Ridiculous Returns and Repeat Performances

It’s pretty rare for an NBA player to put up 50 points in one game. Even rarer is to do so in back-to-back games. In fact, only 12 players in NBA history have achieved such a milestone.

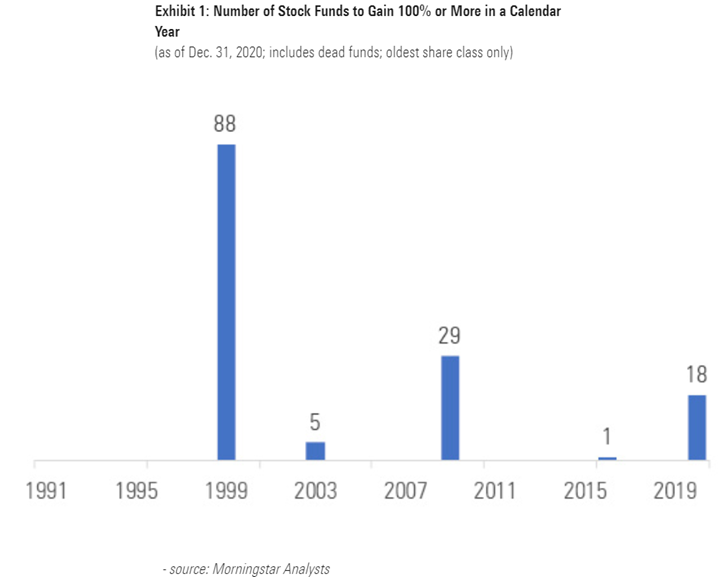

The “rarified air” equivalent for mutual fund and ETF managers in the long-only equity space is returns in excess of 100% in a calendar year. It doesn’t happen very often and when it does, they tend to cluster around extreme market environments.

Morningstar’s Jeff Ptak recently conducted a study around this phenomenon, given that there were 18 such occurrences last year.

Without giving away the punch line too much, let’s just say the odds of back-to-back years for fund managers are even rarer than repeat 50 point performances for NBA players.

The full Morningstar article is here:

What to Expect From Funds After They Gain 100% or More in a Year? Trouble, Mostly (Morningstar)

I also wrote about this topic at length over on the Savant Wealth blog,

“The problem with eye-popping returns has nothing to do with the managers of the funds themselves. They are merely doing their job and, at least in the recent past, have been doing it quite well. Instead, the problem stems in our collective inability to resist the siren song of past performance.”

You can check out my full article here:

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.