The Paper Trail: Apples and Oranges

Welcome to the latest installment of The Paper Trail! In addition to this month's curated third-party investment research, I'll also be linking to my most recent Cliffwater white paper:

Apples and IRRanges: Peeling Back the Challenges of Performance Measurement in Private Markets

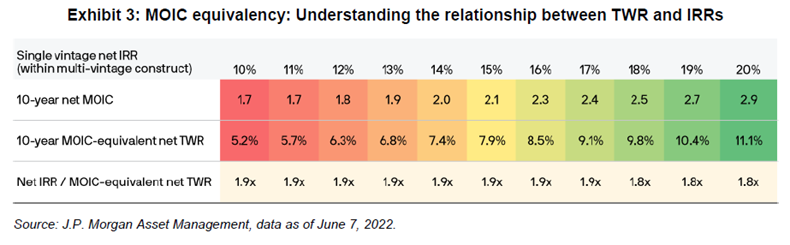

It is well documented that Internal Rate of Return (IRR) is a useful yet incomplete tool for measuring the performance of closed-end, drawdown funds in private markets.

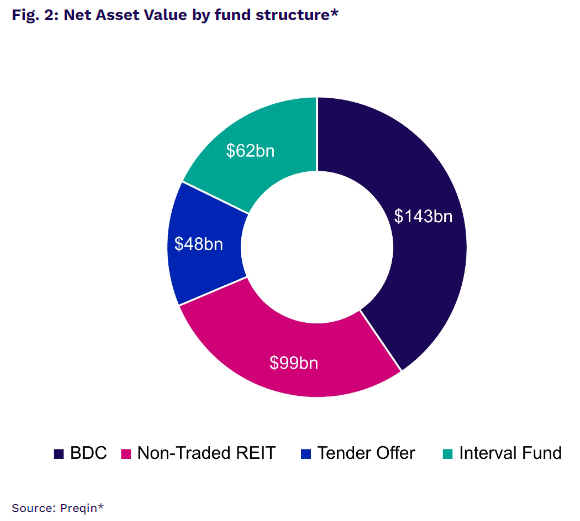

The use of IRR becomes even less relevant when evaluating the performance of semi-liquid evergreen funds that invest in private markets, a category for which time-weighted returns (TWR) matter much more. This is important today, with the trend towards registered perpetual funds gaining momentum. Preqin estimated evergreen fund net asset value (NAV) to be at least $350 Billion at the end of 2023.

Our latest paper seeks to unpack:

- The alphabet soup of private market performance metrics.

- How IRR and TWR are like apples and oranges for comparative purposes.

- Why the unlikely pairing of private markets and perpetual vehicles is like chocolate and peanut butter.

- Whether the juice is worth the squeeze when evaluating evergreen funds against the “traditional alternative” of closed-end drawdown funds.

Given the heavy-handed use of food analogies in this one, all that’s left to say is…bon appétit!

***

March's research roundup also features:

- European buyouts

- Private market valuations

- NAV lending

- Cyber reinsurance

- Alternative risk premia strategies

- Private equity's liquidity crunch

- The Total Portfolio Approach (TPA) asset allocation framework

- Continuation fund performance

- Avoiding value traps with quality and momentum screens

- Corporate behavior in periods of "easy money"

- And much more!

“bps” (reading time < 10 minutes)

How should private equity investors evaluate the performance of finite-life drawdown funds relative to semi-liquid perpetual fund structures?

"While IRR and TWR are not interchangeable, those differences can be reconciled and shouldn’t stand in the way of embracing the innovative pairing of private markets and perpetual funds."

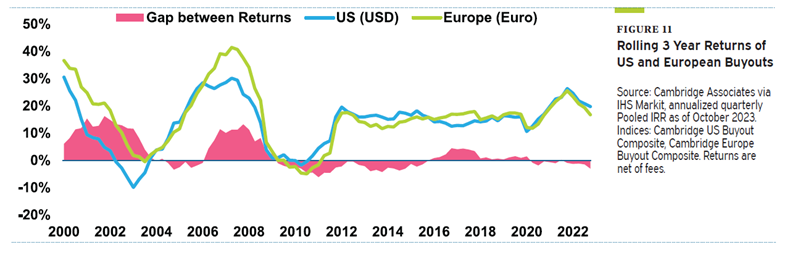

Should private equity investors make room for European buyouts in their portfolios?

"Over the long term, European buyout funds have produced returns in line with US buyout funds. The largest gaps between European and US buyout returns have typically occurred during market upturns and downturns. In USD terms, European buyouts have also exhibited higher volatility than US buyouts. However, when accounting for the currency impact, Europe’s volatility is very similar to the US."

