The Paper Trail – January 2021

Happy New Year readers! (Is it too late to still be saying that?)

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

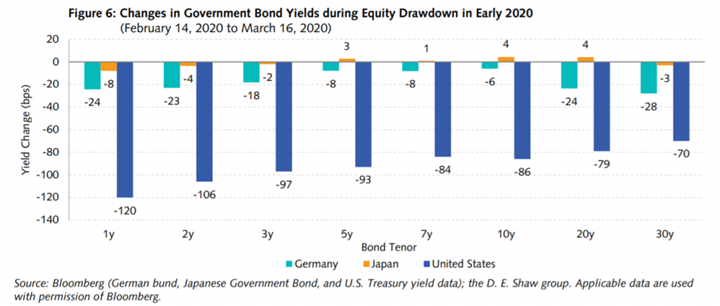

Can bonds continue to be relied upon as a hedge to equity market risk?

“Moreover, the hedging performance of government bonds was much worse in countries that began the year with less room for monetary policy intervention, suggesting some risk regarding future conditions in the United States.”

Running Low: The 2020 Test for Bonds as Hedging Assets (D. E. Shaw)

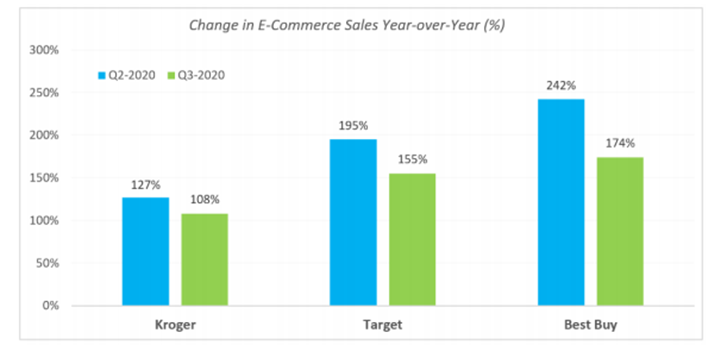

Can traditional Value companies adapt to the very forces that are disrupting them?

“In the 4th Technological Revolution, the Value stocks that severely underperformed in the early part of the cycle went on to generate meaningful outperformance as technological innovations were adopted across the broader economy.”

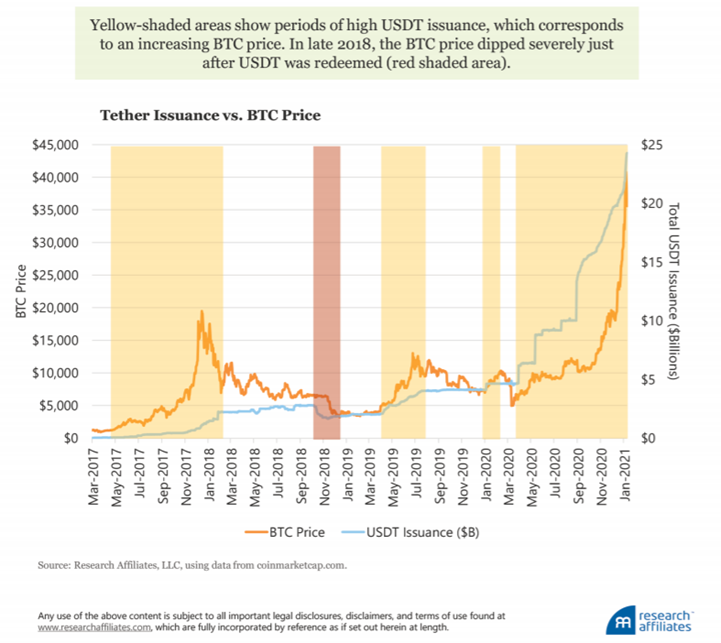

Do Bitcoin investors know what they’re investing in?

“Bitcoin in 2021 is arguably harder to understand than bitcoin in 2013. Whereas in the early days bitcoin was easily defined as an online cash system, today it is much more ambiguous.”

