The Paper Trail: Darkest Before the Dawn

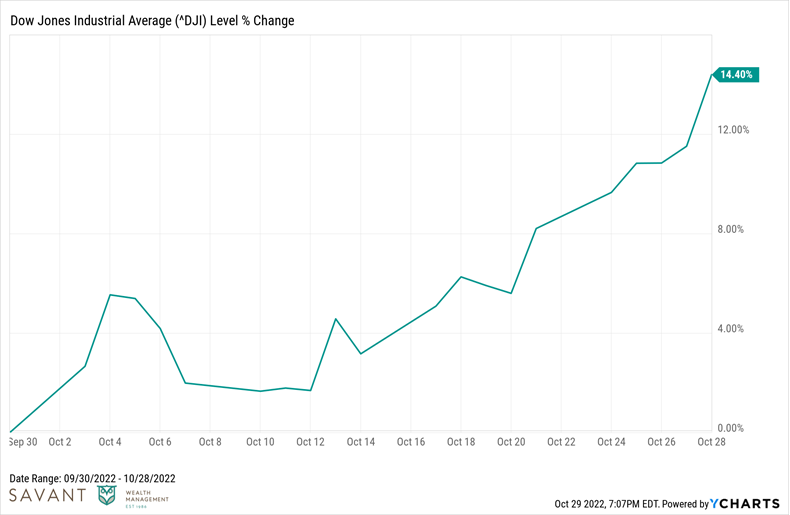

It's ironic that today, on Halloween of all days, markets feel (somewhat) less spooky than they were a month ago.

Following a dismal Q3, the Dow Jones Industrial Average is on pace to register (pending how things close today) it's best October of all time and its best month of performance since January of 1976.

It's been a year of Tricks for investors thus far in 2022. Let's hope this is a sign of some Treats coming our way.

***

Have a fun and safe Halloween! Please enjoy this month's spine-chilling, hair-raising, and frightening (ok, not really) installment of The Paper Trail...

This month's research roundup covers:

- Inflation's silver linings

- Asset-backed securities

- Recessions and real estate

- Bear market bottoms

- Software stock valuations

- Alternative investments in multi-asset portfolios

- Long-horizon asset allocation frameworks

- Evolving private markets dynamics

- And much more!

“bps” (reading time < 10 minutes)

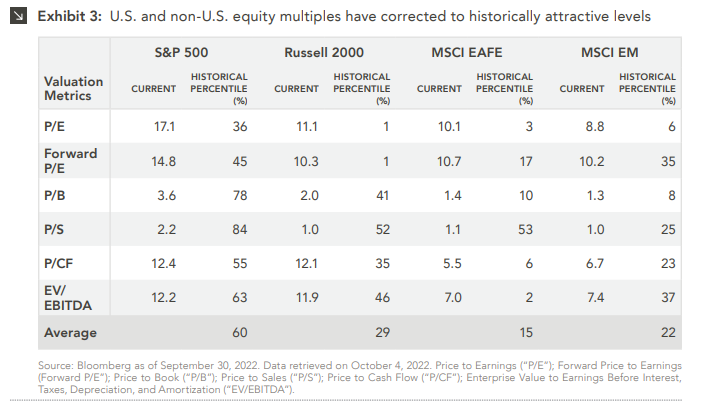

What opportunities may arise from this year's market bloodbath?

"This year’s correction has returned large-cap equity multiples to historical averages, while small-cap valuations appear extremely attractive from an earnings multiple perspective. International equities look even better than U.S. equities after years of relative underperformance with developed and emerging markets trading at lower multiples than their U.S. counterparts. Over longer time periods, fundamentals drive returns, but today’s lower valuations set up equities for considerable upside potential in the coming years."

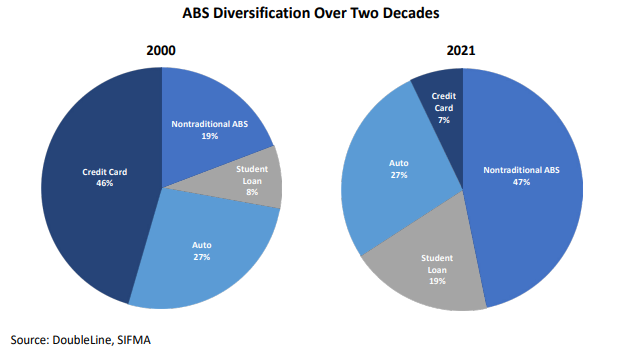

Are fixed income investors under-allocated to Asset-Backed Securities (ABS)?

