The Paper Trail: Always Invert

"The best thing a human being can do is to help another human being know more." - Charlie Munger

“Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.” - Charlie Munger

I would be remiss if I didn't begin this month's edition of The Paper Trail by paying homage to Charlie Munger, who passed away this week at the age of 99.

The above quotes from Charlie embody the spirit of what this blog aims to deliver to investors, advisors, and allocators who are all striving to become a little wiser every day.

To refer to the vice chairman of Berkshire Hathaway as Warren Buffet's sidekick or right-hand man does his legacy a disservice. He was much more than that. As Warren described in a statement this week, “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.”

And despite his advanced age, he remained mentally sharp as a tack until the very end.

It's often stated that we stand on the shoulders of giants. Well, there were few giants taller than Charlie Munger.

A truly remarkable life and a legacy that will carry on forever.

Rest in Peace, Charlie.

***

Now, please enjoy this month's edition of The Paper Trail! November's research roundup features:

- Asset allocation tradeoffs between stocks and bonds

- Digital infrastructure

- Private credit secondaries

- Quality investing in equities

- Vintage year diversification in VC

- The market environment for Hedge Funds

- Derivative income funds and total returns

- Systematic extension strategies, i.e., 130/30

- Market timing and equity premiums

- A framework for individual investors and private markets

- And more!

“bps” (reading time < 10 minutes)

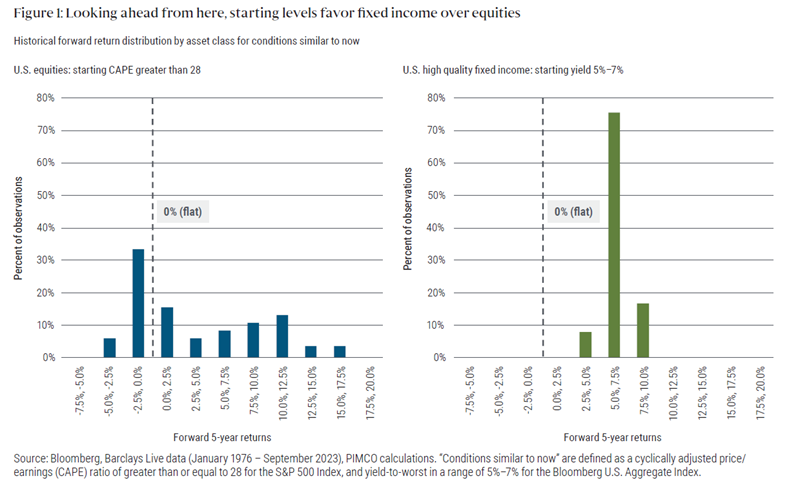

Do current valuations favor bonds over equities?

"History suggests equities likely won’t stay this expensive relative to bonds; we believe now may be an optimal time to consider overweighting fixed income in asset allocation portfolios."

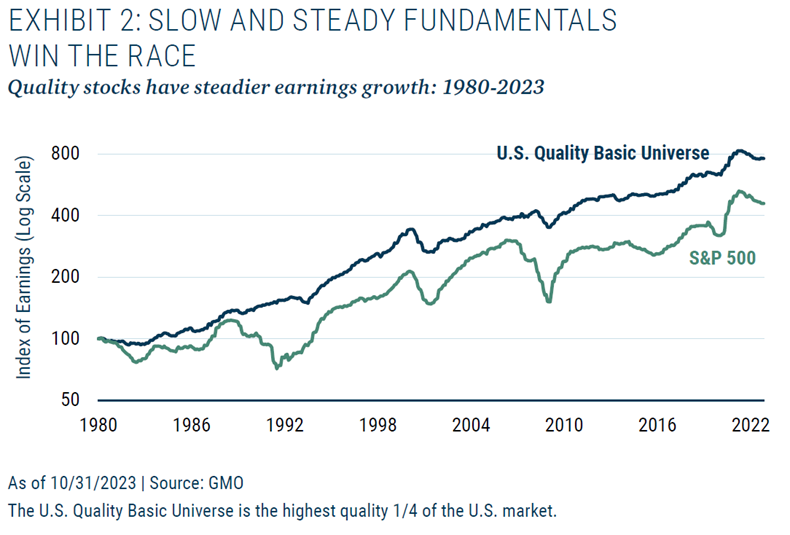

Is quality investing a genuine third choice in the value vs. growth debate?

