The Paper Trail: Always Be Skeptical

The leaves are changing colors, pumpkin spice lattes are flowing, and football is back. It can only mean one thing - the September edition of The Paper Trail is here!

Before diving into this month's best investment research, a few housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

Do economic incentives distort academic and practitioner finance research?

“To obtain positive outcomes, researchers often resort to extensive data mining. While in principle nothing is wrong with data mining if done in a highly disciplined way, often it is not.”

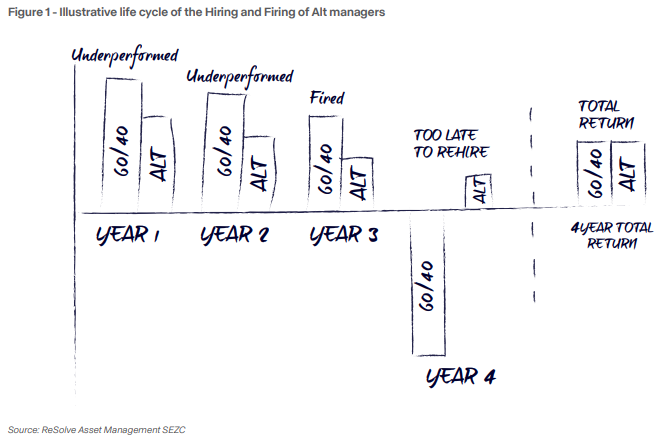

Can the pairing of capital efficiency with non-correlated return streams improve expected returns without having to reach for yield or increase exposure to pro-cyclical assets?

“In a low return environment, it may be a highly effective tool to allow investors to free up portfolio real estate. This newly found real estate can be used to increase portfolio liquidity and flexibility, or for allocating to diversifying exposures and Return Stacking.”

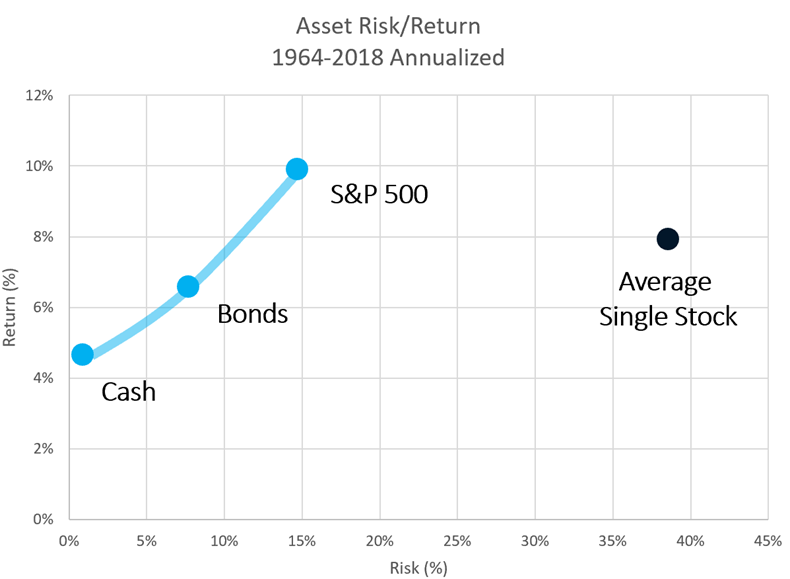

How should investors think about managing concentrated single stock exposure?

“This leads to a difficult paradox for investors, the source of their wealth creation can be the largest impediment to their wealth preservation.”

The Concentrated Stock Puzzle (O'Shaughnessy Asset Management)

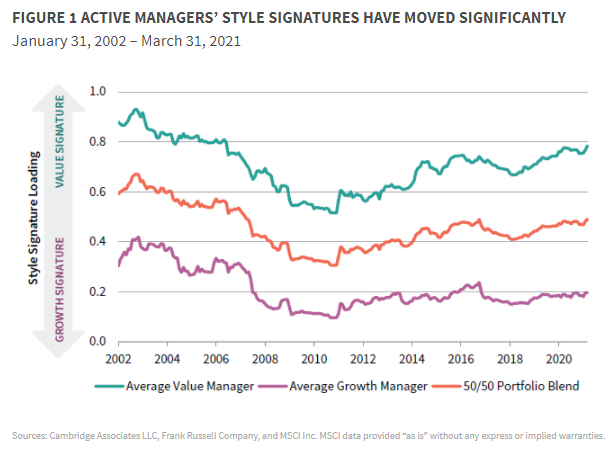

How consistent is the style bias of actively managed growth and value portfolios?

