The Paper Trail – August 2020

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

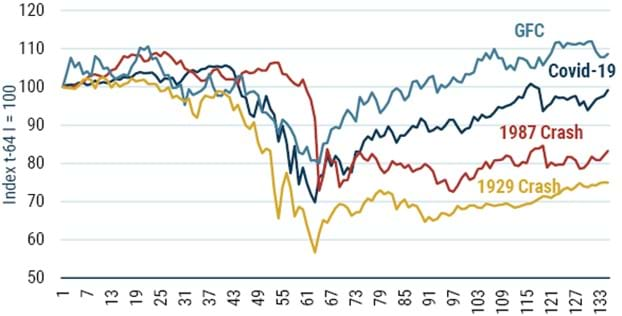

Are today’s stock market valuations justified or absurd?

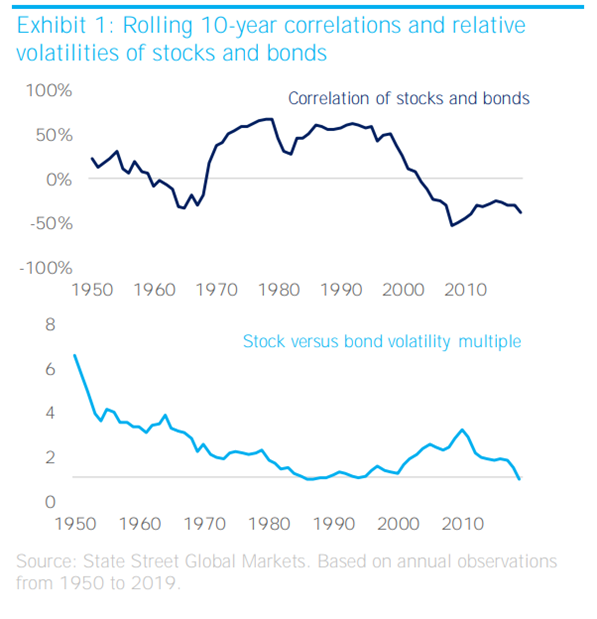

How reliable are the diversification properties of bonds relative to stocks?

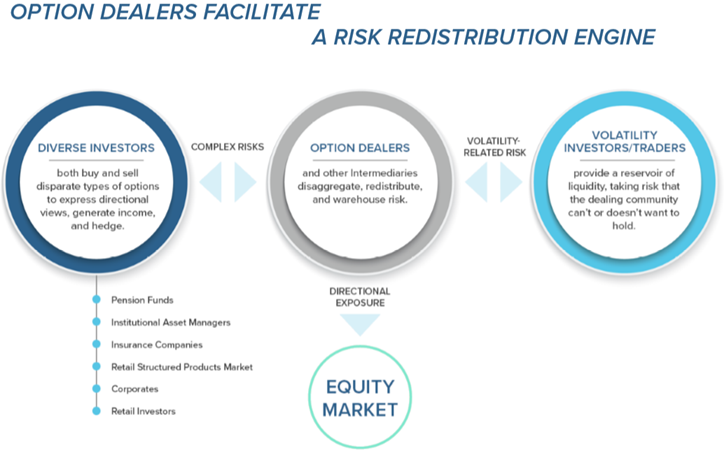

Is volatility investing still viable?

Volatility Investing: Characteristics of a Well-Conceived Approach (Acadian Asset Management)

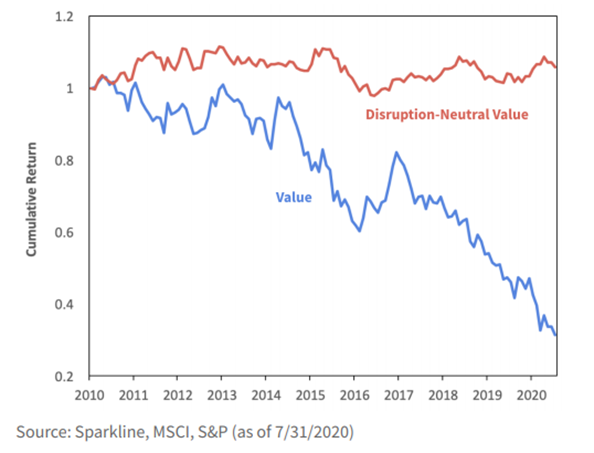

Does the “Disruption” metanarrative explain the Value factor’s recent struggles?

