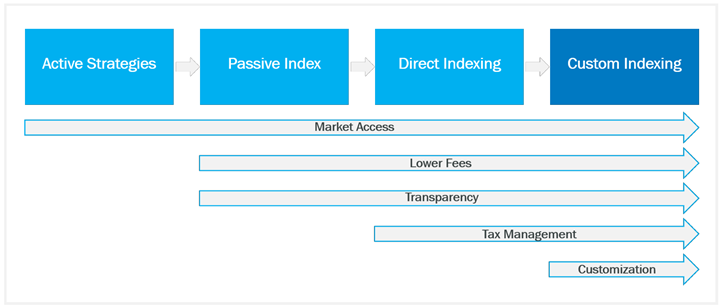

Is Custom Indexing the next big megatrend in investing?

“In this case, can anyone imagine a world where Custom Indexing doesn’t dominate? I find it very hard to imagine because most of the frictions that would have stopped Custom Indexing as a practice – mostly in the form of dollar costs and manual workflows – have already disappeared.”

Custom Indexing: The Next Evolution of Index Investing (OSAM)

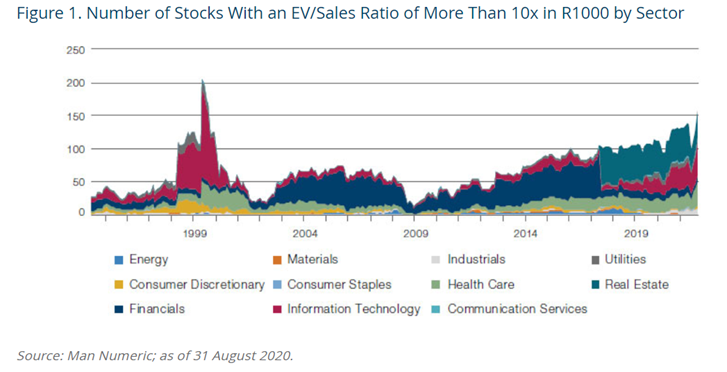

What is the historical performance of ridiculously expensive stocks?

“Indeed, the exception of the FAANGM stocks appears to mask a more powerful and persistent truth: that stocks valued at excessively high levels very rarely deliver the kind of earnings to justify these inflated prices. There appears to be little relationship between sky-high multiples and persistently high return on capital; if anything, companies with such excessive valuations tend to produce lower returns over time.”

Should Chinese equities play a larger role in investor portfolios?

“In the end, greater benchmark inclusion and a sustained influx of foreign professional investors into China’s equity market could be most valuable to investors as a strong indication that index providers and foreign institutional investors remain happy with China’s progress on issues ranging from regulatory policy and legal protections to market access and reporting standards.”

Should Investors Allocate More to China A Shares? Putting Common Arguments to the Test (Rayliant)

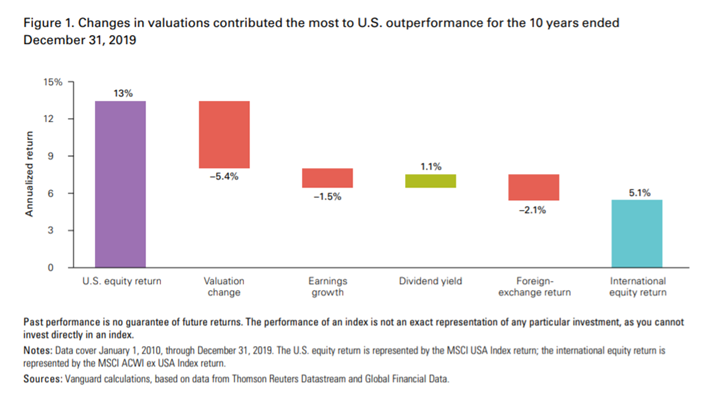

Is the outperformance of U.S. equities relative to non-U.S. equities likely to continue?

“The past 10 years have been tremendous for U.S. stocks relative to their international peers, largely because investors expected the U.S. to grow faster and it did. Now, however, higher valuations and slower earnings growth in the U.S. relative to the past decade make future outperformance unlikely.”

A tale of two decades for U.S. and non-U.S. equity (Vanguard)

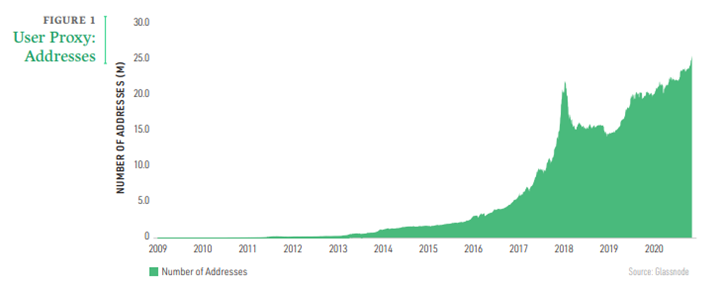

How powerful is Bitcoin’s network effect?