“In the mental model of many investment allocators, growth stocks map to growth managers and value stocks map to value managers. However, in the world of active growth and value managers the dichotomy is less clear.”

Catch My Drift? Active Managers’ Style Tends to Change Over Time (Cambridge Associates)

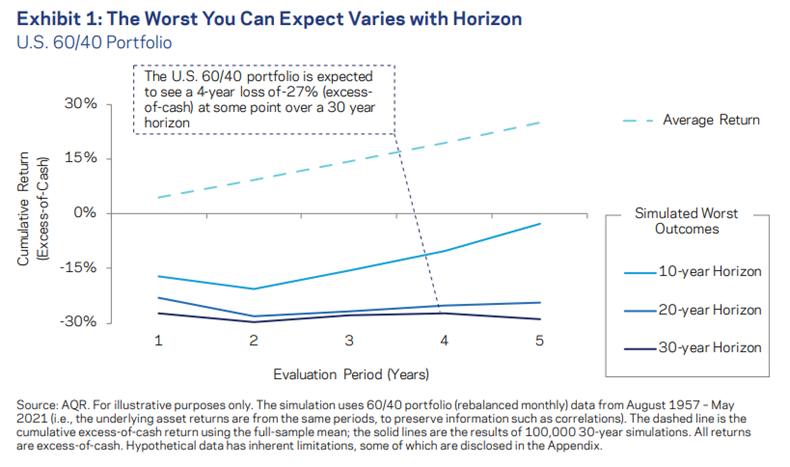

How should allocators set proper expectations on downside risk?

“The big risk for investors with multi-year horizons isn’t short-term worst outcomes; it’s long-term ones."

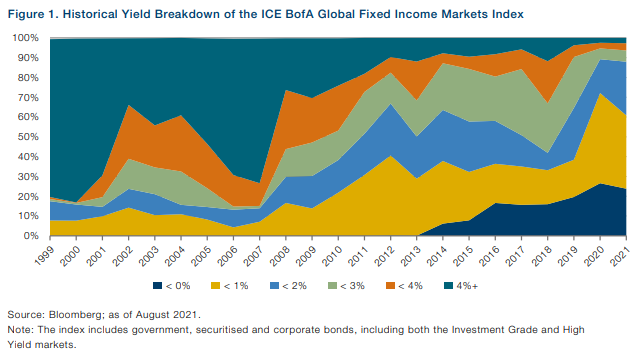

What actions can investors take to navigate ultra-low bond yields?

“More than 60% of the fixed income market yields less than 1% and only 2.5% of the market yields more than 4%.”

Navigating the Lowest-Yielding Bond Market in History (Man Group)

“pieces” (reading time > 10 minutes)

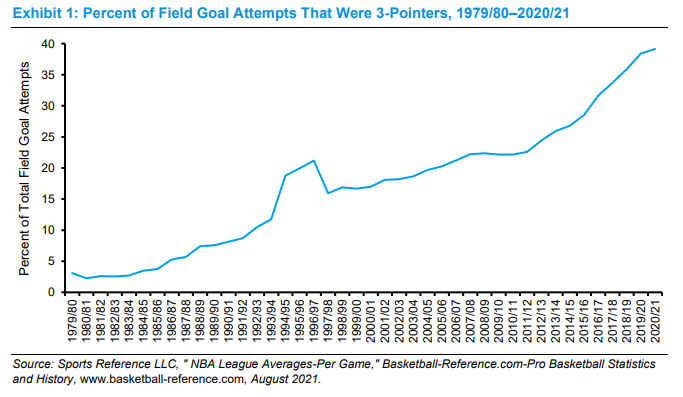

What barriers do sports franchises and investment organizations face that make them slow to adapt to change?