"By providing a third dimension on which to select stocks, a quality strategy can protect investors from the extremes of both styles by allowing them to own a portfolio that has delivered higher growth than the overall market."

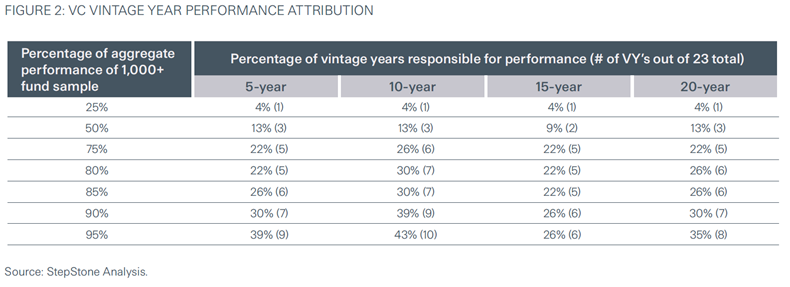

Is vintage year diversification equally as important as manager selection in venture capital?

"These statistics speak to the degree of impact that the strongest vintages have on industry-level performance and underscore the difficulty of trying to “market time” the asset class."

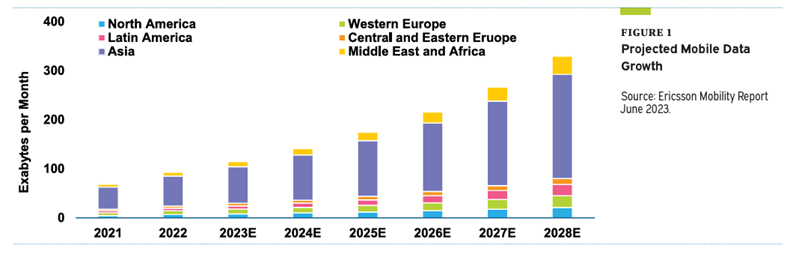

Are there investment opportunities in digital infrastructure?

"Demand for digital infrastructure continues to grow. Global mobile traffic is forecasted to increase 23% year over year between 2023 and 2028. The continued adoption and expansion of 5G networks will enable new functionality and technologies that the existing infrastructure networks cannot cover. "

Private markets investment in digital infrastructure (Meketa)

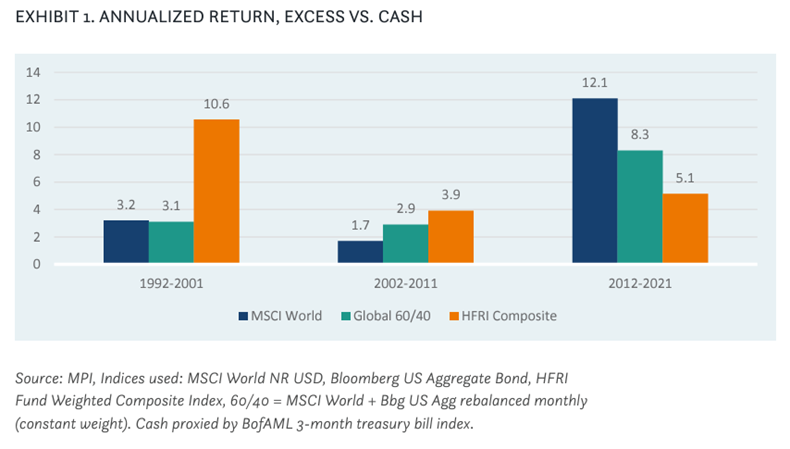

Has the tide shifted back in favor of hedge fund strategies?

