Closet Active

There are few more insulting things you could call a discretionary active fund manager than a “closet indexer.” Them’s fightin’ words! In investor parlance, this barb is intended to chastise active portfolio managers who essentially mirror their benchmark, yet hang out their shingle as being worthy of premium fees under the guise of delivering outperformance relative to said benchmark. Said differently, closet indexers sell you a Whopper for the price of Wagyu beef.

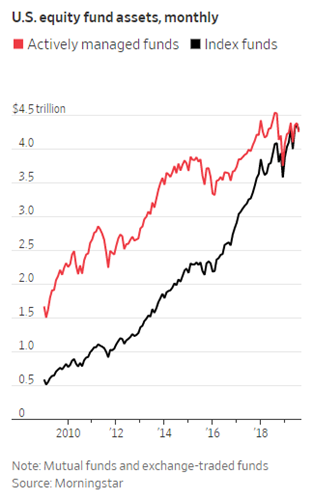

This is no new phenomenon. You could argue that the majority of active funds, particularly those that invest in Large Cap U.S. stocks, exist somewhere on the spectrum of closet indexing. The primary culprit? Career risk. Better to fail conventionally than succeed unconventionally, amirite??? Investors have been wising up to these shenanigans for decades now, leaving closet index funds in droves for the greener pastures of actual index funds that are systematic, rules-based, and – most importantly – cheap. According to the Wall Street Journal, “In the past decade, nearly $1.36 trillion in net flows were added to U.S. equity mutual funds and exchange-traded funds that mimic market indexes while some $1.32 trillion fled higher-costing actively managed counterparts.”

While the veil has been lifted on traditional active stock fund management for years, much ink has been spilled more recently over the notion that there is somehow a “bubble” forming in passive investing. See here, here and here. Sounds smart, but unfortunately for that theory’s proponents it is in no way tethered to reality. Larry Swedroe took that argument to the woodshed in this recent piece. Josh Brown cogently made the case that the real bubble has been in active management all along. And in case there were any remaining doubts, Ben Carlson put them out to pasture in this epic debunking.

The challenge that investors face today is that the lines between these two worlds – active and passive – are becoming more blurred by the day. As Morningstar’s Ben Johnson wrote in a recent article on index investing:

What had started as a means of taking the market’s temperature evolved into a yardstick for active managers and ultimately the bull’s-eye for an emerging crop of index portfolio managers.

These days, it’s pretty rare for me to come across a new ETF launch that sparks genuine interest. Instead, my immediate reaction is often an eye roll or a chuckle. The latest installment of this trend is a new product from a firm called Beyond Investing, the US Vegan Climate ETF (VEGN). Per the company’s website:

the fund seeks to track the Beyond Investing US Vegan Climate Index (VEGAN). VEGAN screens large cap US companies for a variety of ESG (Environmental, Social, Governance) considerations, primarily animal harm and exploitation, as well as fossil fuels, environmental damage, and human rights.

I have no issue with the “mission” of this fund. Not for me, but if that’s your cup of tea – or green smoothie – then good on you. What grinds my gears here is that you are owning ~280 large-cap U.S. stocks for an expense ratio of 60 bps. There are 14 stocks that overlap in the Top 25 holdings of this fund and the S&P 500. In an era where Beta exposure to U.S. stocks is essentially free, is it really worth it to pay an additional 50-60 bps to screen out a few companies? (Berkshire Hathaway is a notable omission. I guess they aren’t fans of Uncle Warren’s morning routine of sausage, egg and cheese biscuits from McDonald’s.)

Lest you think I have some ax to grind with Vegans, let me assure you that I do not. This is just one of many recent examples of an explicitly active strategy being codified by an index and traded on an exchange. This year alone, we’ve seen new ETFs focused on the following areas:

- Outer Space

- Downside Buffers

- Relative Value Strategies

- “5G”

- Factor Rotation

- Fixed Income Sector Rotation

- Interest Rate Volatility and Inflation Hedge

- Peer-to-Peer Lending & Crowdfunding

- Cannabis

- Esports & Digital Entertainment

I could keep going, but suffice it to say – these are not you’re Grandfather’s index funds. Most new products today seem to run counter to the original ethos of index investing. If the benchmark-hugging active mutual funds of the Nineties and Naughts were Closet Indexers, then I guess strategies like these can be thought of as Closet Active – funds that masquerade as index funds under the halo of the ETF structure, but in reality are a reflection of very active portfolio decisions.

Regardless of what asset class, strategy, or theme you are trying to express in your portfolio today, “there’s an ETF for that.” It’s not a bad thing. It’s not a good thing. It just is. It was inevitable after all the major bases were covered in the first wave of ETF innovation that the next wave by necessity would have to be more narrow and more niche. When the Big Three dominate the industry to the extent they do, differentiation is paramount.

I’m not here to stake claim that any particular fund should or shouldn’t exist. Issuers are free to launch whatever products they so desire. If there’s demand for it, it’ll swim. If not, it’ll sink. That’s the beauty of capitalism.

What I am here to say is that it is no longer safe to paint index funds or ETFs with a broad brush. It used to be the case that when you referred to an “Index Fund” or an “ETF” there was a tacit assumption that it was accompanied by the following characteristics:

- low-cost

- low-turnover

- highly-diversified

- tax-efficient

- broad-based exposure

It is no longer safe to assume that ETFs and/or index funds meet any or all of the above attributes.

If there’s one thing I hope readers take away from this post, it’s the need to be diligent, thorough and skeptical when evaluating any potential investment – regardless of its structure or nature. It’s not enough to say Oh, it’s an ETF! or Oh, it tracks an index! to rubber stamp something as a passive investment. Much in the same way closet indexers operate under the facade of providing active exposure, many active strategies – and the high fees that go with them – have engaged in subterfuge to ride the wave of the passive investing zeitgeist. Some may be worth their price tag. I suspect most will not. Either way, always understand what you own, why you own it, and how much you’re paying for it.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.