“One of the main lessons from this discussion is that organizations can be slow to adopt certain approaches even when analysis reveals that they add value. Reasons for this include the fact that losses often feel worse than comparable gains and the inclination to maintain the status quo. But perhaps the biggest factor is that in any field where a good decision leads to a good outcome only some percentage of the time, those who make the right decisions may suffer poor outcomes in the short run and hence look wrong. ”

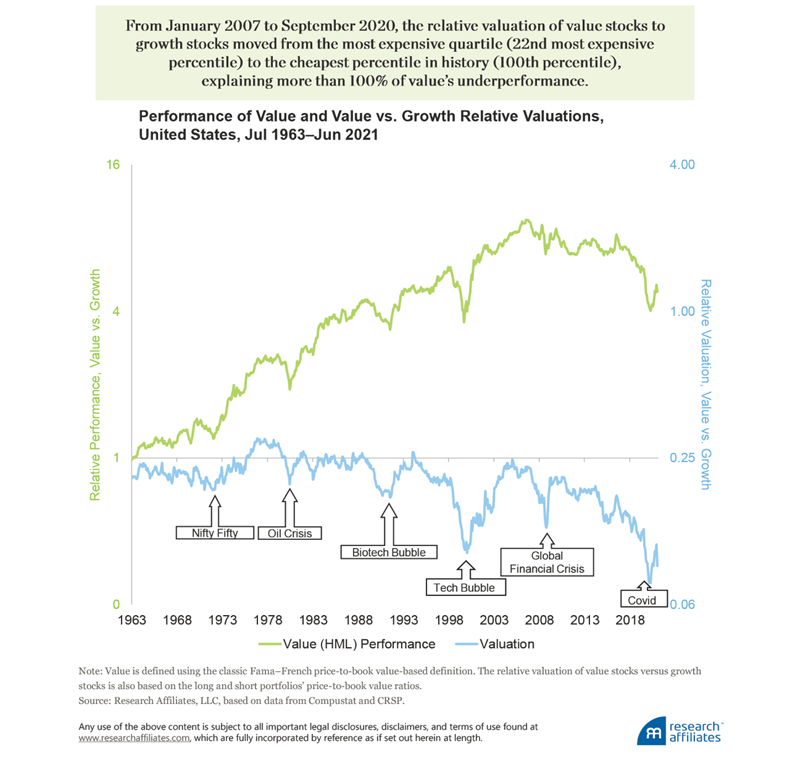

Is it too late to hop on the value bandwagon?

“Value stocks standout as the only asset class likely to generate a 5%–10% real return over the coming decade.”

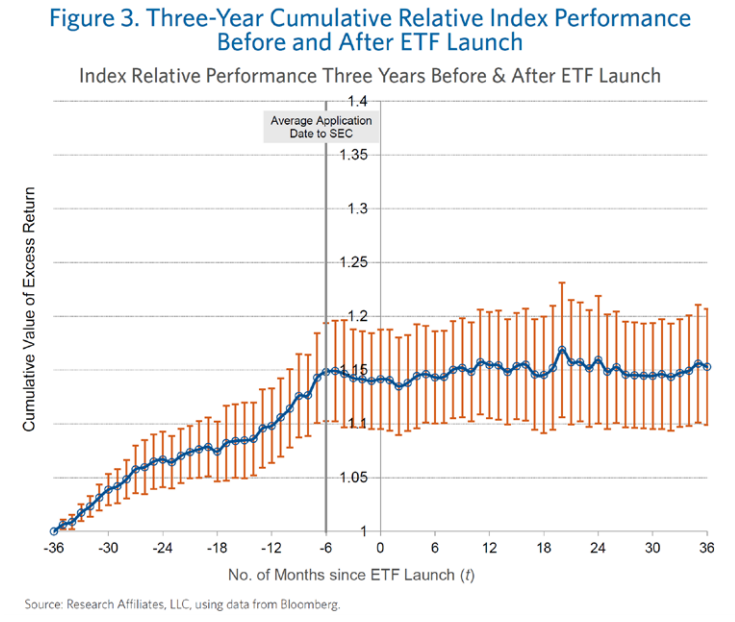

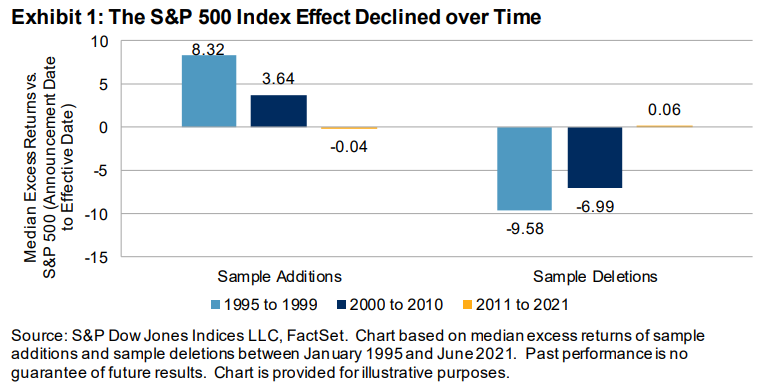

What happens to stocks that are added to, or dropped from, the S&P 500?

