The Paper Trail: Breaking Beta

"Woah, we're half way there. Woah, livin' on a prayer. Take my hand, we'll make it I swear. Woah, livin' on a prayer." - Bon Jovi

We've reached the midpoint of 2022 and like Bon Jovi, many investors feel like they are living on a prayer.

It's been the worst first half of the year in my lifetime for the classic 60/40 portfolio, down nearly 20 percent year-to-date.

In the rare occurrences when 60/40 portfolios are in drawdowns of this magnitude, it typically means that stocks are down significantly more and that bonds are somewhat hanging in there. Not the case this year, with the Bloomberg U.S. Aggregate Bond Index down double digits this year as well.

While it seems like bright spots in a diversified portfolio are few and far between these days, it's not all red out there. Several alternative asset classes - managed futures, catastrophe reinsurance, and direct lending to name a few - have been delivering solidly positive returns this year in what can only be described as a challenging environment for beta-driven portfolios.

You'd be forgiven for thinking that "market beta" - by which I mean traditional stock and bond market exposure - is broken in light of the current backdrop. But I would argue they are merely bent, not broken. That said, investors have more options than ever before to break free from relying on traditional beta alone and can instead augment them with an ensemble of valuable, diversifying strategies. But I digress...

Please enjoy this month's installment of The Paper Trail, which addresses the following questions:

- Is there still a case for Emerging Markets?

- Are buy-and-hold, long-only allocations to commodities likely to disappoint?

- Is there more pain ahead for growth stocks?

- Does Web3 have a soul?

- How unstable is the correlation between stocks and bonds?

- And much, much more!

Have a happy (and safe) 4th of July holiday!

“bps” (reading time < 10 minutes)

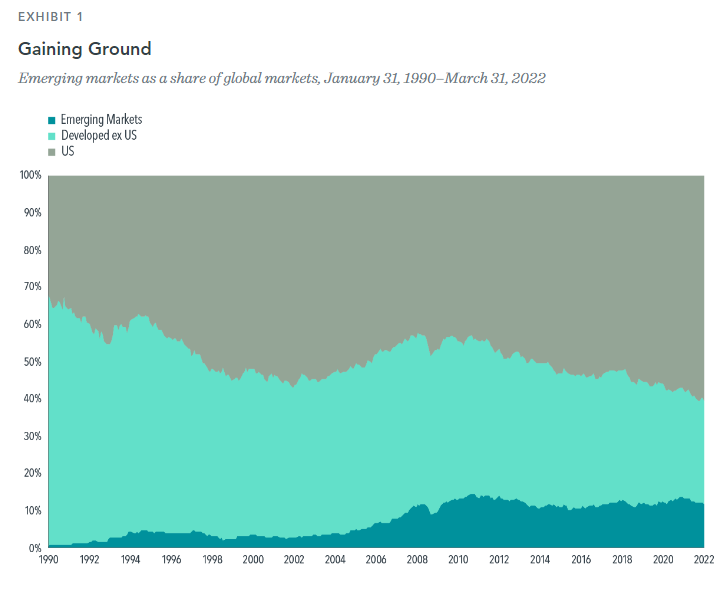

Is there still a case to be made for Emerging Markets?

"Dispersion in returns across countries can seem like a reason to stay away from emerging markets. But diversifying across individual emerging markets can help lower volatility."

The Continuing Case for Investing in Emerging Markets (Dimensional Fund Advisors)

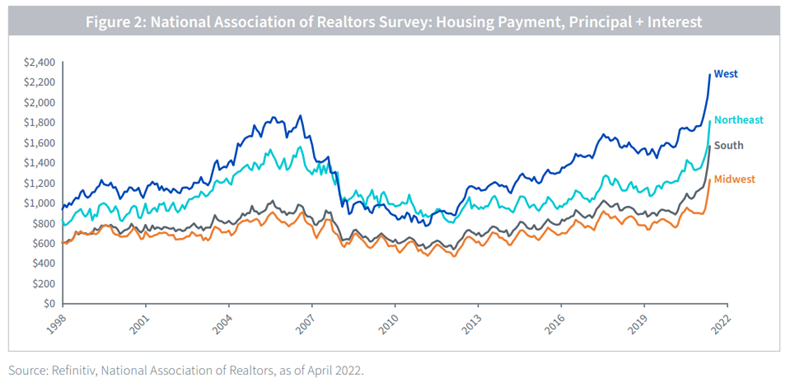

Will housing be the next domino to fall in the economy?