"Over the past decade, ABS has evolved substantially, surpassing other financial products in its ability to provide an attractive and diverse universe of investment opportunities. Importantly, the evolution and growing sophistication of ABS allows skilled investment teams to tailor portfolios to a growing investor base with a broad range of investment goals."

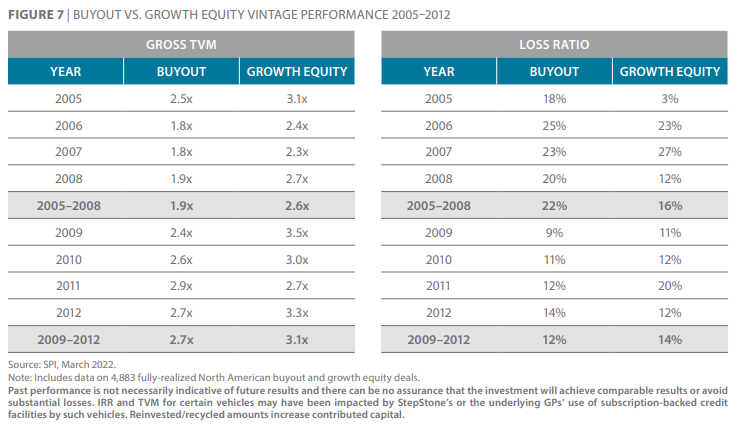

Is growth equity underappreciated as a private equity strategy?

"We believe the most compelling evidence to support an allocation to growth equity is that historical data on returns suggest the strategy has the potential to provide VC upside with buyout-level loss ratios."

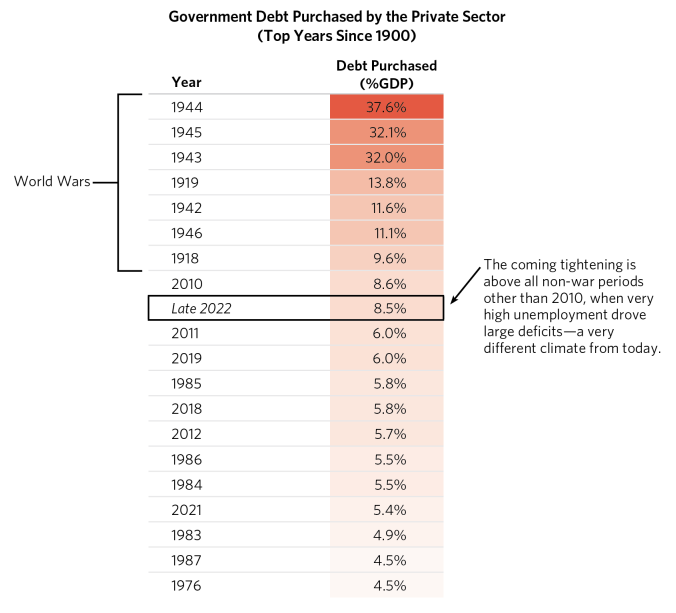

Are investors properly discounting the Fed's removal of liquidity from the market?

"The amount of government debt that will need to be absorbed by the private sector in the coming months is larger than at any time outside of world wars (when the central bank engineered a safe risk premium on bonds) and the global financial crisis."

