Predicting Equity Returns with Inflation (Research Affiliates)

The Paper Trail: Inflation, Inflation, Inflation

What better way to close out the summer than with the August installment of The Paper Trail, a monthly curation of the most interesting, thought-provoking, and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

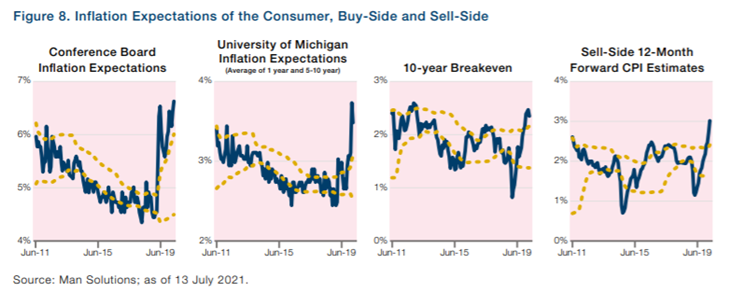

Are inflation indicators signaling a regime change?

“While we wouldn’t call that panic stations, it does indicate to us that there is enough pressure to the upside to make it worthwhile worth doing the risk management work now to ensure investors can respond quickly in the event we get more uniformly red signals.”

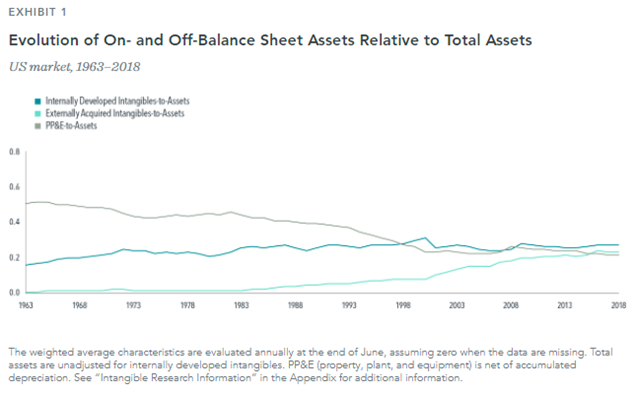

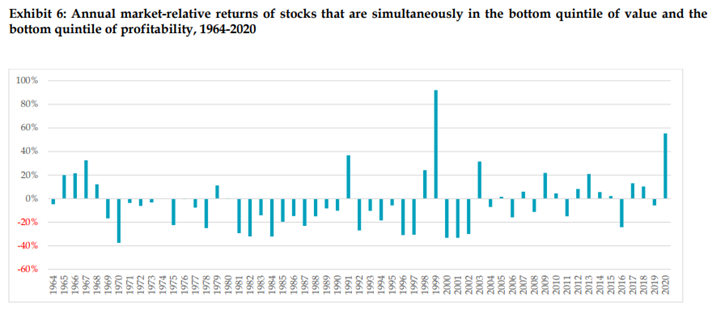

Can adjusting for intangibles on the balance sheet help us identify differences in expected stock returns?

“Estimated internally developed intangibles contain little additional information about future firm cash flows beyond what is contained in current firm cash flows. Moreover, we do not find compelling evidence that capitalizing estimated internally developed intangibles yields consistently higher value and profitability premiums. The results are quite similar across US, developed ex US, and emerging markets.”

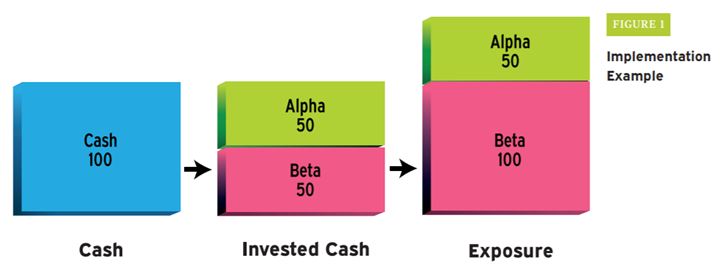

Is the capital efficiency offered by overlay strategies worth the additional operational complexities?