"I struggle to find many grizzly housing bears or anyone who will even entertain a cold spell in the labor market. Housing and jobs don’t need a deep freeze to upset the apple cart; they might only need to get a little icy to trigger downward revisions to economic forecasts."

Housing Could be the Next Cloud Over the Stock Market (WisdomTree)

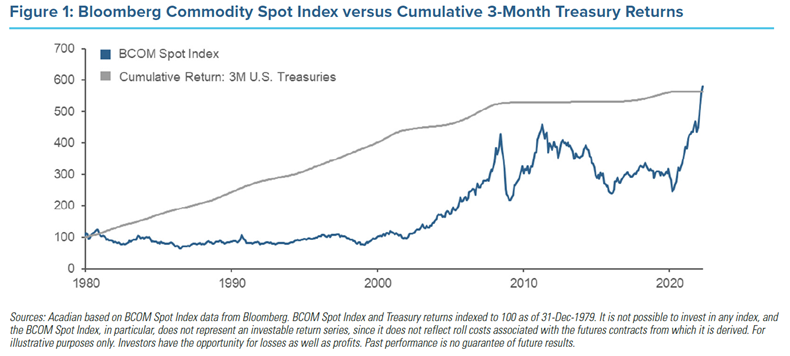

Are buy-and-hold, long-only allocations to commodities likely to disappoint?

"Rather than static long-only allocations or crude timing, we would advocate dynamic long-short positioning over the cross section of commodities. This reflects a view that commodities are regularly mispriced relative to one another, owing to the complexity of their price drivers and market segmentation. Long-short positioning also can be used to optimize exposure to carry, rather than blindly assuming the associated risk or long-term drag."

Commodities and Inflation: The Long and the Short of It (Acadian Asset Management)

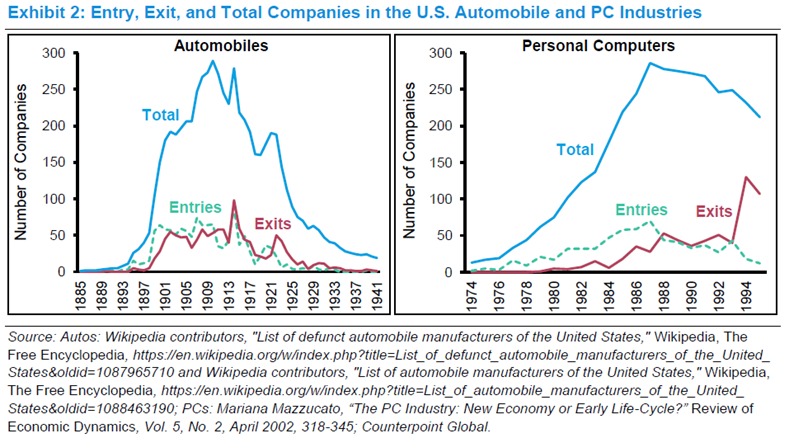

Is there a common pattern among novel industries?

"This pattern is particularly noteworthy in capitalistic economies because of the interaction between financial and technology markets. Capital flows are often very strong as a new industry develops. This money fuels vital experimentation, but since most ideas fail the investments behind them fare poorly. Capital markets are generally less enamored with the industry when exits exceed entrants, but at that juncture fewer companies capture more market share of a growing industry."