An Update from Our CIOs: Progressing Through the Tightening Cycle (Bridgewater)

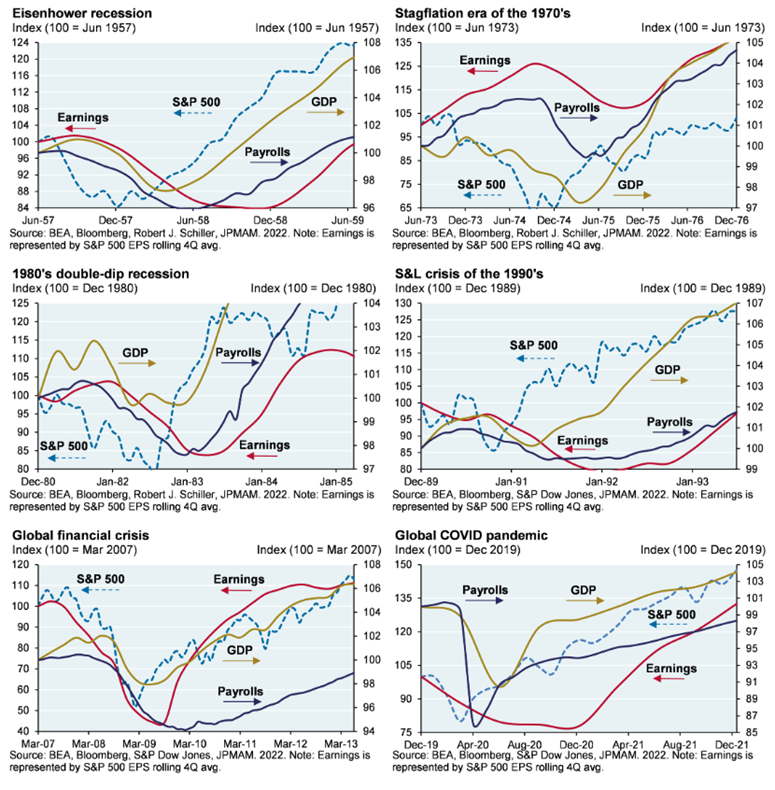

Does the market always bottom before the economy?

"I read around 1,500 pages of research each week and the most consistent message now is a litany of gloom on earnings, valuations, wage and price inflation, Central Bank policy normalization, housing, trade, energy, the surge in the US$, China COVID policy, etc. I am not saying that these things are not important, since of course they are (see Appendix charts). But for investors, there is a remarkable consistency to the patterns shown below: equities tend to bottom several months (at least) before the rest of the victims of a recession."

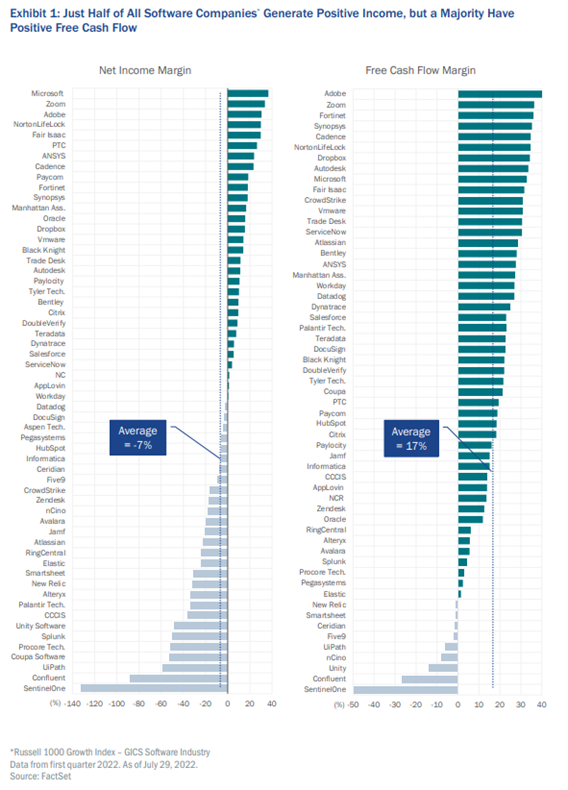

Are Software as a Service (SaaS) stocks actually cheap now?

"After peaking during the pandemic, the significant correction since late 2021 has taken the average software multiple back to pre-COVID levels, despite what we believe is structurally higher growth for many of these companies because of the lessons enterprises learned during the pandemic."