“Overall, our analysis corroborates the general consensus reflected in existing literature: the S&P 500 index effect seems to be in a structural decline (see Exhibit 1). Our analysis also suggests that an improvement in stock liquidity may help to explain the attenuation in the index effect over time.”

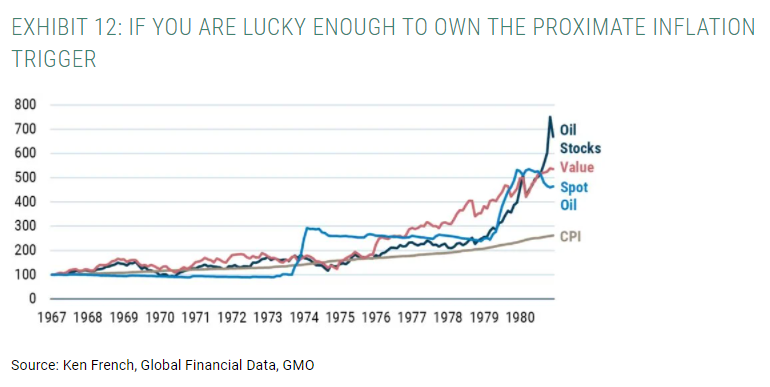

What do we do in the unlikely event that high inflation isn't transitory?

“We have often talked about the need to build robust portfolios – that is portfolios that can survive multiple outcomes. This desire stems from Elroy Dimson’s excellent definition of risk as “more things can happen than will happen”. So thinking through how to ‘inflation-proof’ a portfolio is always a worthwhile endeavor, even in the absence of a strong inflationary view.”

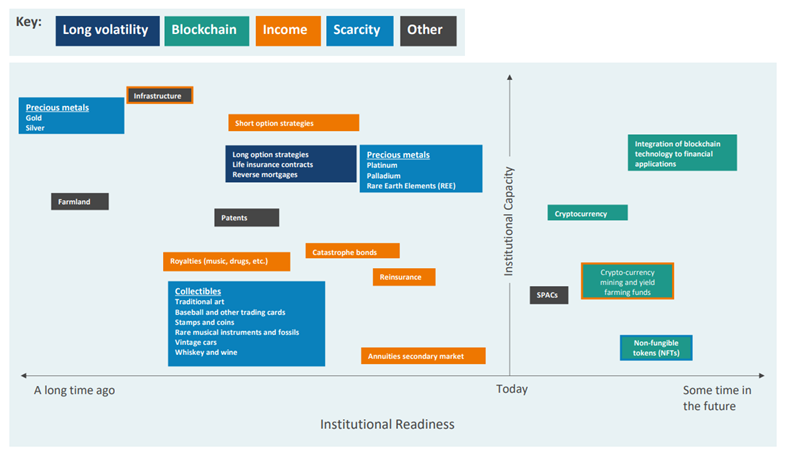

Should investors dip their toes in the water of some of the less-charted parts of today's market landscape?

“The choices people make tend to reflect their willingness (and hopefully ability) to take on specific forms of risk. Within portfolios, investors’ appetite for investments which provide truly differentiated cash flows might find them wading into murkier waters.”

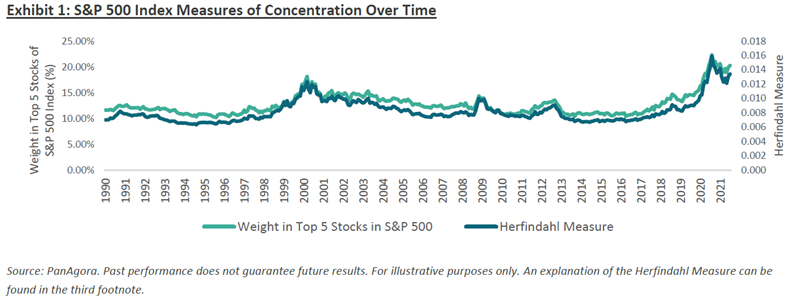

Is now a prudent time to be moving away from market-cap weighted indices?

“Given the current trend of a fall-off in concentration, which could last for years due to less aggressive monetary liquidity and rising long-rates, current moves into passive may be ill-timed. Moreover, historical evidence suggests that a concentration peak leads to years of concentration dissipation and the potential dominance for all kinds of alternative strategies.”

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.