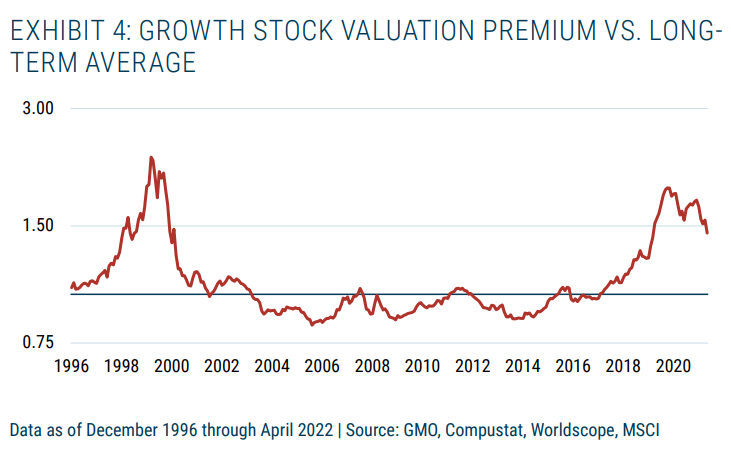

Is there more pain ahead for growth stocks?

"When growth stocks trade at a higher-than-normal premium to value stocks, the underperformance of growth traps is more extreme. Today, growth is trading about 2.3 standard deviations more expensive than normal relative to value. Absent a near-term collapse in growth stocks relative to the market, we will probably remain vulnerable on this measure for some time to come."

“pieces” (reading time > 10 minutes)

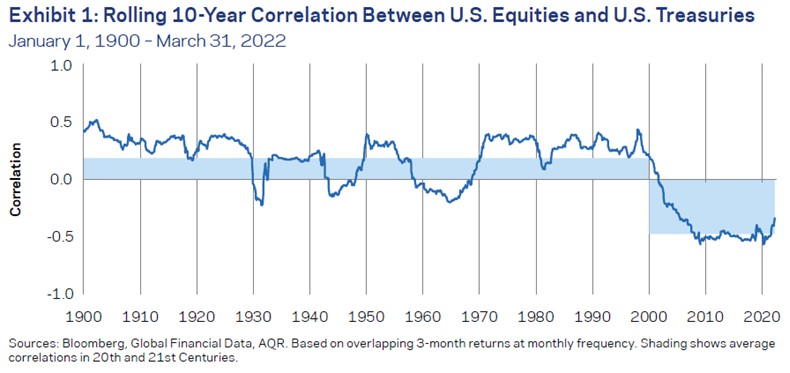

How unstable is the correlation between stocks and bonds?

"In recent decades, stock/bond investors have benefited not only from falling yields and rising valuations, but also from the strong diversification between their two main allocations. We have become accustomed to a negative correlation between stocks and bonds, but this was not the historical norm prior to the 2000s, with the average correlation positive in the 20th century."

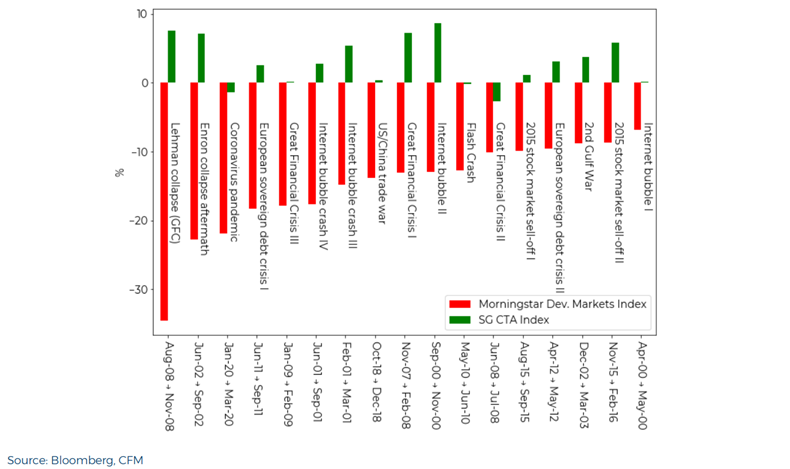

Is now a good time to consider adopting a trend following strategy?

"So, why hesitate in adding TF to your portfolio? It is a statistically significant P&L; while being scalable when applied on medium- to long term timescales and trading predominantly the most liquid futures; and plausible from a behavioral standpoint; it is diversifying even hedging with respect to big moves in equities and inflation; and it is not clear it is going away anytime soon."

