BBBe Careful

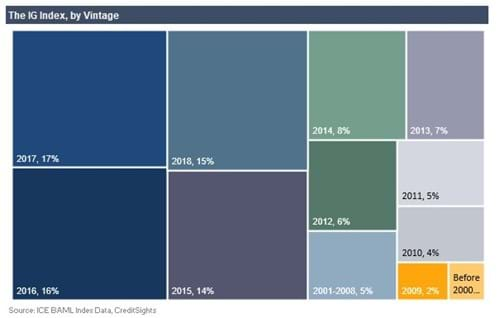

The corporate bond market has nearly doubled over the last ten years. According to the Financial Times, there has been in excess of $1 Trillion (with a T) of issuance every year since 2010. This recent corporate borrowing binge shouldn’t come as much of a surprise. It makes all the sense in the world that companies would want to take advantage of rock-bottom interest rates while the gettin’ is good. In fact, per Bloomberg’s Tracy Alloway, over sixty percent of the bonds in Bank of America/Merrill Lynch’s investment grade index have been issued in the last four years:

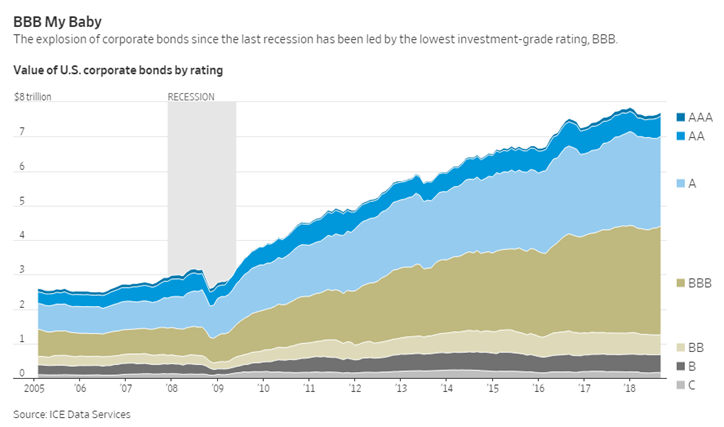

What may come as a surprise is how much of the growth in issuance has come from BBB-rated bonds – the lowest rung on the investment grade ladder.

Source: Wall Street Journal

Some stats:

- The amount of BBB bonds outstanding today is ~50 percent larger than the entire investment grade corporate bond market was at the 2007 peak.

- The roughly $3 Trillion of Triple-B rated debt – more than triple what it was in 2008 – now surpasses the size of the entire U.S. junk bond market.

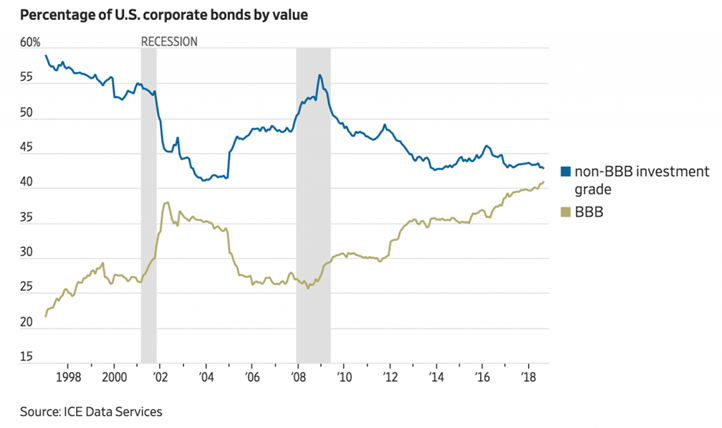

- There is almost as much BBB out there today as non-BBB within the investment grade universe:

Source: Wall Street Journal

So why the explosion in BBB? Because anything lower means bad news if you’re the CFO if a publicly traded company. Here’s the Wall Street Journal:

