The Paper Trail: Back to the Futures

Hope everyone had a great summer! While the dog days may be over, summertime will still be in full swing at the inaugural Future Proof, the world's largest wealth conference festival where the intersection of wealth management, asset management, and fintech will take over Huntington Beach, CA from September 11th-14th.

If you're attending, I'll be speaking on a panel that Monday (details below). If you're not attending, there's still time to register HERE!

Now that everyone's kids are back in school, it's time for investors to go back to school as well. With that in mind, here is some quality Labor Day Weekend reading with this month's installment of The Paper Trail, featuring:

- Fed Funds Futures and Bond Returns

- Shorting Bonds with Trend Following

- The Importance of Fundamentals

- Emerging Markets and the Ukraine Crisis

- Quantifying Direct Indexing's Tradeoffs

- The Relationship (or Lack Thereof) Between Value and Interest Rates

- And Much, Much More!!

“bps” (reading time < 10 minutes)

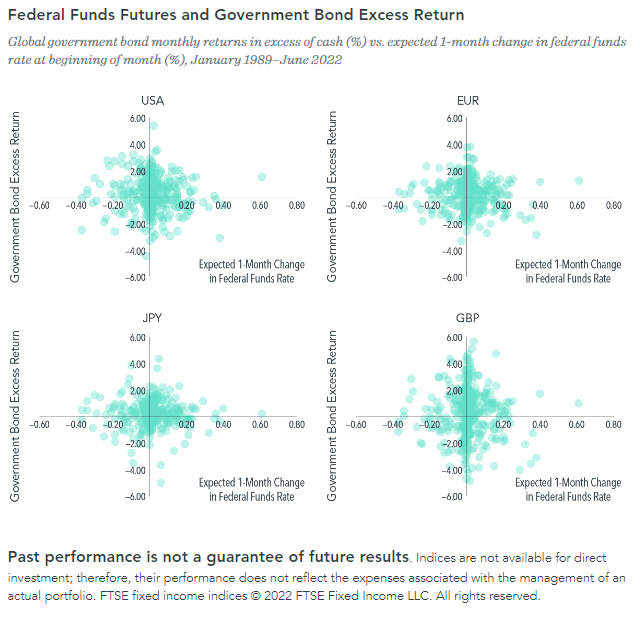

Is there a relationship between expected changes in the fed funds rate and future bond returns?

"Just like recent changes in the federal funds rate, expected changes in the federal fund rates based on current market prices of federal funds futures do not have forecasting power for future bond returns and term premiums. This is not surprising since the federal funds rate is just one of many factors in global fixed income markets driving bond returns across different currencies and durations."

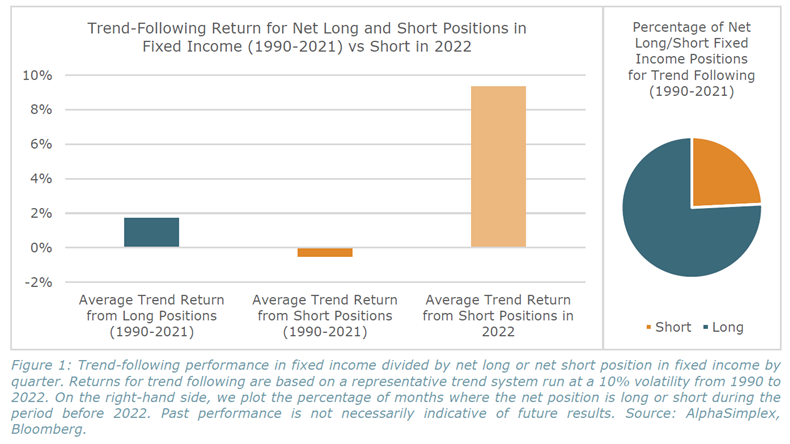

How rare is it for trend following strategies to go short bonds?

"On the right-hand side, we also note that prior to 2022, trend following has only been net short fixed income roughly 24% of the time versus roughly 76% long from 1990 to 2021. In comparison, the typical return for being net short in 2022 has been highly positive compared to the other 31 quarters since 1990 in which trend followers held short positions in fixed income. The contrast in performance from shorting bonds seems to indicate either a fluke or some sort of structural shift."