“The bottom line: Bitcoin’s code base can be copied, but the credibility, and immutability, of its hard money policies cannot. Bitcoin is long past the point of being catchable.”

“pieces” (reading time > 10 minutes)

What are some good bets in a world that doesn’t have a lot of good bets?

“I think such struggles that I, and I think so many others, go through are common and, ironically, key to why some strategies actually work long term and why they don’t get arbitraged away.”

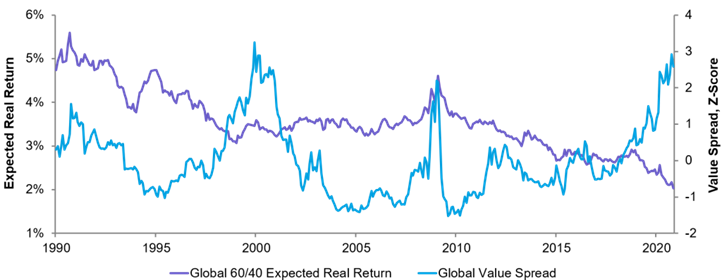

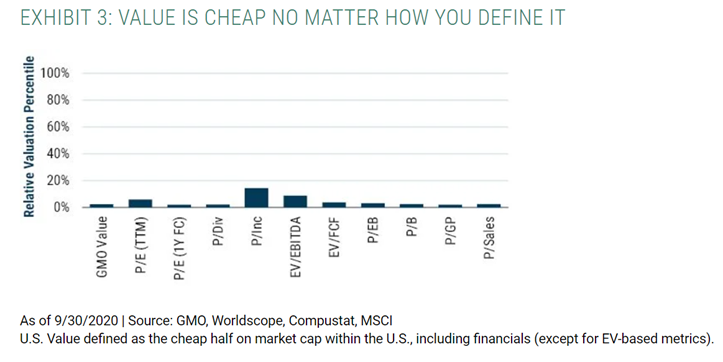

If you don’t find Value attractive today, will you ever?

“With a combination of some the highest valuations ever seen and clear corresponding manic investor behavior, it seems clear to us that Growth stocks are indeed in a bubble.”

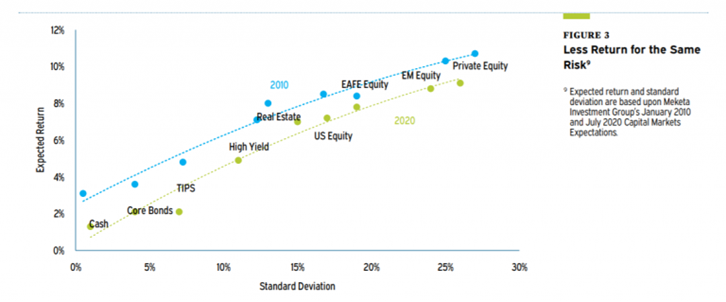

Do low interest rates require looking at strategic asset allocation through a new lens?

“The number of unprecedented conditions in the capital markets (e.g., historically low interest rates, unprecedented fiscal and monetary stimulus, and growing debt loads on governments and corporations) reduces one’s confidence in relying on past relationships and behaviors of asset classes to guide forward-looking investment strategy.”

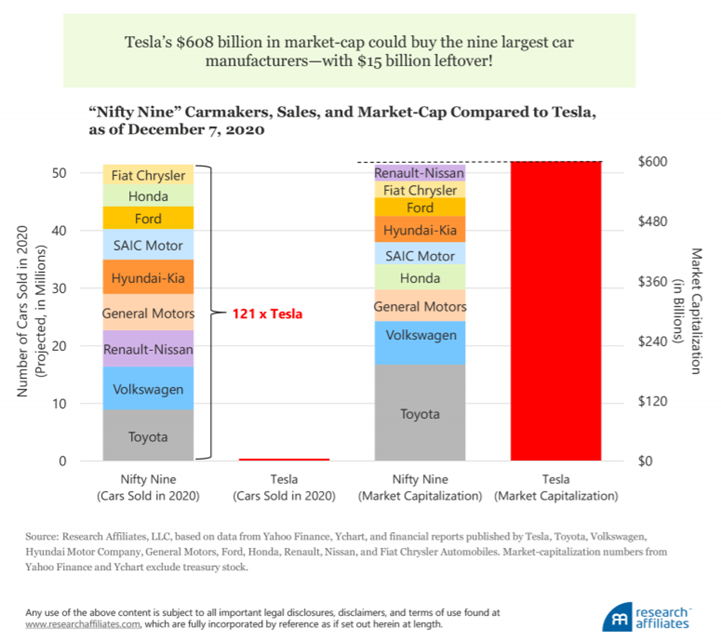

Should Tesla’s addition to the S&P 500 be viewed as a buy or sell signal?