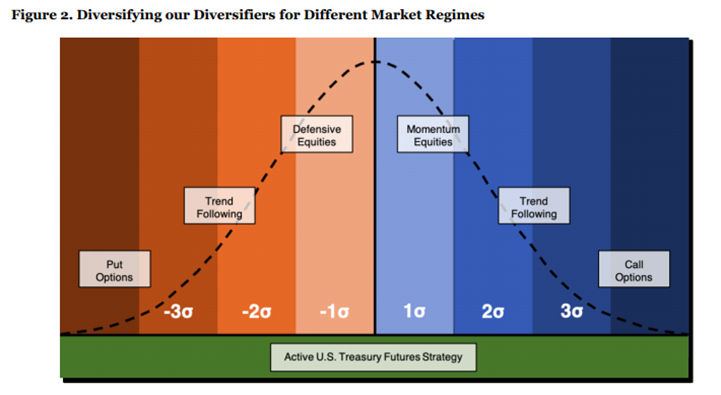

Why is it so important to diversify your diversifiers?

“But what if we’re wrong? What if our thesis is merely a well-crafted narrative of circumstantial evidence? While we believe the portfolio should excel if our thesis is correct, the core design does not rely upon it.”

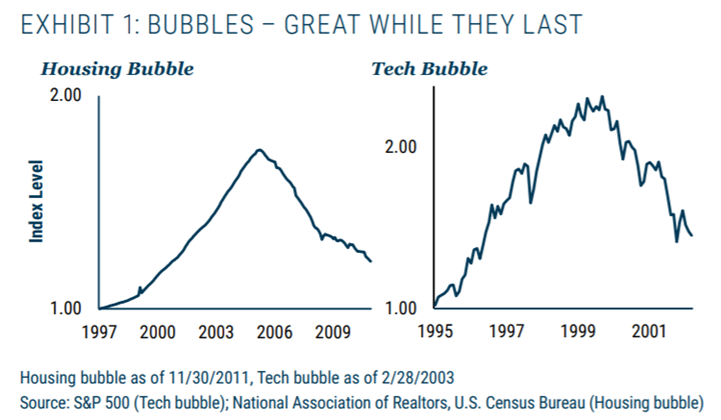

Is the stock market officially in a bubble?

“The great bull markets typically turn down when the market conditions are very favorable, just subtly less favorable than they were yesterday. And that is why they are always missed.”

“pieces” (reading time > 10 minutes)

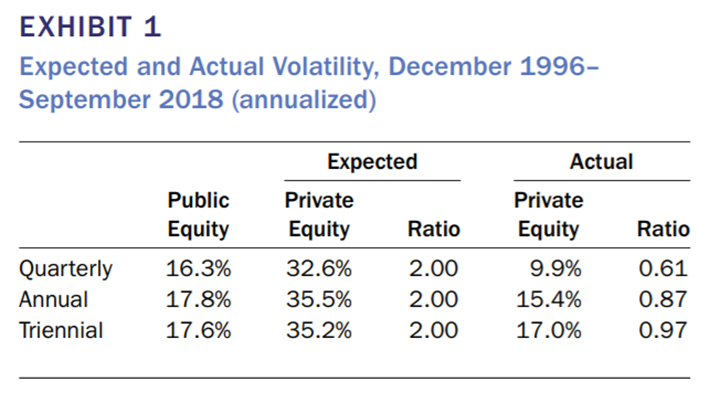

What is the most appropriate way to approximate private equity volaility?

“When applied to the data, this approach yields the stubborn conclusion that private equity volatility is similar to public equity volatility despite its higher leverage.”

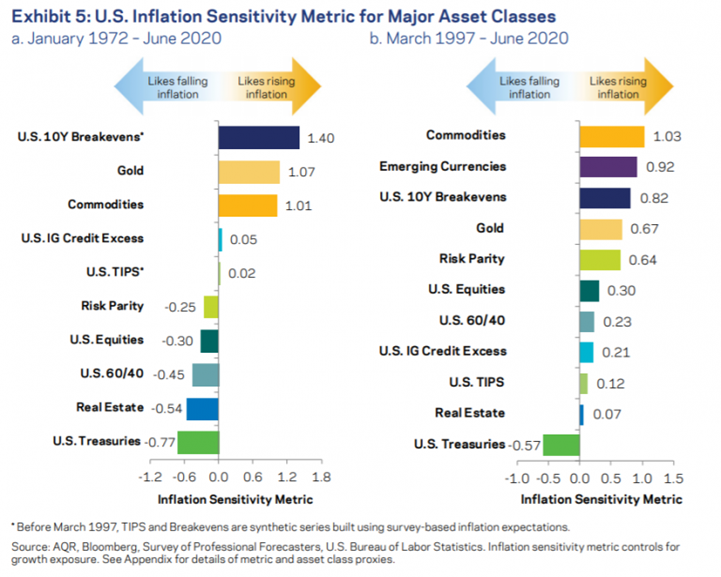

What should investors be more worried about: inflation or deflation?