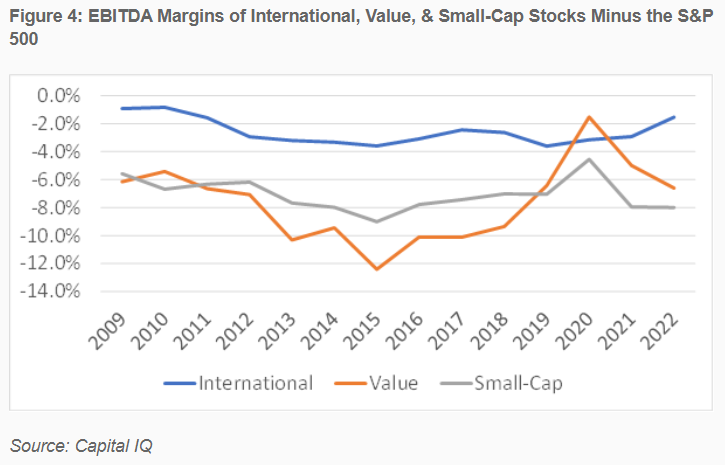

Does the S&P 500 deserve its premium valuation over small, international, and value stocks?

"When looking at return on assets or margins, we don’t see the type of sharp drop that we see in the valuation multiples. Nothing about ROA or margins explains the sharp drop in valuations for international, value, and small-cap stocks relative to the S&P 500."

Why do carry strategies make money over time?

"Fundamentally, the investor in a carry trade is looking to earn attractive volatility-adjusted returns by providing liquidity across term structures."

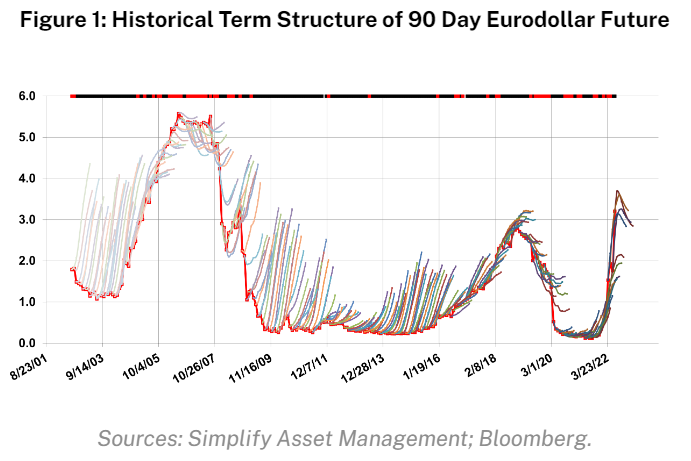

An Introduction to Carry Strategies (Simplify Asset Management)

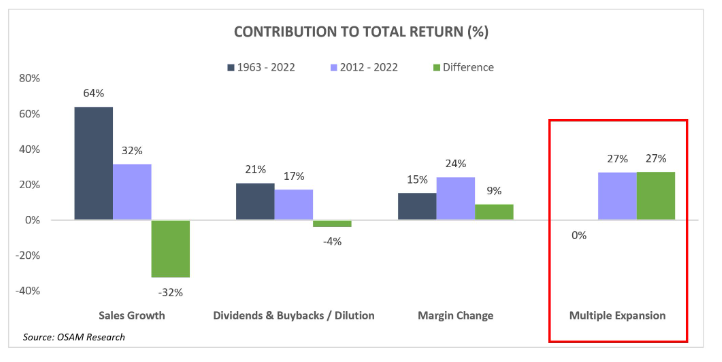

How much of the last decade's stock market returns are attributable to multiple expansion?

"Between 1963 – July 31, 2022, Multiple Expansion had no material impact on the US Large Cap Index Total Return. Yet, since 2012, Multiple Expansion accounted for a staggering 27% of total return."

“pieces” (reading time > 10 minutes)

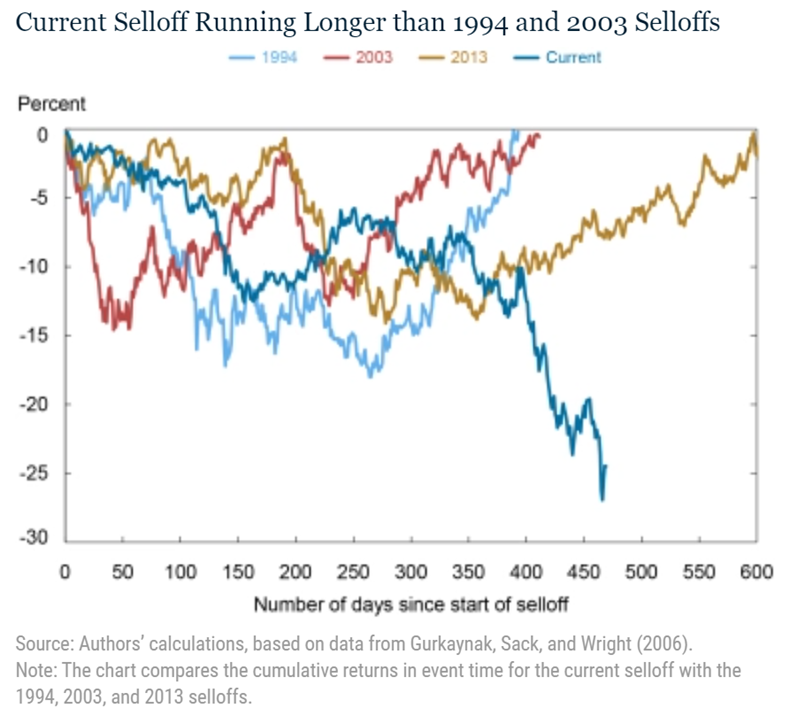

Where does the current bond market selloff rank from a historical perspective?

