The Paper Trail: An Expensive Free Lunch

As I publish this, I was supposed to be on a plane to Ft. Lauderdale for the Wealth Management EDGE/Inside ETFs conference. Unfortunately, Covid had other plans and I am now stuck at home. Seems like we're all destined to get our turn sooner or later...

(Side note - If you're down at the event, be sure to check out the panel I would have been speaking on, Do Alternative Investment Strategies Improve Investor Outcomes? )

Regardless, I wasn't about to allow a little Covid to interrupt my streak of (now) 23 consecutive monthly Paper Trail posts! So, without further ado...

Please enjoy this month's installment of The Paper Trail, featuring:

- The expensive free lunch of diversification in private markets

- Alternative property types in real estate

- Navigating the crypto ecosystem

- Lessons learned from the lost decade in value investing

- Protecting your portfolio from inflation after the fact

- And much, much more!

Stay safe my friends!

“bps” (reading time < 10 minutes)

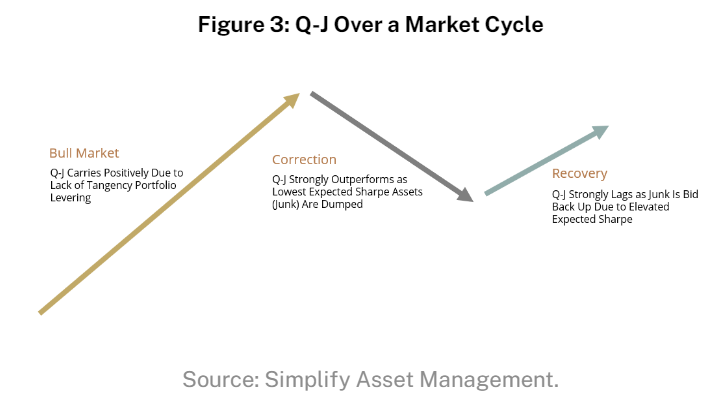

Can the Quality minus Junk (Q-J) factor hedge credit risk?

"As a correction begins, typically after an extended period of investors reaching for more and more risk to meet their expected return targets, investors dump the least efficient assets they hold. By definition, these are the high volatility junk assets with bid-up prices and a poor expected risk-adjusted return. As this sell off occurs, Q-J becomes a powerful hedge as its returns become positive while the aggregate market draws down."

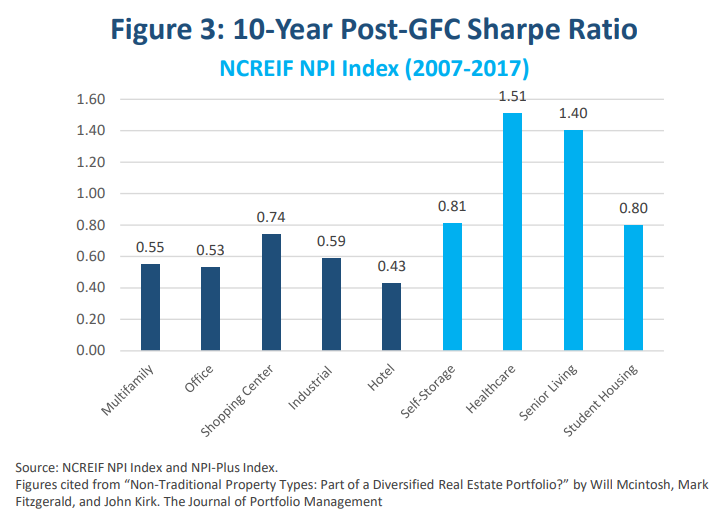

How have alternative property types stacked up against the "basic food groups" of real estate?

"Their findings were extremely compelling: alternative asset classes were both higher returning than conventional sectors like office and were less correlated to both macroeconomic swings, as well as other classes of real estate (which largely correlate highly to each other)."

