(Prediction) Season’s Greetings!

Three things are certain in life: death, taxes and come December every big bank, brokerage shop and fund complex will bombard investors with their Investment Outlooks for the following year. In other words, prediction season is now officially underway. Meb Faber has even put together a compilation list of outlook pieces that have already been published.

Companies put these things out every year because a) there is demand for it – people WANT to believe we live in a world where such clairvoyance exists – and b) no one is going to do any business with them if they send out a one page PDF with nothing but this stamped on the center of the page:

¯\_(ツ)_/¯

I realize that while these twenty-plus page documents may flood the inboxes of financial advisors and other investment professionals, the average investor isn’t reading them. Instead, they are getting bullet points and sound bites through print, social, digital and television media and I would argue that is much more dangerous than the often restrained predictions found in institutional outlook pieces. You’d be hard pressed to find a fund company forecast that isn’t “cautiously optimistic” or that doesn’t have “modest return expectations” with “increased volatility.” Their objective is to offer ideas that lead to increased turnover with the hopes that some of that money in motion will land in of their products. But they always hedge their bets through their choice of words so as not to create any unintended consequences that may impede their asset gathering ability.

Article headlines, magazine covers and TV pundits are a different beast altogether. Often these are people or businesses trying to make a name for themselves, promote their brand, or attract eyeballs to sell ads. And what better way to do that than to make an extreme (but highly unlikely) market call in either direction. Bold forecasts will always be able to rely on these universal truisms:

- We all have very short and selective memories. Nobody will remember if they are wrong, but nobody will forget if they are right.

- Even a broken clock is right twice a day. Markets correct – that comes with the territory. But calling for a crash every year and eventually rolling snake eyes doesn’t make you a genius. It makes you an idiot.

Before we start prognosticating and planning any portfolio makeovers heading into 2017, let’s rewind the tape a bit to early 2016 and see what was dominating the news cycle then:

- Dennis Gartman, publisher of the Gartman Letter, said in late January crude oil will never trade back above $44 ‘in his lifetime’. It is now above $50/barrel. But don’t worry, Dennis was back on CNBC in September explaining why oil won’t go above $55 for years. If there’s one billion dollar ETF idea left out there, it’s an inverse-Gartman ETF…

- “Rich Dad, Poor Dad” author Robert Kiyosaki was back in the news in March, convinced that the market crash of 2016 that he foresaw in 2002(!) was indeed underway.

https://twitter.com/ReformedBroker/status/806684818939461632

- Bond King Jeffrey Gundlach stepped outside of his usual subject matter expertise at the Inside ETFs conference in January and made a bold prediction on Emerging Market stocks, saying “If you’re going to do something in emerging market equities, my recommendation is to short them. They may fall a further 40%.” The Vanguard Emerging Markets ETF is up over 28% since.

