Alternatives in Action

When I wrote The Allocator's Edge, it was designed to be as compressive a guide as possible to the vast universe of alternative investments. As such, it was not meant to serve as a prescription to the reader of how they should incorporate alternatives into their own portfolio, or the portfolios of the constituents they serve. Ultimately, we all come to the table with different experiences, perceptions, biases, objectives, constraints, and preferences. Different strokes will apply to different folks.

Naturally, however, the question has come up from readers and prospective clients of Savant:

What do alternatives look like in practice for a typical client portfolio at your firm?

While there is no such thing as a "typical" client portfolio, there are some common threads as it relates to the types of alternative investments we incorporate across the households we serve and their role in complementing the traditional stock and bond exposures we are all accustomed to. We look to integrate non-traditional asset classes and strategies that can do some of the heavy lifting where a classic 60/40 type portfolio might fall short.

I like to think of it as the new DIY investing. No, not "do it yourself", but rather:

- Diversification

- Inflation Sensitivity

- Yield Generation

With that in mind, our investment team at Savant has authored a hot-off-the-press white paper on alternative investments that is available to download on our website here.

For much of history, many alternative investments were accessible only to institutional investors or the extremely wealthy. Thankfully, the investment landscape continues to evolve, introducing new investment opportunities for professional asset allocators and retail investors alike. The accelerating industry trend of democratization has made great progress in recent years, at a time when both stock and bond markets face their respective challenges.

In addition to evaluating the current market landscape, this paper introduces several alternative asset classes with the potential to serve as complements to traditional stock/bond portfolios. Namely, we review the potential benefits and risks of:

- Reinsurance

- Trend Following/Managed Futures

- Event Driven

- Real Assets

- Direct Lending

While we designed this paper to be educational in nature, it should not be viewed as individual investment advice. Each investor has unique circumstances that should be considered before introducing alternative investments.

Some of the paper's highlights include:

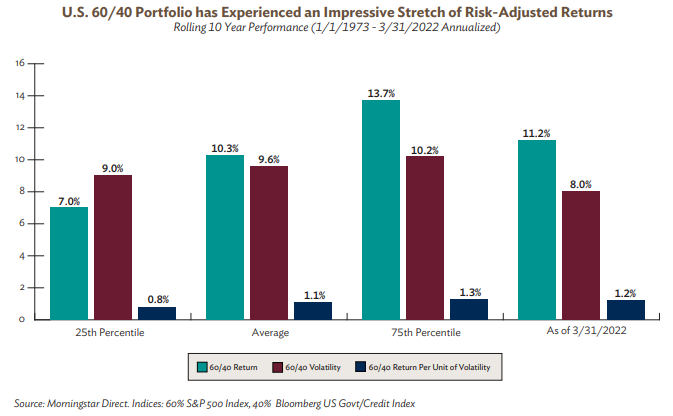

The history of the U.S. 60/40 portfolio. Even in spite of 2022's challenges, the 10 year performance of the 60/40, as of March 31, 2022, has been better than average in both absolute and risk-adjusted terms. With such strong historical (and recent) results, it's no wonder why many investors have clung to this intuitive, and easy to implement, security blanket.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only and do not reflect management fees and transactions costs. Investors cannot invest direct in an index.

A timeline of events, decade by decade, that have shaped the evolution of alternative investments over time. Many major milestones, innovations, academic research, and regulatory acts have happened over time that have directly, or indirectly, informed how we got to now.

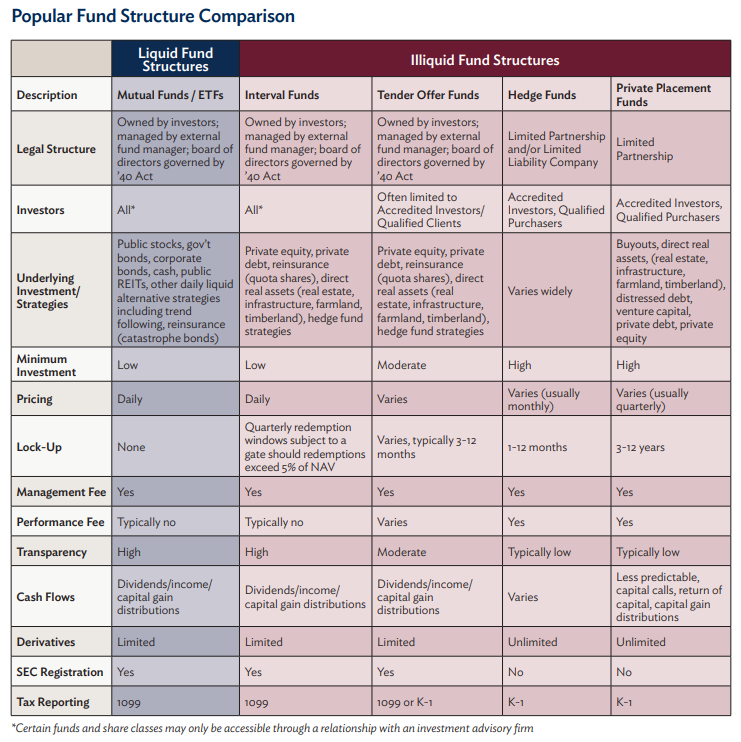

A side-by-side comparison of the various fund structures, or wrappers, that can house alternative investments. Each can play a role depending on an investor's qualifications, liquidity preferences, and other factors. But at the end of the day, there can't be a mismatch between the container and its contents.

Individual profiles of each alternative asset. Trend Following is an example shown below, where we provide a brief summary of the asset class, its 20-year return, volatility, drawdown, and correlation statistics.

Source: Indices referenced include Global Stocks: MSCI ACWI NR; Global Bonds: Bloomberg Global Aggregate TR Hdg USD; and Trend Following: Credit Suisse Managed Futures Liquid TR Index.

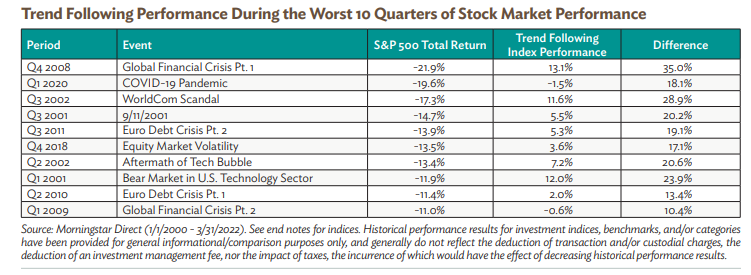

We also include some helpful tables and charts like this one highlighting Trend Following's performance during the worst quarters of S&P 500 performance going back to 2000.

Source: Trend Following refers to Credit Suisse Managed Futures Liquid TR Index.

If you have any interest in learning more about alternative investments, the whole paper is worth a read!

Building Better Portfolios One Asset Class at a Time (Savant Wealth Management)

Savant Wealth Management (“Savant”) is an SEC registered investment adviser headquartered in Rockford, Illinois. Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Savant, or any non-investment related services, will be profitable, equal any historical performance levels, be suitable for your portfolio or individual situation, or prove successful. Savant is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.