Out With a Whimper, In With a Bang

2021 was anything but dull, but you wouldn't have known it from looking at the stock market.

The S&P 500 delivered a total return just shy of 30 percent, but that wasn't the most remarkable thing about the year's performance. That outsized return came with a maximum drawdown of ~5 percent. For context, the average intra-year drawdown going back to 1980 has been 14 percent.

With that, the S&P 500 saw 70 new all-time highs and the prophecy of the infamous book Dow 36,000 (published in 1999) finally came to fruition - better late than never I guess!

In short, the year (in market returns at least) tasted great AND was less filling.

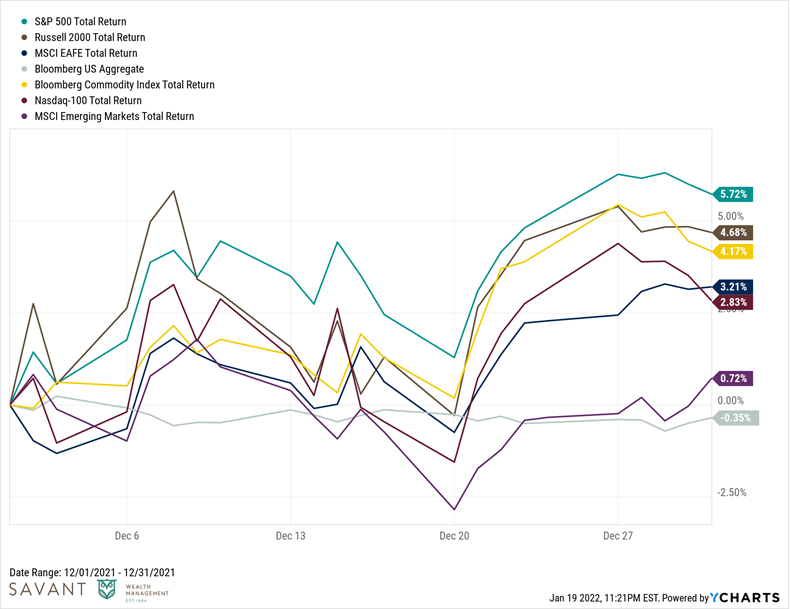

Fittingly, 2021 closed in relatively boring fashion. Stocks and commodities were somewhat flat most of December and caught a Santa Claus rally bid in the final week of trading. Bonds didn't move around too much in the final month of the year.

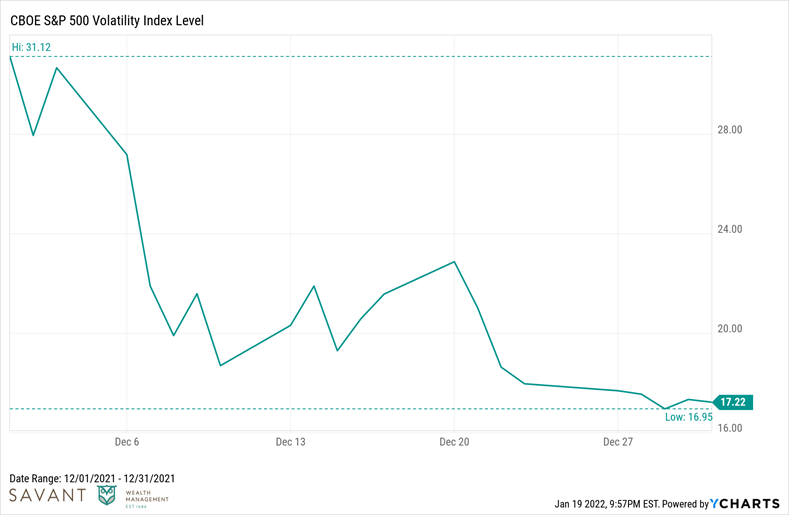

Volatility, on the other hand, collapsed in December. The VIX index, which was elevated from the volatility in the fall, went from 31 down to 17.

