The Paper Trail: Diversify Your Diversifiers

"Wake me up when September ends." - Green Day

Good riddance Q3.

The Summer rally proved to be short-lived, with equity markets giving back their gains (and then some). Interest rates and bond prices continue to defy any sort of precedent. In short, this historically challenging year for investors has continued to test the patience and discipline of many.

Here's hoping we get some relief to close out the remaining three months of the year!

***

Now on to the latest installment of The Paper Trail...

This month's research roundup covers:

- Mitigating line-item risk with diversifying strategies

- Neutralizing sector exposures in equity portfolios

- Single-family rental investments

- The opportunity in publicly traded REITs

- Replicating VC returns in public markets

- Bitcoin's developer community

- And much more!

“bps” (reading time < 10 minutes)

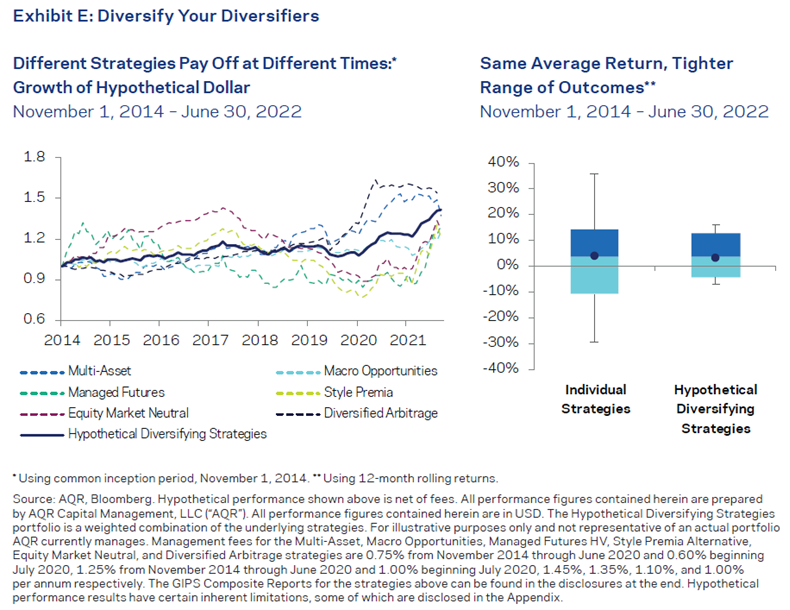

How can investors successfully diversify their portfolios without introducing "line-item risk"?

"Many strategies touted as alternatives offer little in the way of actual diversification. And even if these can be efficiently screened out, the question remains how best to build a portfolio of “true” diversifiers. Individual strategies have ups and downs that, by construction, happen unconventionally. Fortunately, if there are multiple strategies to diversify across, many of these bumps can be made smoother. For these reasons, we believe a diversified collection of alternative strategies may offer the best path to diversification—an investment that is easier to allocate to and easier to stick with."

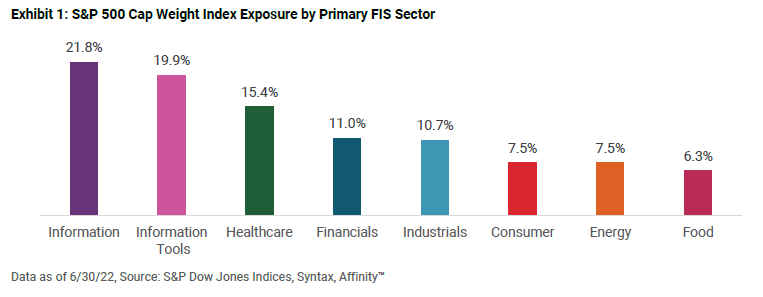

Should investors neutralize the sector exposures in their equity portfolios?

"We discussed how the term sector neutral is a relative term that typically

means a portfolio has similar sector weights as the benchmark. However, by

following a benchmark such as the S&P 500, investors are taking a view that

the largest sectors will continue to outperform the smaller ones. This

challenges the notion of neutrality in our view as it implicitly takes a bullish or

bearish view on particular business risks."

