November to Remember

November 2020 was a month for the record books. In the span of 30 days, we saw:

- A new President and Vice President-elect in the United States.

- Incredibly promising results for three (!!!) COVID-19 vaccines.

- A resurgence in COVID-19 cases and deaths, leading to more closures, stay-at-home orders, and limited Thanksgiving holiday travel.

- The decision by Treasury Secretary Steven Mnuchin to not extend several key emergency lending programs beyond the end of the year.

On the market side of things:

- Tesla was added to the S&P 500 and is now the 7th largest company by market cap. It’s the largest addition ever to the index.

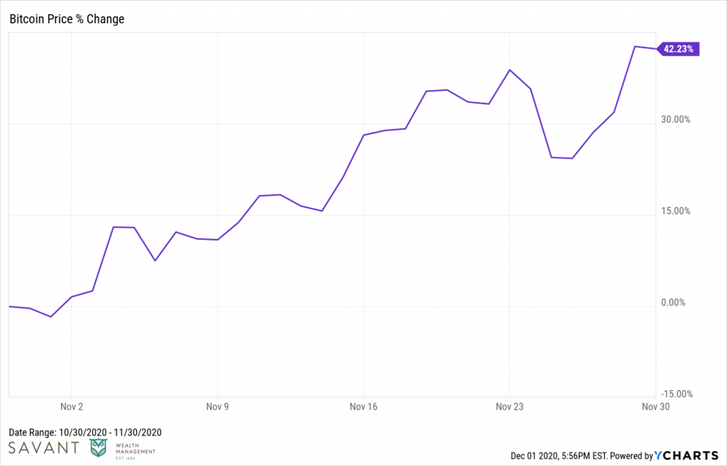

- The price of Bitcoin surged over 40% amid renewed institutional interest in the asset

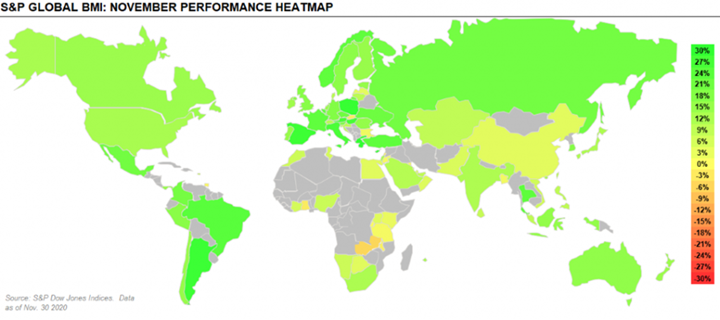

- Stocks across the globe rallied on the positive vaccine news and the light at the end of the tunnel heading into 2021. Literally every single country equity market within the S&P Developed BMI and S&P Emerging BMI ended the month in positive territory.

Source: S&P Global

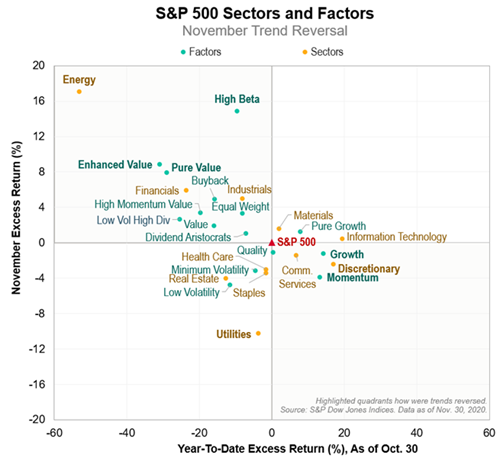

But perhaps the biggest market story of November 2020 was the massive factor and sector reversal that saw just about everything that had been crushed by the COVID economy rally with a vengeance. I mean, look at this:

Source: S&P Global

That is about as clean of a rotation you’ll ever see.

Small-cap stocks, as measured by the Russell 2000 index, had their best month EVER, nearly doubling the performance of the S&P 500. The Russell 2000 Value index did a notch better.

The 2010’s were a frustrating decade for equity investors holding anything beyond U.S. Large Cap Growth stocks. Even the staunchest advocates of global allocations, small-cap biases and value tilts were finding their conviction tested as the decade came to a close. But alas, the 2020s would be a new decade – one full of hope that mean-reversionary forces would swoop in and restore faith to the discipline of diversification. One needed to look back no further than the aughts which saw a “lost decade” for the S&P 500 as almost all other equity categories delivered positive results to remain confident that this period of relative underperformance shall pass. Evidence-based investors entered 2020 with a twinkle of optimism in their eyes.

And then COVID happened.

Every prevailing market trend of the past few years was put into overdrive. Sure, everything went down in February and March, but the stuff that hadn’t been working lately to begin with – value, size, international – all went down even further, leaving a deeper hold to climb out of.

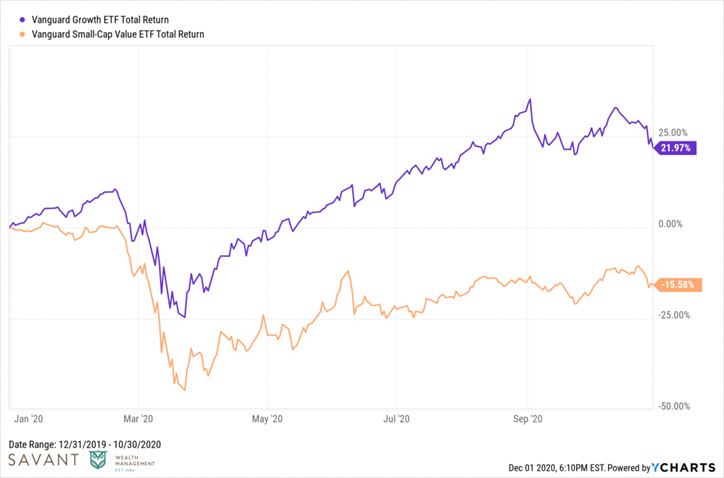

The remarkable performance of the FANMAG and stay-at-home stocks from the March bottom made value investors even more frustrated as the larger, more tech-centric names made new highs. The chart below is the YTD performance of Large Cap Growth and Small Cap Value through the end of October.

I imagine at that point many investors with even a hint of small cap value in their portfolios were beginning to consider throwing in the towel on the asset class altogether, if they hadn’t already. As tempting as it can be to satiate those urges, abandoning a long-term strategy during extreme periods may only compound the problem.

When you’re in deep hole, it’s difficult to imagine how you might dig yourself out. Value investors felt pretty similar during the peak of the tech bubble. On March 31st, 2000, value was lagging growth over a 1, 5, 10 and 15-year basis. Sound familiar? It’s not surprising that many were leaving value for dead after such a rough stretch. Well, fast forward one year later and value was now ahead of growth over every single time frame.

Source: Dimensional Fund Advisors

This is by no means a victory lap for small cap value or a prediction that the next year will be a repeat of the Dot Com mania of the early 2000s. As significant as November was, one month does not erase what has been a brutal three-year stretch of relative performance. That said, you have to start somewhere and months like these serve as a helpful reminder of just how quick and swift rotations can be and that any active strategy requires the fortitude to stick with it long enough to ride out the inevitable bumps along the way.

There are no do-overs or mulligans if you miss out on months like this. If you’ve already paid for the risk, you might want to stick around for the reward.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.