"Evolving market conditions suggest that overall hedge funds will be much more competitive relative to traditional market returns over the next 5-7 years. Investors who do not currently use hedge funds should reconsider the benefits in the new market environment, and those already invested may use this opportunity to refine their scope and objectives and increase allocations as appropriate."

Hedge funds in 2023: How has the environment changed? (Verus)

“pieces” (reading time > 10 minutes)

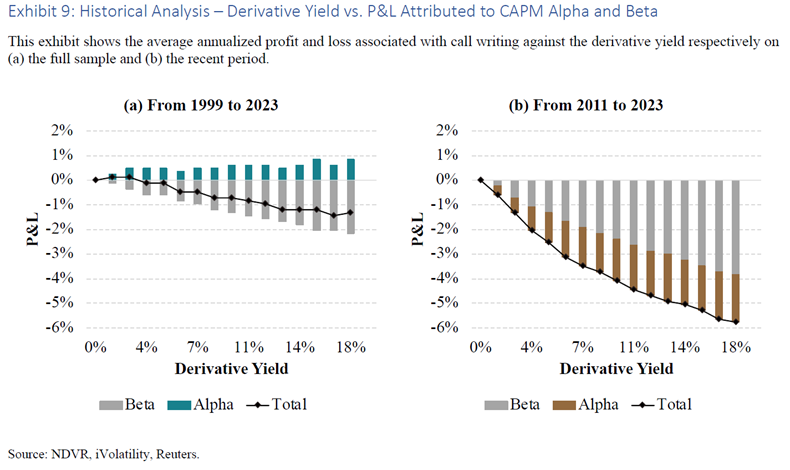

Do high derivative income funds - i.e. covered call writing strategies - deliver higher total returns?

"To the extent people associate high derivative income with high expected total returns, they have made a grave error."

A “Devil's Bargain”: When Generating Income Undermines Investment Returns (NDVR)

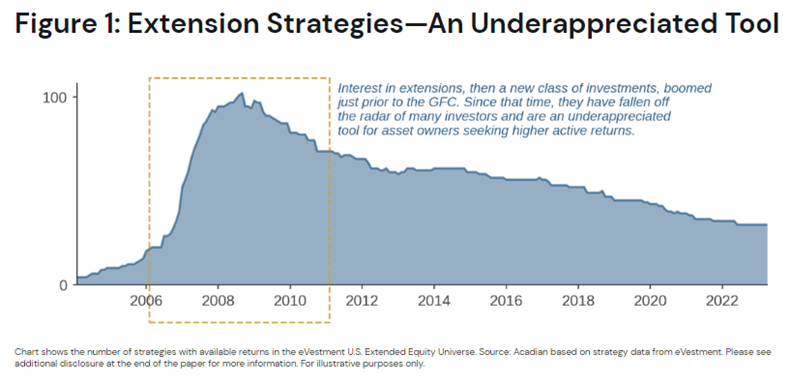

Is relaxing long-only constraints via extension strategies an underappreciated way to seek active returns?

"While some investors have lingering concerns about risks associated with shorting, relaxing the long-only constraint increases flexibility in managing portfolio exposures. Moreover, relative to other approaches to high conviction active investing, which may rely on low-breadth bets, deliberately sacrifice diversification, or mask economic risk, systematic extensions are a highly disciplined approach to achieving the objective."