Value Investing Is Short Tech Disruption (Sparkline Capital)

Is a collection of value metrics better than any one individual measure?

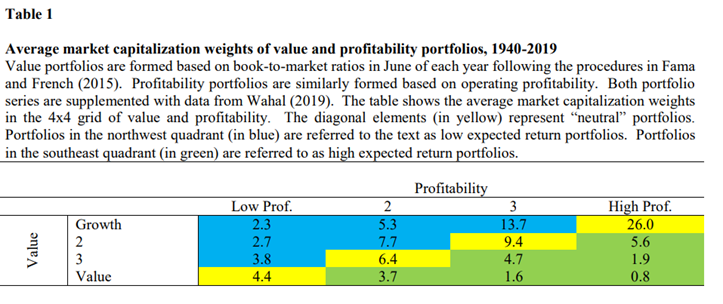

Are investors better off targeting value and profitability jointly, rather than side-by-side?

On the Conjoint Nature of Value and Profitability (Eduardo Repetto & Sunil Wahal)

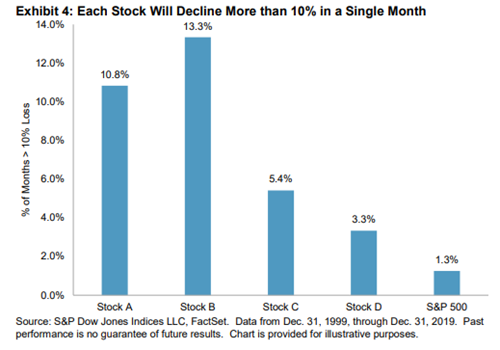

Even if you could identify the best performing stocks ahead of time, would you have the courage to stick with them?

“pieces” (reading time > 10 minutes)

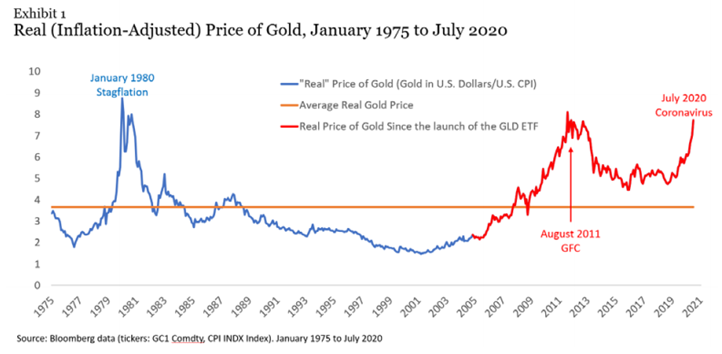

How does the financialization of gold ownership impact its prospective returns?

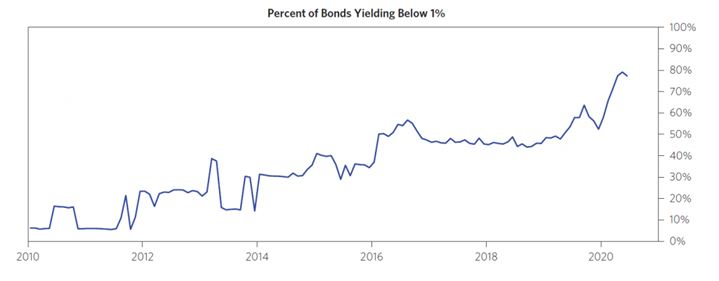

What are the long-term implications of historically low interest rates across the globe?

Grappling with the New Reality of Zero Bond Yields Virtually Everywhere (Bridgewater Associates)

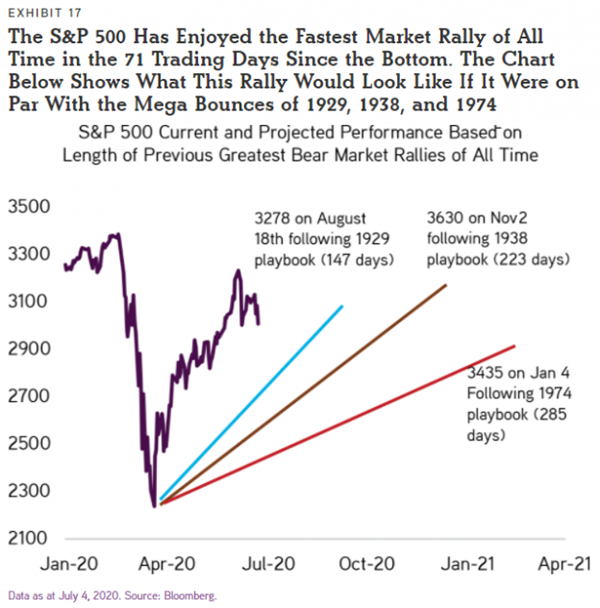

How should allocators think about forward-looking expected investment returns in this phase of the recovery?

