A Vote For Evidence

With the last Presidential debate behind us and the election only weeks away, a common refrain among many investors is wondering how the result – Hillary or Trump – may impact their portfolio. When it comes to politics, we often get caught up in our own emotions, regardless of which side of the aisle we gravitate to. This can lead to situations in which we allow feelings to overcome facts. While there is no questioning the impact feelings can have when it comes time to enter the ballot box on election day, those same feelings can lead to disastrous outcomes if you allow them to consume your investments.

It’s safe to say that this year’s Presidential Election has been a little, how do you say, unorthodox? Yet despite the volatile nature of the news cycle and the debates, markets have largely ignored the political discourse and have continued their march higher for the year. It would be wise for investors to do the same and not allow partisan emotions to enter the investment decision-making process.

To borrow a phrase from Larry Swedroe, our crystal ball is always cloudy when it comes to investing (and in this case, politics.) We don’t know who will win the election. And even if we did, it wouldn’t be of much use as it wouldn’t tell us anything about the ex-post behavior of millions of other investors with competing goals, opinions and interpretations of information. Here is what we do know:

- Identifying actionable return patterns in election years is extremely difficult.

- Not only have stock market returns been positive – on average – in both election years and the subsequent year, they have been so regardless of which party is in office.

- Current market expectations related to the outcome of the election are already factored into security prices and adjust rapidly as new information presents itself.

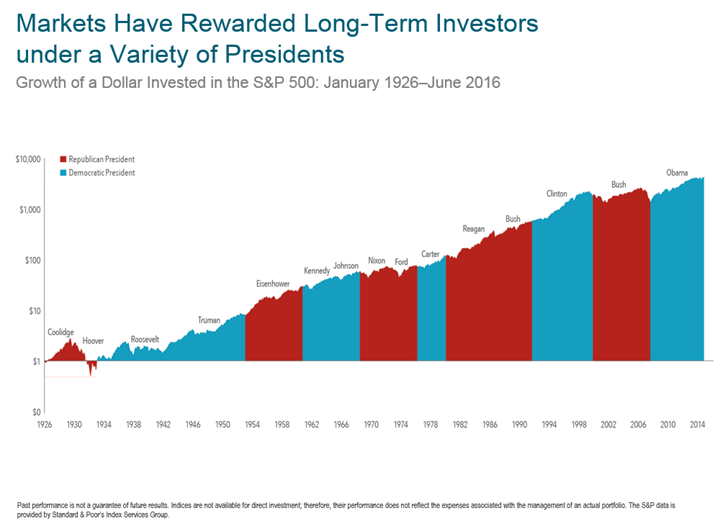

We often say that markets climb a “Wall of Worry” when referencing the resiliency of capitalism in the constant presence of temporary setbacks and negative headlines. I would take it a step further and say that markets also climb a “Partition of Presidents” as markets have reward investors in Republican and Democratic regimes alike. The chart below from Dimensional Fund Advisors (DFA) illustrates how Presidents come and go, party control in D.C. changes hands, and yet markets continue to climb higher.

Source: Dimensional Fund Advisors

It’s easy to pick out a specific example in the image above and use it to draw a conclusion based on today’s environment that fits the narrative of what one thinks will (or should) happen. But outliers can be found anywhere when you are working with a small sample set. For example, of the thirteen Presidential elections since 1964, only two have seen the S&P 500 end the year with negative returns: 2000 and 2008. One could take that information and imply that the tenure of George W. Bush as President was disastrous for markets and responsible in part for the “lost decade” in stocks during the aughts. But when you take a step back and appreciate the extreme circumstances of what our country was going through at the bookends of his two terms – the bursting of the Tech Bubble and the Great Financial Crisis, respectively – it becomes more apparent that the relationship between who is in the Oval Office and what the stock market did is more coincidental than causal. Much like head coaches in sports, Presidents receive too much credit when things go well and too much blame when things go poorly.

Here is Vanguard’s Jonathan Lemco on the subject:

Keep in mind that many factors influence market behavior. The most important is market valuations, but others include globalization, technology, demographics, the Fed and the economy, and unforeseen events such as wars and natural disasters.

Jonathan and his team looked at decades and decades of data on markets and elections and found the following:

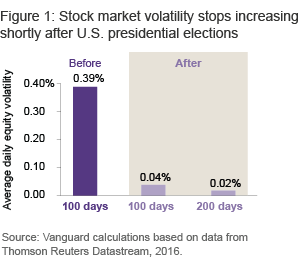

- Stock market volatility tends to increase in the months leading up to an election, but tends to dramatically fall in the months following. Think of it as an uncertainty release valve as the market can finally put a big unknown behind it and move on,

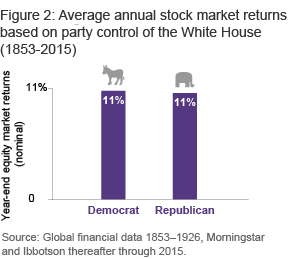

- Going back to 1853 and through the end of last year, we can see that stock market returns in the U.S. have been virtually identical regardless of which party has controlled the white house.

