Scape G.O.A.T.

When market volatility rears its ugly head, you can best be sure that the search for a scapegoat will not be far behind. As long as there are investors underperforming, in either absolute or relative terms, there will be a cohort of folks looking to play The Blame Game. There is no shortage of first-ballot hall of fame candidates being thrown around today:

- The Fed

- ETFs

- Passive Investing

- Buybacks

- Democrats, if you’re a Republican

- Republicans, if you’re a Democrat

- China

- Oil prices

- Trade Wars

But my vote for the Greatest Scapegoat of All-Time goes to:

The Quants (a.k.a. Algorithmic Trading, The Algos, High Frequency Trading, Risk Parity, etc.)

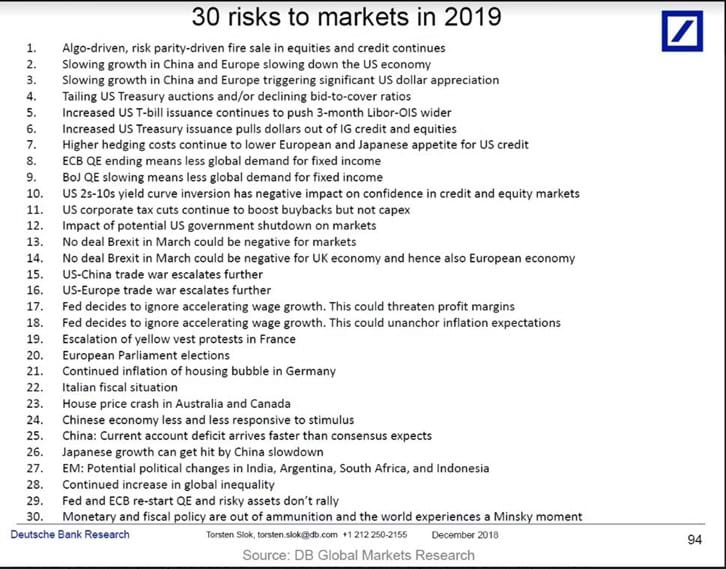

Deustche Bank Securities Chief International Economist Torsten Sløk ranked Algo-driven trading as his number one risk to markets in 2019.

The Wall Street Journal wasn’t too far behind with their own critical report on algorithmic trading following the major correction of the past few weeks:

Today, quantitative hedge funds, or those that rely on computer models rather than research and intuition, account for 28.7% of trading in the stock market, according to data from Tabb Group–a share that’s more than doubled since 2013. They now trade more than retail investors, and everyone else.

Add to that passive funds, index investors, high-frequency traders, market makers, and others who aren’t buying because they have a fundamental view of a company’s prospects, and you get to around 85% of trading volume, according to Marko Kolanovic of JP Morgan.

Fortunately, Financial Twitter had a sense of humor about the attempted takedown of the algos. I LOL’d at this from Josh:

https://twitter.com/ReformedBroker/status/1077938036351135744

And this little back and forth between two of my favorite quants, AQR’s Cliff Asness and OSAM’s Patrick O’Shaughnessy:

https://twitter.com/CliffordAsness/status/1078367730170908672

And lastly this from Cliff, after the Dow closed up over 250 points after being down over 600 points in one day:

https://twitter.com/CliffordAsness/status/1078327750899884033

Algorithmic trading has been around for decades now. It didn’t cause the massive bull market in stocks we’ve had since the end of the GFC, and it certainly should not be the financial media’s patsy in this latest correction. The rise of electronic trading has not been without its flaws, but it has undoubtedly done more good than harm for investors through improved market efficiency and drastically lower costs of trading and investing. Unless of course, you want to back to paying hundreds of dollars per trade in commissions? I didn’t think so…

So long as there are missed opportunities and unforeseen losses to be had, there will be excuses as well. It’s easy to conjure up a million explanations of short-term market fluctuations, but in the end they really all fall into one of two camps:

- Something I own went down and I am angry about it.

- Something I don’t own (or don’t own enough of) went up and I’m angry about it.

Instead of trying to pinpoint the root cause of volatility or downturns, we’d be better served looking in the mirror every once in a while. There are too many variables beyond our control for us to ascertain the true causation of market events. We can, however, control our behavior, and that is ultimately more important. In investing the deepest wounds, the ones that leave the most scar tissue and take the longest to recover from, are often self-inflicted.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.