The Paper Trail: Certain Uncertainty

Memorial Day Weekend is in the rearview mirror, which means that summer has (unofficially) begun and many parents are preparing to send their kids off to summer camp.

I attended a camp of my own this past week - Capital Camp.

For those unfamiliar, Capital Camp is an annual, three-day food & wine festival investment conference in Columbia, MO, bringing together some of the most curious and thoughtful investors, capital providers, entrepreneurs, and executives in a casual setting to learn and discuss many of the biggest themes and topics across the investment landscape. This diverse group of attendees spanned venture capital, private equity, real estate, public markets, hedge funds, wealth management, family offices, and more.

The common thread throughout all these conversations was that of uncertainty. There seems to be no escaping it these days - taming inflation, interest rate volatility, banking stress, recession worries, cracks in commercial real estate, the debt ceiling, artificial intelligence. I could go on.

But don't let that fool you into thinking that yesteryear was full of certainty or that uncertainty will disappear in the years ahead. To borrow a line from Pliny the Elder, "The only certainty is that nothing is certain."

While one of this month's research papers will highlight the elevated macro uncertainty today relative to the less volatile environment of the 2010s, we must recognize that uncertainty is omnipresent and construct our portfolios accordingly. And while uncertainty generally carries a negative connotation, a great deal of progress, innovation, and opportunity can arise from uncertainty.

With that in mind, please enjoy the May edition of The Paper Trail. This month's research roundup features:

- Defensive alternative investments

- Venture capital's reset

- Interest rates and their impact on the returns of hedge fund strategies

- Reported vs. real-world private market performance

- India's stock market expectations

- Economic trend

- Asset-based finance

- Elevated profit margins

- The cross-section of factor returns

- And much more!

“bps” (reading time < 10 minutes)

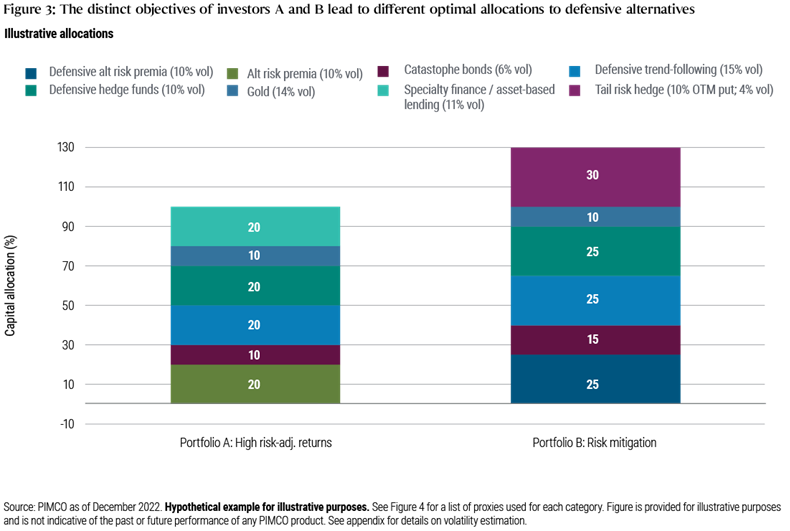

What are the tradeoffs to consider when evaluating defensive alternative investments?

"We believe the ultimate key to success when designing a defensive alternatives program is to take a total portfolio approach. It is critical to ensure sizing of various strategies is commensurate with overall objectives of the program and the impact it is intended to have on the overall policy portfolio."

Modernizing the Diversification Toolkit: Allocating to Defensive Alternatives (PIMCO)

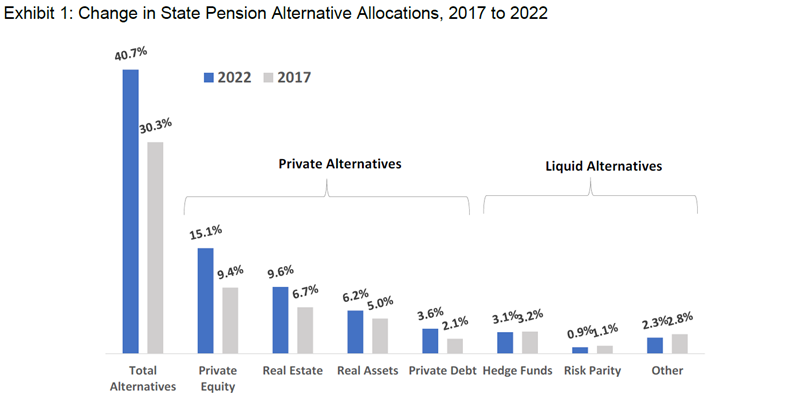

How have institutional allocators' alternative investment preferences changed over time?

