A Small Lump of Value in Your Stocking

“One thing I’ve learned is that in the investment business when you hear the word ‘never,’ it’s about to happen.” – Jeffrey Gundlach

Similar to the coal that one might find in their stocking, investment returns can be lumpy. Even if we feel like we have behaved well as investors, there are just some years when we look at our performance and can’t help but think we were accidentally placed on the “naughty” list.

We have decades upon decades of data and evidence that support the notion that stocks with certain characteristics, or factor exposures, have higher expected returns than the broad market. But historical returns alone are not enough. A factor is meaningless if either a) its just noise or b) its very discovery in academia has led to it being arbitraged away in the real world. In other words, you want a fair amount of confidence in a particular factor’s ability to continue generating excess returns going forward. Fortunately, Larry Swedroe has a useful framework to determine whether a factor should be considered worthy of investment:

Persistent – It holds across long periods of time and different economic regimes.

Pervasive – It holds across countries, regions, sectors and even asset classes.

Robust – It holds for various definitions (e.g., there is a value premium whether it is measured by price-to-book, earnings, cash flow or sales).

Investable – It holds up not just on paper, but after considering actual implementation issues, such as trading costs.

Intuitive – There are logical risk-based or behavioral-based explanations for its premium and why it should continue to exist.

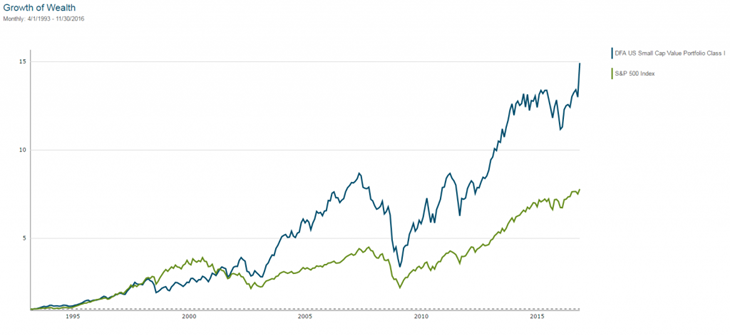

The Value and Size premiums – perhaps the two most popular and cited factors – check off all of these boxes and pass the factor smell test with flying colors. The sweet spot of these two premiums has historically been at their intersection – Small Cap Value stocks. Using live data for the DFA US Small Cap Value fund (Ticker: DFSVX) as a proxy for the asset class, we can see the demonstrated outperformance relative to the S&P 500 – most peoples’ reference point for “the market” – using a Growth of Wealth chart since the DFA fund’s inception in 1993.

From 4/1/1993 to 11/30/2016, a dollar in the S&P 500 would have turned into $7.79 whereas a dollar invested in DFSVX would have given you $14.93.

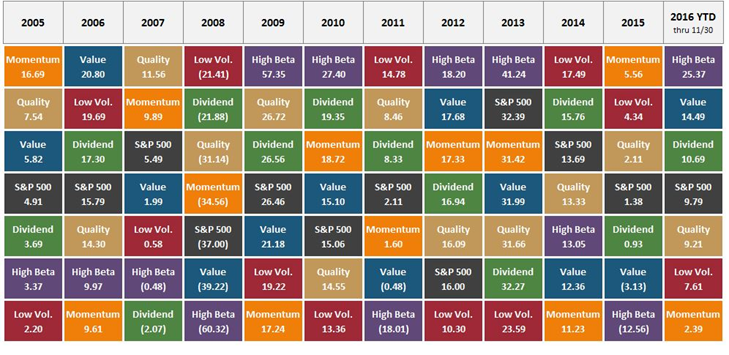

Impressive? Absolutely. A free lunch? Hardly. Understanding a factor premium and earning it in real life are “polar” (my attempt at a holiday joke) opposites. Long-term excess returns can be achieved, but they are by no means guaranteed and the road to get there can and will be paved with many detours to Underperformanceville. As the quilt chart below shows, there will always be the siren song of other factors doing better than the ones you currently own:

