Is Crypto an Alternative Investment?

I could make this the shortest blog post ever, answer in the affirmative, and move on with my day.

But a couple of recent developments have nudged me to play devil's advocate and entertain the other side of the debate...

First, I came across this article from the Wall Street Journal reporting that Public.com, an app-based trading platform and competitor to Robinhood, has rolled out cryptocurrency trading on its platform.

Source: Public.com

Why is this news, you might ask? After all, Robinhood has been offering access to crypto assets for several years now.

For those unfamiliar with Public.com, it can generally be thought of as the church to Robinhood's casino (H/t to Betterment's Dan Egan for the analogy). Several of the features that Robinhood has been lambasted for - payment for order flow, options capabilities for novices, margin trading, the gamification of our short-term gambling instincts - are nowhere to be found on Public.com.

With such divergent approaches, it's no wonder the announcement caught me (and others) by surprise. But should it have? Upon further reflection, probably not.

Commission-free trading apps are used predominantly by Millennial and Gen-Z investors, and those two generations have demonstrated they are quite comfortable mixing in crypto with their stocks. To some, they might as well be one in the same. To others, the notion of purchasing a bond ETF might sound more "out there" than owning some BTC or ETH.

The second piece of news that sparked my interest in answering this question was this week's SEC-approval and subsequent launch of the first U.S. Bitcoin Bitcoin-Linked ETF from ProShares. (The distinction between Bitcoin and Bitcoin-linked is important here as the fund uses futures to gain exposure to the price movement of Bitcoin rather than owning Bitcoin directly.)

Setting aside that this is a pretty inefficient and costly way to allocatoe to Bitcoin, it does represent a fairly seminal moment in the convergence between the traditional financial system and the crypto financial system. A myriad of fund providers have been (unsuccessfully) attempting to launch Bitcoin ETFs for over eight years now, only to be continually rebuffed by the SEC...until now (kind of).

In addition to ProShares, there are at least a dozen other ETF providers with active filings and registrations. The reasons are obvious - there is incredible demand to be met. The ProShares product did about $1 Billion in trading volume on its first day trading - pretty much unheard of for a brand new ETF.

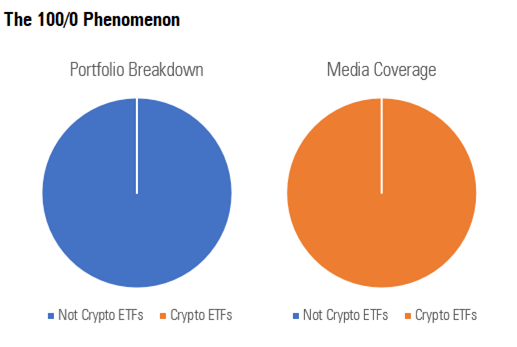

Given the insane amount of financial media attention that has been paid to the pursuit of Bitcoin (and Bitcoin-linked) ETF's, I am reminded of this hilarious chart shared by Morningstar's Ben Johnson:

It's hard to conjure up a more mainstream alternative investment - an oxymoron if there ever was one - than crypto.

Which brings us back to the question at hand - is crypto an alternative investment?

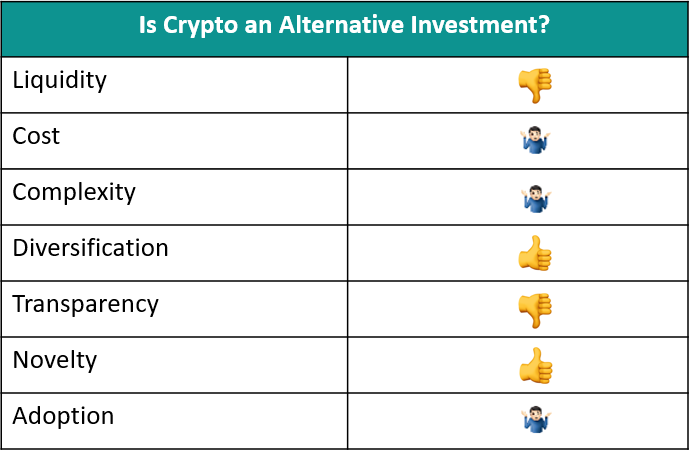

The delineation between traditional and alternative is far from black and white. Traditional and alternative investments are often not that dissimilar to each other in practice, once we isolate the factor(s) that makes the alternative asset alternative in the first place. In the case of crypto, I examined seven variables to try and arrive at a highly scientific and not at all subjective [inset sarcastic face emoji] conclusion about how investors should appropriately bucket the asset class in their portfolios.