A good time for Trend Following … but, then again, it's always been! (CFM)

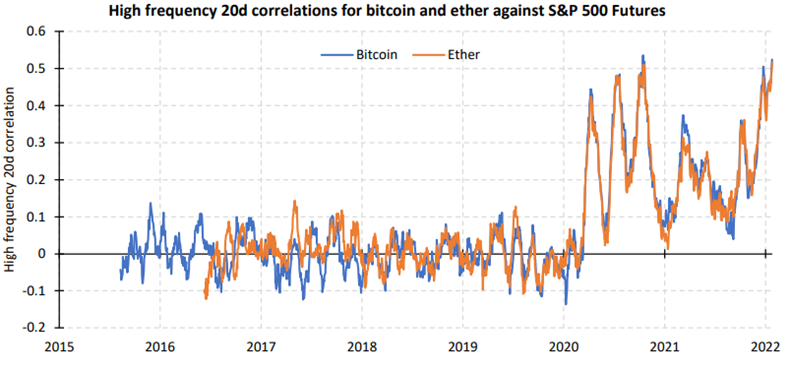

What is the role of crypto, if any, in a broader portfolio?

"It is quite possible that crypto continues on its path to becoming mainstream. Indeed, institutional adoption may increase as a result of the attractiveness of diversification. Further, tokenization has the potential to create new types of liquid investments such as digital art and music that further diversify investor portfolios."

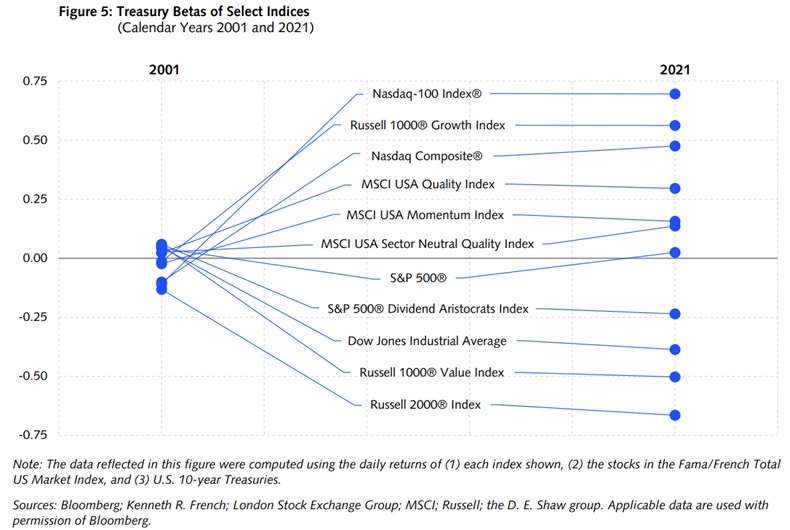

Which stocks are most sensitive to Treasury movements?

"Over the past decade, after years of remaining relatively tightly clustered, the sensitivities of stocks to movements in interest rates have become more dispersed at the individual stock, sector, and style factor levels."

Divergent Interests: Interest Rate Sensitivity in the Cross-Section of Stock Returns (D. E. Shaw)

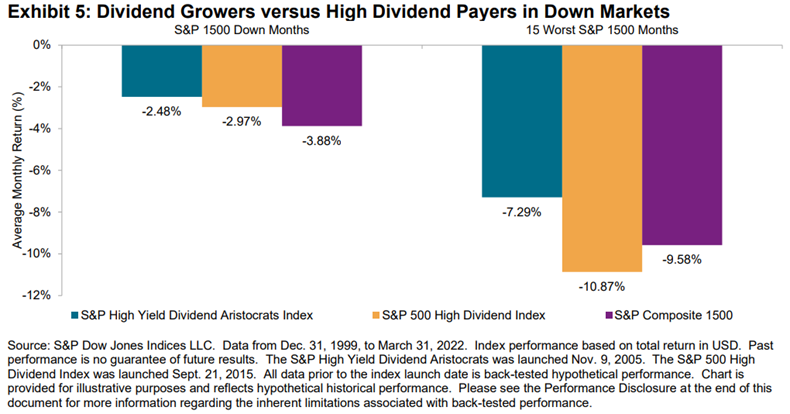

How should investors evaluate dividend growers versus high dividend payers?

