I Bought My First NFT

So.....I did a thing.

And by thing, I mean I bought my first NFT over the holidays.

Here it is. Go ahead, give it a click.

Pretty cool, huh? (indulge me for a minute, even if you disagree.)

Unless you've been living under a rock for the past year, it's likely you've at least heard the term NFT, even if you don't know what it stands for or why you should care. Heck, it was even chosen as Collins Dictionary's 2021 word of the year, edging out metaverse and cheugy (I had to look that one up.)

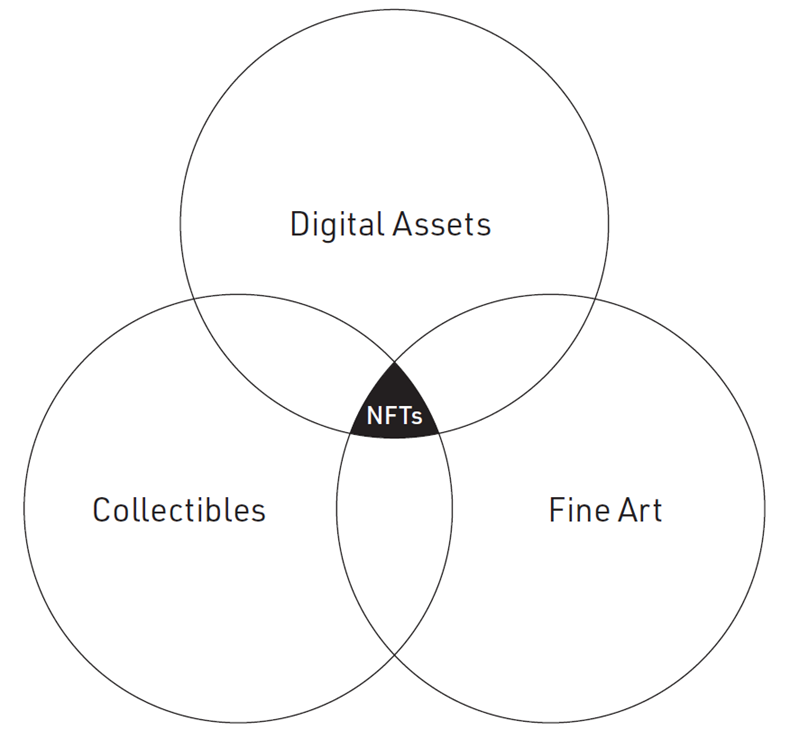

If you were to create a Venn diagram of digital assets, collectibles, and fine art, then non-fungible tokens (NFTs) would likely sit at the intersection of all three. According to NFT marketplace OpenSea, NFTs represent “unique, digital items with blockchain managed ownership.”

These pieces of digital art, media, and virtual goods—ranging from songs and videos to GIFs and JPEGs—are free for anyone to view, stream, download, or listen to. It is the ownership rights to those assets, however, that essentially function as rare collectibles. One tweet likened the purchase of NFTs to “angel investing in culture.” This application of blockchain technology exploded in popularity in 2021, with an extreme example being the $69m sale price for an NFT from artist Beeple.

In addition to showcasing my newly acquired digital art, I wanted to use this post as an opportunity to answer two questions:

Why did I buy an NFT?

and

Why did I buy this NFT?

Why Did I Buy An NFT?

- Curiosity: it's hard to live on finance twitter and not be at least a little intrigued by all the buzz surrounding NFTs. I found myself agreeing and disagreeing with takes from both sides of this polarizing corner of the crypto ecosystem. On one hand, you have the skeptics who can't conceive why anyone would willingly pay money for the privilege of owning a digital asset that literally anyone in the world could "right click and save." And then you have the hypebeasts at the other extreme who laugh in the face of any and all bubble proclamations.

- Boredom: Like many, I took some time away from work over the holidays. With Omicron keeping a lid on our social activities, I found myself with more time to kill than usual during our toddler's naps to poke around and learn more.

- Serendipity: I wasn't actively seeking a certain collection or type of NFT. To be honest, when I would visit OpenSea, the largest NFT marketplace, I would find myself feeling overwhelmed and out of place. Sure, I could filter to see which NFTs were trading the most or which were valued the highest, but what do I know? I have no business trying to identify the next CryptoPunks or Bored Apes Yacht Club. And I wasn't necessarily looking to buy and flip something. I was more interested in eating sardines than trading sardines, if that makes sense. In a weird way, the NFT I bought ended up finding me instead of the other way around. More on that in a minute...

- Experience: The best way to learn about something is by doing. I knew purchasing an NFT wasn't going to be as simple and easy as buying a book on Amazon. Until I went through the exercise myself, however, I didn't realize how many steps were involved and how, for lack of a better word, annoying the process would be.

Why Did I Buy This NFT?

I get to support a creator/artist that I admire. One of the great byproducts of social media is the discovery of brands, products, or creators we otherwise might not find. Anyone who knows me knows my first true love is professional wrestling. So in 2020, when I discovered via Instagram an Australian artist named Sam Evans who almost exclusively creates wrestling-themed art, I was blown away. I'm no art connoisseur, not by a long shot. But this stuff? This stuff spoke to me. Fast forward to today, I have several Sam Evans paintings in my house. (Don't worry, my wife has limited their display to my office or the basement.) So, when I saw on Instagram about a month ago that Sam was minting his first NFT, I knew I at least had to entertain it.

It connects the digital world with the physical. Whereas most NFT projects are strictly blockchain based ownership of a purely digital item, I noticed this little nugget in the description: "original painting with Ric Flair on the screen will be shipped to buyer." The caveat of also receiving the actual physical painting that inspired the digital work is pretty much what sold me on submitting a bid. It's on its way from the other side of the world as we speak, and I can't wait to hang it up when it arrives!

It was relatively affordable. It wasn't cheap, per se. But it also wasn't priced at such an astronomical level I wasn't comfortable with.

I'm OK never selling it. I don't view this digital asset as a slice in my asset allocation for investment purposes. To me, it's more of a consumption asset than something I purchased for an expected financial gain. Would I listen if the right offer came along? Of course. But not having the purchase be contingent upon some uncertain return on investment gives me peace of mind. If it were a bored ape or cool cat or pudgy penguin or some other [fill in your favorite adjective and animal] that I had no real connection to, I'd probably feel some underlying urge to make a short term profit off it.

Most importantly, it makes me feel good. I get warm and fuzzy feelings every time I look at it. No other NFT had yet to spark any sort of joy inside of me. This one immediately transports me to my childhood - watching wrestling on TV while playing with action figures.

NFTs are symbolic of the rise of the creator economy. Proponents of the technology point to the improved creator economics that NFTs can provide. Venture Capitalist Chris Dixon of a16z points to three key features of NFTs that can change the economics for creators: the removal of rent-seeking intermediaries, granular price tiering that varies with fans’ enthusiasm levels, and the conversion of users into owners as a mechanism to lower customer acquisition costs.

Color me skeptical around some of the recent speculation in this space, but if history is a guide the seeds of innovation are often planted in every mania. It is still very early innings and the ecosystem surrounding NFTs will evolve significantly in the coming years. It will be interesting to witness what the next decade holds for NFTs and the problems they are trying to solve.

In case you're wondering, I have no immediate plans to buy another NFT. But I am quite happy that I bought this one.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.