- Liquidity: This one is straightforward. You or I can easily transact in (choose your favorite crypto asset) and settle almost instantaneously on platforms like Coinbase and Gemini. The crypto marketplace runs 24 hours a day, 7 days a week. And unless you're a whale, the market impact of your trades is not much of a concern. On this front, crypto is far from alternative.

- Cost: Your mileage may vary here. The costs of transacting in and owning crypto can actually be quite reasonable, especially if you're buying and HODL'ing and not frequently trading. That said, I've also encountered a variety of listed OTC and private funds that carry exorbitant fees. Caveat emptor.

- Complexity: You can go down the rabbit hole quite easily in crypto-land where things get really complex really quickly. The rebuttal here would be to ask the average person to describe the inner workings of the U.S. banking system and observe the glazed-over look in their eyes. The truth is we are surrounded by complexity all day every day, but we apply heuristics and narratives to simplify our lives. You don't need to be an expert in cryptography or a software engineer to view Bitcoin as "digital gold" or Ethereum as "programmable money".

- Diversification: Throughout its brief history, crypto assets have largely marched to the beat of their own drum. In addition to the eye-popping returns, they have demonstrated modest to low correlation to other asset classes. That said, the increased financialization of the space has seen it behave more like other risk assets during recent periods of macro volatility.

- Transparency, or lack thereof: Literally anyone can download the Bitcoin blockchain. Most blockchains are built entirely on open-source software, meaning anybody and everybody can view the underlying code. Transparency pretty much sits at the center of the whole crypto ethos. Many other alternative assets, particularly those in private markets, are far less transparent.

- Novelty: it's hard to argue anything but alternative when it comes to the novelty of crypto. Asset classes like stocks and bonds have centuries worth of data. Bitcoin, the OG crypto, is barely a teenager. The majority of crypto asset in existence today are still toddlers. If you could plant your flag on one variable as the defining feature that makes crypto alternative, its relative newness might be it.

- Adoption: the answer to this one is highly dependent on who you ask. As mentioned earlier, crypto has fast become a portfolio staple for the millennial and Gen-Z crowd, but their parents and grandparents have been more hesitant to dip their toe in the water, despite Bitcoin's price being regularly affixed to the bottom right corner of CNBC alongside the Dow, S&P, and NASDAQ. The fact that different generations could reach an entirely different answer to the same question speaks to how confusing and loaded a label like "alternative" can be to an asset.

I created a little table to summarize the seven attributes above, using the following legend as a guide:

And the results are...

...MIXED!

Two in favor, two opposed, and the other three are up in the air. What, you thought the results would actually be conclusive? Shame on you!

Alternative or not, there is no denying the growing interest in crypto among investors of all stripes. A recent Fidelity report on digital assets found that:

- 49% of financial advisors have been asked about cryptocurrency investing in the past six months.

- 26% of advisors have plans to increase their use or recommendation of cryptocurrencies in the next year.

- 71% of institutional investors expect to buy or invest in digital assets in the future.

What makes crypto so unique relative to other assets that carry the alternative label is that their emergence came first through "the people" rather than institutions. This is a much different path than the one most other "alts" traverse. Historically, institutional adoption has come first, with democratization to other channels coming second. Even categories like private equity and hedge funds that regularly occupy the public discourse are still largely out of reach for the average investor. The fact that crypto is going the opposite direction almost makes it the Benjamin Button of alternatives.

As disappointing as it may be, there is no "right" answer to the question posed by this post. Ultimately, it's a matter of semantics and reality is in the eye of the beholder.

The discussion above speaks not to the investment merits of crypto in a portfolio. That's a blog post for another day. Rather, it was an opportunity to shine a light on one of many examples in which the line between traditional and alternative is both thin and blurry. Far more so than meets the eye.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.