The Rising Popularity of Alternative Asset Classes in Core Portfolios (Virtus Real Estate Capital)

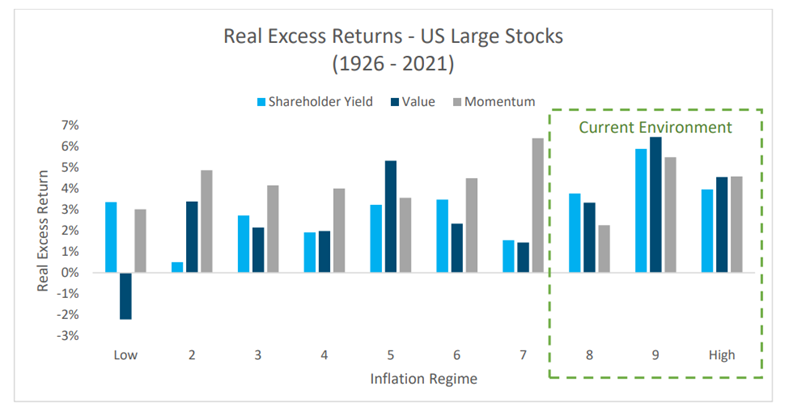

Which equity factors do best in inflationary environments?

"Focusing on higher inflation regimes reveals that key selection factors—Value, Momentum, and Shareholder Yield—generate positive excess return on a real basis, which helps maintain purchasing power."

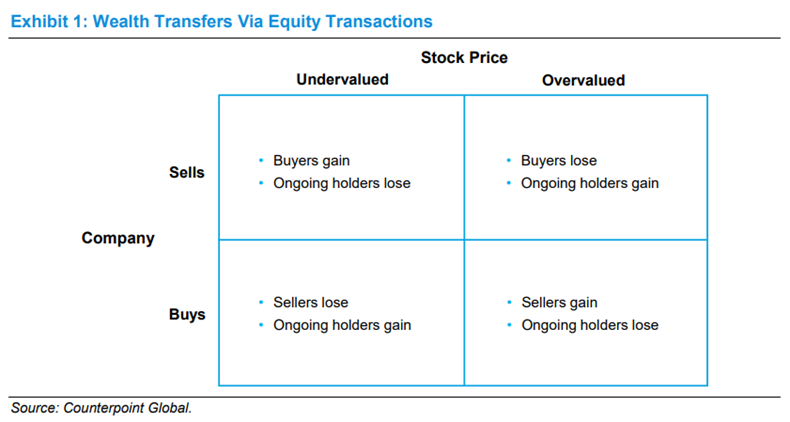

Do companies effectively use equity transactions as a capital allocation tool?

"Companies can also transfer wealth by buying or selling mispriced stock. The evidence shows that in the aggregate companies do sell high and buy low, which means that transacting shareholders fare worse than ongoing holders. "

Wealth Transfers: Redistribution of Value via Capital Allocation (Counterpoint Global)

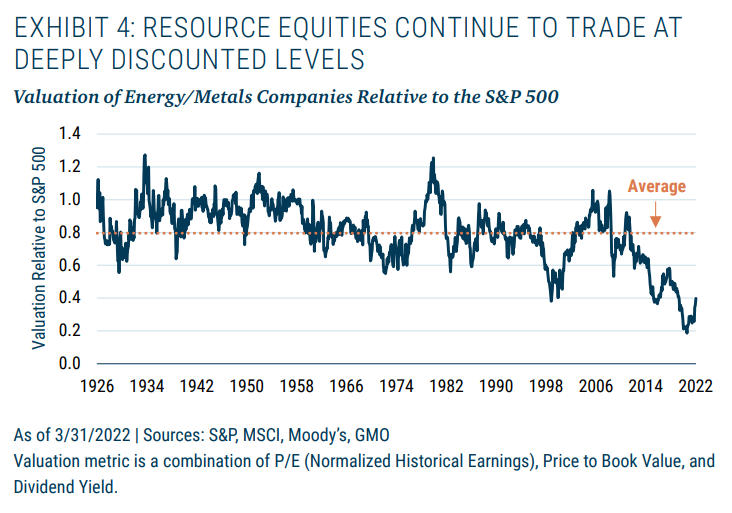

Why do natural resource equities trade at such a significant discount to the broad market?