“There are variety of considerations that warrant additional attention in the cost-benefit analysis of desirability of overlays. For example, there are implementation costs of carry, which may incur losses in normal markets. The introduction of leverage can also exacerbate losses or transpose cross-asset characteristics (e.g., equitizing cash will impart equity-like volatility to a cash allocation). There are also implicit costs, such as time.”

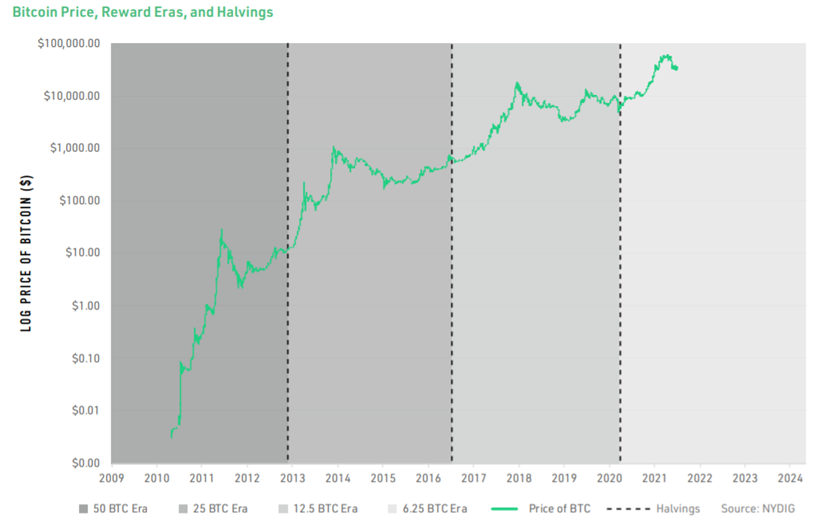

Are Bitcoin’s halving events priced in?

“Halvings and their dates are as close to perfect information as can be known for bitcoin. Repeating patterns associated with halvings would violate even the weakest form of the Efficient Market Hypothesis. Perhaps there is a behavioral explanation for the cycles, that the increased scarcity caused by halvings, even though it is knowable ahead of time, creates more social awareness that calls investors to action.”

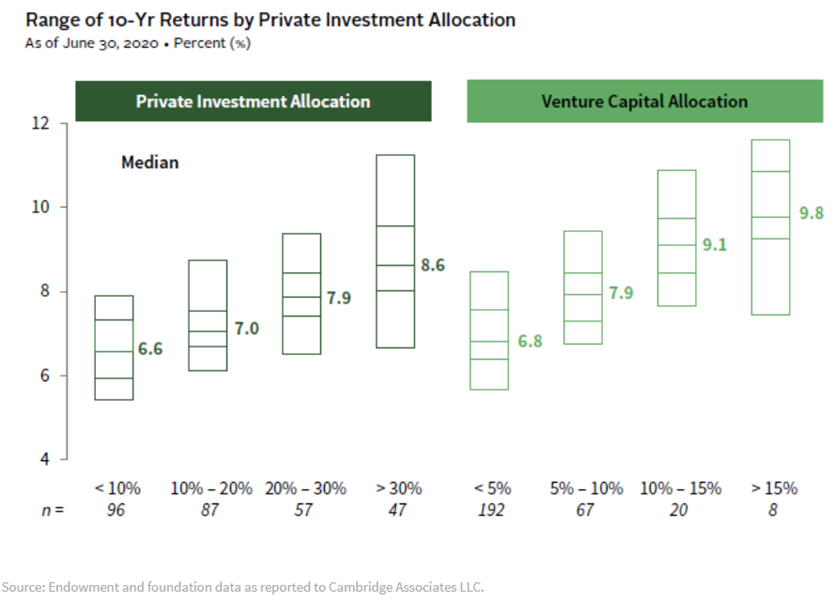

Are the benefits of Private Investments (PI) in a portfolio greater than their costs?