Uncovering the Value in Software Stocks (Jennison Associates)

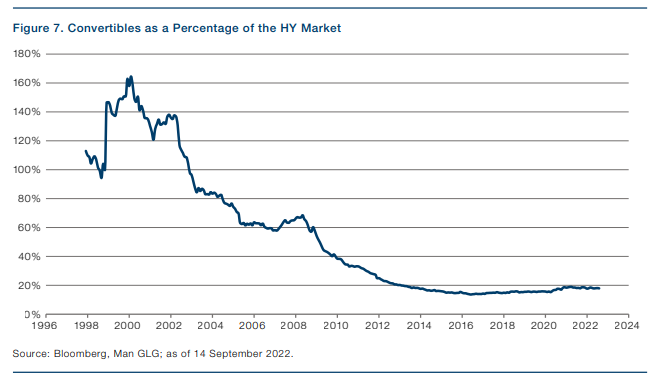

Are convertible bonds looking like an attractive opportunity?

"Now the boot may be the on the other foot. With corporate debt increasingly costing more, we may see a trend towards issuing convertibles. If this does occur, we expect it to supportive for active convertible bond managers. On the one hand, greater issuance means a higher total stock of convertibles – and more opportunities to exploit price dislocations. In addition, primary issuance tends to come at a discount to theoretical value. Finally, we foresee a meaningful transition period during which these relative market sizes normalize which will require a disruptive reallocation of capital within the greater credit universe. "

“pieces” (reading time > 10 minutes)

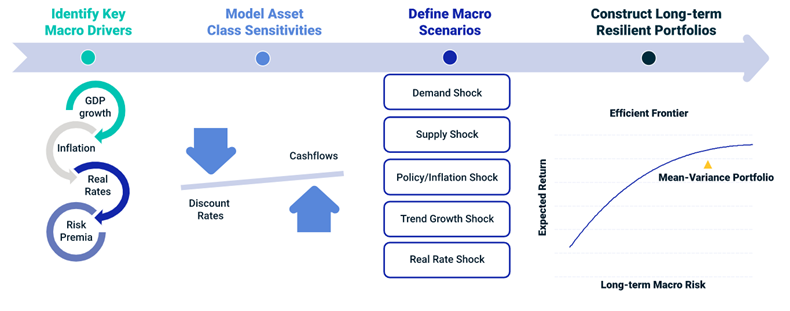

Can asset allocation frameworks be improved upon to provide greater resilience against macro uncertainty?

"Incorporating these long-term dynamics into the investment process requires understanding how the cash flows and discount rates of each asset class are exposed to the macro factors driving the long-horizon investment landscape. Rather than falling into simple growth/inflation buckets, such as equity to growth or real assets to inflation protection, macro sensitivities cut across all asset classes. Every asset class has a different degree of sensitivity to macro shocks of all kinds."

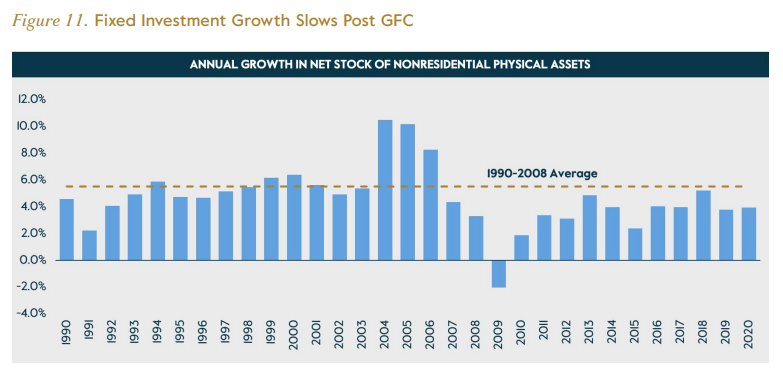

Is the post-GFC era finally over?

"After more than a decade of free money but nowhere to put it (aside from bidding up the price of the existing stock of assets), we seem to be entering a period of “deferred maintenance.” Capital deployment opportunities will increase as management teams and policymakers ramp-up fixed investment to boost capacity, add redundancies, and develop more robust systems and production networks. Viewed from the emotional distance of a three-to-five-year investment horizon, this shift would seem quite favorable to the growth outlook, perilous as it may prove for those investment strategies premised on a limitless supply of money to burn."