"Allocations to alternatives have increased among all investor groups, but perhaps nowhere more than the $3 trillion state pension market, where alternatives increased a remarkable 10% in just the last five years, reaching 41% of total state pension assets as of June 30, 2022. However, not all alterative asset classes benefited. Those alternative asset classes relying upon the private markets (private equity, real estate, real assets, and private debt) rose 11% over the most recent five-year period while liquid alternatives (hedge funds, commodities, managed futures, risk parity, and other risk-mitigating strategies) fell -1%."

Institutions Choosy About Their Alternative Investments (Cliffwater)

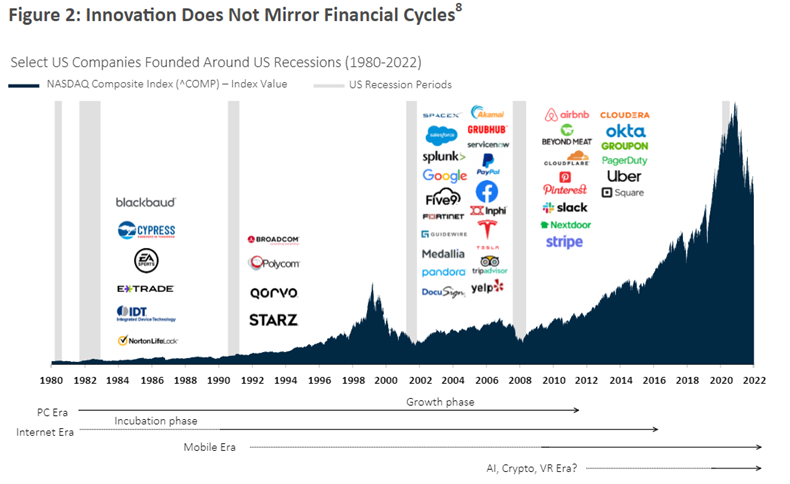

Is the recent market sobriety a good thing long-term for the venture capital ecosystem?

"As investment pacing, valuations, and terms revert toward historical means, we believe the environment will be more compelling for traditional investors. Furthermore, we think competition will be reduced (both from fewer startups, but also lower R&D budgets at tech incumbents), talent availability will be more abundant, and capital efficiency will be at the forefront of every company's mind."

Powerful Long-Term Trends Boost Venture Capital Outlook (Adams Street Partners)

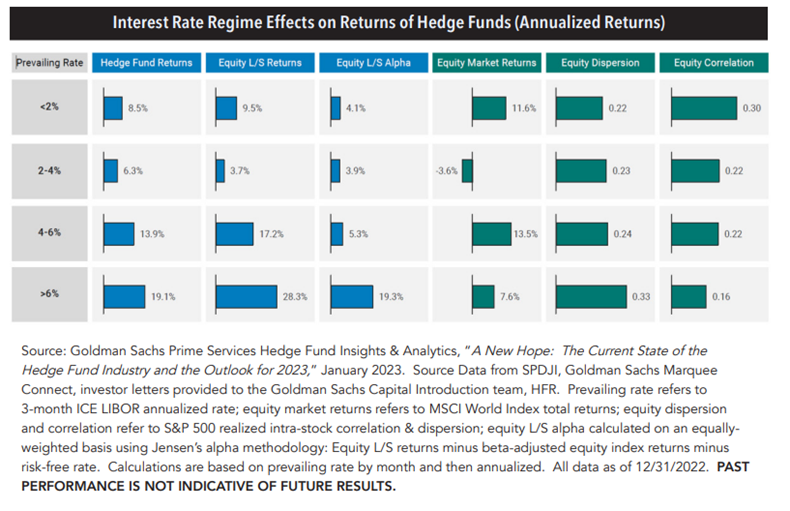

How have the expected return of hedge fund strategies been impacted by rising interest rates?

"In conclusion, a higher prevailing risk-free rate historically has corresponded with elevated hedge fund returns. We believe today’s environment is likely to have similar characteristics. It should translate to higher returns in directional credit strategies. It also increases the rate earned on unencumbered cash, which is a staple of some hedge fund strategies, particularly macro. And finally, there are direct benefits to long/short equity in the form of higher short rebates, along with indirect benefits resulting from potentially higher stock dispersion and lower stock correlation."