Source: ETF Trends

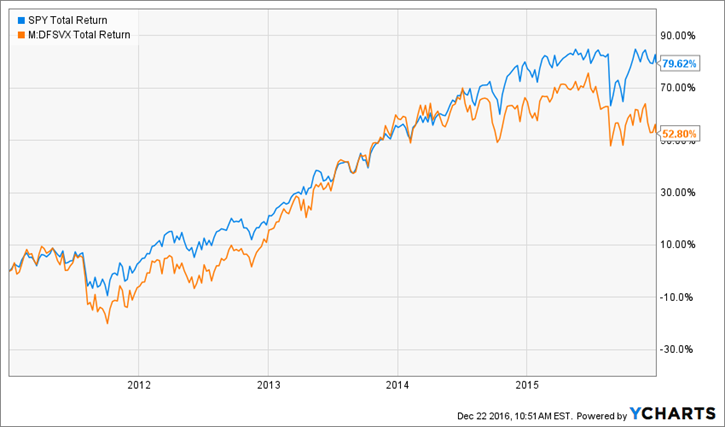

Bouncing around every year from Value stocks to Momentum stocks to Quality stocks and so on will inevitably lead to disappointing results. Choice in factor tilts matters far less than your ability to find ones you have conviction in and stick with them through thick and thin. Circling back to Small Cap Value stocks, many investors and advisors alike were probably getting ready to throw in the towel on their tilts to this asset class at the end of 2015 – and I’m sure a few probably did. If you owned nothing but the DFA Small Cap Value fund from 2011 through 2015, this is what your five-year look back return looked like relative to everyone’s favorite market proxy, the S&P 500 (using the ETF “SPY”):

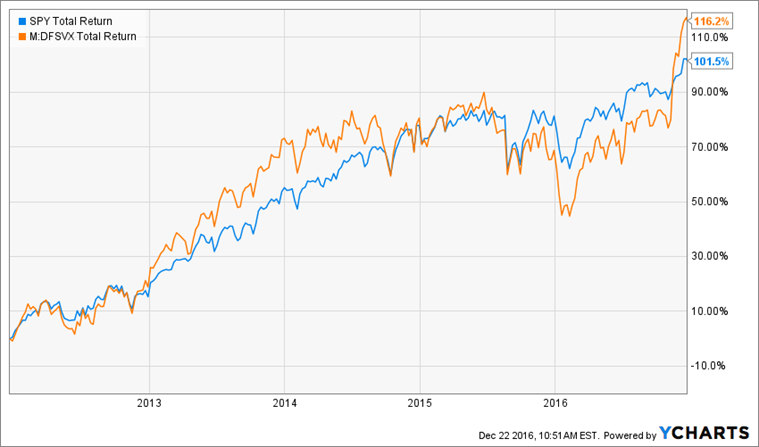

Had you shown the fortitude to stick with that allocation through where we are today in 2016, your five-year return would now look like this relative to the S&P:

In less than twelve months, you would have went from being behind 25 percent over a five-year period to being ahead by roughly 15 percent over the same time frame. That’s how quickly leadership can change and is just one example of why not to invest in the rear-view mirror or regularly call into question a well-thought-out investment philosophy. To paraphrase Jeff Gundlach’s quote at the top, when an asset class or style has been out of favor for a while and seems like it will never start to “work” again, it’s often not too far from turning a corner back in the right direction.

Patience is a virtue for those that are willing and able to exercise it. And if you have conviction in a strategy and can stick around long enough, you might end up with something better than coal in your portfolio’s stocking.

Happy Holidays to all of my readers! It’s been an awesome experience getting this blog up and running this year and I look forward to taking it to the next level in 2017. A heartfelt thank you to my family, co-workers and other members of the financial blogosphere for all of their support in this endeavor. See you all next year!

Further reading:

Swedroe: Sorting Through The Factor Zoo (ETF.com)

(Full Disclosure: My firm, Huber Financial Advisors, uses funds from Dimensional Fund Advisors in constructing client portfolios. Nothing said above constitutes investment advice or a solicitation to buy or sell any securities.)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.