“Building a robust PI program is challenging. Broadly speaking, investors have three main hurdles to overcome to help ensure success: forecasting and managing liquidity, committing to a target long-term allocation, and accessing potential top-performing managers. We expect that being thoughtful about each of these hurdles will likely lead to positive investment outcomes

Building Winning Portfolios Through Private Investments (Cambridge Associates)

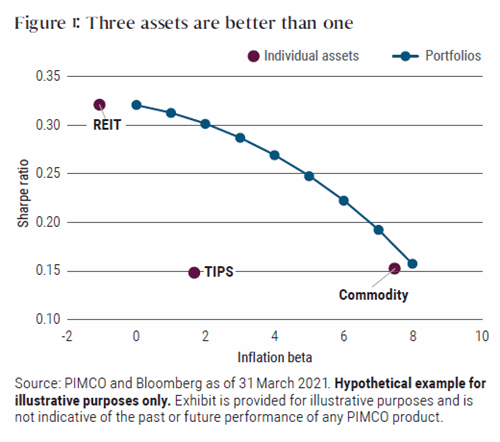

How can investors best prepare for a variety of highly uncertain inflation outcomes?

“Currently, we believe there are fatter inflation tails than the market has expected. But longer term, there is a high probability that inflation will be contained. However, for investors who wish to hedge against inflation risk, we demonstrate how a portfolio approach that combines multiple strategies may be effective in a variety of inflation scenarios.”

Want to Mitigate Inflation? Take a Portfolio Approach (PIMCO)

“pieces” (reading time > 10 minutes)

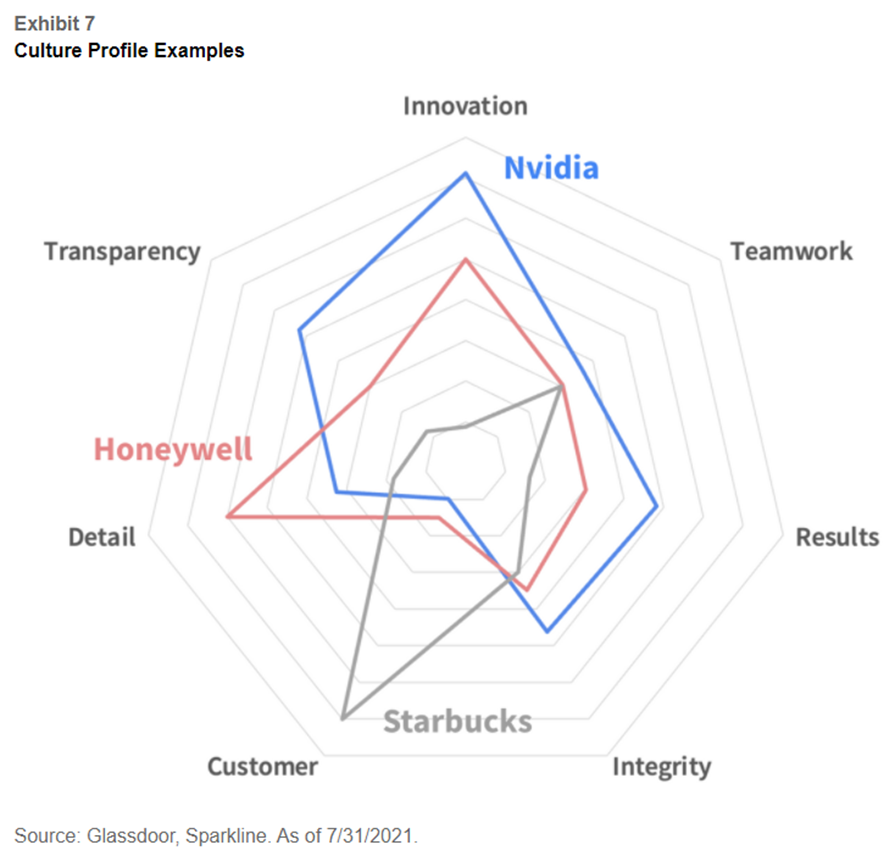

Can company culture be formally measured?

“Culture is the ultimate long game. As a long-duration intangible, cultural investment is often not only ignored by the market but can even be penalized by investors focused on tangible quarterly results. Building cultural capital requires the utmost conviction and patience.”