"The discount has become much larger in recent years, as the relatively small cadre of investors willing to wade into the sector has shrunk further. ESG, sustainability, and divestment campaigns have gathered significant momentum. Electric vehicles have dominated the headlines, if not our roads."

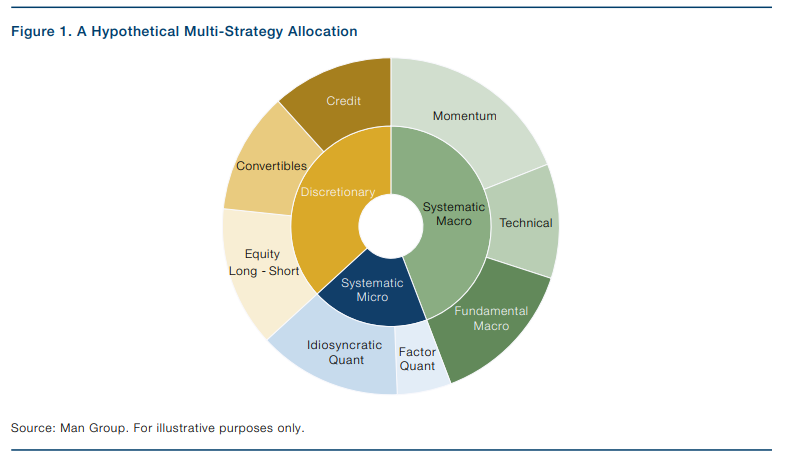

What are the advantages of multi-strategy portfolios?

"A multistrategy portfolio acknowledges that different strategies perform at different times, and allows the portfolio (in theory, at least) to generate a more consistent stream of returns than any individual strategy, under different macroeconomic conditions, and weathering unexpected shocks."

Looking Under the Bonnet: Multi-Strategy Portfolios (Man Group)

“pieces” (reading time > 10 minutes)

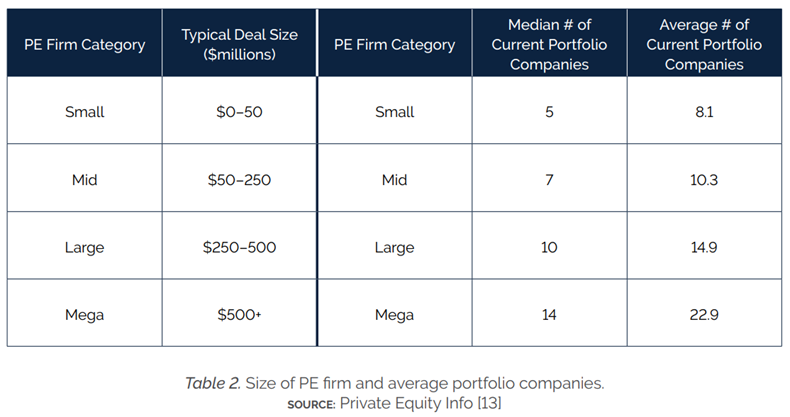

Are private market portfolios diversified enough?

"Turning to private market strategies, the cost of both origination and ongoing surveillance greatly multiplies costs and diseconomies of scale, further limiting the feasibility of utilizing diversification."

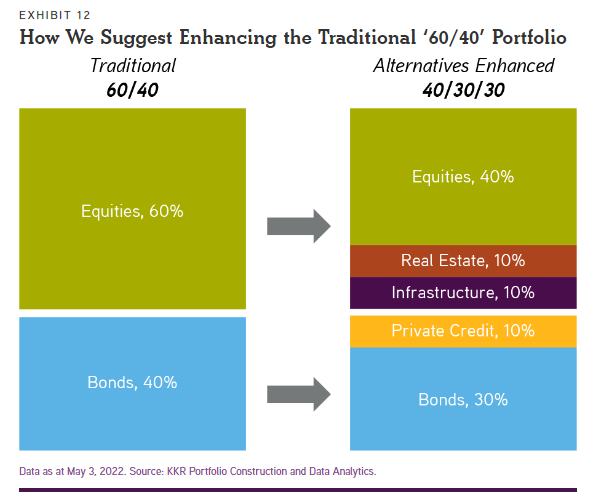

Does 40/30/30 have a chance to become the new 60/40?