Thinking Broadly: Improving Active Performance Via Systematic Extensions (Acadian)

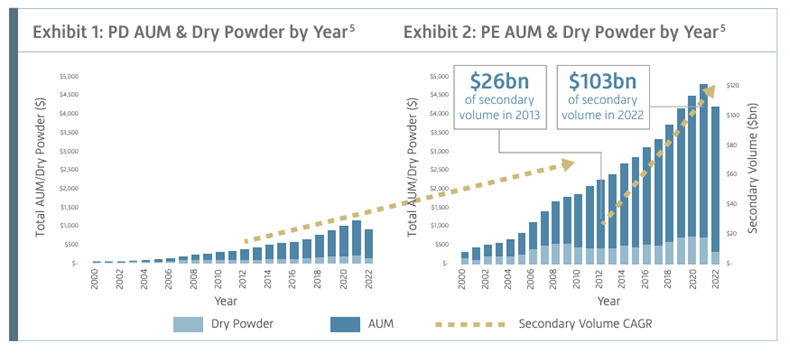

Will secondaries in private credit follow a growth trajectory similar to those in private equity?

"Although the private credit boom has been a more recent phenomenon, we are already seeing downstream secondary market growth. From 2012 to 2022, Pitchbook estimates that credit secondary volume grew to ~$17 billion, representing 30x growth for the decade.4 Given that secondary market volumes typically run on a lag, we believe we are still in the early innings of expansion as private credit AUM has continued to reach new heights in recent years."

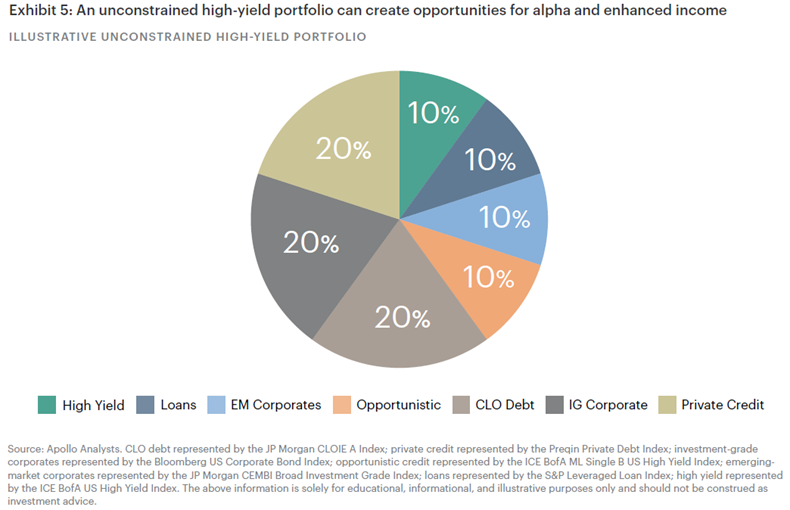

Is there a case for unconstrained approaches to fixed income?

"Benchmark constraints can limit active managers’ investable universe as well as their ability to fully express their own views when building portfolios through credit selection. Because most active and passive strategies are benchmarked to the same indices, market participants can end up with significant and unintended overlap in their portfolios across both managers and strategies. The lack of flexibility and unintended concentration have the potential to increase portfolio volatility and erode risk-adjusted returns over time."

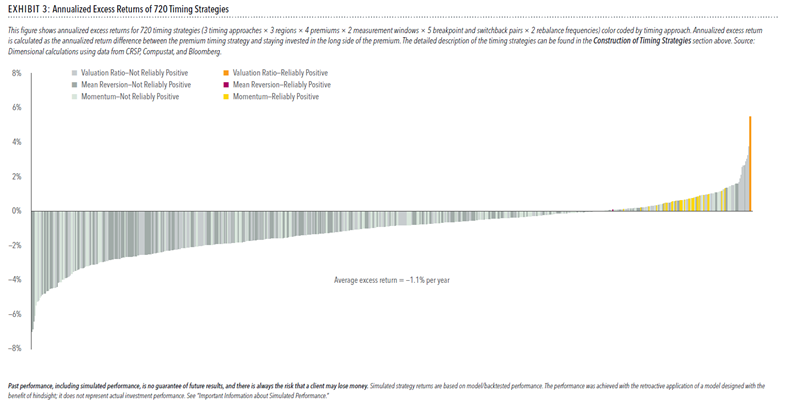

Can equity market premiums (size, value, and profitability) be timed?