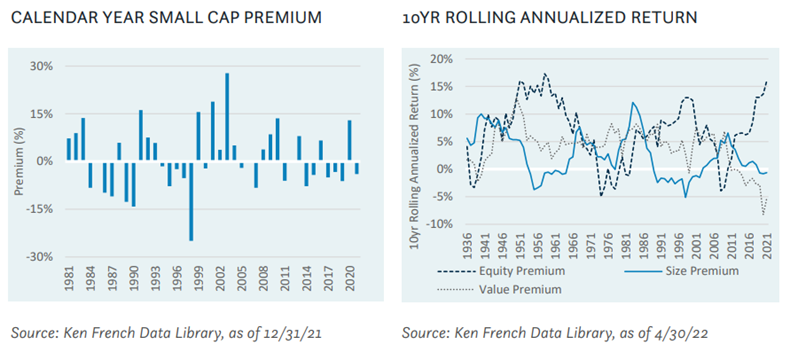

Is there still a small-cap premium in stocks?

"From a purely statistical standpoint, the past 40 years of small cap behavior casts doubt on the existence of a small cap premium. It may be possible that some of the fundamental characteristics of small cap companies have changed over the years, leading to a diminished small cap premium."

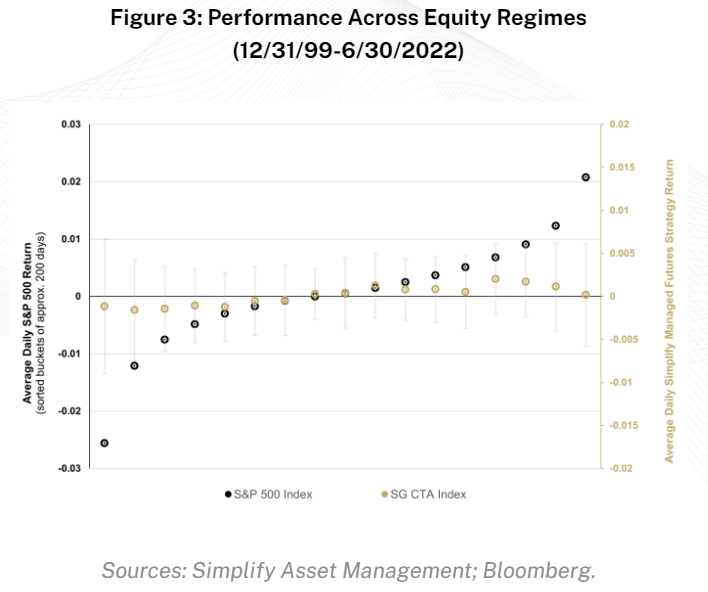

What are the potential portfolio benefits of managed futures?

"One may wonder initially if this is more of a muted beta to equities, or maybe even a beta near zero. But upon careful inspection, you indeed see the beta between CTAs and the S&P 500 becomes increasingly negative as equity performance worsens, precisely the characteristic of positive convexity."

Portfolio Diversification with Managed Futures (Simplify Asset Management)

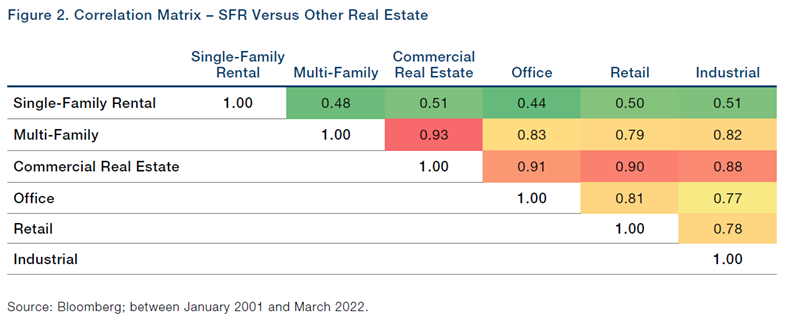

Should investors give greater consideration to a single-family rental (SFR) allocation in their real estate portfolio?

"While performance has been positive, a potentially even more compelling reason to add SFR to a portfolio is the diversification benefits it provides."