"From our perch at KKR, we firmly believe that what has worked in the past, particularly in the last decade of returns being enhanced by the negative correlation of stocks and bonds, will not be as effective in the new macroeconomic environment we envision. As such, there is the potential to enhance the traditional ‘60/40’ mix of assets by using Real Assets and Private Credit to bolster both the performance and the durability of one’s overall portfolio, including maximizing the potential for an increase in its reward per unit of risk. "

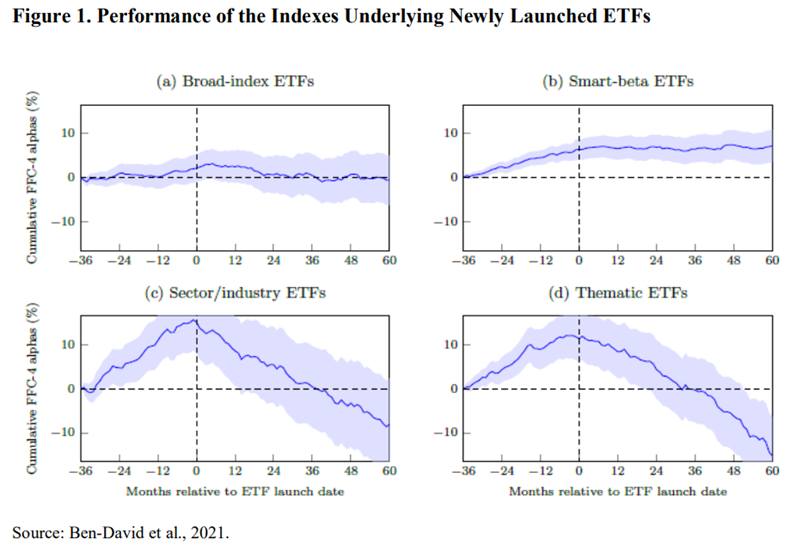

How wary should investors be when it comes to historical simulations and backtests?

"A host of practices and incentives harbored within academia and the investment industry are exacerbating our innate tendency to embrace performance chasing and data mining. Notably, several relevant practices plaguing our industry include p-hacking, noise trading, fad chasing, and nowcasting."

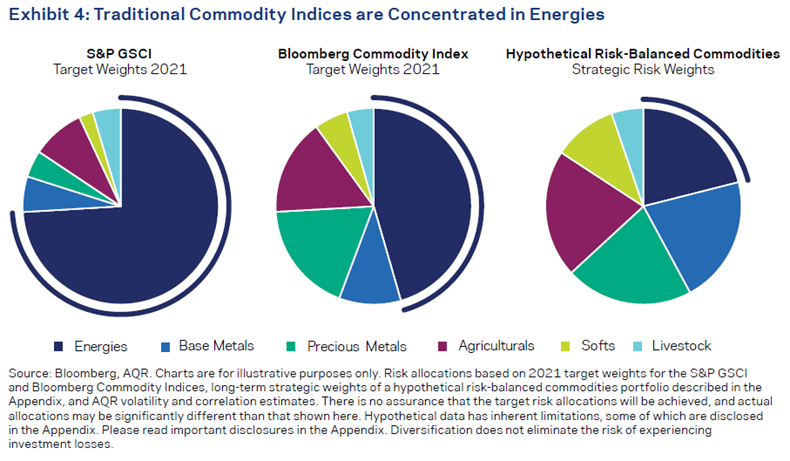

Can standard approaches to long-only commodity investing be improved upon?