Modeling the Expected Return for Hedge Funds—Should It Be Higher Today? (Evanston Capital)

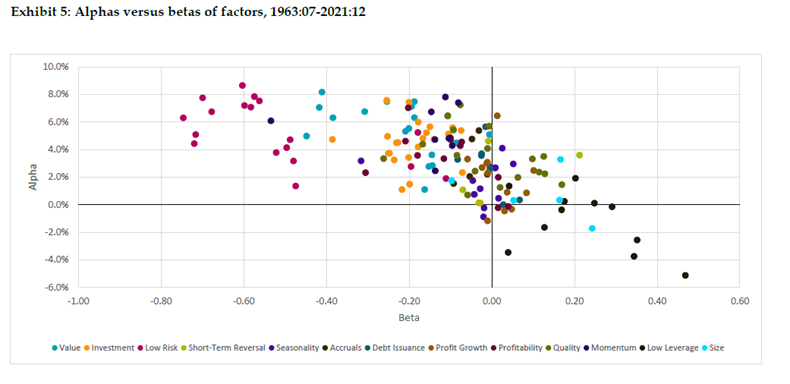

How deep is our understanding of equity market factor behaviors?

"Our study also deepens the insights into factor performance cyclicality, establishes a low-beta effect at the level of factors, and confirms the existence of seasonal and momentum effects in the cross-section of factor returns. Altogether, our findings show which kind of factors are rewarded and which ones not, how their performance varies in different market environments, and how investment strategies can be built on factors themselves."

The Cross-Section of Factor Returns (Robeco Quantitative Investments)

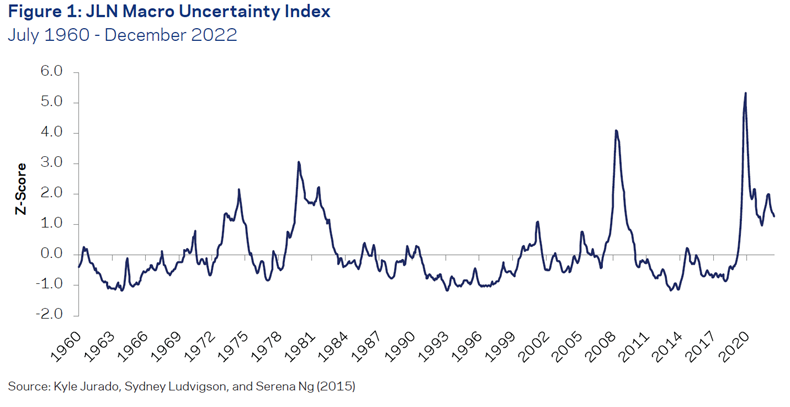

Is today's macroeconomic uncertainty abnormally high relative to history?

"Macro uncertainty has indeed been exceptionally elevated throughout the 2020s. It peaked in the first half of 2020 and is currently at levels not seen since the 1980s, save for during the global financial crisis.2 The recent period stands in contrast to the 2010s, a decade during which macro uncertainty was consistently, and often meaningfully, below average."

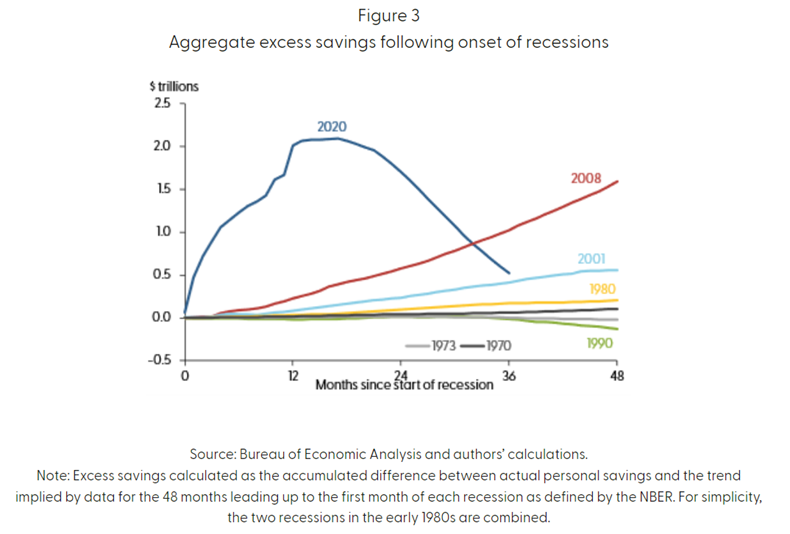

How do household savings patterns from the pandemic-induced recession compare to prior recessions?

