Liquid Alts Revival?

This past weekend’s issue of Barron’s contained a lengthy spread on liquid alternative investments that I was happy to contribute a few quotes to. The piece noted the recent revival in the space as returns have improved, costs have come down, and education around proper implementation has improved, albeit modestly.

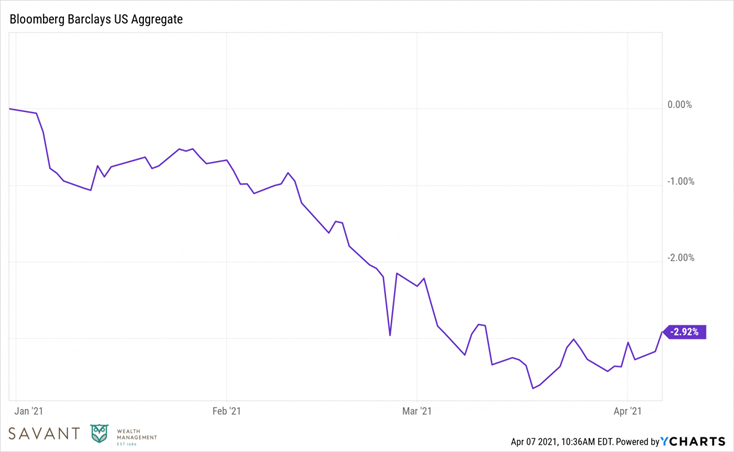

But if you want to know the real culprit behind the recent uptick in interest, look no further:

Down ~3% barely a quarter of the way through the year is hardly anything to clutch our pearls about, but at the same this is a rare and uncomfortable feeling for fixed income investors that are used to steady single digit returns from their bonds. The math is the math and our expectations for bonds should adjust accordingly.

I’ve long been an advocate of “diversifying your diversifiers” but that approach has been a tough sell for the last decade that saw a continued tailwind for bonds, generally rising equity markets, and mixed performance from some of the more common alternatives strategies. As Barron’s describes, they were once regarded as “a solution in search of a problem.” The ways in which the first generation of liquid alts were marketed and sold didn’t do the category any favors either.

The initial wave of liquid alts was popularized in the aftermath of the financial crisis of 2008-09 as allocators sought to shut the stable door after the horses had already bolted. As advisors continued fighting the last war, the asset management industry recognized the rising tide of demand and responded in kind with a tidal wave of supply. The result was too much product in general and too much of it junk. In some cases fees were inexplicable and many firms that had no background or business playing in this sandbox decided to throw some spaghetti at the wall to see if it would stick.

As time passed, the weak hands folded and many of the also-rans left for greener pastures. What remains today is much more encouraging. The higher quality funds have demonstrated their resilience, fees have come down (although there is still room to go) and innovative fund structures like interval funds have broadened the investable universe even further for investors willing and able to sacrifice a bit of daily liquidity in their portfolios. Categories like catastrophe reinsurance, alternative lending, and private real assets can now be accessed via ’40 Act vehicles.

Diversification may occasionally fall out of favor, but it will never go out of style. What diversification means, however, will continue to take on new forms as markets evolve and once out-of-reach diversifiers continue to reach a wider audience and gain broader acceptance.

Investors in traditional 60/40 portfolios have been well rewarded for keeping it simple, but that might not always be the case. Most investors require some amount of diversification away from stocks to manage risk and achieve their goals. For a long time, bonds have served that role with aplomb. But nowhere is it etched in stone that one asset class should be leaned upon to do all the heavy lifting for diversification to work.

To all the allocators out there: it’s time to stop being complacent and start getting creative.

Full article here if you’re a Barron’s subscriber*:

Liquid Alts Were Complex, Pricey, and Underperforming. That May Be Changing. (Barron’s)

*If you’re not a subscriber, the gist of my quotes on alternatives was:

- Treat them as long-term investments, not short-term trades.

- Focus on systematic and transparent approaches.

- Own enough in your portfolio to make a difference, but not so much that you can’t stick with it.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.