Diversifying With Picket Fences: Single-Family Rental Investments (Man Group)

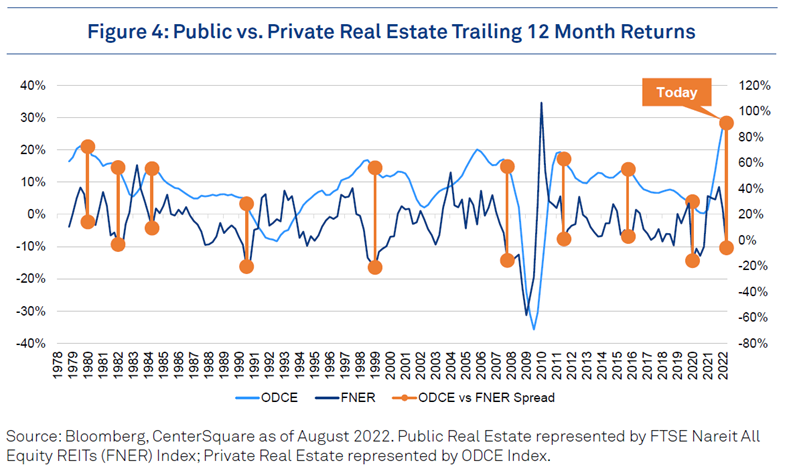

Is the current discount in publicly-traded REITs relative to private real estate providing an attractive entry point?

"We find ourselves today in a similar position where the REIT market seems to be bottoming after adjusting implied real estate valuations for macroeconomic headwinds, all while the private market is still posting strong results. During these periods when the state of the capital markets is in flux and private markets are slow to adjust, we look to the public markets to directionally indicate the path for pricing."

“pieces” (reading time > 10 minutes)

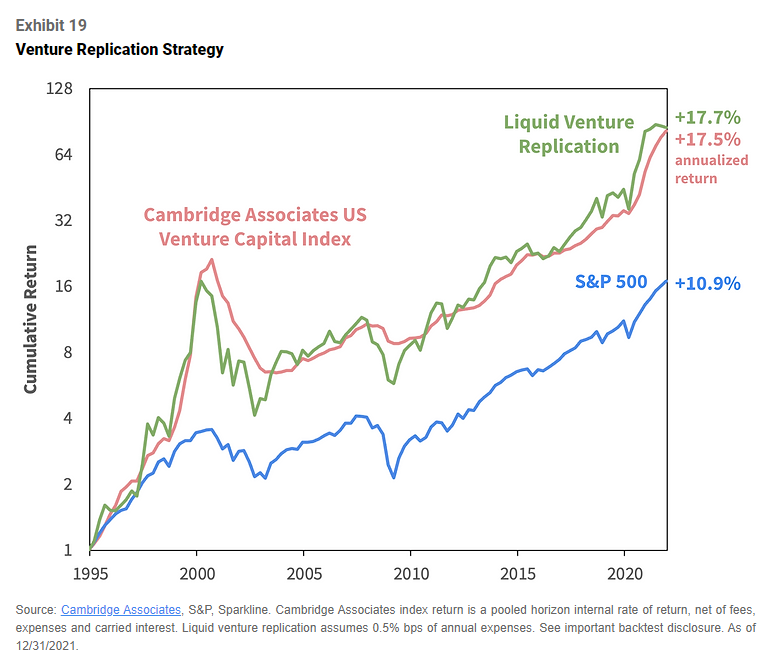

Can Venture Capital returns be replicated using publicly-traded equities?

"The replication holds smaller, younger, faster-growing, and more intangible-intensive companies than the S&P 500. These firms tend to be more expensive and less profitable. Compared to the venture capital index, the replication holds larger and more mature firms. But, as we will see, these mismatches do not make a huge difference in returns."

