Lordy, Lordy, Bogle’s Folly Is Forty

Earlier this week, we celebrated a milestone that forever changed the landscape of investing. It was 40 years ago – August 31st, 1976 to be exact – when the first ever index fund for individual investors was launched: the Vanguard 500 Index Fund (VFINX). As we reflect on the evolution of index funds over the last four decades, it’s almost impossible to imagine a world without them. Representing trillions of dollars of invested wealth across the globe, indexing is now a cornerstone of the fund industry and the default choice for millions of investors.

The concept of an index (or average) of a particular market or asset class far predates the launch of index funds. The S&P 500 Index, which the inaugural index fund was designed to track, had its inception nearly sixty years ago, while another commonly referenced index – the Dow Jones Industrial Average – is well over a century old. Where the rubber truly met the road was when an abstract concept meant to be used as a benchmark for analyzing and judging active management turned into an investable reality. Nowadays, there are indices for just about every nook and cranny of financial markets. Whether you want broad-based exposure to basic portfolio building blocks or the ability to slice and dice the market every which way, the index fund and ETF industry has you covered.

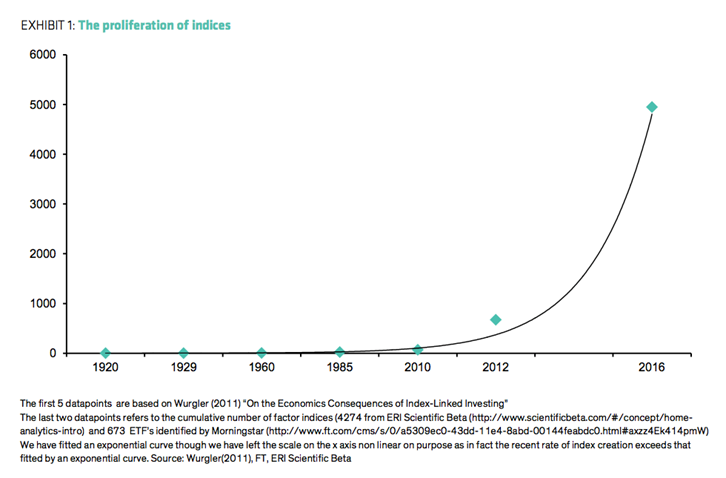

The chart below plots the proliferation in the number of indices over time, with accelerating exponential growth in the 2000s as the index investing movement really began to pick up steam.

Source: The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism (Bernstein Research – August 23rd)

The uber popularity of index (and index-like) strategies today is a far cry from how they were initially received in the 1970s. To say that index investing began not with a bang, but a whimper is the understatement of the century. With a mere $11.4 Million in assets at it’s initial offering, it’s no wonder why it was initially referred to as “Bogle’s Folly – a jab at Vanguard’s founder and industry icon Jack Bogle. “Why would anyone want to accept average returns?” they would say. The notion of willingly accepting mediocrity struck many people as simply “un-American”:

(Thanks to Ben Carlson for sharing this gem on Twitter!)

The ridicule and yawns from the early years should come as no surprise. Most innovations are met with little – if any – fanfare in their infancy. But over time something happened. Slowly, but surely institutions, financial advisors and the general public started wising up to the myriad benefits associated with a “buy the market” approach – diversification, low costs, tax efficiency. The rise of indexing opened everybody’s eyes to the excessive fees being charged and the lack of value being added by the traditional Wall Street model.

Here’s AQR’s Cliff Asness with his take on the impact of the indexing revolution:

…it’s likely we’ve historically had too much active management at fees that were too high, delivering returns that — net of fees — effectively amounted to a big and unnecessary wealth transfer from investors to active managers. The move to indexing to date is likely only a partial corrective.

Suddenly, earning market returns was not synonymous with average, after all. Far from it. In fact, study after study has demonstrated that not only do most professional fund managers vastly underperform their benchmarks net of fees, but also that the very people investing in said funds on average dig themselves an even deeper hole by playing hot potato with their investments. Index investing lit the fuse that sparked this generational, seismic shift in investor preferences that shows no signs of stopping anytime soon.

Today, more and more investors are seeing index funds the way the pioneers at Vanguard always saw them:

Simple yet sophisticated.

Average yet extraordinary.

Passive yet progressive.

Inexpensive yet invaluable.

Rational yet radical.

The numbers don’t lie. Here’s some stats on where Vanguard as a firm and index investing at large stand today relative to their modest beginnings:

- That Vanguard 500 Index Fund with a measly $11.4 Million in AUM back in 1976? It has now amassed over $451 BILLION (across all share classes including the ETF).

- Vanguard now manages over $3.5 TRILLION in assets across both index and active funds (with industry leading costs being the common denominator among both) and has a nearly 22% market share of the U.S. mutual fund and ETF marketplace.

- In 2015, while the rest of the asset management industry experienced net outflows, Vanguard took in roughly $230 Billion.

- On an asset-weighted basis, Vanguard charges a meager 0.13% expense ratio across its funds.

- Vanguard owns 5% or more of most of the companies in which it invests

- Per industry research firm Strategic Insight, as of the end of 2015, index strategies represented roughly 34% of all mutual fund and ETF assets.

More important than any numbers, index investing has played an immeasurable role in breaking down barriers and leveling the playing field so that the Average Joe can build just about any portfolio they desire at a fraction of the cost it would have been years ago. As my friend Morgan Housel likes to say:

There has never been a better time to be an investor. Ever, in history. More people have access to first-class services than ever before. It’s so important, and we don’t spend enough time realizing how good it is.

I find it pleasantly coincidental that this anniversary celebration comes right before Labor Day. As with many holidays that give us all an extended weekend, we at times lose sight of the true meaning and purpose behind why we celebrate it to begin with. Who better than the U.S. Department of Labor to remind us what this day is all about (emphasis mine):

Labor Day, the first Monday in September, is a creation of the labor movement and is dedicated to the social and economic achievements of American workers. It constitutes a yearly national tribute to the contributions workers have made to the strength, prosperity, and well-being of our country.

So as we head out for the long weekend, let us all pay homage and raise a glass to a visionary man and his crazy idea that ignited a social movement and transformed the lives of millions of Americans (and their wallets) for the better: Jack Bogle and the Index Fund. Happy Labor Day everyone!

40 years of innovations in indexing (Vanguard Blog for Advisors)

How the Vanguard Effect Adds Up to $1 Trillion (Bloomberg View)

Birth of the Index Mutual Fund: ‘Bogle’s Folly’ Turns 40 (WSJ)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.