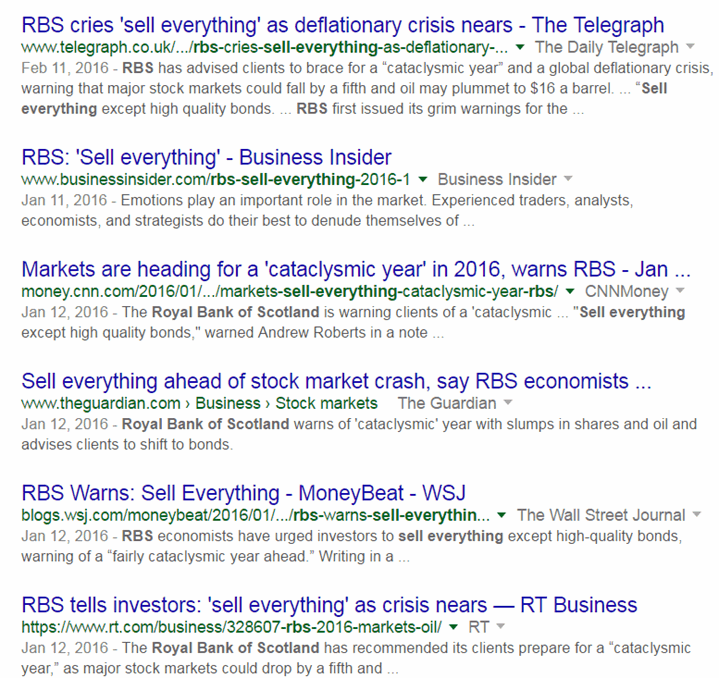

- Lastly, and perhaps most notably, was RBS’ advising investors to “Sell Everything” on January 11th, 2016. Almost every major news outlet picked up on this story immediately:

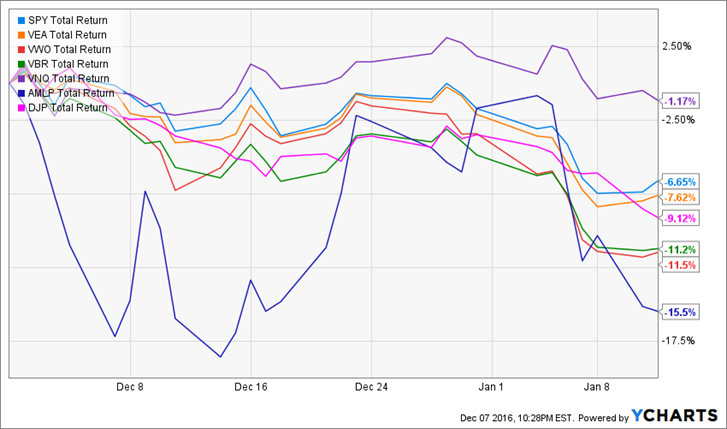

Here’s a snapshot of select ETF performance from December 1st, 2015 until this this “call heard round the world” was made:

(SPY=US Large Cap Stocks; VEA=International Developed Stocks; VWO=Emerging Market Stocks; VBR=US Small Cap Value Stocks; VNQ=REITs; AMLP=Master Limited Partnerships; DJP=Commodities)

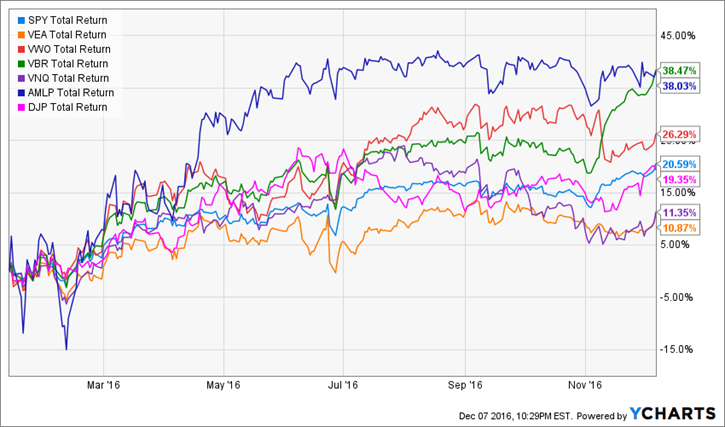

And here’s how those same ETFs have done since…

These whiffs would be laughable if it weren’t for the fact that there are a lot of hard-working people out there that don’t know any better and actually take action on these outlandish recommendations. This type of activity takes place year round but is magnified in January. Turns out a lot of people take “new year, new beginning” quite seriously and literally. That mindset can cause investors to act as if the slate has been wiped clean and that it’s time for a brand new portfolio playbook. But the reality is that the clock striking midnight on New Year’s Eve doesn’t make the crystal ball any less cloudy than it was before.

Market Outlooks and “Top 10 Investment Themes for Next Year” lists can make for interesting reading. But they can also make for terrible distractions to the business of investing. It’s important we distinguish between what’s interesting and what’s actionable. The former is rarely the latter. Perhaps we could all benefit by spending less time “Preparing Portfolios for 2017” and more time Preparing Portfolios for 2027 and beyond.

Additional Reading:

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.