The Paper Trail – April 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

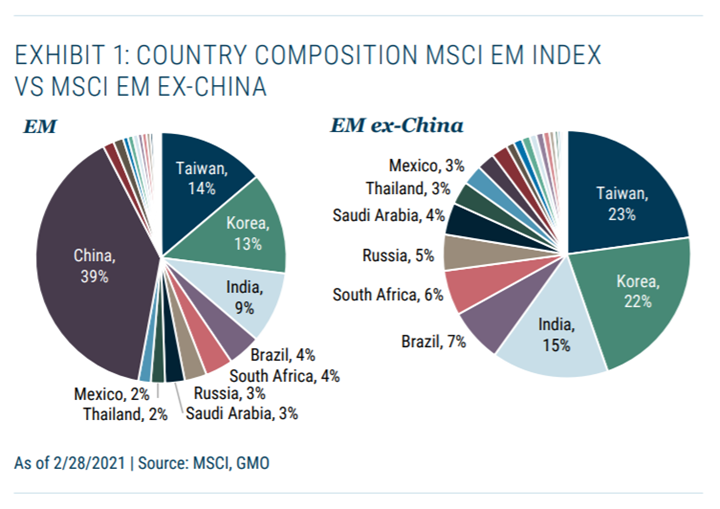

Is there a case for having separate allocations to China and the rest of the Emerging Markets?

“Any evaluation of a universe should include a study of liquidity and capacity. Caution is merited here. China, it turns out, accounts for approximately 40% by number of stocks and by weight, but even more by liquidity. This is because faster-moving retail traders in China have ensured a high level of liquidity and volume for local companies. An ex-China universe, by our calculations, will lose about 50% to 60% of the liquidity of EM.”

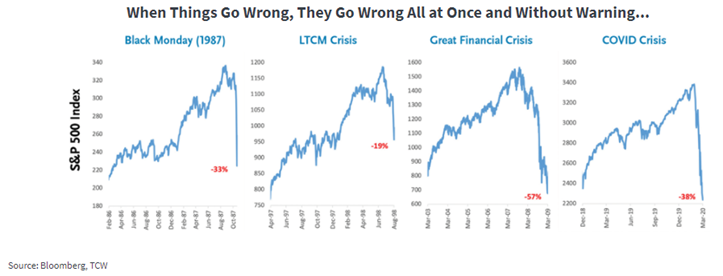

How important is process when the you-know-what hits the fan?

“Capital market pricing may tend towards rationality over long time periods, but in moments of crisis and panics, pricing is only as rational as the crowds who determine them.”

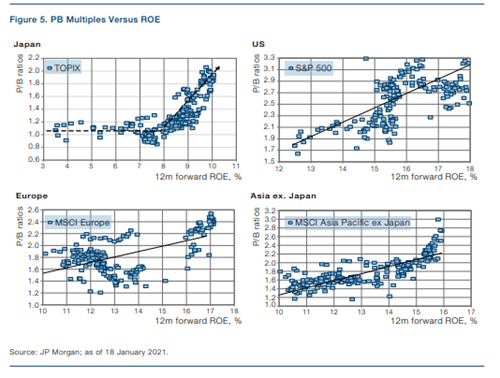

Will the patience of Japanese Value investors finally be rewarded?

“In all other regions, the PB ratio moves in a linear fashion with ROE: as ROE increases, so does the multiple. In Japan, businesses which achieve the exalted 8% figure enjoy a disproportionate PB premium; those which don’t have their multiple crushed.”

The Wait is Over: The Resurgence of Japanese Value (Man Group)

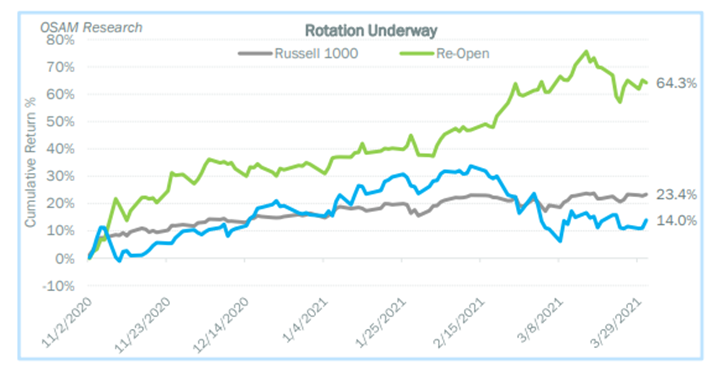

Does the recent “re-opening” rotation into value stocks and cyclical sectors have legs to it?

