Nobody Knows Nothing

“It's tough to make predictions, especially about the future.” ― Yogi Berra

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain

Yogi Berra and Mark Twain.

Two of the most quoted people in the history of humanity.

Chances are if you're reading this, you've likely heard both of the above quotes before. I am far from being the first financial blogger to use them and I certainly won't be the last.

We all nod our heads in agreement when we hear these two quotes, but the truth is we find it much more difficult to actually abide by their intentions.

This week will mark the one-year anniversary of Russia's invasion of Ukraine, a tragic geopolitical conflict that has resulted in too many lives lost.

We can only hope for some version of a peaceful resolution sooner than later.

It's always an uncomfortable mental exercise to opine on financial market matters juxtaposed with a humanitarian crisis, but investors' around the globe collectively wondered in February of 2022 what sort of impact a prolonged war would have on their portfolios.

Many things seemed obvious on February 24, 2022.

You wouldn't have been alone if you expected the following things to happen over the subsequent year:

- Europe would experience an energy crisis, given their dependency on Russia for natural gas supply.

- Ukraine's economy would fall into a deep recession.

- The Russian Ruble would plummet relative to other major currencies.

- European stocks would underperform U.S. stocks.

Each of these expectations were confirmed by the immediate price action following the invasion and it is human nature to extrapolate what is happening now well into the future.

So where do things stand today, roughly one year hence, with the conflict still in full force?

Not quite where you'd expect.

Matt Phillips and Emily Peck at Axios shared some numbers this week that may surprise you if you haven't been paying attention and just assumed chaos still reigned supreme in markets.

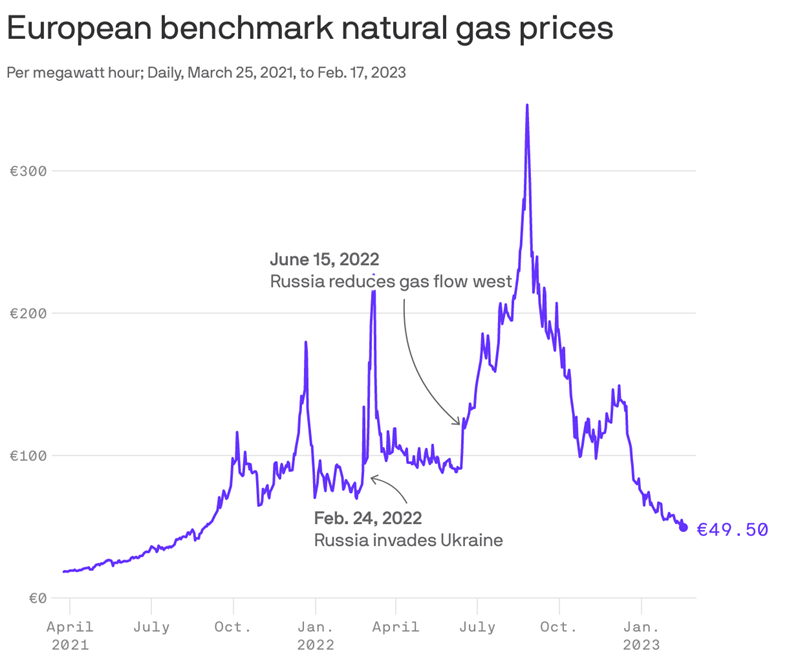

First up, European natural gas prices. Despite massive volatility and major spikes throughout much of 2022, prices are now lower than they were before the invasion. An increase in stockpiles and reduced demand from a milder than expected winter have helped Europe avoid (for now) what seemed like an inevitable crisis a mere few months ago.