"There are clear distinctions that set dividend growers apart from other dividend stocks. Dividend growers, which tend to be quality companies, have generally shown greater resilience in unsteady markets and could address concerns about dividend stocks in a rising-rate environment, to some extent."

A Case for Dividend Growth Strategies (S&P Dow Jones Indices)

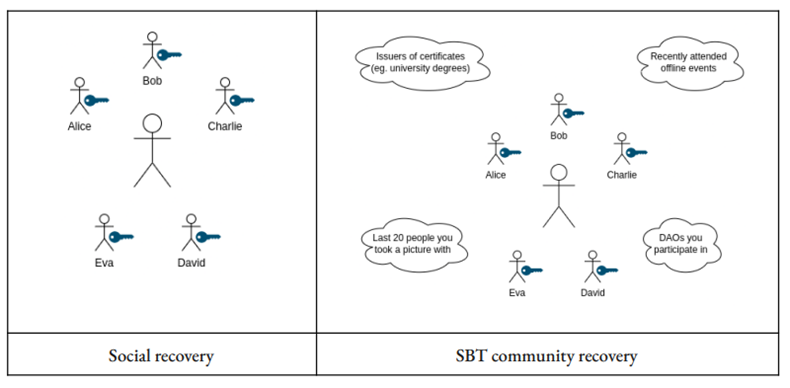

Does Web3 have a soul?

"Even more promising, we highlight how native web3 social identity, with rich social composability, could yield great progress on broader long-standing problems in web3 around wealth concentration and vulnerability of governance to financial attacks, while spurring a Cambrian explosion of innovative political,

economic, and social applications."

Decentralized Society: Finding Web3’s Soul (E. Glen Weyl, Puja Ohlhaver, Vitalik Buterin)

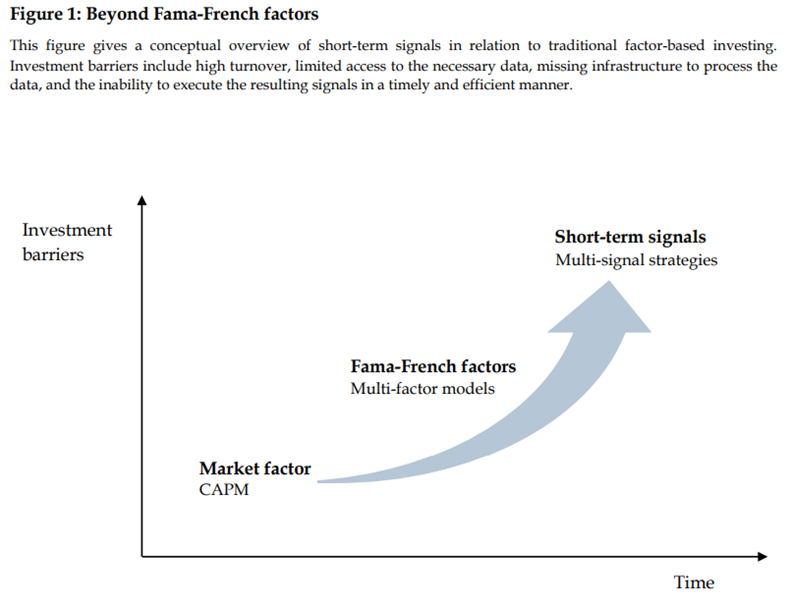

Is there alpha to be captured from short-term signals?

"Our results imply that high-turnover anomalies are rejected too easily based on market friction arguments. However, many investors may experience other investment barriers which prevent them from harvesting these short-term signals. Such investment barriers include having limited access to the necessary data, missing infrastructure to process the data, and the inability to execute the resulting signals in a timely and efficient manner."

Beyond Fama-French Factors: Alpha from Short-Term Signals (Robeco Quantitative Investments)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.