Pandemics, Portfolios and Perspective

If you’re reading this, you’re probably a bit concerned. It’s okay, I am too. Our susceptibility to fear is the common thread we all share as investors. It doesn’t make you weird, it makes you human.

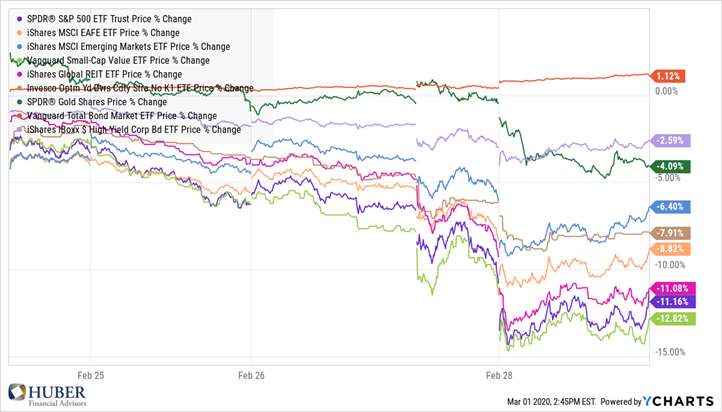

Last week was one of the worst weeks in history for global stock markets, as the outbreak of the coronavirus (COVID-19) outside of China began to worsen. The S&P 500 dropped over eleven percent for the week. There were three days that each saw declines of over three percent. Selling beget selling which beget even more selling. Investors looking for a bounce or buyable dip later in the week were met with utter disappointment.

There weren’t many places to hide, as evidenced by the chart above. Surprisingly, international equities outperformed on a relative basis, but it was by no means pretty. High yield bonds suffered. Gold was resilient most of the week, but then joined the selloff at the end. High quality fixed income was the one saving grace, as bond yields plummeted giving a boon to bond prices. The flight to quality was strong, and helped soften the blow for any investor with some semblance of a balanced portfolio.

So what’s next? That’s the only question that matters, since the past is past. Unfortunately, it’s a question that none of us – and I do mean none of us – have the answer too. Perhaps we see similar volatility and losses in the weeks ahead. Or perhaps this current correction ends like so many others we have seen in this current cycle, with a V-shaped recovery and a march towards continued new highs. Only in hindsight will we know which direction the market decides to take.

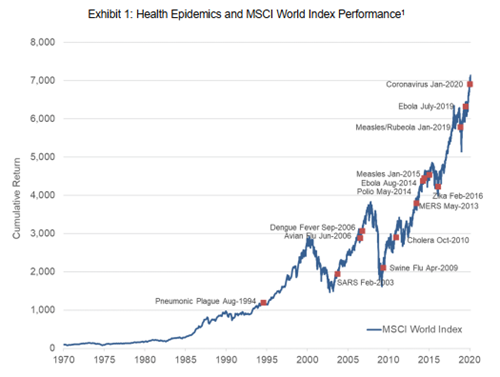

But here’s what we do know. We do know that this isn’t the first time the stock market has had to digest a health epidemic scare. The folks at Cliffwater looked at each historical instance in which the World Health Organization (“WHO”) declared a “public health emergency of international concern” (PHEIC). This declaration concept was formalized by WHO following the SARS outbreak in 2003.

Source: Cliffwater

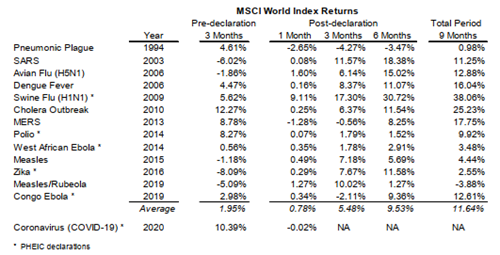

Cliffwater looked at the global equity market reaction in each of these situations. In almost every case, these prior epidemics had little lasting impact on global equity markets. In all but one instance, markets were higher six months following the declaration.

Source: Cliffwater

This is in no way meant to diminish the human impact of what’s happening in China and across the world. I’m also not trying to treat COVID-19 and other historical epidemics as apples-to-apples comparisons. This one is different – they’re ALL different.

I have absolutely zero interest in playing the role of armchair epidemiologist – not my field. Last time I checked, CFP® didn’t stand for Coronavirus Fear Prognosticator. Morgan Housel summed it up well with a recent tweet:

Similarly, Corey Hoffstein of Newfound Research referenced the concept of Gell-Mann amnesia in a recent note:

“If I can give one piece of advice to anyone in times like these, it is to go read a few articles written by journalists about a field you’re an expert in and highlight all the things that are wrong. Then go read a few articles about the markets this week. Or politics. Or the Coronavirus. Then assume there are just as many mistakes made; you just don’t know where.”

The natural human response after week’s like last is to assume you need to DO something. But you don’t have to. Investors often confuse activity with results. If you can embrace market prices for what they are – a reflection of all known information and aggregate consensus expectations of the future – then you can recognize that just knowing that things have gotten worse is not really actionable knowledge. It’s already baked in the cake.

The market will continue to incorporate new information as it becomes known, for better or worse. And the market as a whole may over or under-react to that new news, but we’ll only know which one ex-post. These are variables outside of your control. But the one variable you can control is how YOU react in the face of others panicking.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.