“Since November, the S&P 500 index is up 23%. While that is an astounding number for such a short period of time, it glosses over what is happening under the hood of the equity markets—a massive rotation away from deflationary assets (mega cap tech, gold, bonds) and towards reflationary assets (cyclicals, small value, and commodities). This rotation is evident in factor returns when considering their underlying factor exposures.”

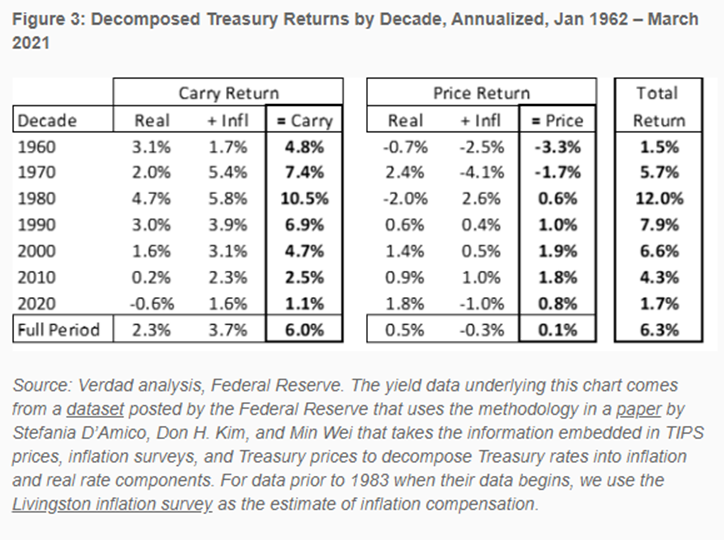

Do Treasuries still play an important role in a diversified portfolio?

“The key thing to watch for is signs of this post-1980 paradigm shifting, of inflation and growth decoupling, which would create the conditions for a longer-term bear market in Treasuries and a longer-term bull market in real assets."

“pieces” (reading time > 10 minutes)

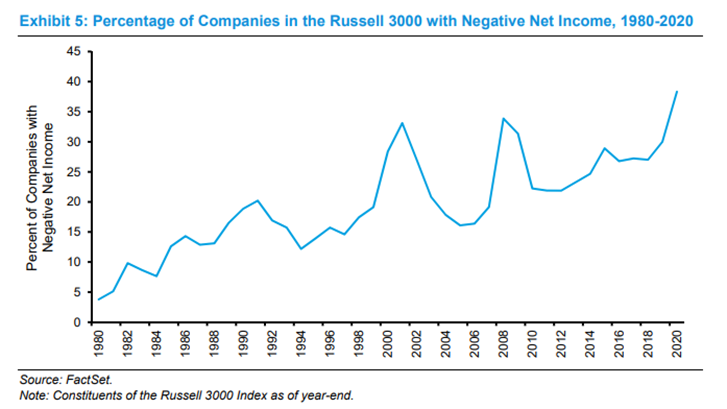

Why is separating expenses from investments so critical in measuring corporate performance?

“To be clear, companies can report losses because their expensed investments exceed current earnings, which is good if the investments promise attractive economic returns. Companies can also report losses when their expenses exceed their sales, which is bad if the business is fundamentally unprofitable. Separating expenses from investments has never been so important.”

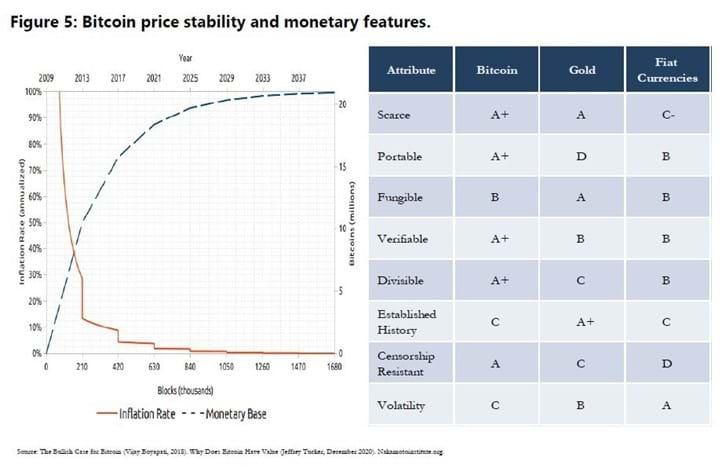

Where does digital money fit in a portfolio?