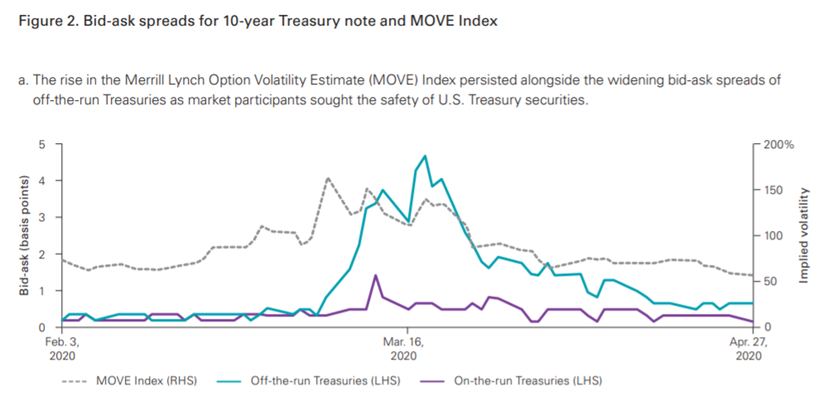

How did bond markets weather the storm during the market volatility of March 2020?

“The initial liquidation of risk assets, such as corporate bonds and commercial paper, quickly expanded to include safe-haven assets such as U.S. Treasury securities, resulting in the breakdown of the historical relationship between risk assets and risk-free assets: Long-term U.S. and European government bond yields began to rise rapidly, while equities continued to tumble. Most notably, this pressure produced cracks in the U.S. Treasury security market, one of the world’s deepest and most liquid asset classes, and one that is foundational to the efficient operation of capital markets.”

The dash for cash: Observations on the fixed income market ecosystem during COVID-19 (Vanguard)

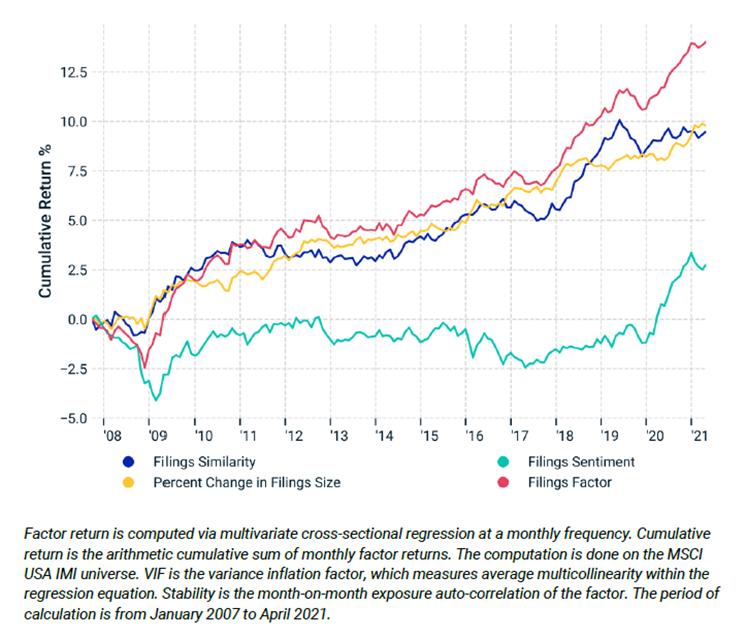

Is information about future stock returns embedded in a company’s SEC regulatory filings?

“Using the 10-K) and (10-Q) regulatory filings by companies in the MSCI USA Investable Market Index (IMI) universe, we found that changes in the structure and language of these filings had strong implications for a firm’s future stock performance.”

Is thematic investing the opposite of factor investing?

“By going short in key asset pricing factors, investors in thematic indices are trading against quantitative investors who seek long exposure to the same factors. From an asset pricing perspective this implies that investors in thematic indices face a low expected return. Nevertheless, there is a clientele for these strategies.”

Betting Against Quant: Examining the Factor Exposures of Thematic Indices (Robeco)

Where does inflation really come from?

“Without a radical shift in labour’s bargaining power (for which we see no sign), it is unlikely that inflation will be able to embed itself in the system.”

Do past inflation dynamics tell us anything about future stock market returns?

“The negative relationship between inflation rates and the equity risk premium may be unexpected to some because equities are a claim on real assets and, therefore, should provide a hedge against inflation.”

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.