Source: Axios

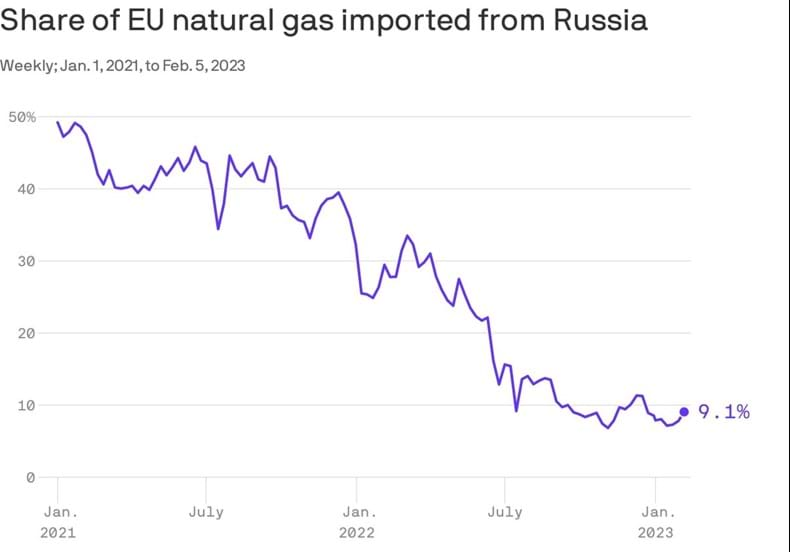

Not only that, the EU's dependency on Russia for natural gas imports is at its lowest level in years, falling from about 40% of imports around the time of the invasion to under 10% now.

Source: Axios

Source: Axios

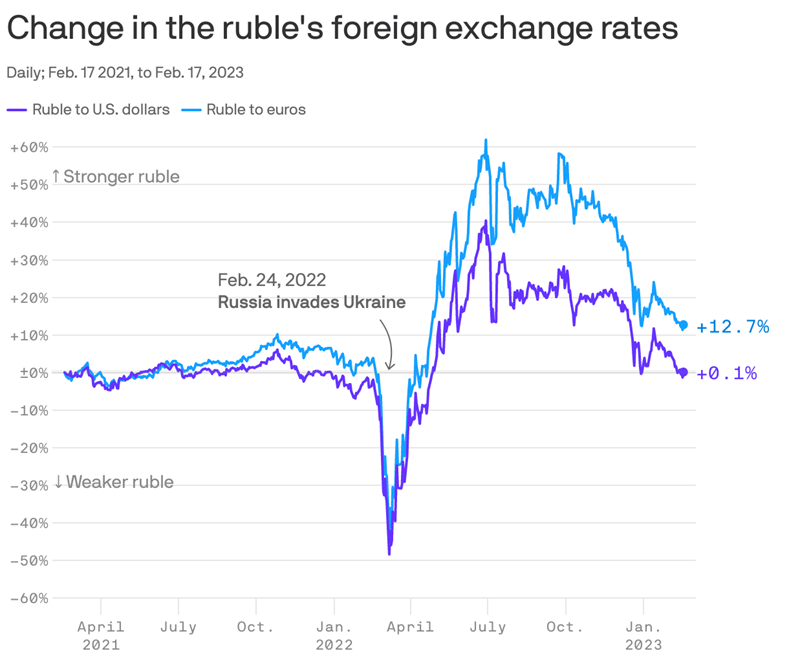

As expected, the Russian Ruble fell off a cliff in the immediate aftermath of the invasion, amid unprecedented sanctions and financial pressure from the developed world. And while Russia's economy has in many ways been crippled, they have been able to stabilize their currency by raising interest rates, tapping their national reserve fund, and turning towards "friendlier" emerging nations for energy exports.

Source: Axios

On a more positive note, Ukraine's economy is on the mend - falling less than initially expected in 2022 and expected to grow modestly in 2023. Despite fighting a major land war on their own territory, the country has been able to continue exporting goods and services while receiving a tremendous amount of military, financial, and humanitarian aid from many countries throughout the world.

Lastly, the stock market. You probably know where this is headed, but let's discuss it anyway. Yep, that's right. Your eyes are not playing tricks on you. European stocks have outperformed U.S. stocks since the start of the war.

Past performance is no guarantee of future results. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only.

So, the next time you feel the urge to make market calls based on macro events, remember this example and embrace the wisdom of Berra and Twain.

People quote them for a reason.

And if you're going to make a forecast the next time we experience a macro shock, try this one on for size:

Human beings are resilient creatures and will find a way to adapt to new economic realities.

So far, that prediction is undefeated.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.