“The 2010s cast doubt on traditional models that wrongly predicted rising inflation. On the other hand, there are plausible arguments that the present wave of stimulus may (eventually) be more inflationary than the responses to the Financial Crisis of 2008.”

Fire and Ice: Confronting the Twin Perils of Inflation and Deflation (AQR)

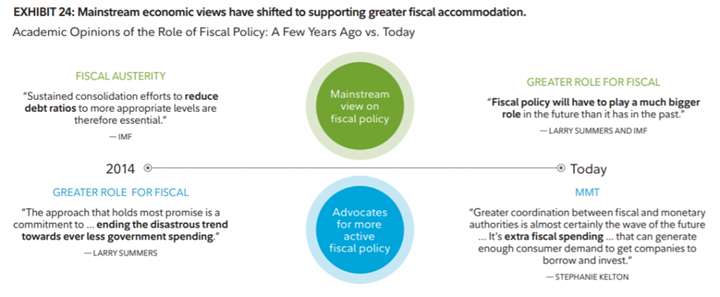

Is unsustainable debt a ticking time bomb for traditional asset allocation?

“The investment setting is always defined by our collective desire to avoid the last mistake: The reduction of systemic risk among banks and receding deflationary pressures was replaced by the increased systemic risks of central banks and rising inflationary risks.”

Unsustainable Global Debt: Roadmap for Strategic Asset Allocation (Fidelity Investments)

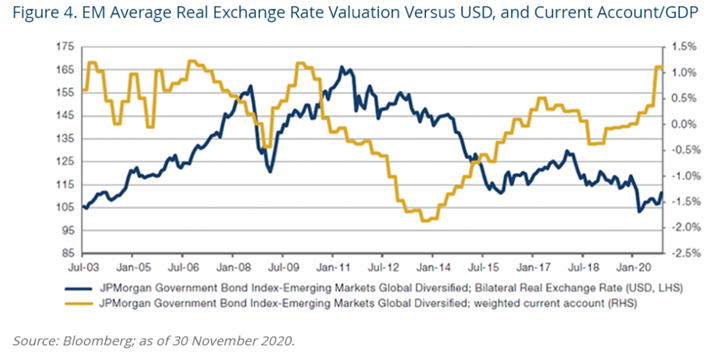

Should investors be skeptical of the recent performance bounce in Emerging Markets?

“Many of these economies have fallen into a vicious circle where they cannot grow fast enough to stabilize the debt/GDP ratio, and if they expand fiscal and/or monetary policy to stimulate growth, they quickly run into imbalances in their current accounts.”

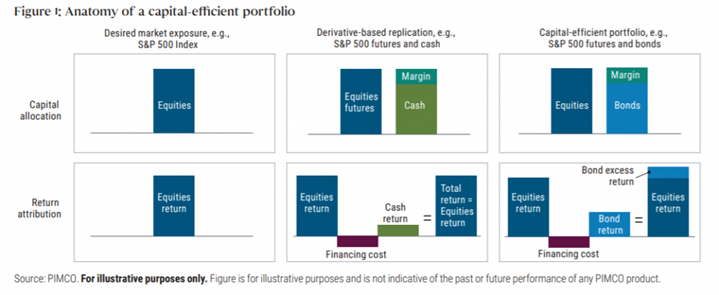

Are “capital-efficient” strategies underutilized by investors?

“Capital-efficient approaches can free up cash, increasing overall portfolio liquidity and flexibility. They can give investors access to a broader range of alpha strategies without affecting beta allocations.”

Capital‑Efficient Strategies: Tackling the Challenges of Low Prospective Returns (PIMCO)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.