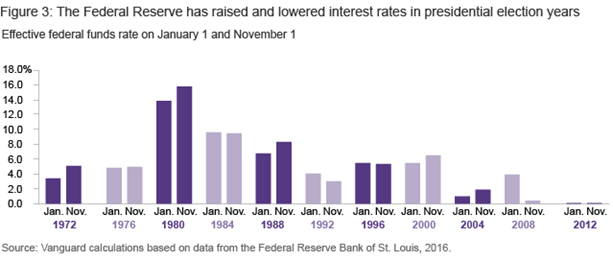

Most investors hold portfolios of both stocks AND bonds so it makes sense to dig in and see how the Federal Reserve has acted in election years and if any patterns have emerged concerning interest rate fluctuations. Unsurprisingly, there has been no clear-cut impact of elections on bond performance and the Federal Reserve has both raised and lowered interest rates in election years.

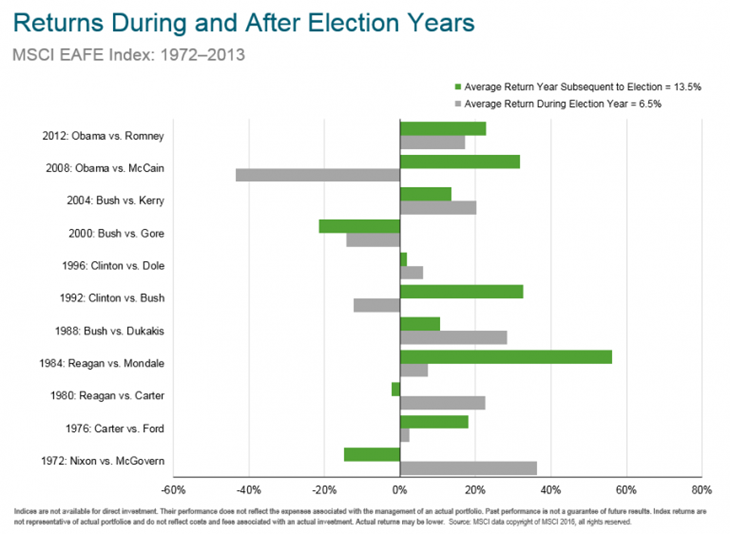

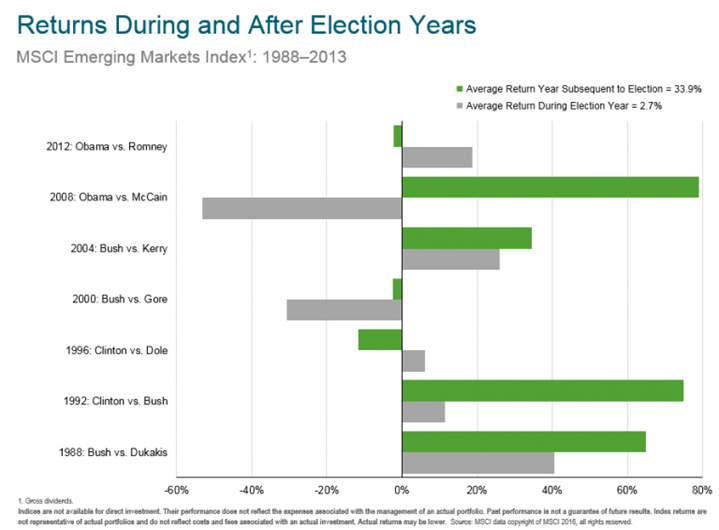

Other research from DFA extends into international equity markets, showing positive average returns during U.S. election years and the following year in both Developed and Emerging Markets, represented by the MSCI EAFE and MSCI Emerging Markets Indices, respectively. Granted, the data for these markets doesn’t stretch back as far as what we have domestically, but it paints a very similar picture.

Source: Dimensional Fund Advisors

Source: Dimensional Fund Advisors

There are no sure things in investing, but a bias towards non-U.S. stocks has certainly benefited investors following election years in recent decades.

While the betting odds certainly favor one candidate at the moment, no one knows for sure what the outcome will be until the votes are tallied on November 8th. And even if we had clairvoyance into the outcome, it wouldn’t tell us anything about subsequent returns. Historical averages during election cycles for different asset classes can help provide us perspective and maybe even keep us from making rash decisions. But the world seldom provides us with averages. More than likely, we will experience an outlier in either direction. It’s important to remember that while who controls the White House and Congress is certainly a factor that influences the expectations and behavior of market participants, it is just that – a single factor, one of many, and certainly not the be-all and end-all variable in determining stock and bond market performance.

Personal choices for November’s election aside, when it comes to electing a long-term, goals-based investment portfolio, a “candidate” who is pro-diversification, pro-common sense and pro-evidence is something we should all vote for.

Further Reading:

Worried about the election’s impact on your portfolio? Markets are nonpartisan long term (Vanguard)

(Full Disclosure: My firm, Huber Financial Advisors, uses funds from DFA and Vanguard in constructing client portfolios)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.