Let Your Cash Flourish

There is one asset class that every investor holds in some amount: cash. I’ve never been an advocate for a material, strategic allocation to cash in the context of a diversified investment portfolio. That said, there are often instances where it is entirely appropriate to keep a substantial cash balance outside of your portfolio. Beyond what you keep in your checking account for regular cash flow, it is perfectly normal to hold small amounts of cash to cover near-term liabilities, larger amounts waiting to be deployed into a portfolio over time, substantial future expenditures such as automobile or house down payments, or simply an emergency fund.

The problem with cash today is that in many cases, investors simply leave money sitting in a bank account. There is more than 13 trillion dollars sitting in bank accounts (checking and savings account) in the United States, and more than 40% of those dollars are deposited at one of the four largest banks (Bank of America, Chase, Citi, and Wells Fargo).

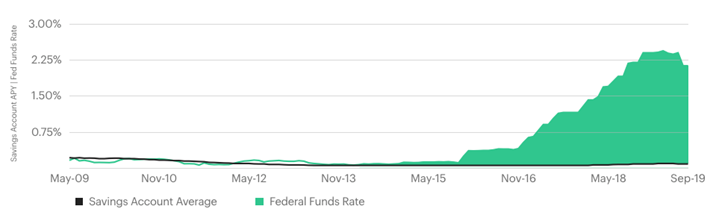

Most of those 13 trillion dollars are earning next to nothing. The average rate paid by savings accounts is only 0.09%, and checking accounts pay even less. Meanwhile, banks could be paying a lot more. The Federal Funds Rate, which influences the amount which banks can pay on deposits, is nearly 2%.

Some depositors with larger balances might be in an even worse position. The FDIC provides insurance of up to $250K for an individual account, and any amount held in an individual account at a single bank above that limit is at risk. Banks court higher balances by offering “private client” services or related discounts, but it might not always be the right thing for the client. Those banks that do offer higher rates generally want to cross-sell their customers on other services and will constantly be marketing to you once you open an account.

Many clients of our firm have also found themselves in these situations, holding more than they need in an account earning very little or spending time seeking out higher yielding accounts only to find that they were given a “teaser rate” and have to start the process all over again.

Flourish Cash

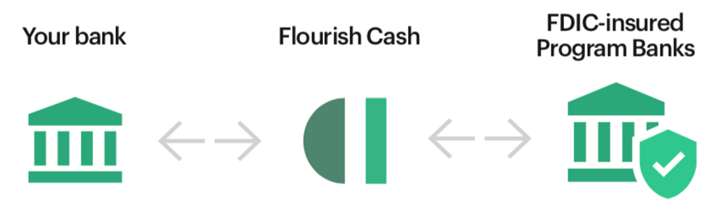

To address this need and to help our clients do more with their cash while keeping it insured, we partnered with Flourish Cash earlier this year. A Flourish Cash account can be opened in just a few minutes, seamlessly works alongside our clients’ existing bank accounts, and pays a rate much higher than the 0.09% paid by the average savings accounts (today, Flourish Cash pays 1.90%–check the website for updated rates).

Flourish Cash is not a bank – they have partnered with banks that have joined their program. Any money that is deposited into the Flourish Cash account is automatically deposited at their Program Banks, which are FDIC insured. You can contact Flourish Cash for a list of the banks that they work with.

The money is not invested; it is simply deposited at the Program Banks. You can access your money on any day and transfer money as often as you’d like.

Source: Flourish Cash

Source: Flourish Cash

Because of the way the platform works, Flourish Cash is able to provide FDIC insurance of up to $2MM for an individual or $4MM for a joint account. They simply spread the money out among multiple banks, providing multiples of the per-bank FDIC limit.

Flourish Cash for institutions

Recently, Flourish Cash added the ability for businesses and nonprofits to open accounts. They receive the same rate as individuals and get up to $1.5MM in FDIC coverage per entity. We know that many business owners keep far more cash in operating accounts than they need day-to-day, and nonprofits frequently keep 6-12 months of expenses in cash. There are even fewer banks paying competitive rates on business cash, and that money is usually earning nothing. Flourish is a simple way to change that.

Flourish is available by invitation only through the advisors that they partner with, so you cannot sign up directly. If you’re a current or prospective client of Huber Financial Advisors, or just want to learn more about Flourish Cash, please reach out to us!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.