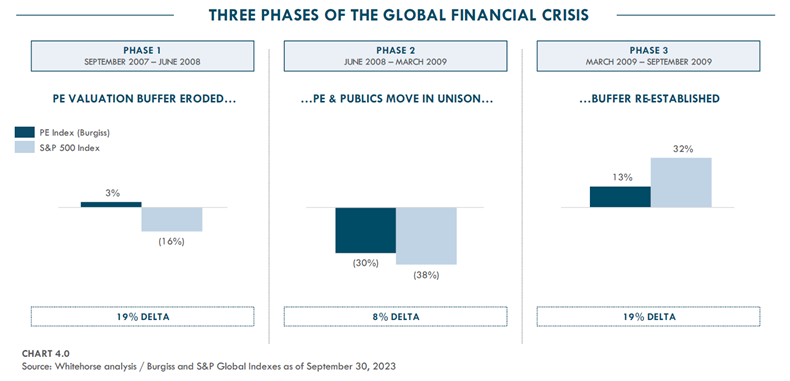

Are private equity valuations irrational?

"Interestingly, we find that those concerned about private equity valuations tend to overemphasize the narrative that private equity does not follow public markets on the decline, but they fail to report when private equity valuations lag public markets on the recovery."

Coming to the Defense of Private Markets Valuations (Whitehorse Liquidity Partners)

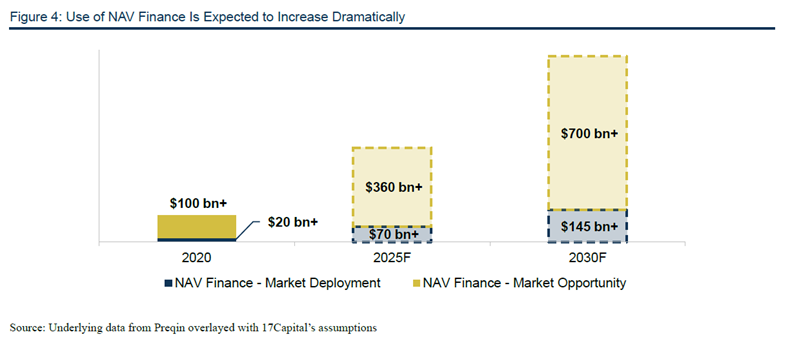

How large is the opportunity set for NAV lending?

"As we look forward, it’s clear that growth in NAV finance will likely continue to be correlated with the expansion and evolution of the global private equity universe, which has seen its total AUM increase by roughly 15% annually on average over the last ten years. Importantly, the AUM of private equity funds that are beyond their investment period – the target market for NAV finance – is expected to rise to more than $5.5 trillion in 2030, a roughly 60% increase since 2020."

NAV Finance 101: The Next Generation of Private Credit (Oaktree Capital)

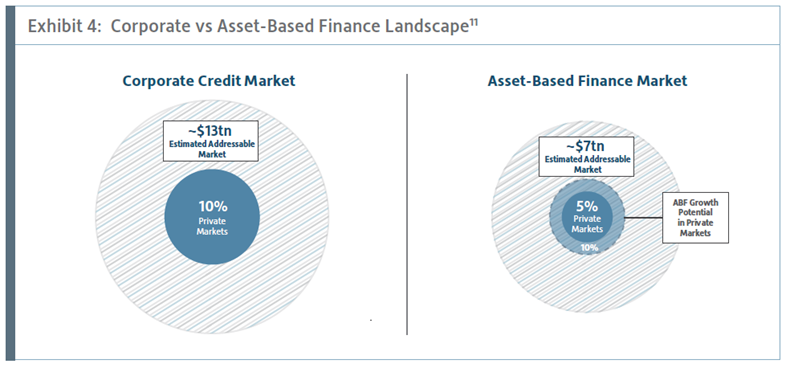

Is Asset-Based Finance (ABF) the "next big thing" in private debt?

"We estimate private ABF is on track for 20%+ annual growth over the next several years. Many favorable dynamics support the growth, including regulatory headwinds sweeping through the banking sector, the inherent virtues of ABF as an asset class, and accelerating demand from investors hungry for credit alpha and diversification."