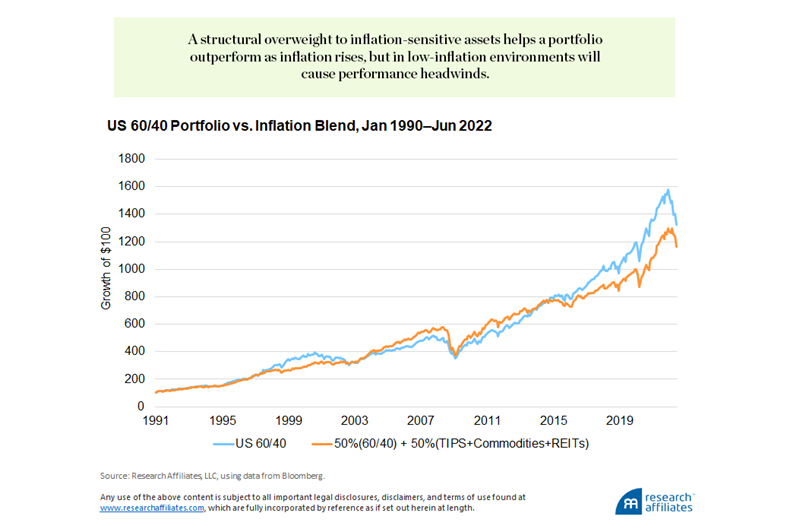

What signals can investors turn to when seeking to manage the risks of a lengthy inflation cycle?

"As you read this article, inflation may still be rising or maybe it has already peaked. Either scenario has impacts on our portfolios. We find that using the inflation cycle metric, which identifies a deviation in longer-term expected inflation, provides a dynamic tilting mechanism that allows investors to profit from inflation surprises both to the upside and to the downside."

The Silver Lining of Unexpected Inflation (Research Affiliates)

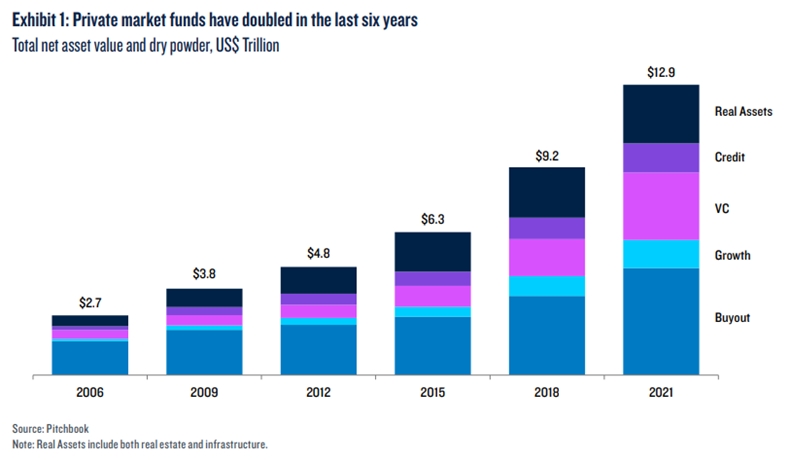

What are the portfolio implications of an evolving private markets landscape?

"Quite simply, traditional models of companies raising capital through bank officers and stock exchanges have been disrupted. The resulting growth and transformation in private capital markets is opening new investment opportunities – as well as new sources of risk – for institutional investors. On the one hand, many private equity and credit markets are sufficiently scaled to allow investors to increase allocations, diversify portfolios and access potentially higher returns. On the other hand, investors need to consider the illiquidity, embedded leverage, higher fees and limited transparency as well as potentially frothy valuations in some corners of private markets."

The New Dynamics of Private Markets: Investment Risks and Opportunities (PGIM)