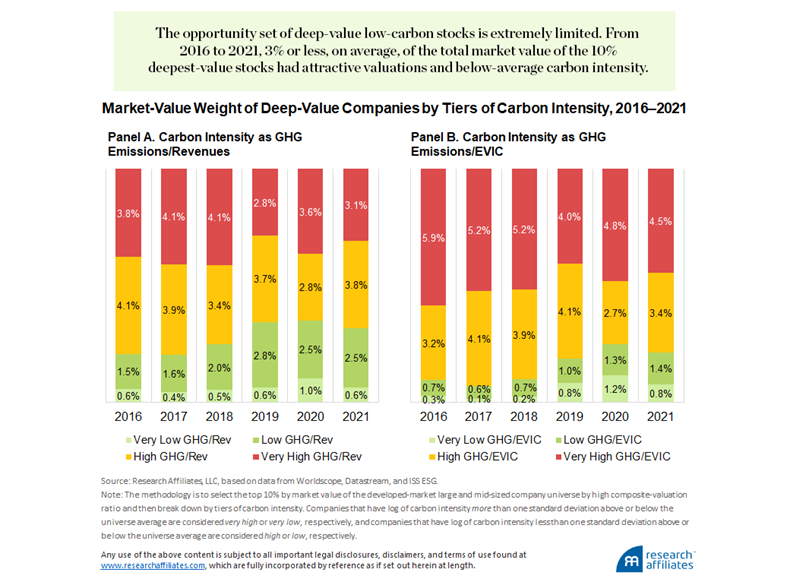

Can climate-focused value investors have their cake and eat it too?

"Companies with attractive valuation multiples typically have high-carbon profiles (e.g., in 2021, a typical value portfolio had a carbon intensity level higher than three times the market average). Therefore, the opportunity set of low-carbon deep-value companies is very limited. The result is that the preference for a low carbon intensity level in a value strategy easily leads to impractically high levels of concentration and illiquidity. Trade-offs in both the amount of carbon reduction and in the ability to achieve a deep-value bias are a necessary part of meeting these dual objectives."

Necessary Trade-Offs: Climate vs. Investment Objectives for Value Strategies (Research Affiliates)

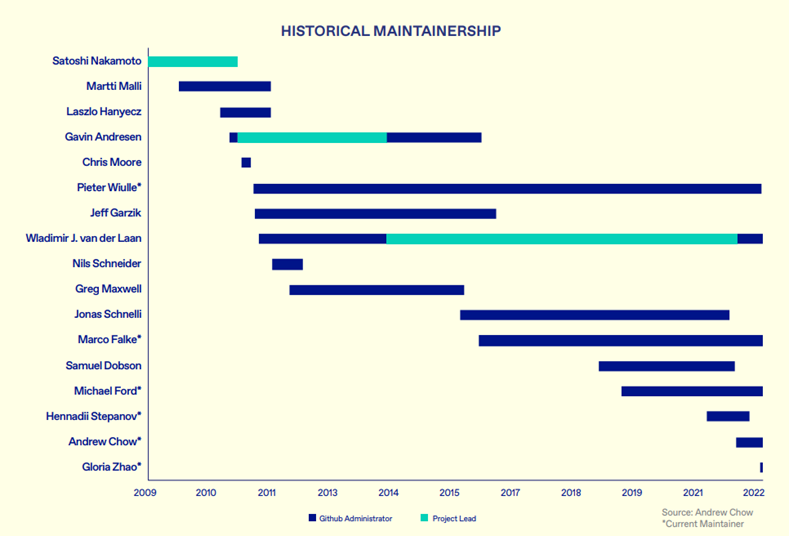

How important is Bitcoin's developer community to its future growth and adoption?

"The development of Bitcoin has seen many phases since the white paper first appeared in 2008. It has gone from closed-source development by a pseudonymous individual to one that is today truly open and decentralized, something few other digital assets can claim. We may never know the real identity of Bitcoin’s creator, but today that no longer matters. Bitcoin is a collaborative effort by thousands of developers around the world, most of whom we know."

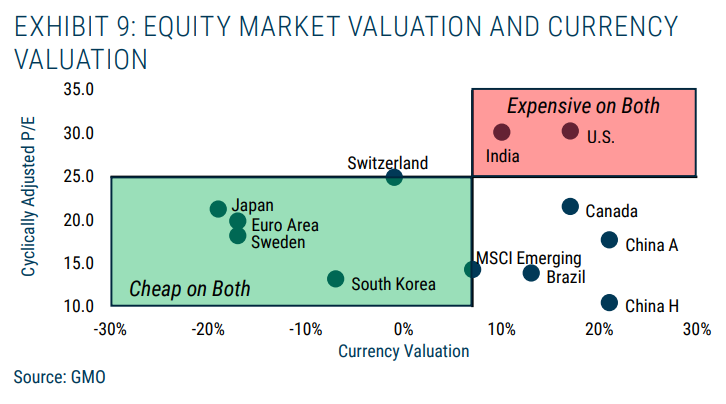

What are the implications of a strong U.S. Dollar for global equity markets?