Asset-Based Finance: Sizing The Next Generation of Private Credit (Atalaya Capital Management)

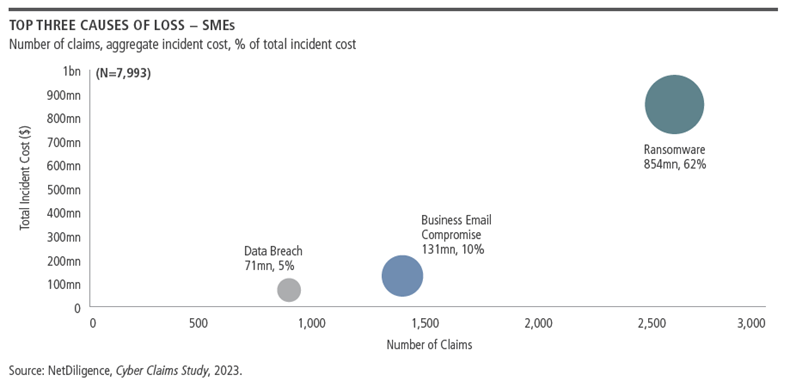

Should Insurance-Linked Securities investors consider cyber risk as part of their allocation?

"In our view, cyber (re)insurance is essential for financial protection against information technology threats and is set to become even more embedded in risk management practices. ILS have already supported market growth, and 2023 was a significant milestone, with the first-ever public 144a catastrophe bonds covering cyber perils providing a total of $415 million of capacity."

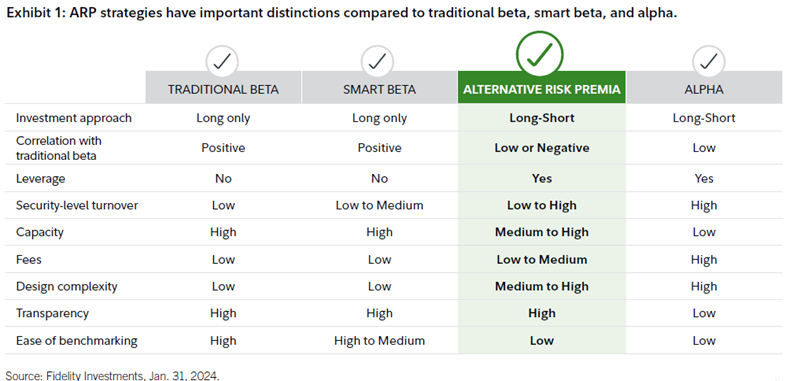

How do Alternative Risk Premia (ARP) strategies compare to more traditional "alpha seeking" Hedge Funds?

"When considering ARPs in relation to alpha, e.g. hedge funds, it is important to recognize their distinctions and similarities. Structural features such as transparency, cost efficiency and greater liquidity set ARP strategies apart from hedge fund vehicles. However academic research has demonstrated that many hedge fund strategies make use of ARP styles, either directly or indirectly.1,2 In fact, this trend is not new—it predates the emergence of ARP strategies as a separate investment category"

Alternative risk premia: Building blocks for resilient portfolios (Fidelity)

“pieces” (reading time > 10 minutes)

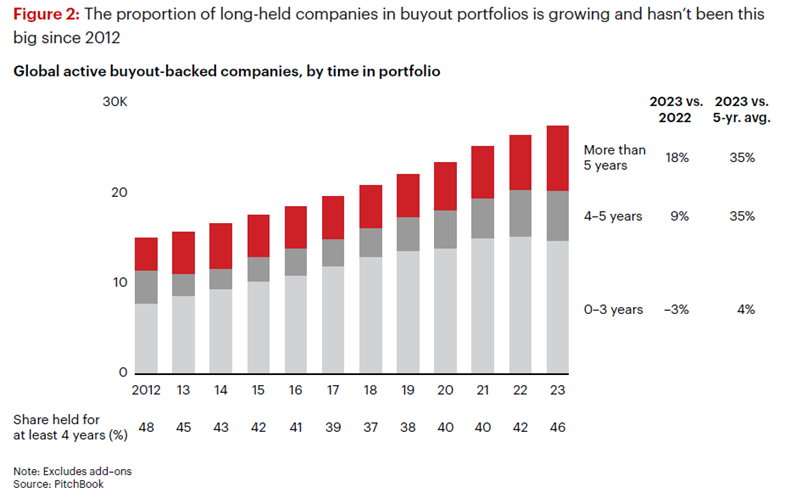

What will it take to solve the current liquidity crunch in private equity?

"The value trapped in these aging companies isn’t enough to solve the distributions issue on its own. Indeed, generating more liquidity is a years-long process, not a quick fix. What’s required of GPs right now is credibility building. For firms looking to raise capital in the next 24 months, LPs are almost certainly going to be asking for a well-defined blueprint for generating near-term distributable cash— a holistic, portfolio-wide strategy that uses every tool at the firm’s disposal to boost distributed to paid-in capital (DPI)."