"We show that households rapidly accumulated unprecedented levels of excess savings—defined as the difference between actual savings and the pre-recession trend— relative to previous recessions. Moreover, despite a rapid drawdown of savings in recent months, there is still a large stock of aggregate excess savings in the economy—some $500 billion. The distribution and allocation of excess savings and wealth across the income distribution suggest that households on average, including those at the lower end of the distribution, continue to have considerably more liquid funds at their disposal compared with the pre-pandemic period. We expect that these excess savings could continue to support consumer spending at least into the fourth quarter of 2023."

The Rise and Fall of Pandemic Excess Savings (Federal Reserve Bank of San Francisco)

“pieces” (reading time > 10 minutes)

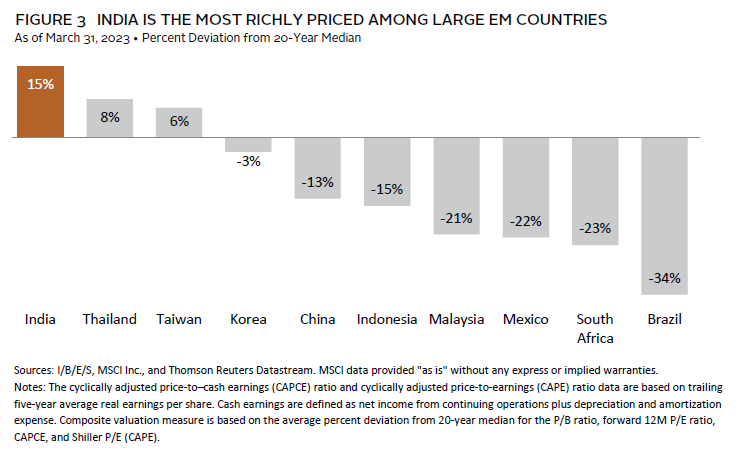

Can India's stock market live up to its expectations?

"India has arguably the most compelling long-term growth opportunity in the global economy today. However, we don’t think Indian equities are an attractive overweight position on a tactical investment horizon. The long-term structural shifts in India’s economy will take years to play out, and the market appears fully priced for this reality with little margin of safety. "

Buying India’s Growth Story, But Not Today (Cambridge Associates)

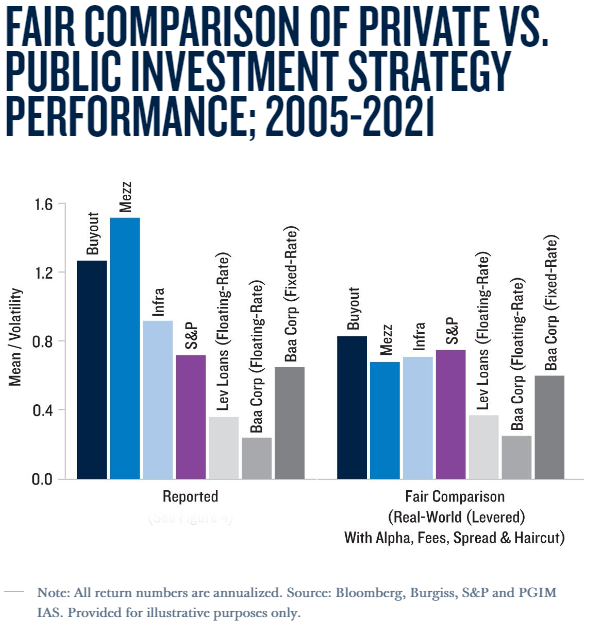

Is the reported outperformance of private assets (over public) achievable in the real world?

"Consequently, reported private asset class performance measures (e.g., pooled IRRs) – which assume an investor’s allocation is always 100% invested in a highly diversified set of funds – are misleading because they do not incorporate fund selection, commitment pacing and the performance of uncalled and uncommitted capital, which are all an integral part of a private investment strategy’s real-world performance."

Private vs. Public Investment Strategies: Reported and Real-World Performance (PGIM)

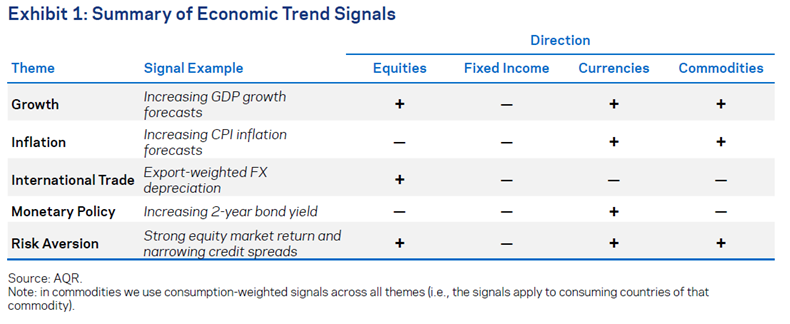

Can managed futures strategies be improved by incorporating "economic trend" signals?