“The analog money system builds on centralized trust. No more evident is faith-based money than in the words on the back of physical US dollar notes: “In God We Trust.” Digital money is built on math. It is there for everyone to see. For everyone to criticize. For anyone to improve upon.”

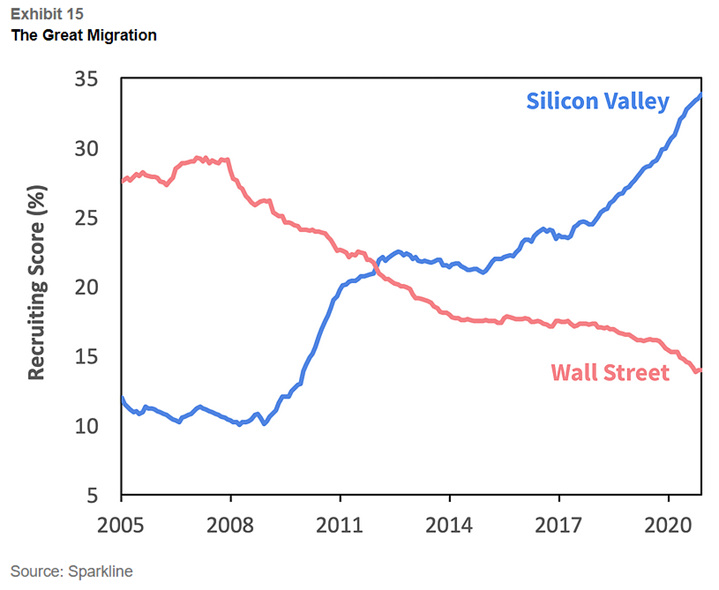

How important is recruiting and retaining top talent to a company’s stock performance?

“Work is inexorably migrating toward information-intensive, unstructured, and creative tasks. These are the fields where the best is 10 to 100 times better than the average. As a result, firms today must place a great emphasis on acquiring superstars and not settling for average.”

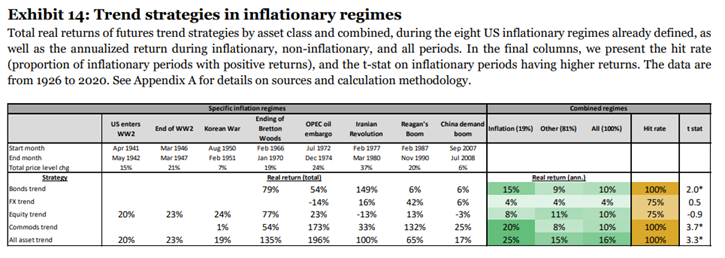

How should allocators prepare for a potential resurgence in inflation?

“Our results suggest that trend-based strategies focusing on equity, bonds, FX, and commodities have strong hit rates during the eight inflation episodes and provide an impressive level of protection. We consider a range of equity portfolios and find that popular factors like value provide some benefit during our definition of inflationary times.”

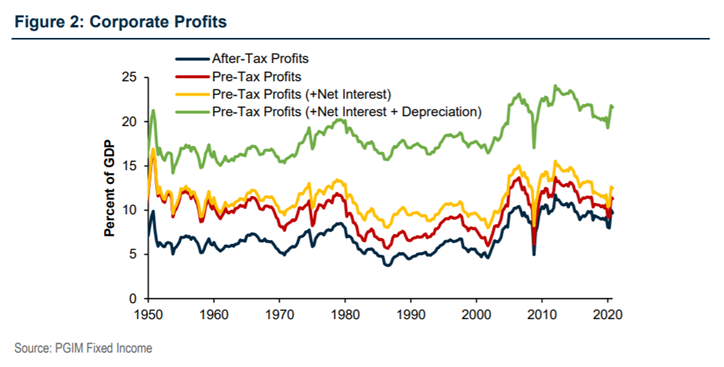

What does the future hold for U.S. corporate profits?

“As a bottom line, our work indicates that over the next few years the share of corporate profits is likely to remain elevated by historical standards, at somewhere between 20% and 23% of GDP. Moving much beyond that range would seem to require a sizable shock or deep structural changes in the economy.”

The Evolution of U.S. Corporate Profits: Dissecting 70 Years’ of Performance (PGIM)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.