"Despite pointing to some promising timing strategies at first glance, our analysis shows that their outperformance is very sensitive to the sample period, region, or a minor adjustment to the strategy construction. While it is tempting to focus on a few shiny objects in the backtests, when looking at the big picture, it is clear that the odds of using valuation ratios, mean reversion, or momentum to successfully time the premiums are poor."

Another Look at Timing the Equity Premiums (Dimensional Fund Advisors)

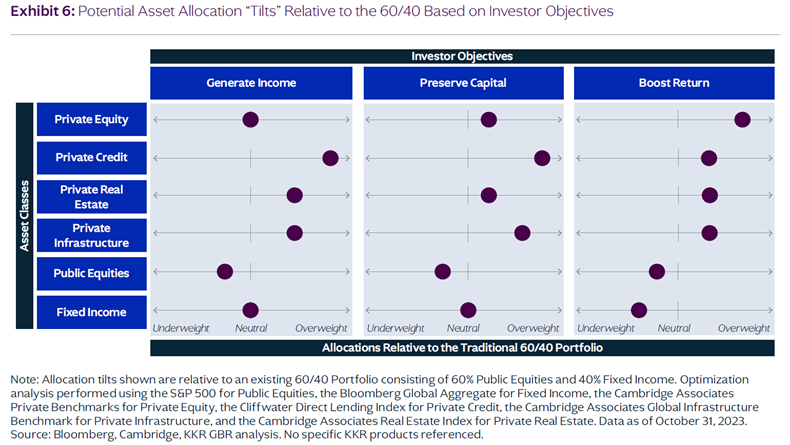

Is there a framework for individual investors seeking to incorporate private markets into their portfolios?

"Importantly, there is no cookie cutter approach to Private Markets investing as goals vary by age, sources of income, life circumstance and a myriad of other personal considerations."

A New Foundation for Global Wealth: Rebuilding Portfolios for the New Regime (KKR)

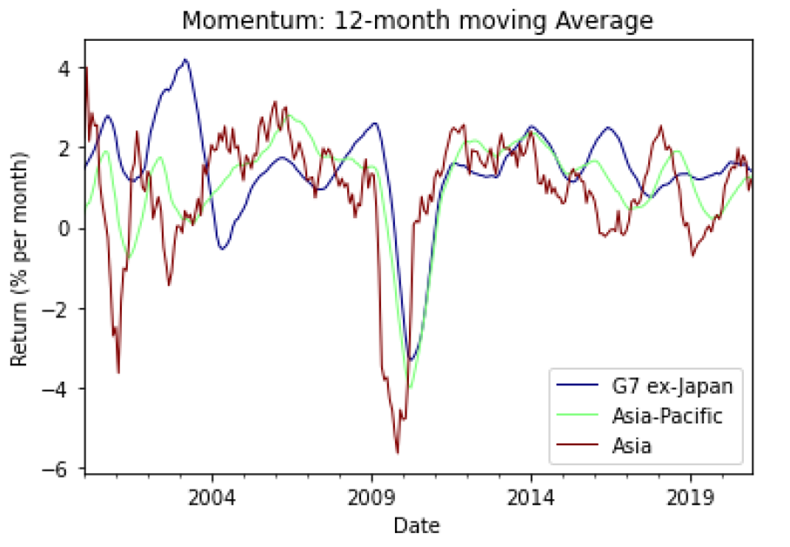

What have we learned about the momentum factor 30 years after it was first documented?

"The pervasiveness of momentum returns provides perhaps the strongest evidence against the efficient market hypothesis. We find positive momentum returns in the post-2000 period in markets throughout the world, long after the phenomenon was first documented. We do not find support for risk-based explanations of momentum but find that behavioral theories provide insights about why we observe momentum in some markets but not in others."

Momentum: Evidence and Insights 30 Years Later (Jegadeesh & Titman)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.