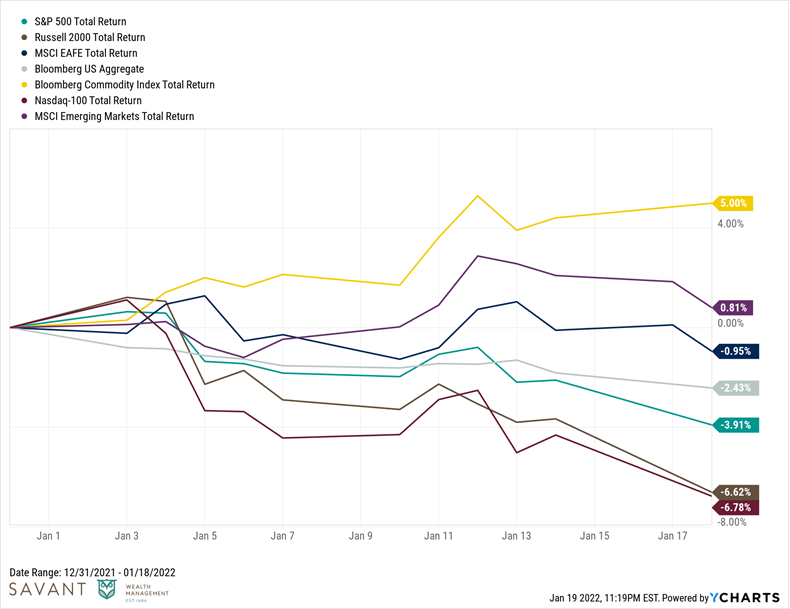

I know the turn of the Gregorian calendar shouldn't be a meaningful event in and of itself, but man did the markets wake up when the new year began.

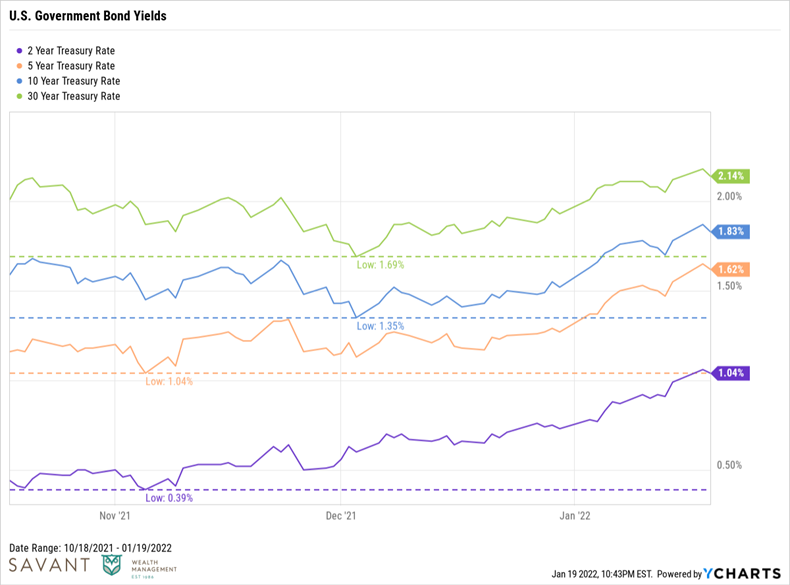

The biggest story of the year (so far) has to be the move back up in interest rates. These might not seem like big moves to the average person. And in absolute terms, they're not. But on a relative basis, and off such a low base, these are pretty meaningful moves to see over such a short time frame. This has led to a rough start to the year for the Barclays Bloomberg Aggregate Bond Index, down ~2.5 percent.

Commodities are the only asset class meaningfully positive this month. Within stocks, last year's red-headed stepchild - Emerging Markets - is the only major equity category in the black.