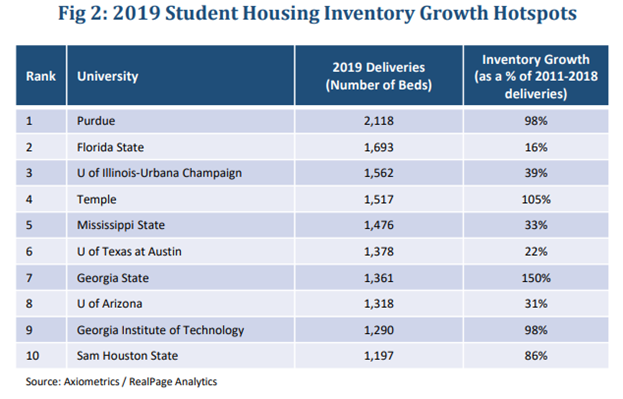

Will student housing survive the post-COVID real estate market?

Student Housing in a Post-COVID World (Virtus Real Estate Capital)

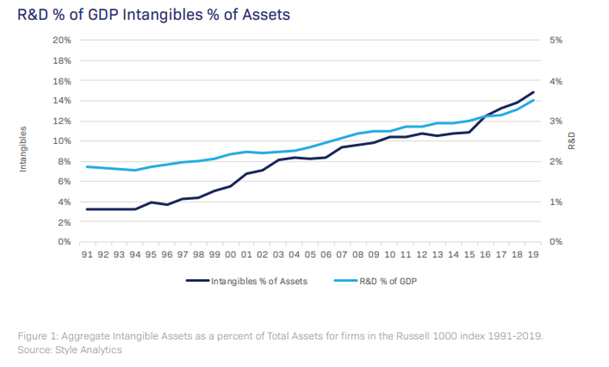

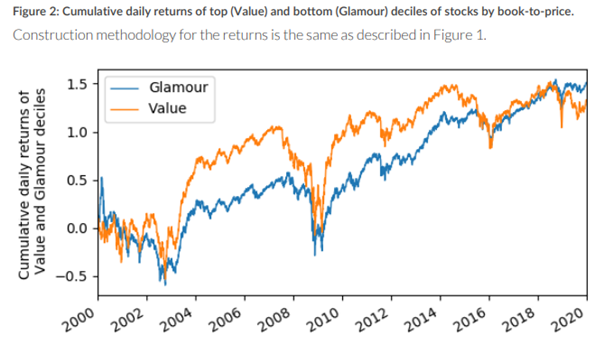

Why have value stocks, as traditionally measured, underperformed since the global financial crisis of 2008?

Diagnosing the Recent Decade of Drawdown in Value (Two Sigma)

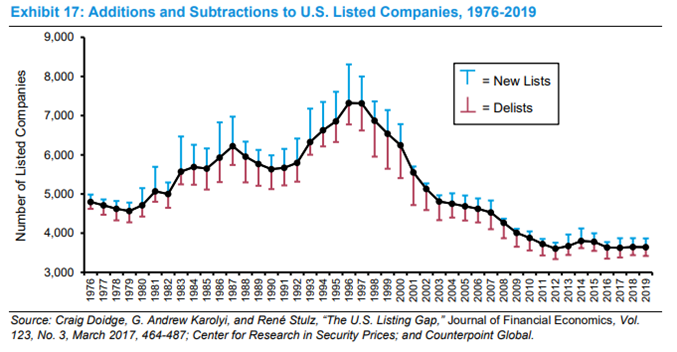

What have been the driving factors behind the long-term trend of companies shifting away from public markets in the U.S.?

Public to Private Equity in the United States: A Long-Term Look (Morgan Stanley)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.