"The U.S. and India are the two countries with the dubious distinction of being notably expensive in both equity market and currency terms, whereas Japan, Korea, Sweden, and the Euro Area all have the alluring combination of being cheap on both. Emerging as a region is far and away the cheapest on equity valuations and its aggregate currency valuation is exactly average – cheap from a USD perspective but not particularly from that of the “average” currency."

35-Year Highs For The Dollar: Our Currency, Our Problem (GMO)

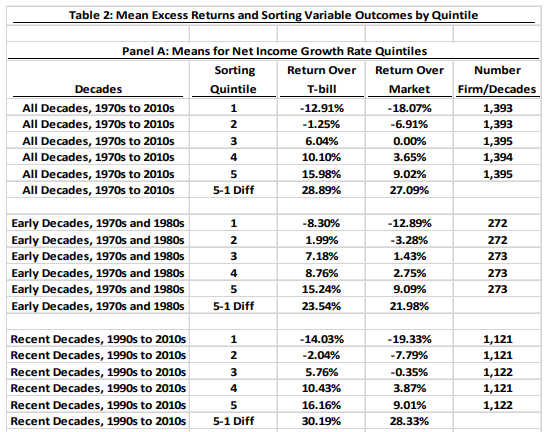

Which accounting-based firm characteristics best explain differences in long-term stock returns?

"A direct statistical “horserace” shows that net income growth is by far the strongest variable in terms of explaining decade-horizon stock returns. Average net income also has explanatory power, while sales and asset growth have almost no explanatory power in the horserace. That is, while growth in variables other than net income are correlated with stock returns, their effects operate through the channel of their effect on net income growth. "

Source: Hendrik Bessembinder. For illustrative and discussion purposes only.

The Role of Net Income Growth in Explaining Long-Horizon Stock Returns (Hendrik Bessembinder)

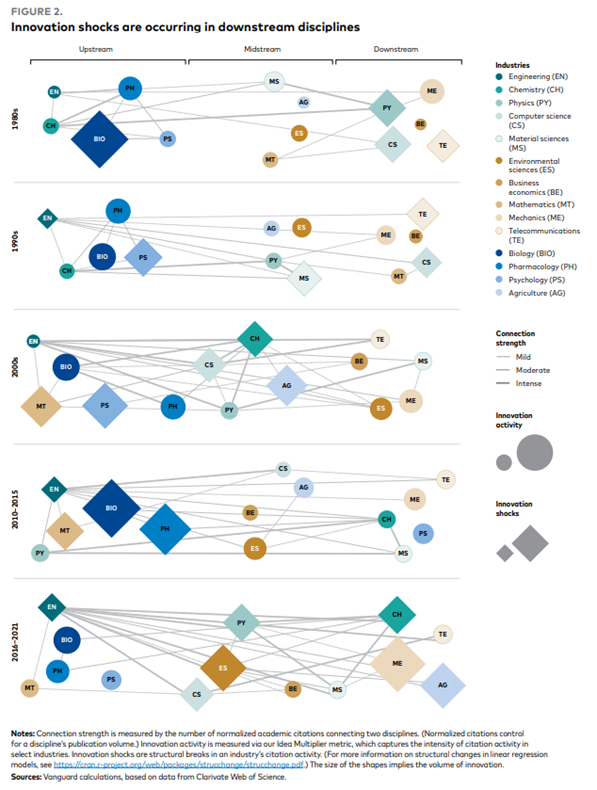

How does innovative research in the U.S. ultimately find its way downstream?

"Regardless of location on the upstream/downstream gradient, research disciplines are more likely than ever to cite research outside of their field—three times more likely than they were in 1980. Therefore, while it’s likely that good ideas are becoming harder to find, a good idea today can crosspollinate with many more ideas than previously possible"

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.