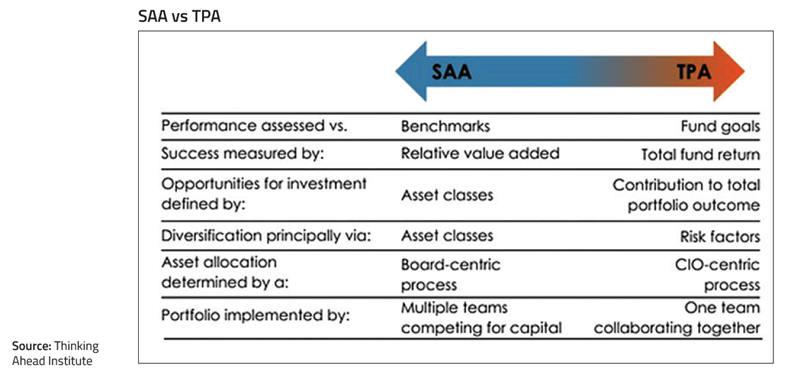

What is the Total Portfolio Approach (TPA) and how does it compare to other asset allocation frameworks?

"As a result, TPA allows for opportunism; investing with a mindset of what is the best investment right now, while maintaining allegiance to the portfolio risk budget. This relentless focus on justifying every marginal dollar of allocated capital against all other options is a defining differentiator compared with other models."

Innovation Unleashed: The Rise of Total Portfolio Approach (CAIA Association)

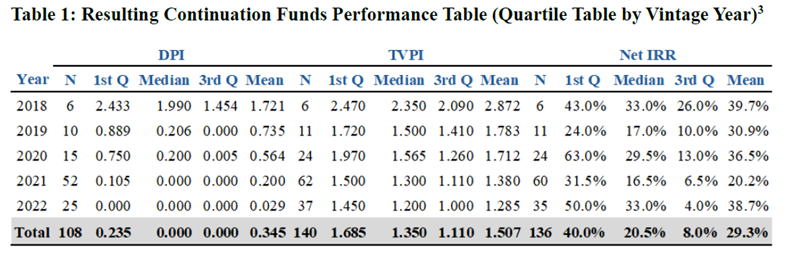

How have Continuation Funds performed relative to other private equity transaction structures?

"Clearly, the bulk of Continuation Funds are still in their very early days, and any performance data has to be considered as largely driven by net asset value. Still, the statistics provide important indicative insights into the performance characteristics of the sub-asset class of private equity."

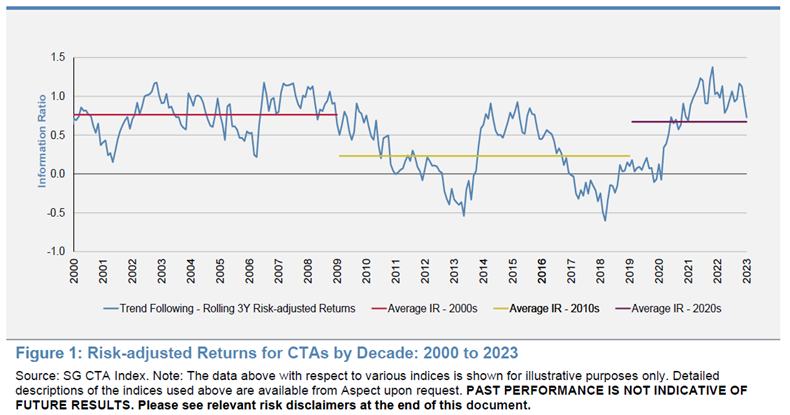

Can managed futures perform well outside of equity market crises?

"Equity bear markets are only one, relatively infrequent, subset of disequilibria, which can be manifested across any asset class, or sometimes limited to individual markets within broader asset groups."