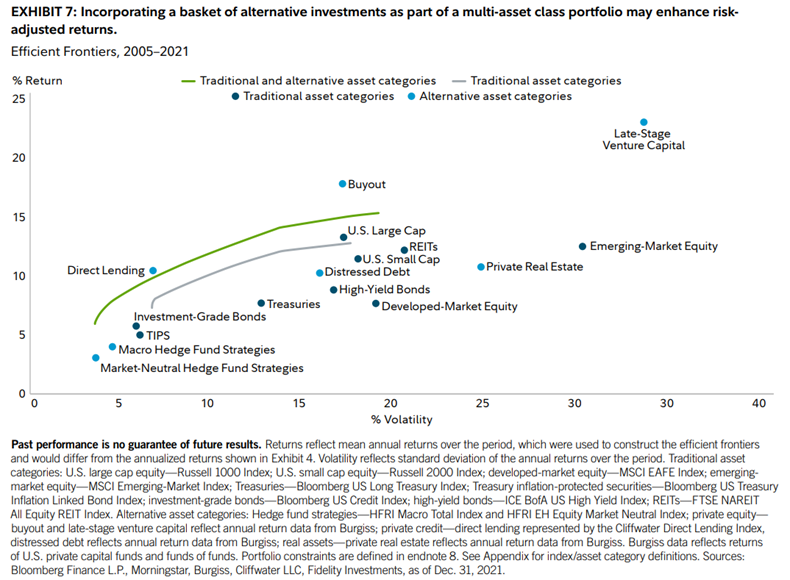

What is the role of alternative investments in multi-asset portfolios?

"As the asset mix is expanded to include alternatives, the efficient frontier moves up and to the left on the chart, reflecting a higher level of return for the same unit of risk. By broadening the investment opportunity, this second set of portfolios boasted the stronger historical risk-adjusted returns of the two frontiers. This improved efficiency is the result of including additional asset categories with diversification benefits or higher historical returns at an equal or lower expected level of risk."

Alternative Investments and Their Roles in Multi-Asset Class Portfolios (Fidelity)

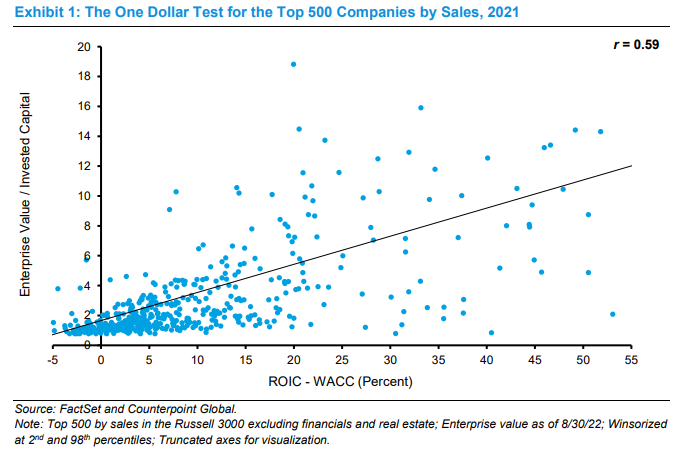

How helpful is Return on Invested Capital (ROIC) in assessing whether a company is creating value with its investments?

"Financial metrics are widely used in the managerial and investment communities. But not all measures are created equal. A good metric is one that is well defined in concept and corresponds with desired objectives. ROIC is straightforward in principle but requires numerous judgments in implementation. Shoddy calculations are common."

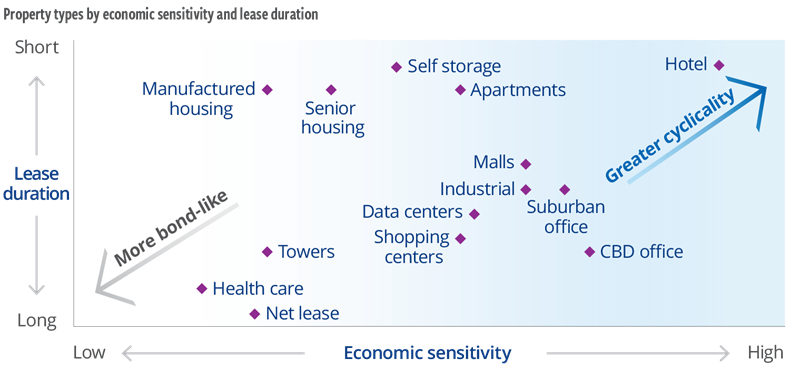

How would a recession impact the outlook for both listed and private real estate?

"In the case of slow growth—or even a recession—longer, inflation-linked rental contracts offer relatively strong and steady income growth potential."

Recession and the roadmap for listed and private real estate (Cohen & Steers)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.