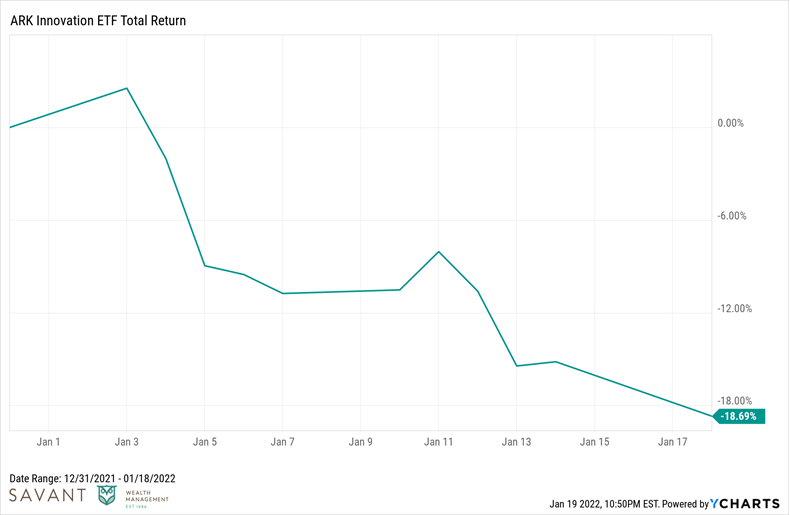

The decimation of non-profitable growth stocks was one of last year's biggest trends, and Cathie Wood's ARKK ETF was/is the posterchild for that trade. After a brutal 2021 where ARK's flagship fund lost 23 percent, the pain has continued with YTD losses of another 18 and change.

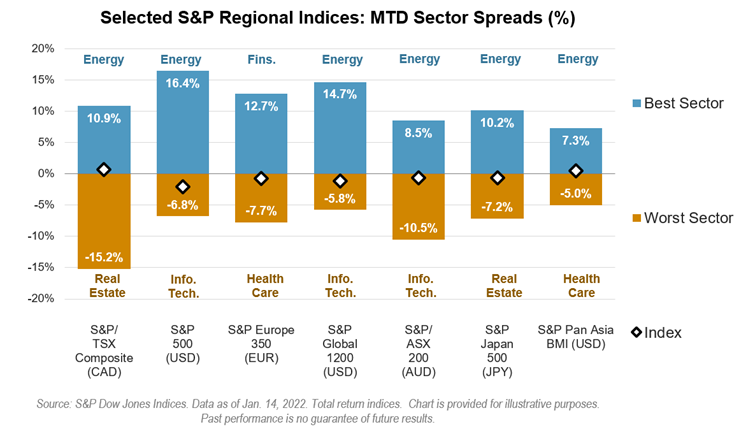

Sector dispersion is all over the place. Two weeks into January, and these are the differentials we're seeing between the best and worst performing sectors in different regions across the globe. Notice that Energy is #1 in all but one. To no one's surprise, tech and healthcare share the bottom of the barrel.

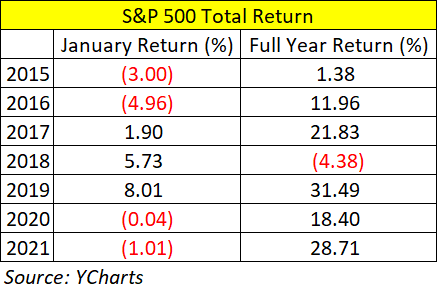

“As goes January, so goes the year.” the old Wall Street adage says. Like most market aphorisms, it sounds clever in theory but the results are mixed at best in practice. Don't believe me? Take a look at the last seven calendar years...

While the short-term gyrations of the markets are full of noise, there do seem to be some meaningful undercurrents (inflation, rates, valuation spreads, et al.) that may indicate a regime change of sorts is underway. While we can't predict the short-term, we can prepare and plan for the long-term.

In that spirit, we hosted our annual market outlook webinar for Savant clients last week. I was joined by Savant's Director of Investment Research, Gina Beall, and the two of us reviewed the year that was 2021, the state of the economy, current market trends, and how we're thinking about asset allocation and portfolio construction in 2022 and beyond. We covered a ton of ground and wanted to share it with any and all who want to watch and listen. We hope you enjoy!

We know how January is going. As for the rest of the year, only time will tell and there's a whole lotta ball game left.

Investment Review & Market Outlook [On-Demand Webinar] (Savant Wealth Management)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.