"Because they share a common mechanism, economic trend and price trend tend to be positively, though modestly, correlated. A comprehensive trend-following strategy that combines price and economic trends thus outperforms either approach standalone."

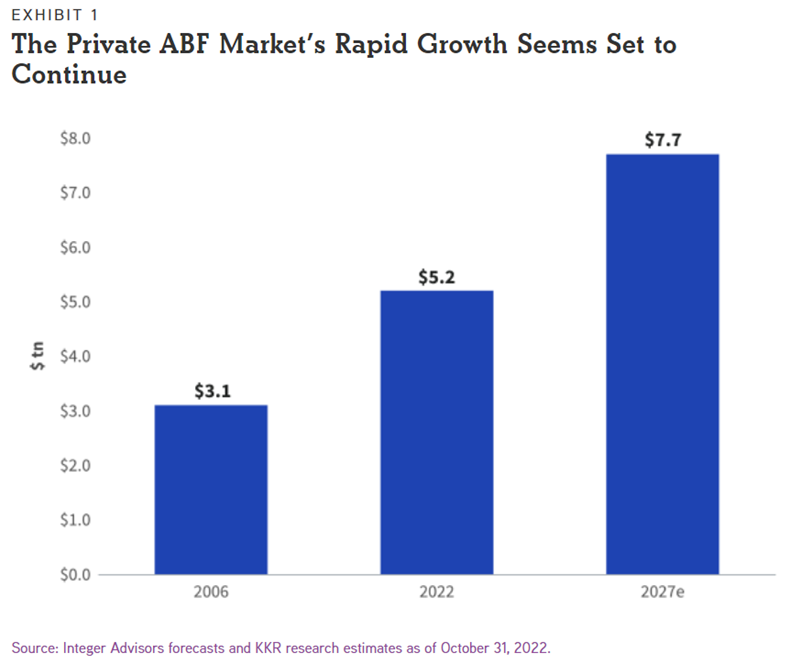

Is asset-based finance (ABF) the next frontier of private credit?

"The impressive speed at which private asset-based finance (ABF) has expanded in the wake of the Global Financial Crisis is a sign of an ongoing structural shift that we think will continue to drive strong growth. Considered alongside its potential investment benefits, we think the asset class has earned investors’ attention."

Asset-Based Finance: A Fast-Growing Frontier in Private Credit (KKR)

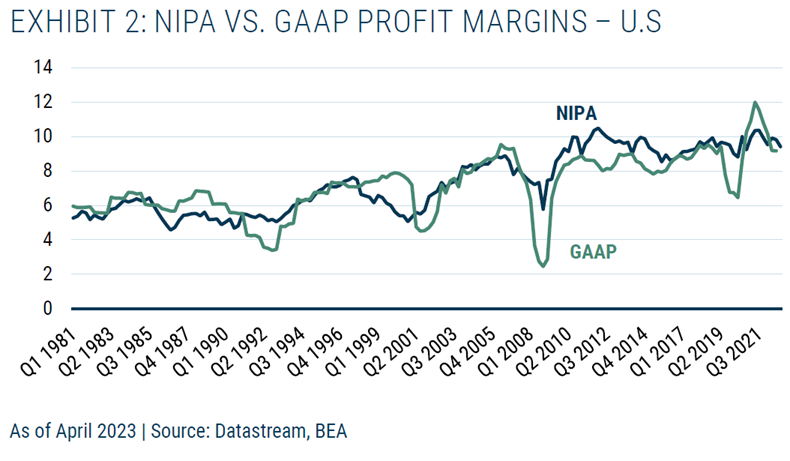

Why haven't historically high profit margins shown any sign of mean reversion?

"It transpires that fiscal deficits have been the culprit. Between 1950 and 2011, the fiscal deficit averaged just less than 3% of GNP each year. In the period from 2012 to 2022, the fiscal deficit was more than double the previous average, at 6.6%. This isn’t just the impact of the pandemic: the same basic pattern holds even when I exclude the Covid years! The main sources of the increased deficit have been health spending and social security expenditure (again true even with Covid data excluded). Is this era of what Minsky would have called “Big Government” here to stay? That is beyond my ken, and I am chastened by my failed prognostication over the last decade."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.