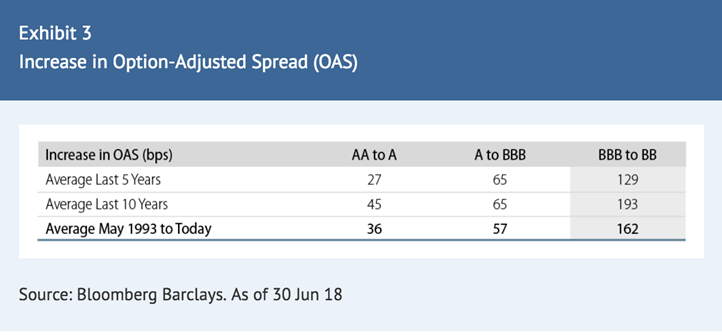

Chief financial officers have been borrowing as much as they can get away with without their debt being classed as junk, because the move to junk leads to sharply higher borrowing costs. The attention paid to that rating boundary means the usual danger of leverage comes with an extra risk: the buildup of BBB bonds could mean even more downgrades to junk in the next recession than usual.

This chart from Western Asset puts in in perspective. The additional borrowing costs from AA to A or A to BBB are material, but not eye-popping. The shift from BBB to BB (the “top tier” of junk) is another story.

Source: Western Asset

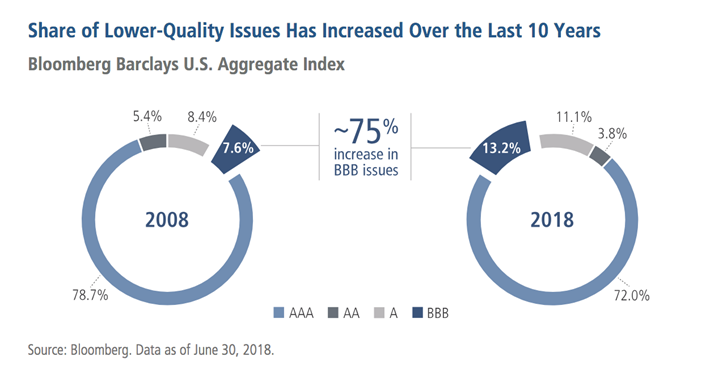

The implications of this dramatic shift for bond funds and ETFs are significant. This chart, via Neuberger Berman, highlights the transformation in the composition of the Bloomberg Barclays U.S. Aggregate Bond Index – the most commonly used benchmark and widely tracked index in fixed income.

Source: Neuberger Berman

It’s not just the financical media talking about this. The Bond Kings of SoCal are weighing in as well…

In a recent interview with Reuters, DoubleLine’s Jeffrey Gundlach had the following to say:

Gundlach, who oversees more than $123 billion and is known on Wall Street as the Bond King, said investors should avoid investment-grade bonds. They are riskier than they used to be because “triple-B” rated credit – the grade for securities just above “junk” status – has increased dramatically since 2008, from 20 percent of all investment grade credit to approximately 50 percent today, he said. Those companies are at the greatest risk of a downgrade when the next economic downturn hits.

Guggenheim’s Scott Minerd had this to say on Twitter:

This is a wake-up call: The sensitivity of credit markets is rising. Some problems we can see from a long way off, others are idiosyncratic and seemingly come from nowhere, but spreads are vulnerable to blowing out.

— Scott Minerd (@ScottMinerd) November 20, 2018

So what does this all mean?

Does it mean all BBB-rated corporate bonds are bad? Of course not.

Does it mean that corporate credit as a whole is doomed? No, but caution is certainly warranted.

Does it mean that fixed income investors of all stripes should monitor and review their core bond allocations with eyes wide open? Absolutely.

What this means for index investors is to not take the “IG” label at face value, and to be aware of the underlying methodology and composition of any indices you are tracking. For those that allocate to active bond managers, it means asking them how they are currently positioned and understanding the flexibility, or lack thereof, in their investment mandates to express any view they might have on this dynamic.

This post was not meant to sound any alarm bells, but I do think it’s worth paying attention to. At the very least, it’s a good excuse to look under the hood of your fixed income investments and see what kind of risks you’re taking. It’s also a healthy reminder that not all investment grade paper is created equal.

Additional Reading:

Credit Markets: To BBB or Not to BBB? (PIMCO Blog)

An Update on BBBs (Western Asset)

There Have Never Been So Many Bonds That Are Almost Junk (WSJ)

A $1 Trillion Powder Keg Threatens the Corporate Bond Market (Bloomberg)

Tudor Jones sees peril in corporate credit ‘bubble’ (Financial Times)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.