"The current selloff again diverges most notably from the others after day 400. The chart also shows that the 1994 and 2003 selloffs ended around day 400, whereas the current one was quickly worsening at that stage."

The Bond Market Selloff in Historical Perspective (Liberty Street Economics)

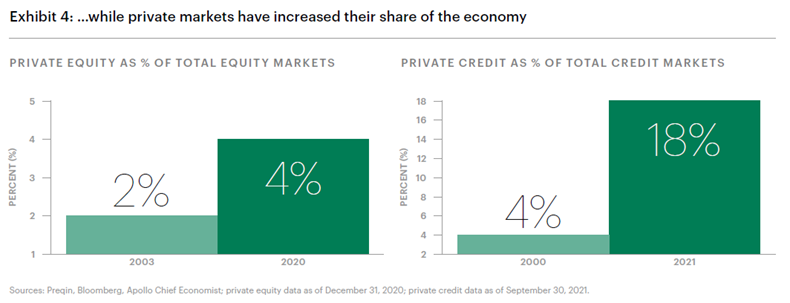

Can private market alternatives improve traditional 60/40 portfolios?

"We believe that those investors who can afford to forgo some level of liquidity can benefit from the opportunity in private markets as a source of potential excess returns as well as a mitigant to overall portfolio volatility."

How alternatives can address your 60/40 portfolio blues (Apollo)

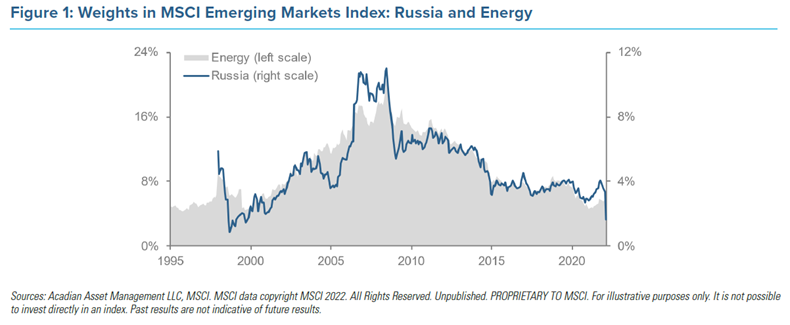

What are the implications of the Ukraine crisis for Emerging Markets investing?

"These reflections on post-invasion market behavior have several implications for EM investors. First, allocators should evaluate prospective benchmarks as active strategies, in and of themselves. No candidate EM benchmark should be adopted without scrutiny."

Reflections on the Ukraine Crisis: Watershed for EM Investing? (Acadian Asset Management)

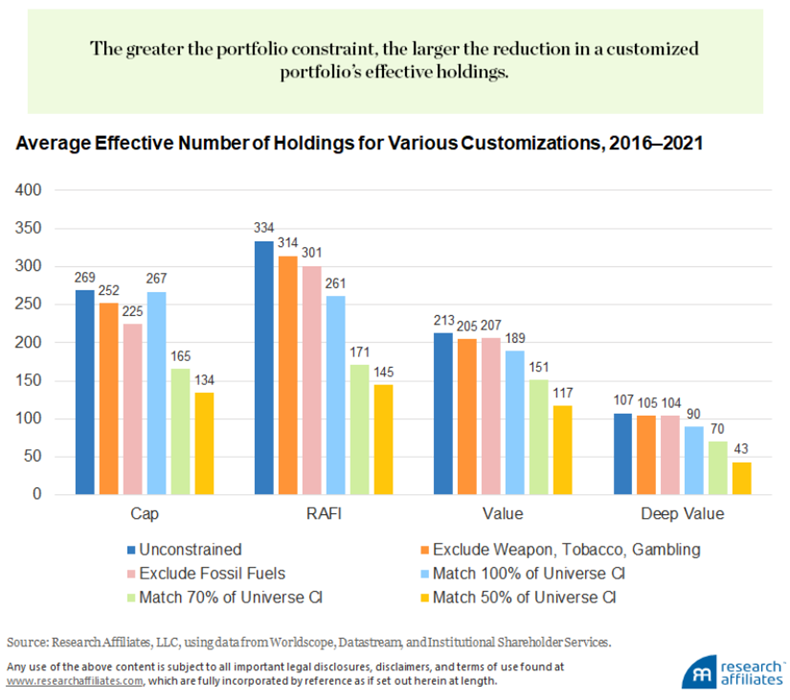

What trade-offs are involved when it comes to portfolio customization and direct indexing?

