Rebalancing Act

The pain felt across financial markets during Q1 left many investors asking themselves the same question:

To rebalance, or not to rebalance?

By the end of March, the market gave you a more conservative portfolio, whether you wanted one or not. No matter your starting asset allocation – 70/30, 60/40, 50/50 – you own materially less in stocks today than what you originally signed up for. The question now is: which is the “right” portfolio moving forward – the one you started with or the one you have now?

The answer is not always cut and dry. To paraphrase Mike Tyson, “everyone plans on rebalancing until they get punched in the face.”

This recent experience has likely served as a gut-check on true risk tolerance for many investors. It’s easy to adopt a more aggressive posture when times are good and a similarly defensive stance following extreme volatility. Our aversion to risk never has been, and never will be, static in nature.

Unless you are extremely lucky, it’s unlikely you will rebalance at the exact peaks and nadirs of the market. The good thing is, you don’t need to in order for rebalancing to be a valuable tool. Risk management, not return maximization, is the name of the game here. Left alone, and given enough time, a 60/40 can evolve into an 80/20 portfolio, or even a 90/10. Sure, the journey to that point would be a fun ride even with a few bumps along the way. But what happens when the “Big One” hits and you are 20-30% more exposed to equities than you intended?

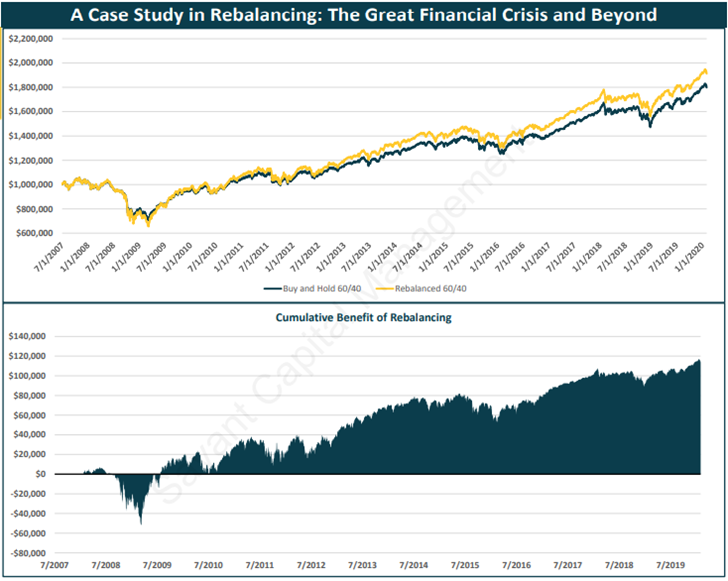

Rebalancing can help in the opposite scenario as well, after large stock market declines. Let’s use the Great Financial Crisis as an example, comparing the experience of two 60/40 stock-bond portfolios – one that is Buy and Hold and another that is Rebalanced at predetermined levels of asset class drift.

Data source: Morningstar Direct. See Endnote for additional disclosures.

The investor who rebalanced into the teeth of the GFC had egg on their face for several months (that felt like years.) But by maintaining a stable risk profile, the Rebalanced 60/40 was in prime position when things ultimately rebounded in March of 2009. Meanwhile, the Buy and Hold 60/40 was closer to a 40/60 when the market bottomed and left a meaningful portion of the recovery on the table. The cumulative benefit of the decision to rebalance became more apparent in the ensuing years.

So let’s assume you are committed to periodic rebalancing. Now what?

We can debate until we’re blue in the face what the optimal rebalancing methodology is. I recently wrote an article for RIA Magazine on the topic, but wanted to expand upon it more here.

There are myriad ways to skin the proverbial cat. Calendar-based vs. Drift-based is the most common debate. But there is nuance when it comes to implementation. For example:

- In calendar-based, you could choose an annual, semi-annual, quarterly, or some other schedule.

- If you prefer drift-based (as we do at Savant), what should your tolerance bands be? 3%? 5%? 10%?

- Should those be applied at the asset-class level only or to sub-asset classes as well?

- Should you use symmetric bands, i.e. +/- 5%, or asymmetric bands, i.e. 3% on the downside but 7% on the upside?

- Should the bands be relative or absolute?

- Should momentum and/or valuation of asset classes play a role in the decision?

- Should you do it all at once, or stagger it over multiple periods?

You get my drift.

When it comes to rebalancing, the journey is less important than the destination. Establishing preset rules and guidelines about how and when you will rebalance is paramount to the strategy itself. And adhering to these rules in a systematic fashion is the best way to keep your rebalancing actions from veering into market timing territory.

The act of rebalancing is not a comfortable one. Nor should it be. But as Rob Arnott of Research Affiliates is fond of saying, “in investing, what is comfortable is rarely profitable.”

Much like what we have done lately in our personal lives, perhaps now is the time to get comfortable being uncomfortable with our portfolios as well.

Additional Reading:

Both Sides: Should you rebalance after the crash? (CityWire RIA)

Endnote: Stocks are represented by the MSCI ACWI IMI NR USD Index. Bonds are represented by the BBgBarc US Agg Bond TR USD Index. For the ‘Buy and Hold 60/40’, the investor is assumed to start with $600,000 in stocks and $400,000 in bonds. The investor simply holds the positions and accepts the changes to the portfolio allocation mandated by buy and hold returns. The ‘Rebalanced 60/40’ investor is assumed to start with the same $600,000 in stocks and $400,000 in bonds. However, when this investor’s stock allocation drifts below 55% or above 65%, the portfolio is automatically rebalanced back to target. This exhibit does not take taxes strategies such as tax loss harvesting nor tax considerations such as capital gain taxes into account. This case study utilizes returns from 7/1/2007 through 1/31/2020.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.