Capturing Unpredictability: Trend Following Alpha (Aspect Capital)

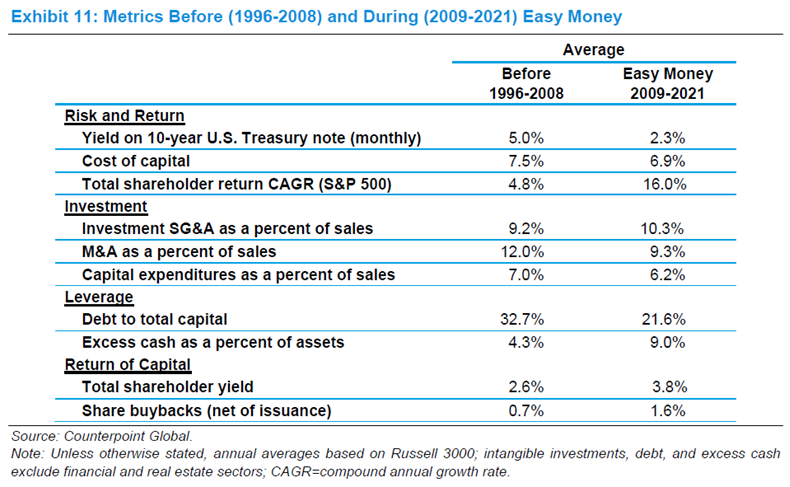

How did the "easy money" era of low interest rates from 2009-2021 affect corporate behavior?

"Our focus is on how U.S. public companies acted in the regime of easy money. In theory, lower interest rates and ready access to capital would suggest that public companies invest more, use more debt, and hold less cash. More abundant investment opportunities would also imply restraint from returning cash to shareholders. But that is not what public companies did."

Cost of Capital and Capital Allocation: Investment in the Era of “Easy Money” (Counterpoint Global)

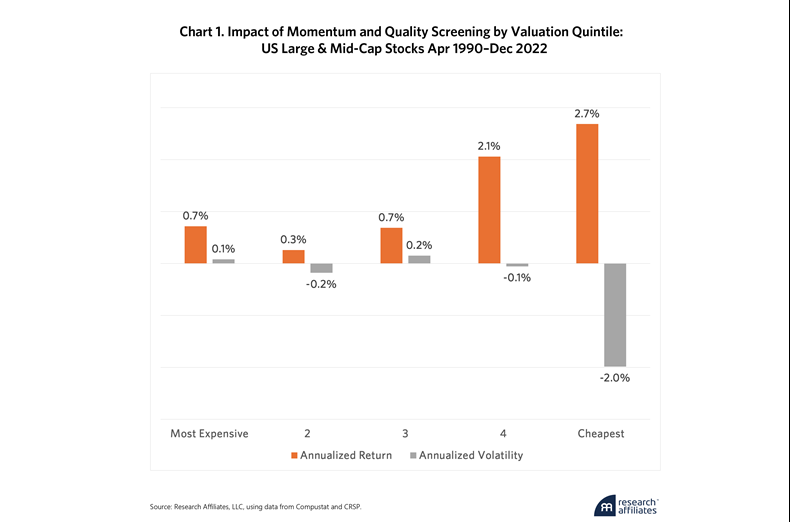

Can quality and/or momentum screens help investors avoid "value traps"?

"Low quality and sentiment-driven momentum are common features of value traps. By purging problem stocks using momentum and quality signals, returns improve across all but the most expensive companies. These improvements are most notable in the two cheapest valuation quintiles of the market, with the projected value premium increasing by an estimated 5.2% per year."

Active Value Investing: Avoiding Value Traps (Research Affiliates)

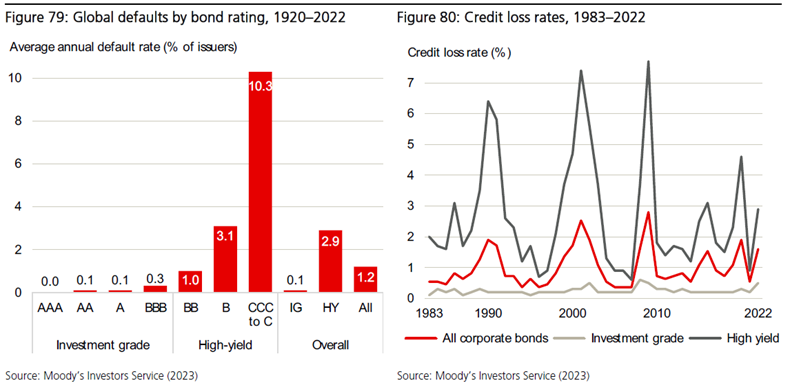

Has the positive yield spread in corporate bonds over Treasuries provided sufficient compensation for the additional risk?

"Based on long-run evidence from 1900 for the US and 1860 for the UK, we have seen that IG corporate bonds have offered a significant credit risk premium over equivalent government bonds of around one percentage point. The premium from high-yield (or junk) bonds is some two percentage points higher than this. We also review long-run evidence since 1815 which shows that risky sovereign bonds are also subject to credit risk. They have enjoyed a long-run credit premium even higher than that on HY corporate bonds."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.