"The investment industry’s most important role (although many may view it as ancillary to the management of investment portfolios) may be the management of client expectations. Investors need to understand the portfolio characteristics, expected risk, and expected returns of the strategies they are considering. Direct indexing is no exception."

Quantifying the Impact of Direct Indexing (Research Affiliates)

Can arbitrary starting and ending points distort the analysis of asset class returns?

"As another example, the 20-year period ending February 2008 indicated that the S&P 500 index had earned 3.4% more than the Bloomberg Aggregate, annually. This was fairly consistent with the long-term premium observed for stocks over bonds in the US. However, when measured one year later, investment grade bonds exhibited an annualized 20-year outperformance of 0.2%. Note that this relationship (of bonds outperforming stocks) lasted for only that single month."

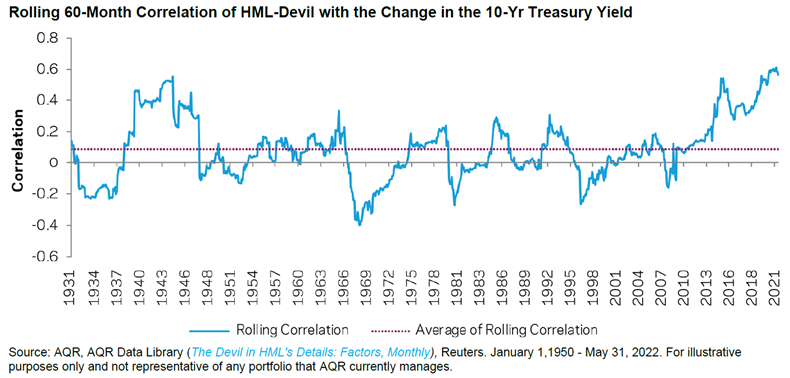

Is a bet on the value factor really just a bet on interest rates?

"Frankly, the assumption of so many pundits who state, when value versus growth has been trading correlated to interest rates and they desperately need something to say, that it makes perfect sense as growth cash flows are much longer dated, is just wrong. They should stop repeating this easy, facile, mistaken and misleading observation."

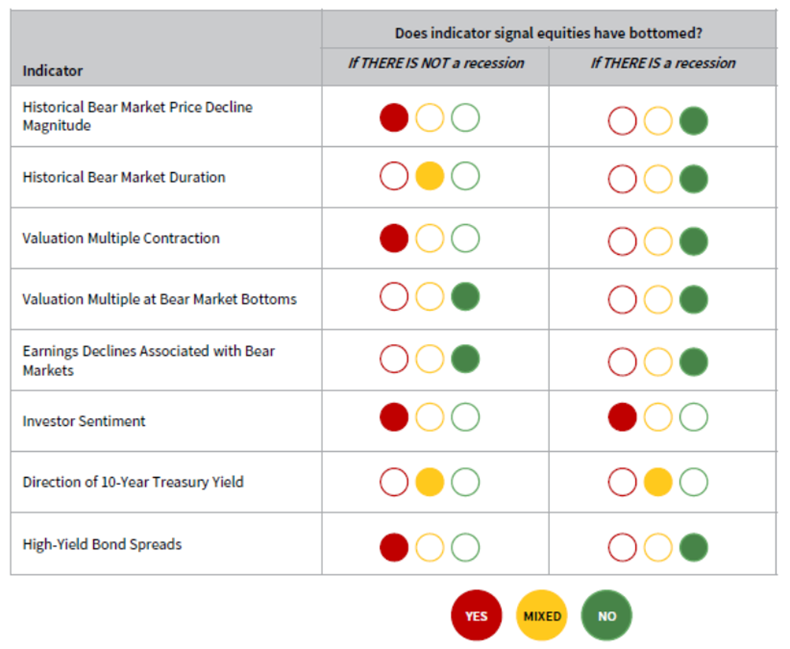

Is the worst of this bear market in equities behind us?

"If the United States does not enter a recession in the next year or two, the market may have bottomed with the decline in prices and valuation multiples close to non-recessionary bear market averages. However, if a recession comes soon, the equity market is only 50% to 70% of the way to the bottom if history proves to be a useful guide."

VantagePoint: Have US Equities Hit Bottom? (Cambridge Associates)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.