“And what could we buy using the total $608 billion of Tesla’s market-cap? How about the “Nifty Nine,” the nine largest car manufacturers in the world—Toyota, Volkswagen, Renault-Nissan, General Motors, Hyundai-Kia, SAIC, Honda, Ford, and Fiat Chrysler? Yes, that’s right, and we would still have $15 billion left over, enough to buy around 300,000 Tesla cars for our closest friends and family.”

Tesla, the Largest-Cap Stock Ever to Enter S&P 500: A Buy Signal or a Bubble? (Research Affiliates)

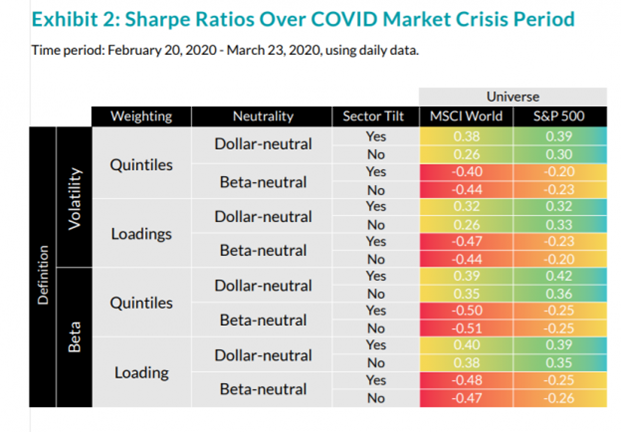

What are the implications of design choices in the performance of factors?

“In fact, not only did the performance differ depending on whether the factor was constructed dollar or beta neutral, but the sign of the performance differed.”

How Design Choices Impact Low Risk Factor Performance (Two Sigma)

Are investors underestimating the power of the platform business model?

“The modern digital platform has taken this primordial concept to epic proportions. The dominance of firms such as Google and Amazon is just another of the many side effects of the megatrends of globalization and technology.”

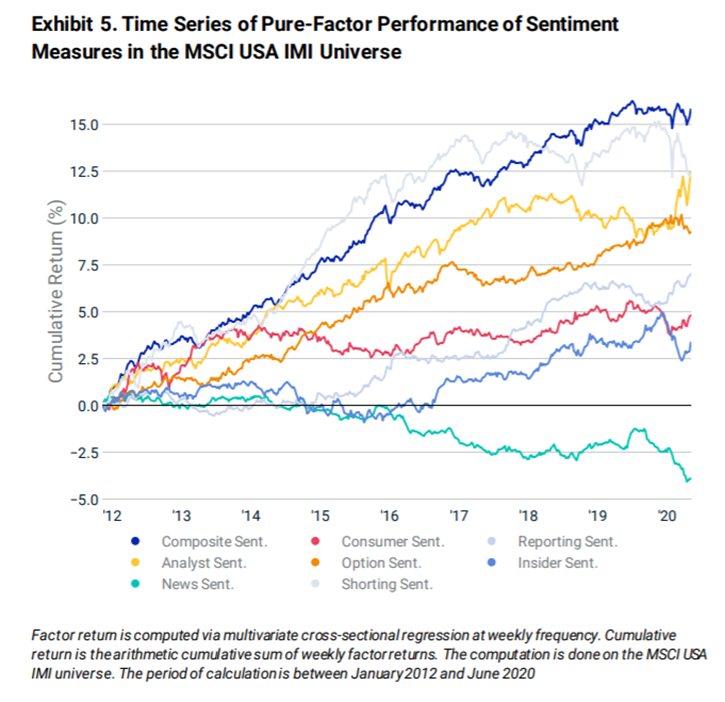

What is the relationship between investor sentiment and stock returns?

“Our analysis indicates that sentiment factors may provide investors with additional transparency into sources of risk and return and may provide a promising avenue for potential positive risk-adjusted returns as compared to traditional factors.”

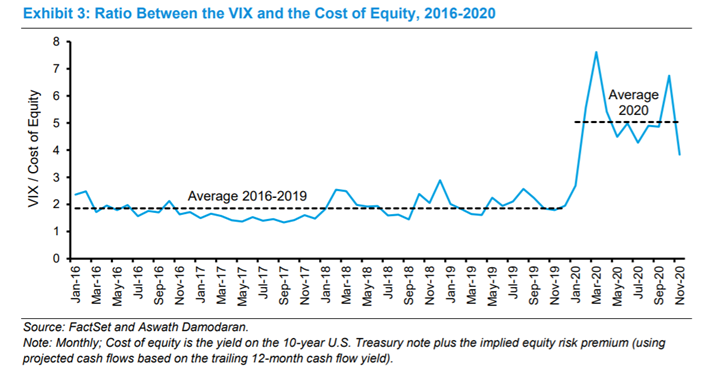

How unusual is it to have a below average cost of capital and above average volatility?

“Businesses that have real option value benefit from a lower discount rate on their current operations and from the higher volatility of the options available to them.”

WACC and Vol (Counterpoint Global)

Thanks for reading and please have a happy and safe New Year. See you in 2021!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.