"Commodity sectors have shown low correlations to one another, so a portfolio that balances risk across sectors can better diversify idiosyncratic risks and therefore deliver higher risk-adjusted returns. In addition, passive indices have historically exhibited large swings in realized volatility, especially during periods of drawdown, presenting a sizing challenge to allocators. This can be mitigated by dynamically adjusting position sizes to target a more stable amount of portfolio volatility. Lastly, commodities portfolios can be enhanced through active tilts based on supply-and-demand fundamentals, global macroeconomic data, roll yield, and price trends within commodity markets."

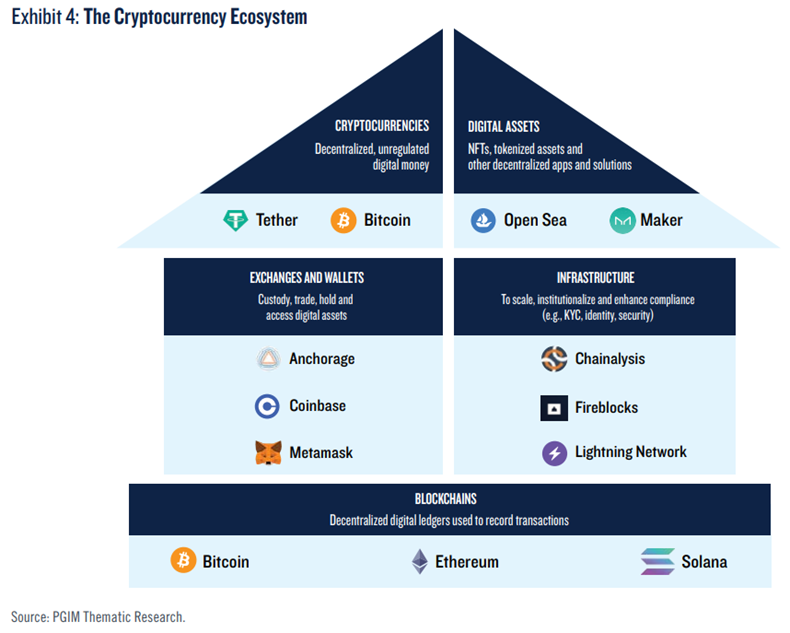

How should investors navigate the cryptocurrency ecosystem?

"Critically for investors, this broader ecosystem – and the tremendous innovation it is generating – has many companies, use cases and applications that are likely to endure regardless of the success of the cryptocurrencies that spawned them. Indeed, many of these use cases are not limited to or reliant on cryptocurrencies at all."

Cryptocurrency Investing: Powerful Diversifier or Portfolio Kryptonite? (PGIM)

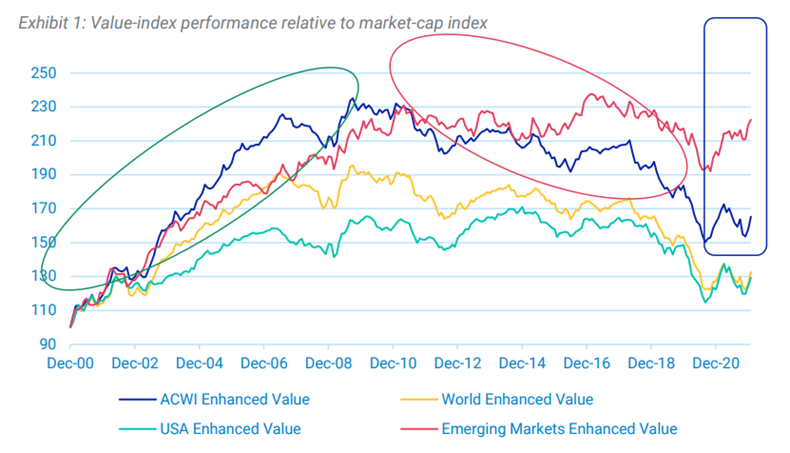

What lessons can be learned from Value's lost decade in the 2010s?

"We found three elements that changed from one decade to the other that caused value strategies to outperform for the first decade of the millennium and underperform for the second: the value factor’s own performance, exposure to nonvalue factors in value strategies and stock-specific returns."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.